Dinero: Staking Redefined

Dinero's unique approach to liquid staking generated over 50k ETH in deposits last year. They now look to broaden their institutional and layer 2 user base.

Formerly known as Redacted, Dinero was born during the height of the DeFi Revolution and underwent their rebrand in 2024 with an expanded product suite and larger mission. To throw you back into the nostalgia of the previous cycle, their official protocol launch included an Olympus DAO style fundraising campaign - where participants could “bond” CRV (Curve), CVX (Convex) or ETH in return for BTRFLY, Redacted’s official token. The unique choice allowed Dinero to become a blackhole for DEX governance tokens, such that they could become a centerpiece in on-chain liquidity, directing market-wide incentives.

Dinero quickly leveraged their position within the Curve and Balancer ecosystems, launching the below products:

Hidden Hand

Similar to Votium, Hidden Hand is a “Bribe Marketplace.” It allows third parties & token issuers to take part in the governance process of liquidity protocols like Balancer, Aura, BeethovenX, Pancakeswap, etc, by providing incentives for holders to vote in a certain direction. The concept was popularized in the Curve ecosystem, where protocols that had a Curve pool for their tokens would bribe CRV stakers to vote to direct future emissions in the direction of their pool. It is worth reading additional materials on how CRV emissions work, but a high level explanation is that many liquidity protocols have chosen to distribute their native token as an incentive to liquidity providers over a long time horizon. Given that the distribution is subject to each protocol’s governance process, creating a marketplace for voting allows governance participants to truly unlock the value of their votes.

Who are the natural participants in a marketplace like this?

Supply Side: Governance participants that own and lock AURA, BAL, etc and are willing to vote in line with the highest bidder.

Demand Side: Stablecoin issuers, Liquid Staking Token issuers, Liquid Restaking Token issuers and any protocol that has issued a token and is in need of deep on-chain liquidity. Protocol’s like Lido, Frax, Rocketpool have historically been users of Hidden Hand in order to scale the liquidity of their tokens as the supply of the asset trends upwards.

Pirex

The second piece of Dinero’s product suite was Pirex, which enables the creation of liquid wrappers for DeFi staking tokens like CVX, GMX, GLP & even Dinero’s native token. Protocols often require that users stake tokens in order to participate in rewards distribution or voting activities, partially for standard “accounting / tracking” purposes but also because it better rewards long term participants in the ecosystem. Pirex attempted to mitigate some of the downsides that come along with token locks, including the lack of liquidity, the need to claim and autocompound rewards and the volatility of any future rewards.

pxTokens were liquid representations of a locked position, such that they could be used throughout DeFi all while reaping the benefits of their staked underlying positions. For GMX, there were additional benefits - anyone who staked GMX received a multiplier for the length of time their tokens were staked, which would reset as soon as the tokens were unstaked. pxGMX instead kept the underlying tokens locked, such that they would always be earning the max multiplier, but a holder would be able to sell the full position onto the open market if they were in need of liquidity.

We believe that it should be impossible to look past the team behind Dinero if you are remotely interested in DeFi, given their deep knowledge of the industry's current trends as well as its shortcomings. Through products like Hidden Hand and Pirex, Dinero has found themselves somewhere floating between the P2P (Protocol to Protocol) and P2C (Protocol to Consumer) realms. Now, their recent expansion builds on top of their crypto native strengths, but also attempts to look broader and target institutional participants - perhaps at the perfect time.

Rebrand & New Product Suite

Crypto Twitter is often shortsighted, the overrepresentation of momentum traders and shitposters creates an environment much like an echo in a small room. Certain trends are loudly discussed and it is easy to overweight the importance of any given topic. Many of these trends will be shortlived. If you are a builder or investor in the space, it is important to log off and create your own vision for what will matter in 1, 5, 10 years. We believe the rebrand from Redacted to Dinero in July was a realization of this & a showcasing of the conviction the team had that they can build something more important than short term tools for a limited market. I would highly recommend reading both the official rebrand blog post as well as 0xSami’s thoughts to understand the long term vision of Dinero.

“For us, Dinero represented a new approach to building products. We are no longer focused on the long tail of the DeFi risk curve. Instead, we’re entering the arena with some of the largest projects on Ethereum.”

