EigenFi & Ebisu; The Inevitable DeFi Ecosystem of EigenLayer

EigenLayer brings a new incentive layer on top of Ethereum; It is inevitable we see a DeFi ecosystem establish itself around restaking yield. Studying the past gives us a glimpse of the future - Ebisu

Introduction

Every crypto-economic system is driven by the principles which underpin it. For Ethereum, this can largely be attributed to two main things: ETH’s burn mechanism via EIP-1559 and Ethereum’s staking mechanisms. Ethereum’s staking mechanism is directly responsible for the $30bn+ liquid staking token (LST) market which exists today. The LST ecosystem at large has propelled Ethereum’s on-chain economy continuously forward, with the majority of these LST’s being used productively in a variety of protocols such as: Aave, MakerDAO, and most notable of all, EigenLayer. EigenLayer will evolve Ethereum’s staking network-effect by allowing users to “restake,” through offering pooled security which will secure an additional set of applications known as “Actively Validated Services” or AVS’ for short. While a full exploration of what the EigenLayer and AVS ecosystem looks like is outside the scope of this article, you can find more on it here.

Many innovations can be introduced as AVS’ built on EigenLayer, but a less explored topic is what we will refer to as “EigenFi,” the DeFi ecosystem which is nurtured by EigenLayer’s restaking yield. We can expect EigenFi to play out not identically, but similar to how LST-Fi has played out thus far.

How We Got Here

Ethereum’s transition to proof of stake created novel demand for ETH, forcing network security participants (stakers) to own & stake the token in order to participate in proposing blocks & attesting to the state of the network. There is incredibly strong demand for Ethereum blockspace and these validators have been able to earn ~4% in non-dilutive yield. Naturally, the Ethereum staking mechanism has become a black hole for ETH, surpassing $72B in value staked at the time of writing. Looking forward, with only 25% of the ETH supply staked, there is ample opportunity for continued growth. For reference, the 6 largest Proof of Stake (PoS) networks after Ethereum have an average staking ratio of 66.5%, signaling there is almost inevitable growth for Ethereum’s staking ratio, much of which will likely be driven by EigenLayer, which already accounts for 1.5% of all staked ETH at the time of writing.

The act of staking has had large second-order effects on how we view ETH as an asset and has played a large role in supercharging Ethereum DeFi. As a result, new protocols have spawned, such as:

Liquid Staking Providers: Applications like Lido & Rocket Pool have created non-custodial marketplaces that match ETH holders with validator operators and allow them to take part in the network’s consensus mechanism, without needing to own 32+ ETH or host a validator themselves. One step further, Lido returns a standardized receipt token to stakers that represents their claim to a yield bearing ETH position

Superior Lending Protocols: DeFi applications (Maker, Prisma, Lybra) have also allowed the use of liquid staking tokens (wstETH, rETH) to be used as collateral to borrow crypto assets or stablecoins, bringing about new potential on-chain lending features.

Looped Leverage

Delta neutral staking

Self-repaying Loans

Now within Eigenlayer restaking, there are 3 parties to consider:

ETH restakers (self-explanatory)

Operators: users that run EigenLayer’s software to secure applications built using the platform, while allowing stakers to delegate ETH to them.

Actively Validated Services (AVS): EigenLayer refers to applications utilizing their security as Actively Validated Services. A few of the notable AVSs are likely to be data availability providers (EigenDA), rollup sequencing services (Espresso Systems), oracles and fast finality cross-chain bridges.

