How Liquid Are Liquid Restaking Tokens?

Roughly 73% of Deposits on EigenLayer have come through Liquid Restaking Tokens (LRTs) - But How Do The Liquidity Profiles of These LRTs Differ?

EigenLayer’s First AVS Hits Mainnet

The release of EigenDA, EigenLabs' data availability AVS, on mainnet today officially marks the beginning of the restaking era. While the EigenLayer marketplace has a long road ahead, one trend has made itself very clear: Liquid restaking tokens (LRTs) will be the dominant avenue for restakers. Over 73% of all EigenLayer deposits have been made through LRTs, but just how liquid are these assets? This report dives into answering that question, and addresses the nuance around EigenLayer at large.

Introduction to EigenLayer and Liquid Restaking Tokens

EigenLayer enables the reuse of ETH on the consensus layer through a new crypto-economic primitive referred to as “restaking”. ETH can be restaked on EigenLayer through two primary ways: through ETH natively restaked, or with a liquid staking token (LST). The restaked ETH is then used to secure additional applications known as Actively Validated Services (AVS), which in turn allows restakers to earn additional staking rewards.

The main qualm users have with staking, and restaking as well, is the opportunity cost of staking one’s ETH. This was solved for native ETH staking with liquid staking tokens (LSTs), which can be thought of as liquid receipt tokens representing one's staked ETH amount. The LST market on Ethereum currently sits around $48.65bn, constituting the largest DeFi sector by a significant margin. Today, LSTs represent roughly 44% of all staked Ether in total, and as restaking continues to grow in popularity, we expect to see the Liquid Restaking Token (LRT) sector to follow a similar, and potentially an even more aggressive, growth pattern.

While LRTs do possess some similar characteristics to LSTs, they differ drastically in their mission. The end goal of every LST is essentially the same: stake the user’s ETH and offer a liquid receipt token for them. However, for LRTs, the end goal is: delegate the user’s stake to an operator(s) which will then support a basket of AVS. It is up to each individual operator to choose how their delegated stake is distributed across these various AVS. Thus, the operators that LRTs delegate their stake to have a large influence on overall liveliness, operational performance, and safety of the restaked ETH. Lastly, they also have to ensure there is proper risk assessment for the unique AVS' supported by each operator, as slashing risk will likely differ depending on the services offered. Note that slashing risk will essentially be zero at launch for most AVS, but we will slowly see the “training wheels” taken off as time goes on and the staking marketplace becomes increasingly permissionless.

However, despite the structural risk differences, one similarity remains the same: LRTs lessen the opportunity cost of restaked capital by providing a liquid receipt token that can be used as productive collateral around DeFi, or also swapped out to mitigate the withdrawal period. This last point is especially important, because one of the primary benefits of LRTs is circumventing the traditional withdrawal period, which is 7 days for EigenLayer alone. Given this core axiom for LRTs, we anticipate there will naturally be net-selling pressure against them as the barrier to entry to restake is so low, but the barrier to exit is so high, thus liquidity of these LRTs will be their lifeblood.