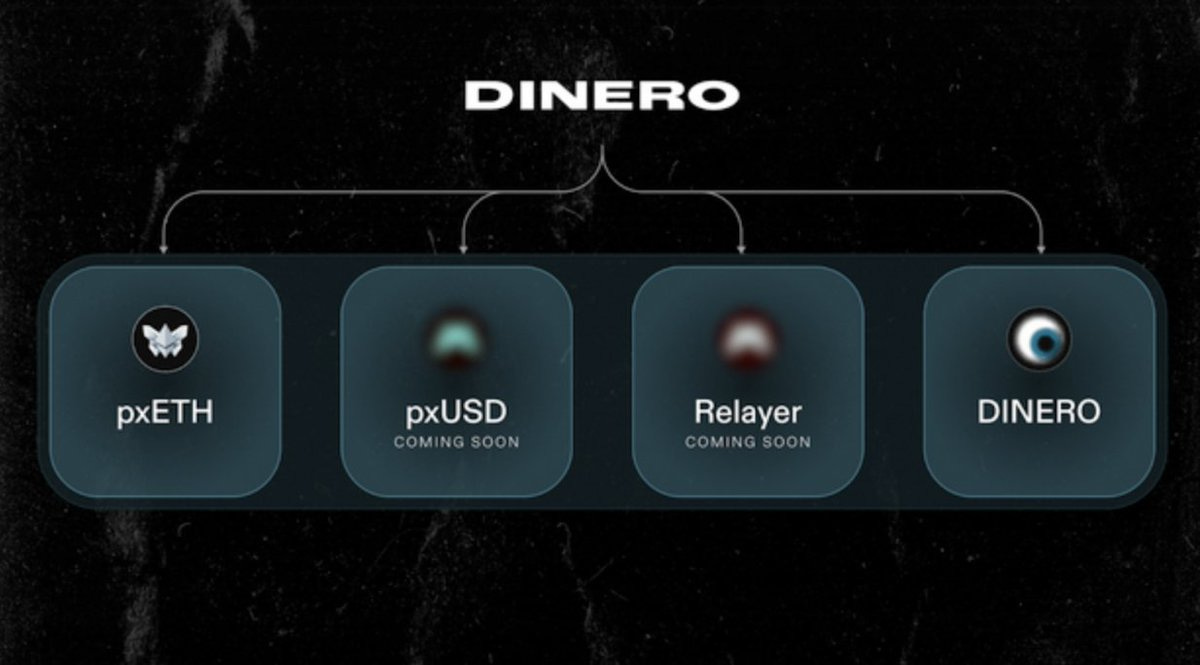

So what is Dinero? As seen in the image below, Dinero is a suite of products that are all uniquely valuable on a standalone basis, but can come together in an exciting fully integrated system. We are going to break the product suite down at an individual level, below:

Liquid Staking: “An ETH LST solution designed to simplify the staking process, making it more accessible and user-friendly. Being a solo validator comes with opportunity costs. Other LSTs aren’t flexible enough. Pirex ETH aims to solve both of these problems.”

pxETH: An ETH pegged asset, backed by staked ETH that does not receive any native staking yield, but can be used throughout DeFi.

apxETH: A vault version of pxETH, that earns amplified staking rewards due to the subset of users that have chosen to hold pxETH instead.

2. Decentralized Stablecoin: Access to a truly, non-custodial medium of exchange is of the highest importance to building a strong crypto ecosystem. So far, the best way to do this is to issue a dollar pegged asset, overcollateralized by ETH or other crypto native assets in a smart contract.

pxUSD: This stablecoin will be backed by apxETH and pegged to a dollar. It will differentiate itself from competitors through its capital efficient collateral and its utility in the broader Dinero ecosystem.

3. The Dinero Relayer: At a high level, a Relayer is a service that takes transactions submitted by users and “relays” them to the network such that they can be processed and included into a block. Dinero is able to build a network of Ethereum validators through their pxETH product, which will all run custom client software supporting the Dinero Relayer.

Meta Transactions: Transactions that bypass the need for the transactor to pay a gas fee in ETH, by allowing the relayer to publish it instead of the EOA behind the transaction.

Private Transactions: At a certain validator set size, Dinero will be able to construct blocks of transactions that are sent to them such that they can offer users a way to avoid the public mempool.