Restaking to secure these applications creates opportunity for ETH owners, as EigenLayer AVS will likely both generate fees and potentially launch their own tokens. Restakers, in theory, will then earn inflationary token rewards alongside protocol fees, allowing ETH holders to compound their staking yield by providing additional security guarantees. At this stage it’s difficult to accurately estimate the additional yield that restaking will provide, as there are a number of variables at play, including: number of AVS, profitability of AVS, number or users restaking and the commissions by EigenLayer Operators. However, Ethereum is currently “paying” an enormous ~$2.4B sum in rewards to stakers. If EigenLayer AVS are able to increase the current staking yield just 50-75 basis points from 3.5% to 4-4.25%, this would be another $340-$510M in rewards distributed to those that restake. We believe restaking will grow in popularity as a result of Ethereum’s staking yield being adjusted downward - the result of an increased supply of staked ETH, which will increase the opportunity cost of not restaking. There is an ongoing discussion of how these mechanisms may change, which you can read more about here.

The financial incentives behind restaking, will undoubtedly create a new sector of DeFi, EigenFi, allowing users to capitalize across the risk spectrum on the EigenLayer ecosystem. For example, creating the “Lido of EigenLayer” introduces liquid restaking and thus liquid restaking tokens (LRTs). LRTs lean into the composability of public blockchains, fostering the financialization of EigenLayer’s pooled security—allowing users to have both liquidity and yield without choosing one over the other. LRTs, much like LSTs, will be the collateral of choice for many crypto users across CDP Stablecoins (Ebisu Finance), lending protocols, DEXs, perpetual futures applications and more. Put simply, why would a user forfeit DeFi yield opportunities to lose liquidity and stake their ETH or vice versa, when instead they could forgo opportunity cost and chase yield through both.

Historical Case Study & Overview on CDP Stablecoins

The market does not seem not fully informed about the risks of restaking, influenced by bear market PTSD and the scars from meltdowns, yet this focus on past failures may overshadow current successes.

Since roughly the inception of DeFi on Ethereum, people have been trying to figure out ways to create decentralized stablecoins. It’s not an easy task to create stability or harmony in a dynamic chaotic environment, but a few protocols have proven their ability to do exactly that. A couple examples include: MakerDAO and Liquity.

While Maker is largely known for fostering the success of DAI, the largest CDP (Collateralized Debt Position) stablecoin in circulation today, under the hood it is a very complicated protocol. The complexity of MakerDAO's framework seems like a drawback, but it also is a competitive moat. The intricacy of its operations deters others from attempting to replicate its model, largely due to its sophisticated governance process which it heavily relies on.

On the other hand, there is a lesser known protocol called Liquity, a zero governance, immutable protocol (non-upgradeable contracts) that was deployed in 2021, and has worked absolutely as intended ever since. Their success, contrary to Maker, can largely be attributed to their simplicity. While a full deep-dive on both of these protocols is outside the scope of this article, let’s briefly explore how each one works.

Maker Overview:

