Bitcoin Staking: Babylon Cap-3 Post Analysis

$3.33 Billion BTC flowed into Babylon during it's latest cap raise. In this article we help you understand all the trends shaping the newly emerging world of Bitcoin Staking, pioneered by Babylon.

If you are unfamiliar with Babylon and need a quick primer, see our brief intro we wrote prior to this Cap Raise. Other resources include the white paper, and the Babylon website directly.

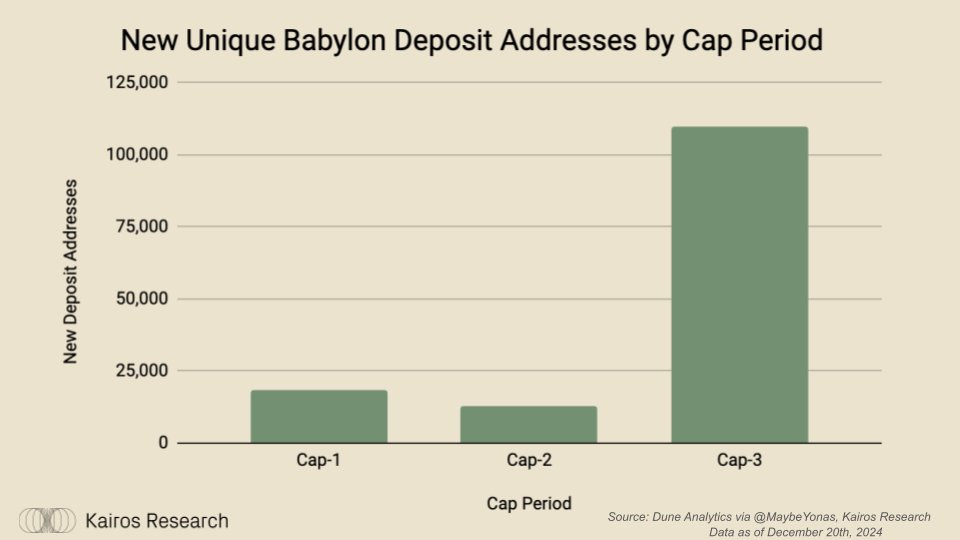

New Unique Depositor Growth

For 1,000 Bitcoin blocks, Babylon allowed new BTC deposits to be staked via Babylon. During this period of roughly one week, approximately 33,300 additional BTC were staked via Babylon from across roughly 110k new unique addresses, bringing total TVL to around 57k BTC, which briefly eclipsed $6bn in dollar terms.