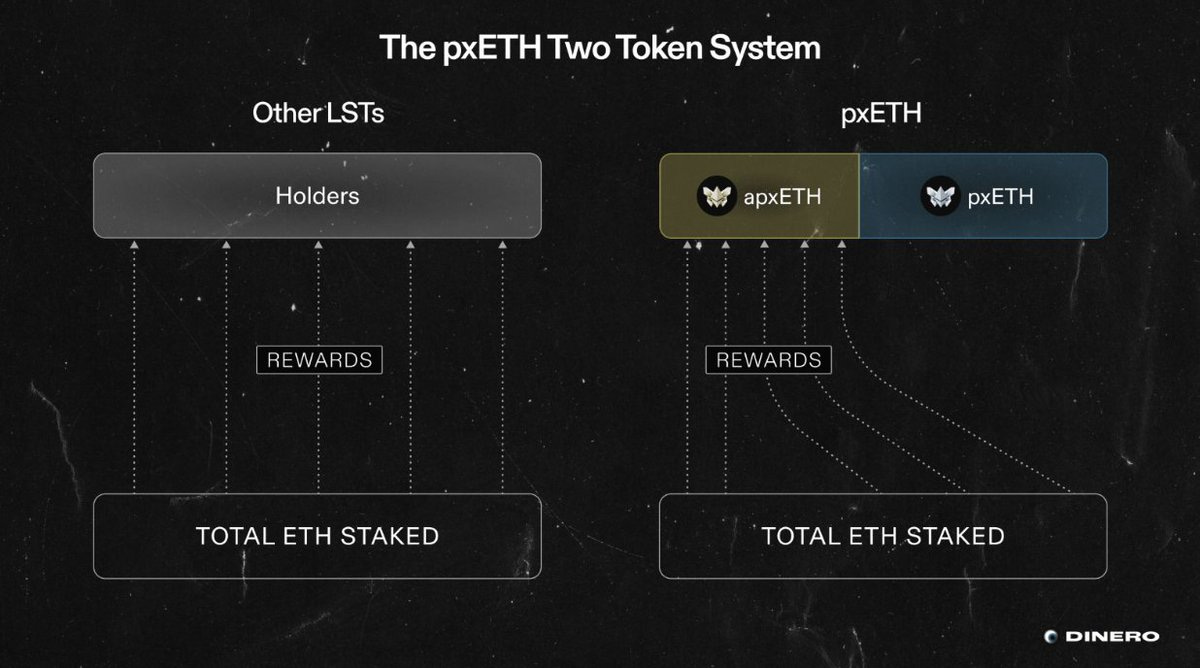

The first question you should ask yourself is, “Why would anyone choose to hold pxETH and give their yield away to the apxETH vault?” pxETH’s two token model is very interesting to us, because we believe that by separating out the holders into two categories, passive yield earnings and active yield seekers, you create an incentive for the active managers to provide deep liquidity for the whole system - where they can earn significant yield from a source of their own. Sophisticated market participants in theory will be able to provide sufficient pxETH / ETH market depth around a 1:1 peg with a limited amount of funds, finding a healthy equilibrium for the amount of pxETH that will remain outside of the vault. All the while, apxETH depositors will enjoy their higher yield.

This combined with Dinero’s role in the wider liquidity marketplace gives the protocol a huge opportunity to avoid dishing out billions in liquidity incentives as we have seen other LSTs and LRTs do in the past. We recently wrote a report on protocol financials, noting that Lido has spent $200 billion in Liquidity Incentives over the years and is just now able to significantly cut back after years of token expenditure. While these incentives clearly paid off and made stETH into the most widely used LST, it came at the expense of early LDO holders due to significant dilution. Dinero had the opportunity to learn from LDO’s growth and find other routes to generate deep liquidity.

The Dinero Vision

Dinero has been built around two core concepts:

Sustainable Yield Generation

Market Efficiency

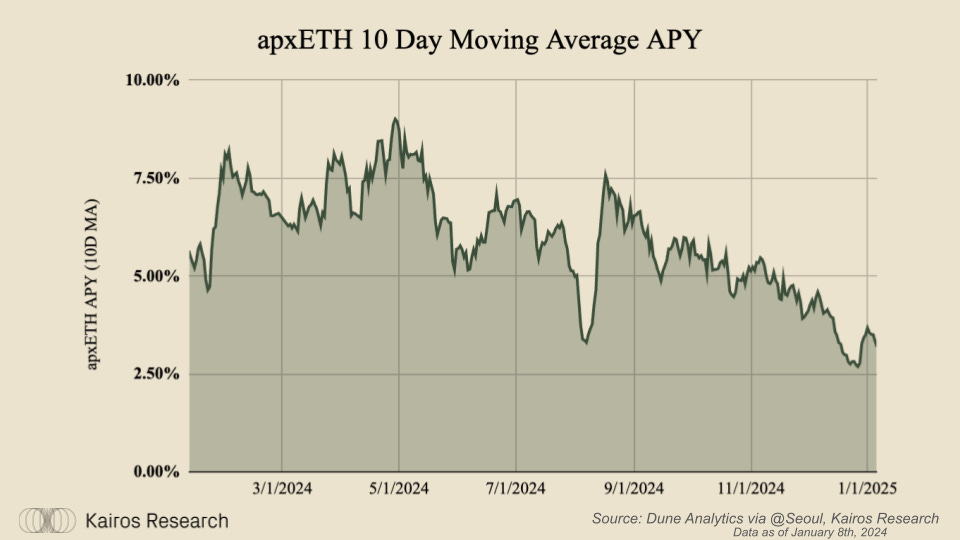

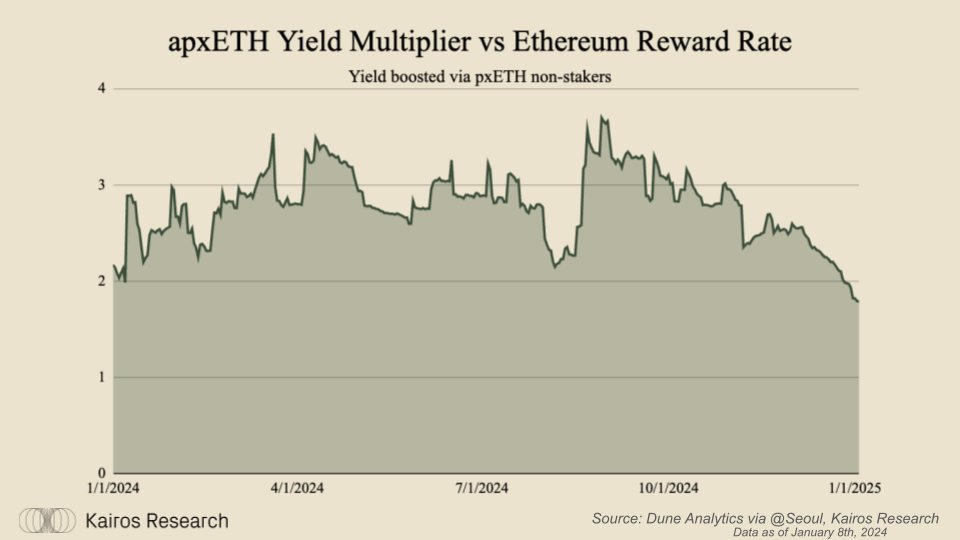

Hidden Hand & Pirex both played a role in facilitating each of these for their users & the next wave of Dinero products expands on a similar playbook. See the graphic below to see the yield premium generated by the apxETH vault, over that of other LSTs:

Liquid Staking in the Ethereum ecosystem is one of the purest forms of sustainable yield generations and Dinero is rolling out several solutions to ensure TVL growth over the next several years.