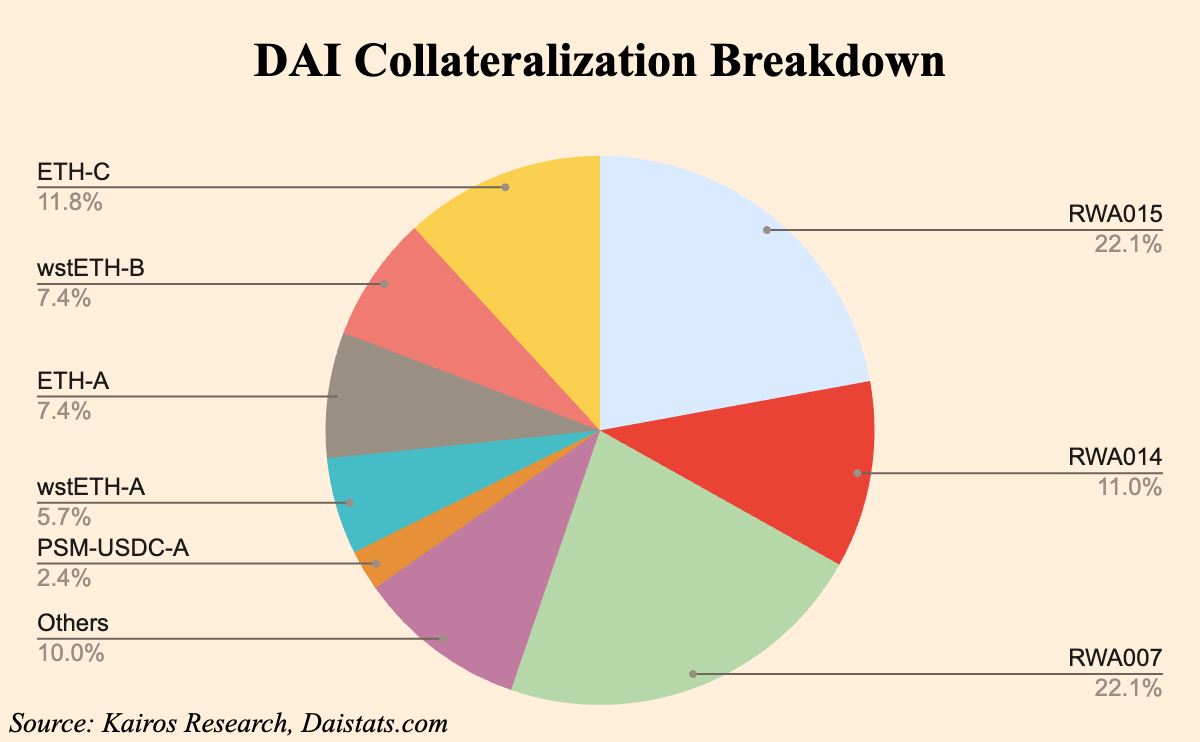

Dai is created (minted) by users who deposit various accepted tokens or RWAs as collateral in Maker Vaults. This collateral is oversupplied compared to the minted DAI to maintain sufficient backing and stability. Dai's “value” is managed through governance by MKR token holders who vote on key parameters like stability fees and collateral types. The system ensures Dai's stability against the US dollar, despite the volatility of its crypto collateral. At the time of writing, there is 5.15bn Dai in circulation with a total collateralization ratio of 272.50%.

Liquity Overview:

The Liquity protocol enables users to take out loans in a stablecoin (LUSD) using only ETH as collateral, with a focus on minimal fees and optimal efficiency. It features a Stability Pool for managing liquidations and a redemption mechanism to maintain LUSD's dollar peg. Liquity is distinct for not having a governance token; instead, it offers LQTY tokens as rewards to users who contribute to the protocol's sustainability, such as those participating in the Stability Pool or serving as frontend operators. This reward system incentivizes activities that enhance the protocol’s robustness and adoption.

While both of these protocol’s success can ultimately be attributed to ETH standing the test of time, by receiving ample adoption and fostering the right crypto-economic principles, the success of these two protocols can largely be attributed to different things.

For Maker, their early foresight gave them a head-start and a Lindy Effect going forward. Additionally, you could make the argument that their DAO governance has turned out to be a feature, not a bug - a rarity. While allowing a community to openly govern and sway the direction of the protocol may seem daunting, it has turned out to be well received by MKR governance participants. Their governance could further be attributed to the financial alignment built into the protocol, as MKR is the final backstop against bad debt in the ecosystem.

When looking at Liquity, from the chart’s perspective, it doesn't necessarily look successful. However, the fact that they are still around is a massive success. Zero intervention from the team, simply game theory and crypto-economics playing out in real time, a rare and beautiful success story in DeFi. However, you could argue that the lack of governance led to lack of eyeballs on the protocol, ultimately leading to less attention, and less users. Lastly, it’s also important to note that timing matters when launching your product. Maker launched multi-collateral Dai in the midst of a bear market in 2019 when crypto was completely contrarian, and therefore Dai was able to be successfully catalyzed ultimately by the adoption we saw via DeFi summer and the 2020/2021 bull run.