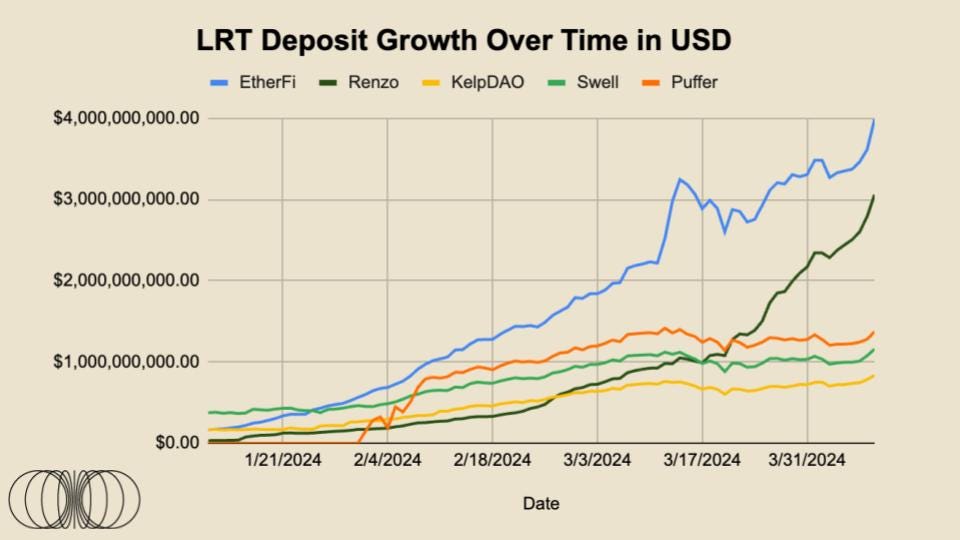

Therefore, as EigenLayer’s TVL continues to climb, it’s important to understand the driving forces behind the protocol’s growth and how these forces will impact inflows / outflows in the coming months. At the time of writing, 73% of all deposits into EigenLayer have been made through Liquid Restaking Tokens (LRTs). To put this into context, on December 1st, 2023, LRTs had around ~$71.74m in deposits. Today, April 9th 2024, they have grown to around $10bn, representing an impressive 13,800%+ increase over less than 4 months time. However, as LRTs continue to dominate restaking deposit growth for EigenLayer, there are some important factors to consider.

Not all LRTs are composed of the same underlying assets

The delegation of stake across AVSs from LRTs will vary in the long run, but not much in the short term

And most importantly, liquidity profiles across LRTs vary drastically

Given that liquidity is the most crucial advantage of LRTs, the majority of this report will focus on that last point.

The bull case for EigenLayer deposits right now is heavily incentivized by the speculative nature of Eigen Points, which we can assume will translate into some form of airdrop allocation for a potential EIGEN token. No AVS rewards are currently live, which means there is currently zero incremental yield on top of natural staking rewards across these LRTs. To drive and sustain $13.35bn+ of TVL, the AVS marketplace will have to naturally find the equilibrium between the desired incremental yield of restakers, and natural price of what AVS are willing to pay for security.

As for LRT depositors, we have already seen EtherFi’s tremendous success out the gate with their ETHFI governance token airdrop, capturing a fully diluted valuation of roughly $6bn at the time of writing. Taking all of the above into consideration, the potential for *some* capital flight away from restaking becomes increasingly likely post EIGEN launch and other anticipated LRT airdrops.

However, as far as reasonable yield goes, users will be hard pressed to find higher yield elsewhere in the Ethereum ecosystem that doesn’t involve EigenLayer in some regard. There are several intriguing yield opportunities throughout the Ethereum ecosystem. Ethena for example is a synthetic stablecoin backed by staked ETH and a hedged short position in ETH futures. The protocol is currently dishing out roughly ~30% APY on their sUSDe product. Further, as users become increasingly comfortable with interoperability and bridging to new chains, yield chasers may look elsewhere, potentially driving productive capital flight away from Ethereum at large.

All of this being said, we believe it is reasonable to assume that we won’t see any incremental staking yield event larger than a potential EIGEN token airdrop towards restakers, and large, blue-chip AVS which have raised at high 9 figure valuations in the private markets potentially issuing their tokens to restakers as well. Therefore, it is plausible to assume that some percentage of ETH will find its way out of the EigenLayer deposit contracts via withdrawals after these events.

Given there will be a seven day cool down period for EigenLayer withdrawals, and the overwhelming majority of the capital is restaked via LRTs, the quickest exit route would be to swap out of your LRT to ETH. However, the liquidity profiles across these various LRTs range drastically and many would not be able to facilitate large scale exits at market price. Furthermore, at the time of writing, EtherFi is the only LRT provider which has withdrawals enabled.

We think that LRTs trading at a discount to their underlying assets can cause a painful cycle of arbitrage for restaking protocols, imagine an LRT is trading at 90% of the value of its underlying ETH - a market maker / non-atomic arbitrageur may step in to buy this LRT and move forward with the redemption process, hopefully netting an ~11.1% profit assuming the price of ETH is hedged. A general supply / demand observation is that there is more likely to be net selling pressure on LRTs, as sellers may avoid the 7-day withdrawal queue. On the opposite side, users looking to restake may deposit their ETH immediately, giving buying LRTs on the open market little benefit of staking ETH that they already own.

As a side note, we expect that further choices of whether to withdraw or remain restaked will ultimately come down to the incremental yield offered via restaking once multiple AVS go live along with in-protocol rewards, and slashing is fully implemented. We are personally of the perspective that many are underestimating the incremental yield that will be offered through restaking. However, that is a whole report for another day.

Data Tracking

The data portion of this monthly report begins below and will track the growth, adoption & liquidity conditions of the top LRTs, as well as any notable news that we believe should be covered.

Top 5 LRTs Overview & Growth

LRT Liquidity & Volume

While staking via LSTs & LRTs has several key advantages over traditional staking, this usefulness is almost completely undermined if the LRTs themselves are not incredibly liquid. Liquidity refers to the “efficiency or ease with which an asset can be converted into ready cash without affecting its market price.” It is imperative that issuers of LRTs ensure that there is sufficient on-chain liquidity for large holders to swap in and out of the receipt token near 1:1 value of the assets’ underlying values.