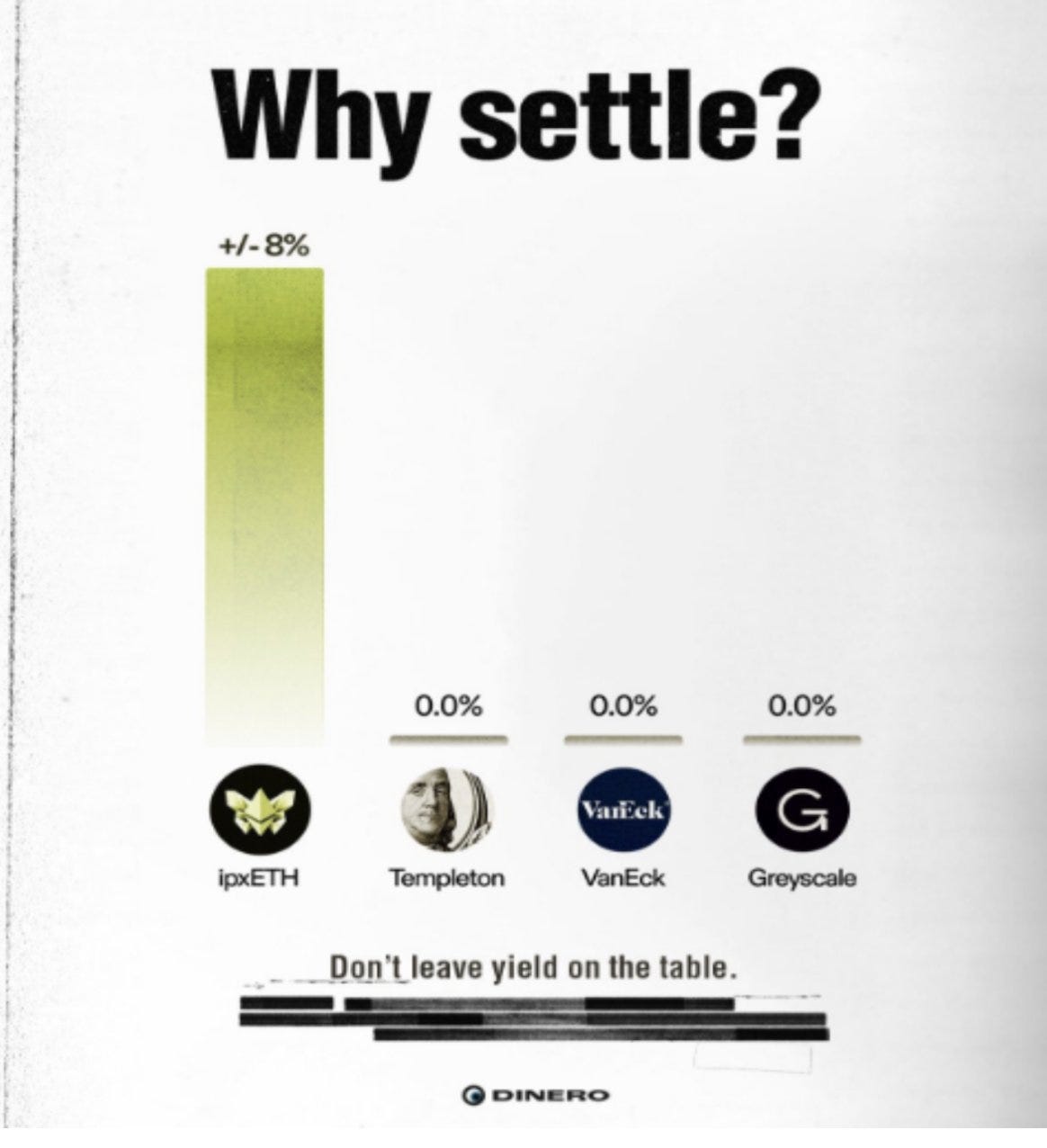

In partnership with Galaxy Digital & Nomura’s Laser Digital, Dinero is rolling out an institutional liquid staking product. The product is notably differentiated from vanilla pxETH, given that it will be issued in a permissioned environment and will not be composable throughout DeFi like Dinero’s other products. However, it will be designed to give strictly regulated institutions like brokers and Registered Investment Advisors access to Ethereum staking yield. We think the cross demand for exposure to ETH and exposure to staking yield is impossible to overstate.

ETH’s liquid staking market is already sitting at $51B in TVL already amassed across Lido, Binance, Rocketpool and others. At $174M in TVL, Dinero accounts for 0.34% of Ethereum LSTs and has a lot of potential for market share growth. Kairos believes the whole pie will also grow significantly larger, given that the percentage of ETH’s staked (28%) is only a fraction of Solana’s (66.3%), Sui’s (78.3%) and Aptos’ (79.3%). If Ethereum was to double its stake rate, that would be another $130B in potential value for Dinero to compete over & there is clear social consensus that would push stakers to delegate assets to other protocols outside of Lido.

So where does the new demand come from?