As we enter 2024, there are a plethora of bullish events unfolding which could help catalyze Ebisu’s growth. Today, the market dynamics are fundamentally different for ETH, with staking, native restaking, liquid staking, and liquid restaking all opening up new potential avenues for growth. Ebisu can stand on the shoulders of the giants which came before and take learnings from both Maker, Liquity, and others in the space.

Market Context & LST Adoption for CDP Stablecoins

When we think about the nuclear meltdown from last year, despite the disgraceful fraudulent actions which took place, the main catalyst was due to Luna’s implosion. The Luna fiasco is low-hanging fruit for people who would rather FUD than think, but it’s important to note that CDP stablecoins are fundamentally different from the mint-burn, two token, algorithmic design mechanism that was implemented by Terra/Luna. CDP Stablecoins have also proven to be synergistic with Liquid Staking Tokens (LSTs). To further examine this, let’s do a brief analysis to understand where exactly LSTs are being used today.

It makes sense as to why these tokens see such high utilization rates given LSTs are a superior form of collateral since they are yield bearing assets. To further the value proposition, liquid restaking staking tokens (LRTs) will provide even greater yield than traditional LSTs, theoretically making them even more attractive collateral. Of course, there are risks with LRTs that are not present with LSTs. We’ll cover the risks more in depth in a section further on in this report, but the important takeaway is that re-staking yields from EigenLayer will allow for the CDP stablecoin model to further evolve.

Understanding the LRT Landscape

Looking at the LRT landscape today, we see four big players: EtherFi, Puffer Finance, Kelp Dao, and Renzo. Between these four protocols alone, they have amassed a total value locked (TVL) of $3.48bn. Keep in mind that most of this TVL is from native staking, not from restaking LSTs, with Kelp DAO being the exception. It is likely that most of these protocols will also opt into allowing restaking of LSTs, which will drive TVL even higher. So the next obvious question is what will people do with their LRTs? When looking at the historical data above of where current LSTs are being used, the largest LSTs have the majority of their supply in lending markets, or CDP stablecoin protocols, and we will likely see this trend continue, with Ebisu emerging as a categorical leader.

Brief LRT Risk Assessment

While the entire risk framework of underwriting LRTs is outside the scope of this article; we can quickly highlight important considerations across the Eigenlayer stack:

AVS Slashing

Does the LRT provider have a comprehensive understanding of the protocol risks associated with each validated AVS?

What is the LRT provider’s delegation strategy? Is it open source or proprietary? Does the LRT provider’s community have input in delegation?

Operator Malpractice

Who is the operator(s) for the underlying EigenPods?

Does the operator have a proper risk mitigation strategy in place to avoid slashing and downtime?

Does the operator’s dev-ops team have enough bandwidth to combat unforeseen circumstances relative to the number and complexity of AVS being secured?

Does the operator have offchain insurance to compensate for potential slashing events?

What is the commission structure of the operator?

Supported Deposit Assets

Is the LRT composed of natively restaked ETH, or restaked LSTs?

If restaked LSTs, who are the node operators for those LSTs?

What percentage of the overall deposits does each type of accepted collateral make up?

Access to Liquidity

What is the TVL of the LRT?

Is there a healthy amount of secondary market liquidity for the LRT?

What is the redemption process for the LRT?

What are the short term liquidity incentives LRT providers are offering?

Smart Contract

What protocol architecture risks exist for the LRTs?

How are rewards being paid out? Rebasing or value accrual?

What is the fee structure of the LRT provider?

How are admin multisig permissions structured? What permissions are involved in transferring assets and pausing withdrawals?

The following risks are not endogenous to the LRT, but arise as a result of the LRTs being adopted across the broader crypto-economic landscape.

Oracle

Are there reliable and robust price oracles in place to ensure accurate pricing of the LRTs?

Governance

What governance risks exist for the LRTs?

How are AVSs chosen to be secured?

To what extent can governance be used to ‘king make’ AVSs? What incentives does this dynamic create?