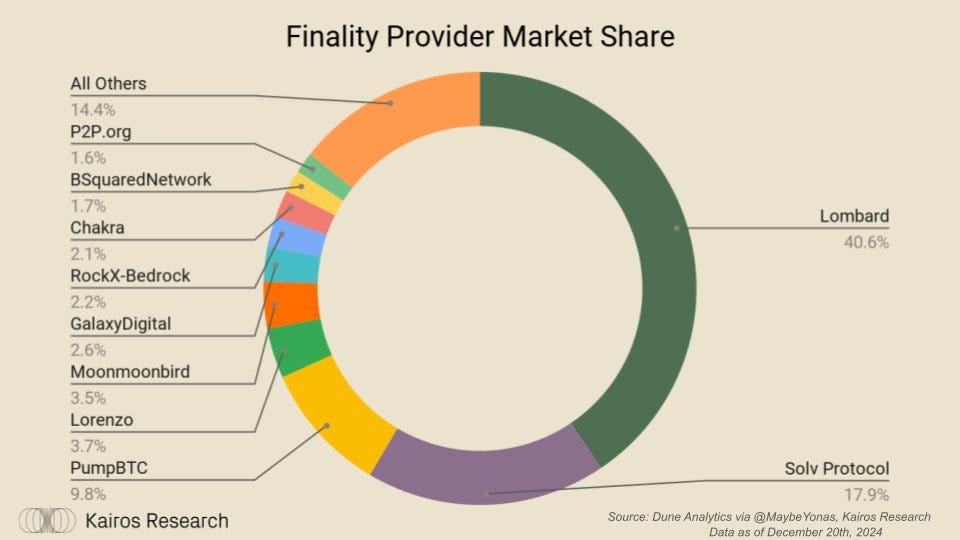

Finality Provider Market Share

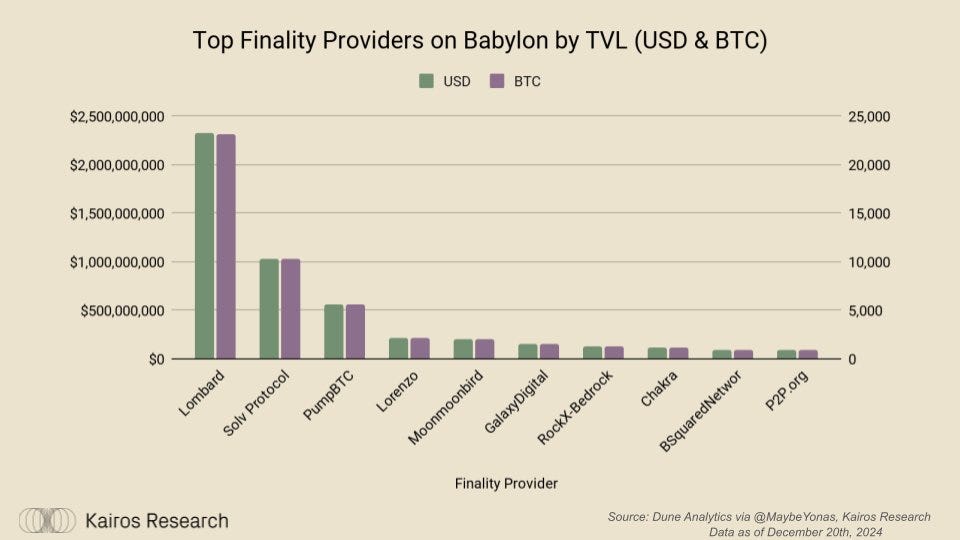

At the end of Cap-3, Lombard_Finance remained the largest finality provider, adding an additional 16k BTC of stake with them, bringing their grand total to around 23k BTC, which accounts for 40% of Babylon's total deposit marketshare.

SolvProtocol, the second largest Bitcoin LST protocol held strong and crossed the 10k Bitcoin threshold.

Overall, the Bitcoin LST providers dominated the show for Cap-3, and now 75% of total BTC deposits into Babylon are staked with LST providers. This is a great forward looking signal for BTCfi, as $4.2bn of BTC LSTs can be productively utilized across DeFi.

Babylon TVL Over Time

While the deposit limit was set to 5k BTC, the closest anyone came was 4998 and there were only 3 total transactions over 1k BTC, all by the same address. See our "Whale Analysis" section below for further details. Overall, Babylon TVL is now becoming a real rival amongst its other DeFi peers. After only 3 cap raises, Babylon is the 9th largest protocol by TVL, and the 2nd largest restaking protocol.

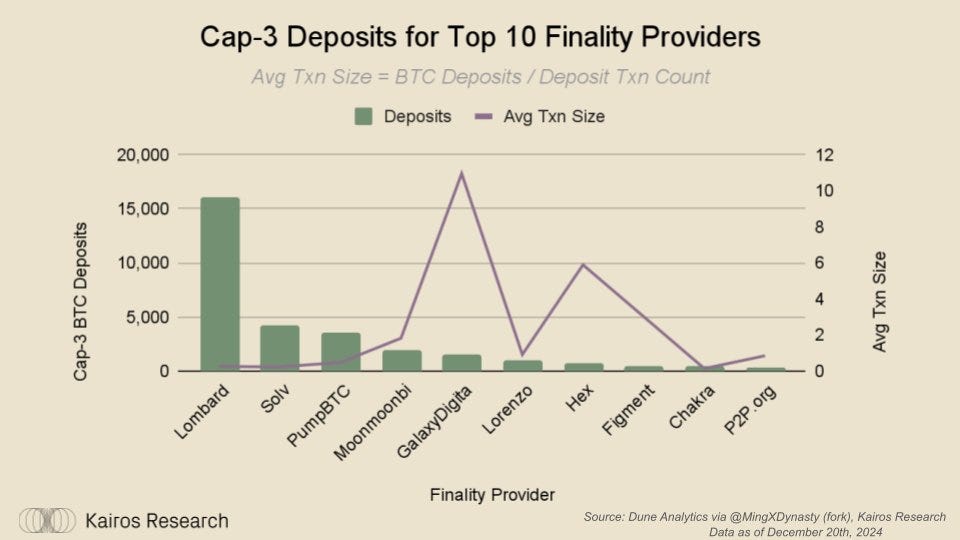

Deposit Count & Avg Txn Size by Finality Providers

While the Bitcoin LSTs saw the lowest overall avg txn size, likely due to exogenous factors like users, or bots, looking to gain exposure to potential airdrops, the institutional players like Galaxy Digital and Figment saw much higher averages. For example, Galaxy's average transaction size was 10.95 BTC (~$1m+) and Figment's was 3.02 (~$300k+).