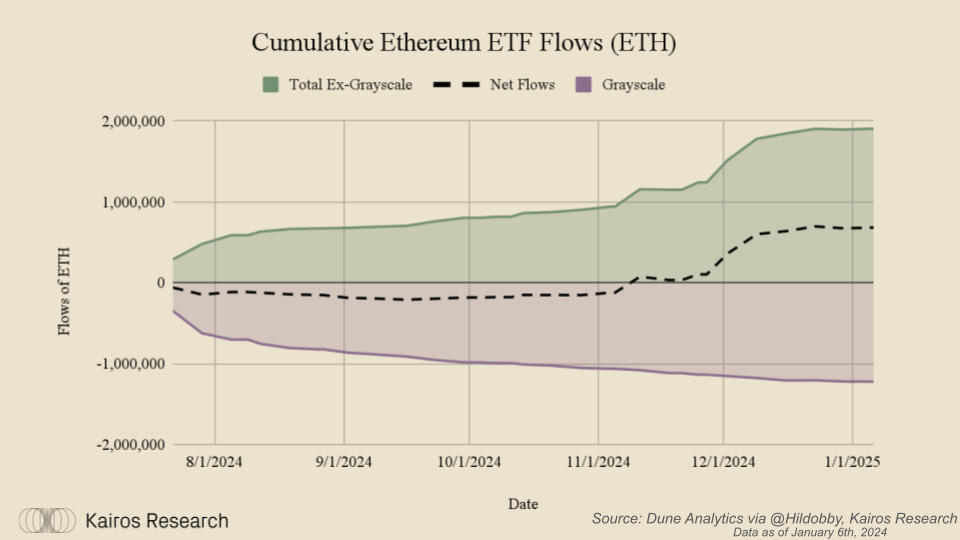

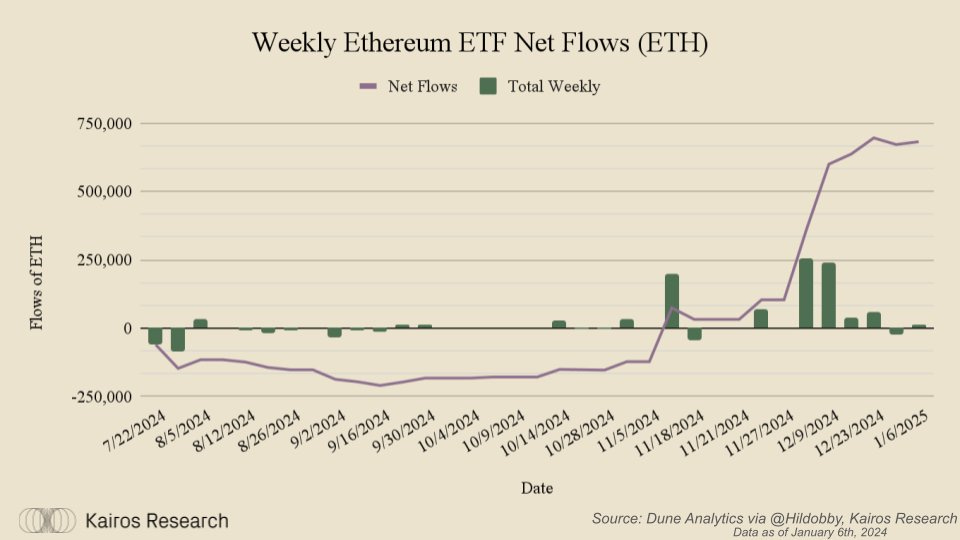

The Ethereum ETFs are currently undergoing a delayed version of the Bitcoin ETF process, where Grayscale muted the impact of inflows as investors trapped in their trusts fled after years of being locked. We can see in the image above, that at the beginning of December, ETH ETF flows flipped positive and we believe that they won’t look back. There is clear institutional demand for ETH and we predict that the conversation around ETH ETFs staking their assets under management will be highly relevant in 2025 and 2026.

Dinero also launched a product that allows Layer 1 and 2 networks to issue ETH LSTs, native to their individual network. The process flow involves Dinero providing the underlying infrastructure by staking users’ ETH as apxETH and issuing a Branded LSTs to the network it was staked through via LayerZero. Partner chains are able to choose both what the LST is named and how yield is distributed, whether through rebasing or upon user withdrawal, offering flexibility in how the yield is managed and presented to their users. There are already 10+ partner protocols working with Dinero, including seiyanETH on Sei, zkETH on zkSync Era, iETH on Ink Network and moveETH on Movement which will launch once their chain is live.

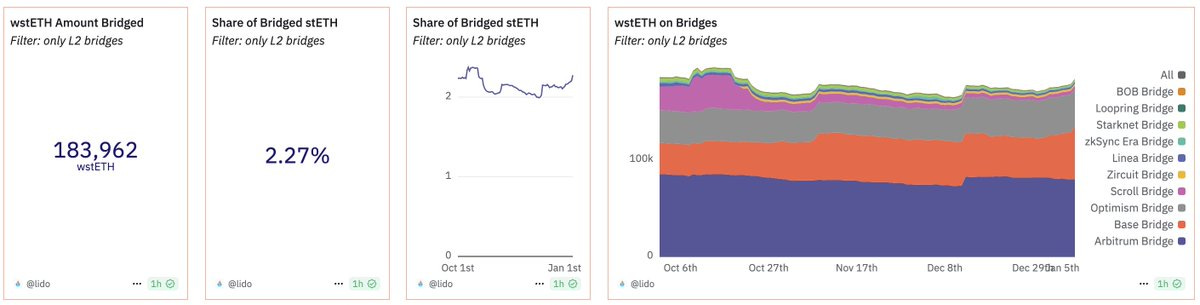

As more and more activity moves to Layer 2 networks, a vast amount of the LST supply will also find itself migrating to scaling solutions. We believe that a differentiated product with a strong focus on LST integration across L2s will prove to be not only fast growing, but also sticky. As seen in the Dune Analytics query below, ~$619M worth of Lido Staked ETH has been bridged to L2s - a number that increased by nearly 11.2% over the past month. Over the next couple of years we expect to see exponential growth in LSTs across scaling solutions as liquidity deepens on Arbitrum, Base, Optimism and other staking / restaking focused L2s like Swell and Scroll.