Cross-Chain

In the case of cross chain LRTs, how is bridging implemented? Are canonical or non-canonical bridges being used?

In the case of non-canonical bridges, how is the LRT provider approaching issues with fungibility with the L2 enshrined bridge, and the tradeoff of batch latency?

Centralization Concerns

What is the market structure of LRTs?

To what extent do LRTs have a centralizing effect on EigenLayer’s shared security offering?

Much like the LST landscape, we expect LRTs to be a winner-take-most market structure, with roughly a one year time frame for things to solidify. In the short term, however, there will be multiple winners because the risk profile between LRTs will vary greatly depending on the LRT's Operator set & which AVSs are being secured.

At launch, the incremental slashing risk from restaking will be low given EigenLayers slashing veto committee & screening of AVSs. But, in a future world with infinite AVSs, there are 2^n -1 permutations of AVSs that can be secured by an Operator, with n being # of AVSs secured. So, there can be lower-yielding, conservative LRTs and higher-yielding, risky ones - analogous to why there are bond credit ratings. And, given low switching cost between LRTs, off-chain LP agreements, and low risk of AVS slashings in the short run, first mover advantages may not be too strong.

Furthermore, the design space for LRTs is bigger than LSTs given AVS rewards dynamics. While all of those topics could be explored further, it gives us a general idea of the surface level risk that is faced when deciding which LRTs should be allowed as collateral.

CDP Protocol Risk

Beyond all of the EigenLayer, liquid staking and smart contract risks mentioned above, collateralized debt stablecoin protocols have at least 5 imperative mandates:

Ensuring all loans have sufficient & liquid collateral

Properly using oracles to price collateral assets

Ensuring that there is a properly designed & incentivized liquidation engine

Ensuring that the issued stablecoin has sufficient on-chain liquidity

Creating mechanisms to ensure that the issued stablecoin will remain near its $1 peg

Stability pool

Variable interest rate

Redemptions

For the sake of this article, we will focus on #1, 4 & 5.

Lending protocols must be acutely aware of market conditions, especially as they relate to on-chain liquidity of their collateral assets. After looking at other market leaders, Aave & Compound use collateral caps, LTV Ratios, Liquidation Thresholds & Liquidation Penalties to ensure that the protocol can minimize any potential bad debt. It should be noted that Compound’s governance is able to make changes to LTV Ratios for listed collateral assets, without damaging any existing positions. Below are a few examples of how these two lenders treat LST assets as collateral & how drastically different collateral can be treated on opposing platforms.

Using $1 as an example, the above table shows that Compound allows you to borrow 90 cents against every dollar of LST collateral & if your LST collateral value drops below 96.77 cents, your position will go into liquidation - where a sophisticated participant (liquidator) can sell your collateral assets and earn a 3% fee on the collateral for assuming & selling the collateral.

To have a usable CDP lending protocol, the stablecoin issued (ebUSD) must have sufficient on-chain liquidity. Borrowers will stray away from a protocol that provides them with a high slippage prone stablecoin, as they will immediately be underwater on any position they take. Furthermore, a stablecoin with very little on-chain liquidity will be prone to large price fluctuations, causing potential liquidations (dependent on single / multi block oracle pricing) and difficulty liquidating large positions, as liquidators may lose capital via slippage while closing the debt position.

Establishing on-chain liquidity of ebUSD will be an exciting challenge in the early stages of Ebisu, one that has many possible solutions, including: ebUSD / USDC (or ETH) pledges from early investors & backers, liquidity mining of Ebisu’s native tokens to LP’s of ebUSD, rewards or bribes to veCRV / Convex to establish Curve liquidity or bribes via Redacted’s Hidden Hand to establish liquidity on Balancer.