Each of the existing LRTs have very unique liquidity profiles. We expect these conditions to persist for a number of reasons:

Certain protocols will get lucky with investors & users providing liquidity against their LRT in the early stages

There are many ways to incentivize liquidity, through grants, token emissions, through on-chain bribing systems, or in anticipation of such events via “points”

Some protocols will have more sophisticated, concentrated liquidity providers that will keep their LRT near peg with less total dollar liquidity

It should be noted that concentrated liquidity only works in a tight price band & any price moves out of the chosen range will result in significant price impact

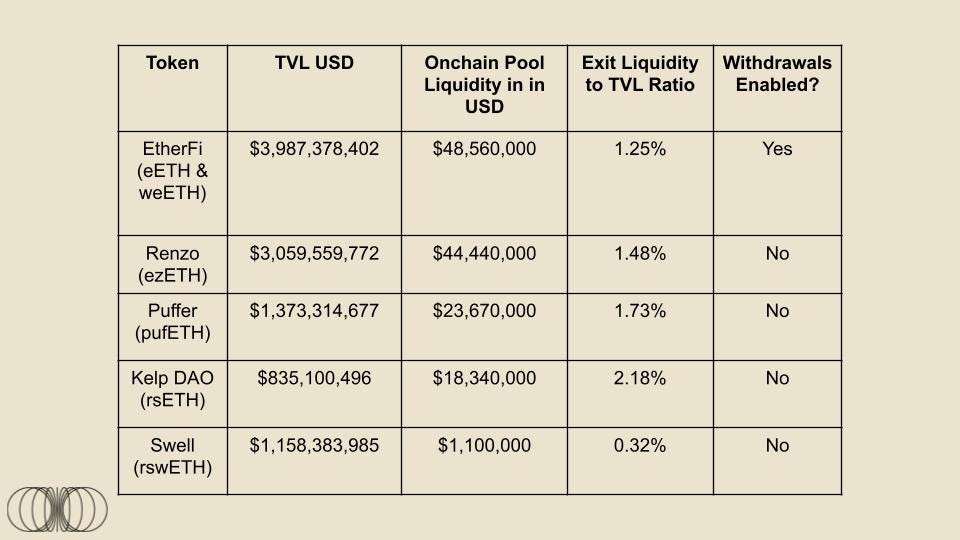

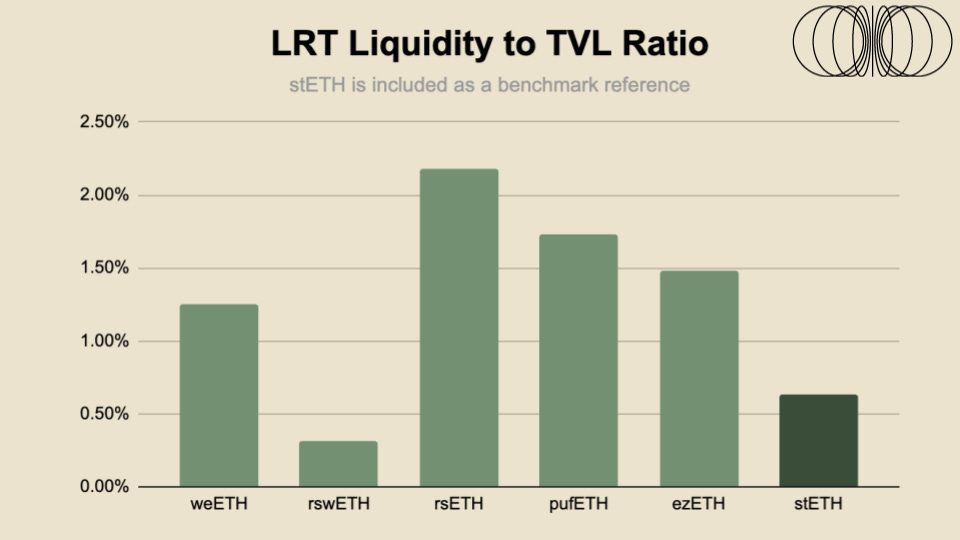

Below is a very simple breakdown of the Ethereum mainnet (+ Arbitrum) onchain pool liquidity for the top 5 largest LRTs. Exit liquidity is defined at the dollar value of the cash-like side of the LRT liquidity pools.