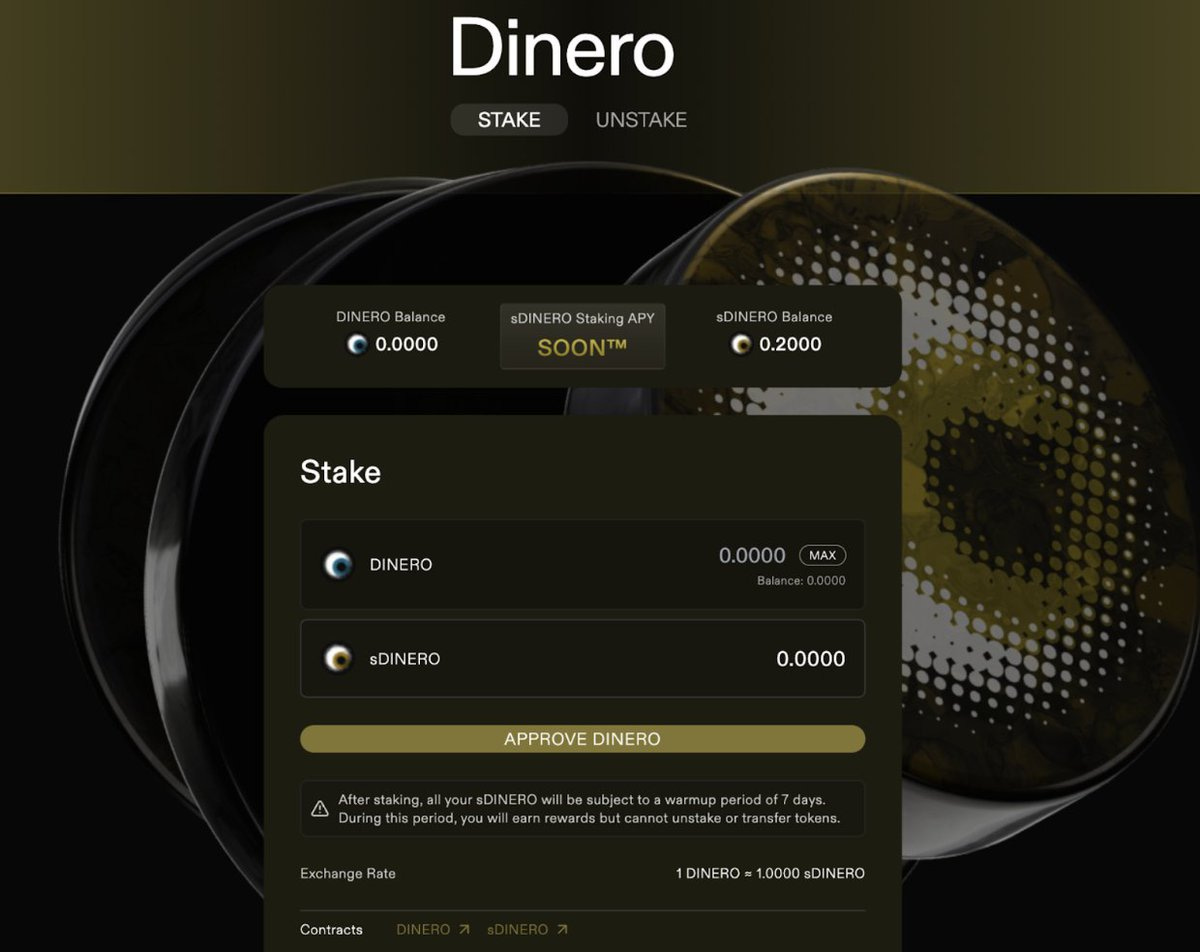

Value Accrual - The DINERO Token

Redacted was very quick to return value to token holders after the protocol launched, a theme which has stayed consistent and carried over to the DINERO token. Users are now able to stake their DINERO for sDINERO which earns autocompounded rewards and gets a 3x boosted governance voting status. As seen in the image below, DINERO has a 7 day warmup and cooldown period for sDINERO staking, effectively making it a 14 day minimum process to ensure longer-term alignment on participants.

At the time of writing, sDINERO is paying out roughly 13.6% APR and 30.6% of the total token supply is staked. This translated to around a current run rate of $4M in annual payouts to DINERO stakers - which comes from a mix of protocol earnings and inflationary incentives. As noted in the linked blog post, the earnings are converted to DINERO and paid out to stakers

How are these earnings generated and how will they scale in the coming years? Each of Dinero’s products has some form of fee for value accrual back to the protocol:

Hidden Hand Fee: A 4% fee to all bribes paid through the marketplace, split half to the treasury and half to sDINERO

Liquid Staking Fees: A 10% fee on all staking rewards earned by the protocol and a 0.5% for pxETH holders looking to instantly withdraw their tokens back to ETH via a liquidity buffer.

We look forward to seeing how the team plans to monetize the Dinero Relayer, but we believe there is ample opportunity to do so. Users looking for Meta & Private transactions will both be okay paying a premium to the Ethereum network’s usual gas fee for the added benefits and Dinero will be able to charge a small spread and absorb this premium.

What's Next?

The Dinero teams’ ability to understand the industry and build useful products has been very clear. We think their push into liquid staking fits well into their objectives and provides them an opportunity to compete in one of crypto’s largest addressable markets. Beyond growing a product line with consistent, predictable revenue - amassing hundreds of millions / billions in assets under management or TVL will unlock a much broader future for the protocol. At Kairos, we believe that the ancillary product lines that can be launched once you achieve critical mass are how you can return the most value to token holders and the Dinero team has proven to be forward thinking and creative.