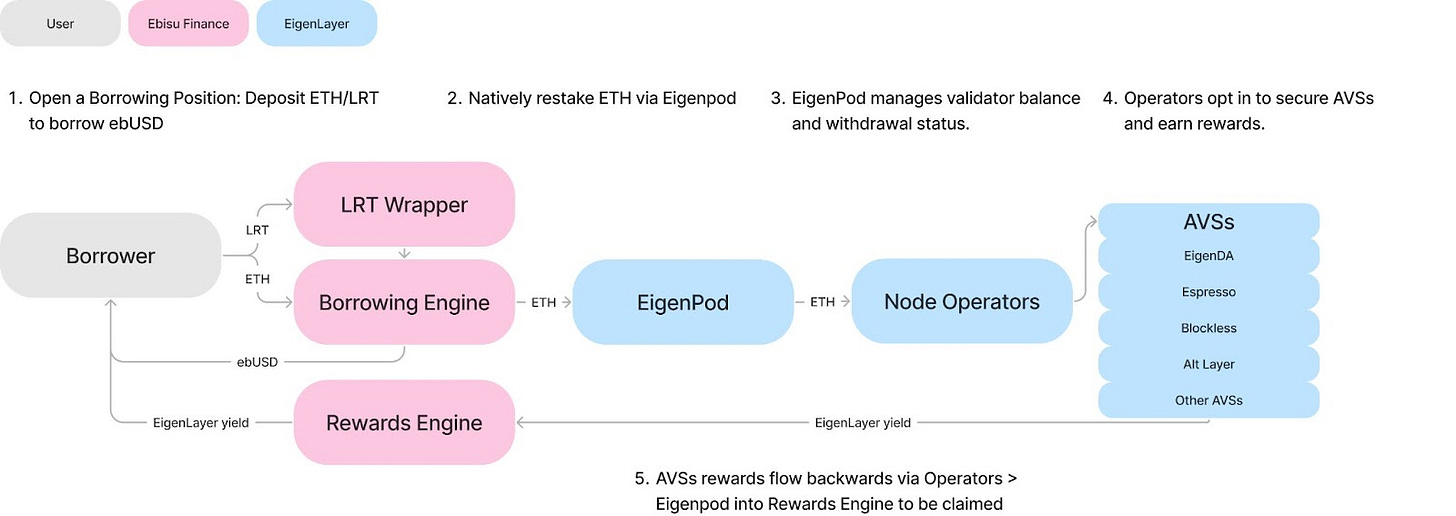

Introduction to Ebisu

Ebisu unlocks capital efficiency for restaked assets by enabling users to draw dollar-denominated credit (ebUSD) against natively restaked ETH and LRTs (more assets coming soon) via a non-custodial, decentralized stablecoin. ebUSD gives users access to a stable store of value while enabling yield generation through AVS rewards and Ethereum staking rewards. By driving demand for LRTs, Ebisu also contributes to scaling the restaking ecosystem, bolstering the shared security and economic alignment within Ethereum.

Similar to how Maker, Aave, and other protocols allow you to borrow against your staked ETH, Ebisu takes this one step further to allow you to borrow against restaked ETH. Borrowers will be able to use Ebisu to borrow the protocol’s collateralized debt position (CDP) stablecoin, ebUSD. Like Dai, ebUSD also serves as a censorship-resistant store of value. While there are tradeoffs to CDP stablecoins, having completely decentralized stablecoins is key to achieving the true end state of decentralized financial technology.

Outside of creating a censorship-resistant stablecoin, users of Ebisu can convert ebUSD to staked ETH and follow the restaking process again, allowing them to secure multiple AVSs and loop Ethereum staking + EigenLayer yields - while incrementally increasing their risk profile.