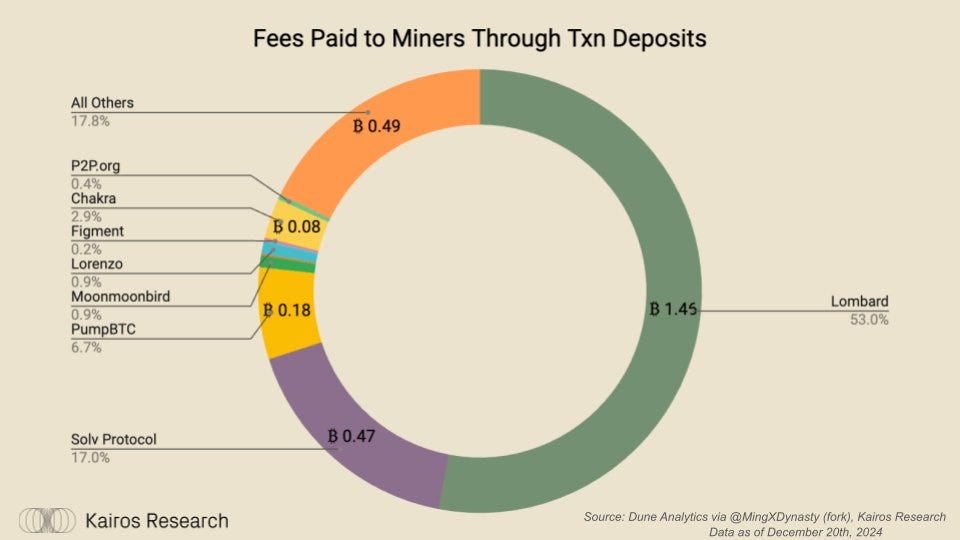

Fees Generated by Finality Providers

Babylon's breakthrough for unlocking productive use of Bitcoin on its native network can also have second order effects for other existing network stakeholders. For example, the Cap-3 window saw 2.75 BTC of fees generated for miners via transaction fees. Over the long run as the block subsidy continually compresses, transaction fees will matter even more than they do today in order to incentivize miners to secure the network. Again, the LSTs will play a crucial role here as they will consistantly be facilitating deposits and withdrawals, all leading to more transaction fees on the Bitcoin network.

Whale Analysis

The largest depositor for Cap-3 was bc1pzfyw6gj38v4xskx8n03e8r8hk9wn0gsm3kr0xxcznle8xvy93xgsv60qxh The anon whale deposited 9998 BTC across Lombard (4998 BTC), Solv (3000), and PumpBTC (2000) respectively. At the time of the deposits, the aggregate deposit amount was roughly $1bn. The wallet funding is fairly easily traceable until it reaches 37XuVSEpWW4trkfmvWzegTHQt7BdktSKUs, an account which previously held roughly $7bn of BTC onchain before transferring it to another wallet ( bc1q8yj0herd4r4yxszw3nkfvt53433thk0f5qst4g ). However, tracing this original whale wallet back via first funded, it eventually leads to Huobi, roughly 8 years ago.

There was speculation that this wallet may be Justin Sun, and while not confirmed, he did have other wallets on Ethereum that withdrew around $200m stETH from EigenLayer (txn hash: 0x84af473143465d9d3f358c1573b5f6c3118b28e1579322ea1a1d51df10baaf3e) and then began withdrawing the stETH from Lido in 1k clips. The transactions between the actions on Ethereum & the Bitcoin network have roughly an 8 hour difference between them. It is important to note as well that he implemented a similar strategy on Ethereum with deposits across all the major LRTs as well while they were running their points programs.

This is an incredible vote of confidence for this longtime whale to put what appears to be roughly $1bn of their stack into the liquid staking token protocols built on top of Babylon.

*DYOR and it is left up to the reader to speculate on who the whale may be if they wish*

Additionally, the second largest depositor was bc1p3nmr2yzmgaml07lx7n3ehe8a2uvu2nrqfrqx8leqt562t4dnm8tsqxmpyt, but this address deposited exclusively to Lombard for a total of 7279 BTC, this accounts for 45% of Lombard's overall deposits. Between this address and the one above, the two whales comprised 51.8% of Cap-3's overall deposits. This wallet appears to trace back to a Binance hot wallet where it was first funded 4 years ago.

*All wallet analysis done via @arkham - DYOR*

Overall, the important takeaway is that the largest depositors are the ones seeking optionality and lessened opportunity cost by choosing Bitcoin LSTs. Hopefully, this means we see a meaningful injection of BTC liquidity to DeFi to the tune of several billion dollars.

Closing Thoughts

Overall, Cap-3 was a massive success. With over $3bn of new deposits, Babylon is now the 9th largest protocol by TVL in all of crypto, with a grand total of $5.54 billion in TVL. This Cap proved particularly successful for the Bitcoin LSTs, and now Lombard has surpassed Coinbase's own cbBTC in terms of BTC deposits by a margin of roughly 3k BTC. Notably, Cap-3 deposits even outpaced Bitcoin ETF inflows.

At Kairos Research, we believe a winner-takes-most market structure will likely play out for the Bitcoin LSTs, and Lombard is a clear leader if this these trends are to continue. What will make or break these various LSTs will be their ability to grow sustainably while simultaneously ensuring user's trust remains steadfast. On that last note, in the coming weeks we will be releasing standards and best practices for all the Bitcoin LSTs built on Babylon. These best practices are comprised of our own thoughts, along with thoughtful feedback and insight from ecosystem participants and industry leaders. We look forward to sharing these standards, along with future coverage of Babylon's flows, LSTs, and overall ecosystem.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.