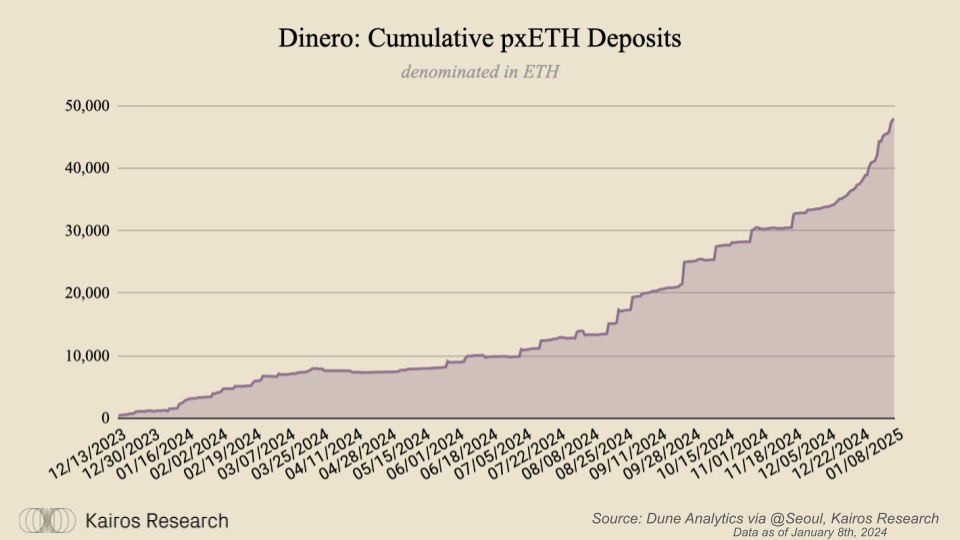

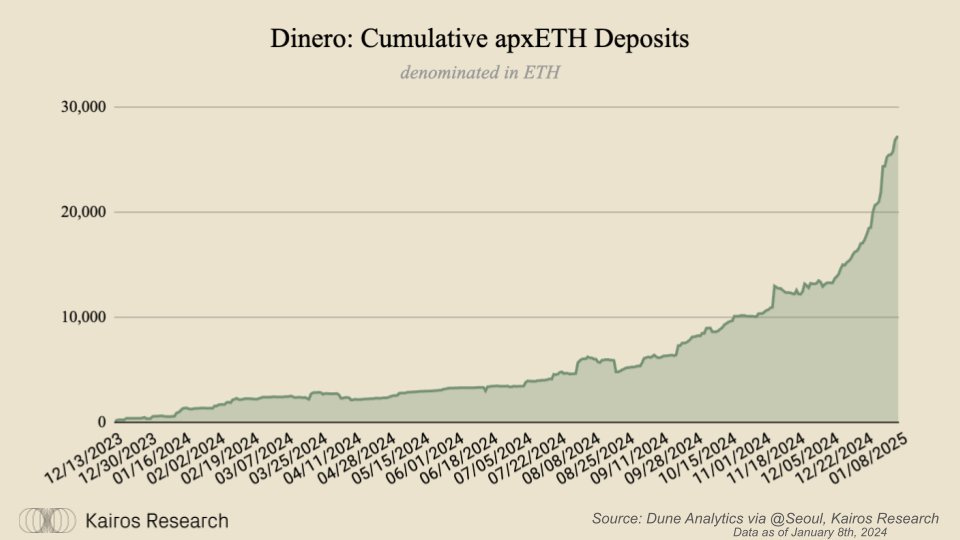

As seen below, Dinero has started 2025 strong seeing some of its fastest growth in ETH terms for their liquid staking product. Since January 1st, pxETH’s TVL has seen a 13.6% increase. Since December 1, 2024, pxETH’s TVL is up over 49%. apxETH’s growth is likely reflexive, given the boosted yield encourages deposits and increased deposits increases economic activity across pxETH pairs, such that the yield remains boosted for apxETH. Continued Dinero growth alongside a strong year for ETH and other crypto assets could make it very possible for Dinero to surpass the billion dollar in deposit mark. As of today, Dinero is the 13th largest Ethereum liquid staking protocol - check out DeFiLlama’s ranking to see their nearby competitors.

Over the next several months, Kairos will be tracking the data behind Dinero’s growth and providing updates on:

The protocol’s largest growth drivers, whether that ends up coming from Branded LSTs, ipxETH or elsewhere

The Dinero Relayer, its Go-To- Market strategy and who the power users of the permissionless RPC end up being

The value being returned to sDINERO stakers and the trends in protocol earnings

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.