To see the full picture, imagine the following process:

A user has native ETH that they are looking to earn staking yield on, so they deposit to a Liquid Restaking Token (LRT) provider such as EtherFi, KelpDAO, Renzo, or Rio and are presented with the LRT receipt token that may be used throughout DeFi

The user now takes their LRT and wants to utilize it as collateral for an on-chain loan, so they deposit the receipt token to Ebisu - where they can earn yield on their collateral and borrow ebUSD

ebUSD may be converted for any on-chain asset, so the user may decide to utilize the borrowing platform to increase their purchasing power (& risk) to buy other crypto assets. The user could theoretically loop their LRT position by buying ETH with ebUSD, re-depositing the additional ETH to an LRT provider and adding more collateral to Ebisu.

To unwind their position, the user could use any unutilized crypto assets to repurchase ebUSD and repay their outstanding debt. Paying off outstanding debt frees the users LRT collateral to be withdrawn from Ebisu

Below are visuals created by Ebisu to show the behind the scenes process of utilizing the protocol, where the user can simply bring their ETH to Ebisu, get it staked through an LRT provider, into an EigenPod, where it begins to natively secure Ethereum and a number of AVS.

Peg Mechanism and CDP Architecture

With any lending protocol, it is imperative to ensure that bad debt does not accrue in the system. Ebisu lending implements isolated collateral positions, so that the system can work smoothly to liquidate the riskiest debt positions. ebUSD can be redeemed against its underlying collateral at face value. eg. 1 ebUSD can be redeemed for $1 USD denominated in restaked collateral. Redeemed ebUSD is used to repay the riskiest debt position, and transfers the respective amount of restaked collateral from the liquidated position to the redeemer.

Additionally, Ebisu will have a stability pool, as is common amongst CDP stablecoins. The Stability Pool, funded by users, safeguards loans by providing ebUSD as liquidity to cover debts from liquidated debt positions. This ensures that the total supply of ebUSD is solvent and adequately backed. Upon the liquidation of any debt positions, an ebUSD amount equal to the dept position’s outstanding debt is eliminated from the Stability Pool to settle this debt. Concurrently, the remaining collateral of the liquidated debt position, net of liquidation fees, is transferred to the Stability Pool. Depositors in the Stability Pool are then eligible to withdraw a portion of this liquidated collateral, pro rata to their proportion of the Pool's total balance. This arrangement is designed to leave a net benefit for depositors, as the value of the collateral is generally higher than the amount of debt that was extinguished.

Use Cases

So what is the purpose of Ebisu? After seeing strikingly high demand (~$4.5B across Aave, MakerDAO & Compound) to borrow against staked ETH, it is a safe assumption that leverage on-top of restaked ETH will also be popular within the ecosystem. With sufficient liquidity, staked ETH is a much more lucrative collateral for borrowers - allowing them to earn yield on their assets, in a sense creating an ever increasing borrowing capacity. Ebisu is another DeFi lego that builds on this idea & allows users to get creative (more or less risky) with the structure of their restaking positions. As noted in the above sections, Ebisu serves several key purposes within the EigenFi ecosystem:

Allowing unconstrained and decentralized borrowing against LRTs

Creating a yield-bearing, censorship resistant stablecoin in ebUSD

Facilitating looped borrowing, allowing users to increase their risk exposure, increase their yield and secure additional AVSs

Down the road, Ebisu could enable self-repaying loans by using staking yield to pay off ebUSD borrow interest

Looking Forward

There is no denying that a lot of capital has been driven to EigenLayer in hopes of receiving an airdrop(s). However, once the token speculation has settled, how much of this capital can we expect to stay around as opposed to going elsewhere? There is good reason to think that a lot of this capital will remain in EigenLayer simply because it will be extremely difficult to justify moving it elsewhere. On a risk-adjusted basis, people will be hard pressed to find organic levels of yield elsewhere, without having to face the opportunity cost of locking their ETH in a vault style product. Additionally, given the large amount of circulating LRTs, it is likely that protocols will find it easier to incentivize deposits of LRTs rather than native ETH. For all these reasons and more, we expect EigenLayer to remain the canonical black hole for yield and liquidity, again, furthering the potential value proposition of Ebisu.