There is over $136m in readily available pool liquidity for this group of the five largest LRTs, across Curve, Balancer & Uniswap, which is impressive given the nascency of the restaking sector. However, to paint a clearer picture of how liquid each of these LRTs are, we will apply a Liquidity / Market Cap ratio to each asset.

Compared to the top LST, stETH, LRT liquidity ratios are not overly concerning. However, given the additional level of restaking risk combined with the fact that Eigenlayer has a seven day withdrawal period added on top Ethereum’s unstaking queue, LRT liquidity may be even one step more important than LST liquidity. Further, stETH trades across several large centralized exchanges, with orderbooks managed by professional HFT firms - meaning that stETH liquidity is much more than what is simply seen on chain. For example, there is over $2m in +-2% orderbook liquidity on OKX & Bybit. Therefore, we think it may be helpful for LRTs to explore this avenue as well with regards to engaging with centralized exchanges for integrations and educate market makers on the risk / reward for being a liquidity provider on these centralized venues. In next month’s edition we will dive deeper into the split between stable pool liquidity, x*y=k liquidity & concentrated liquidity across the top LRT pairs.

LRT Peg Data

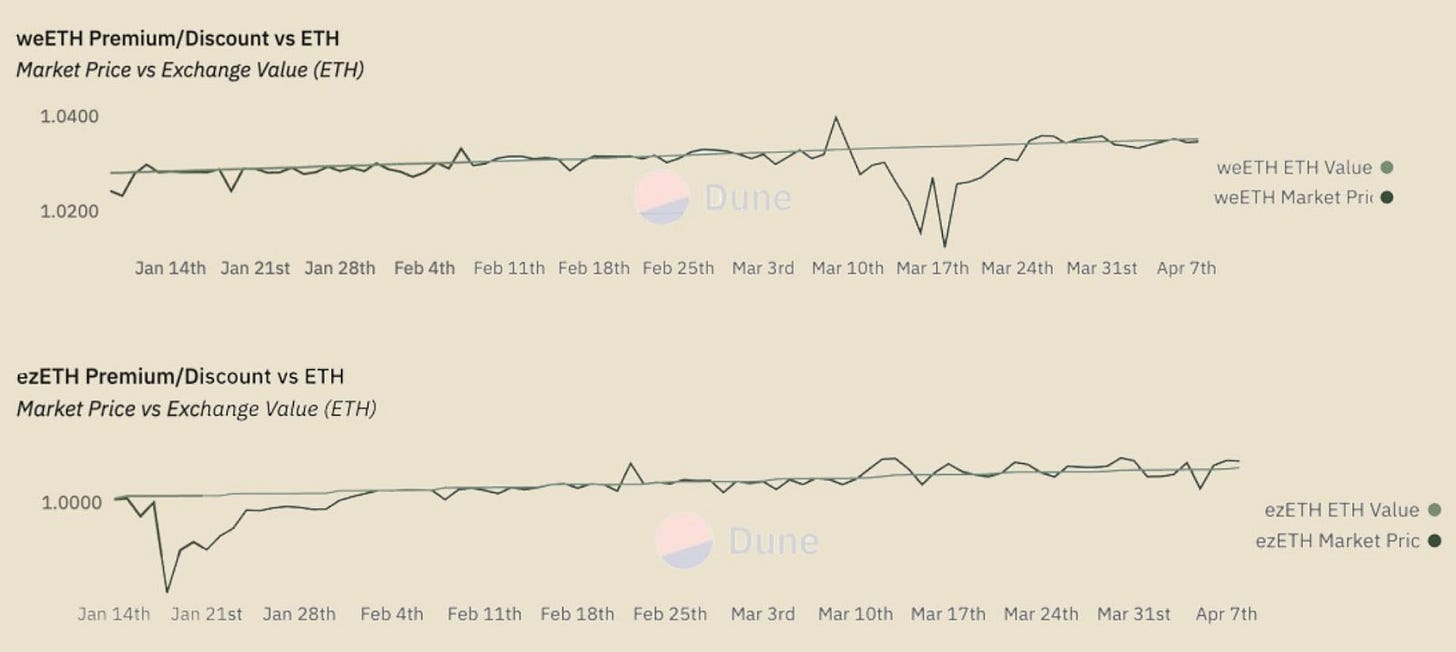

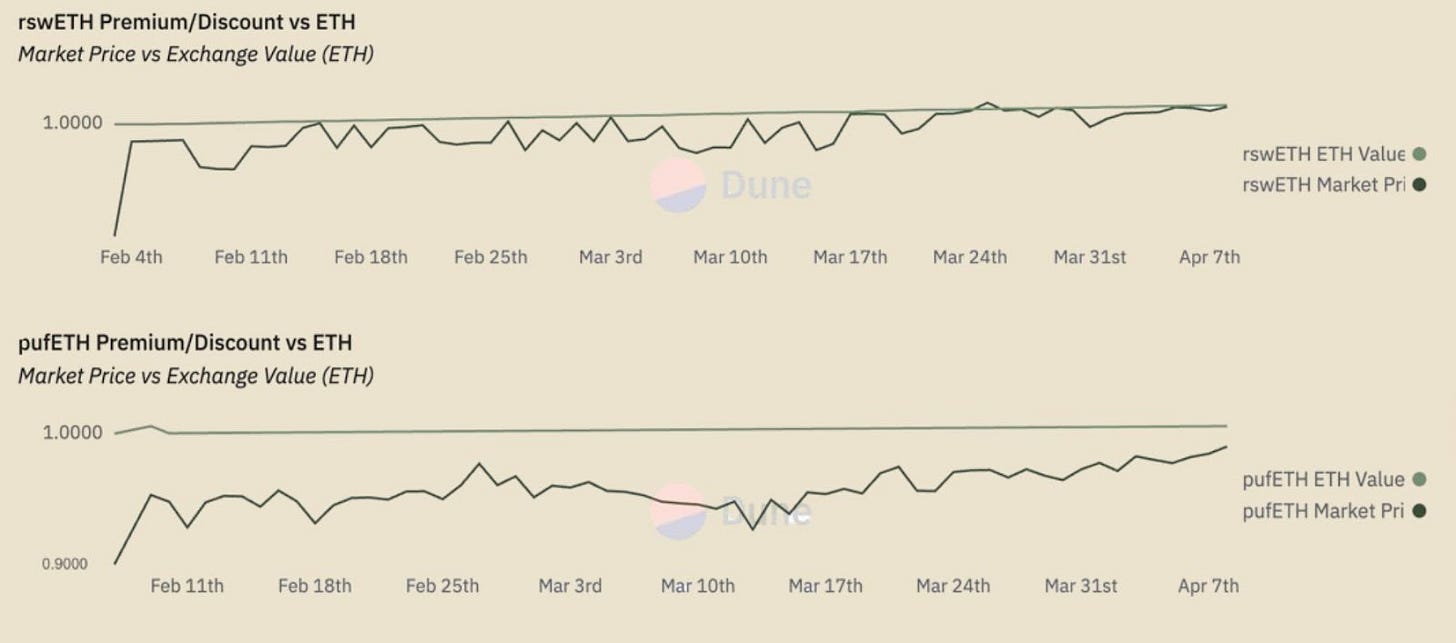

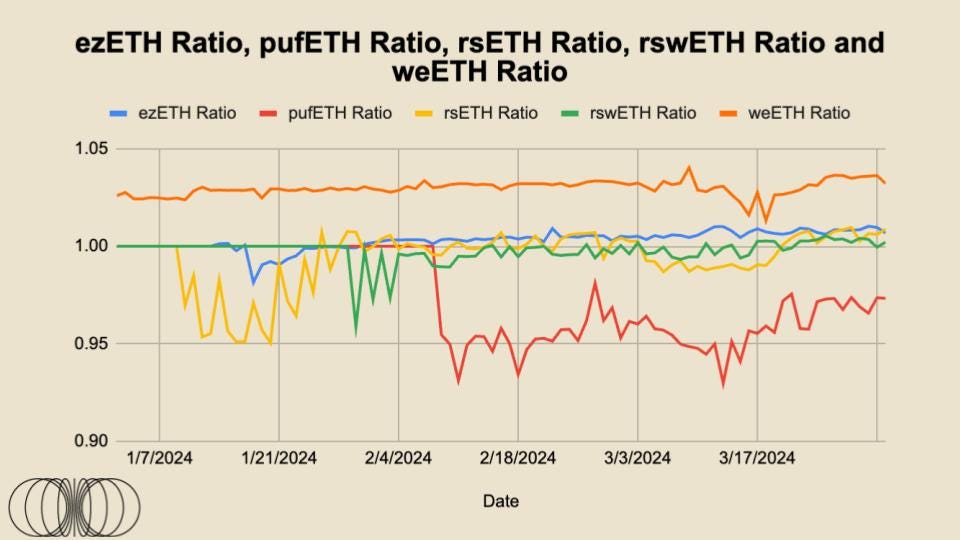

You can see in the chart above that rsETH, rswETH, and ezETH all trade relatively close together on a 1:1 basis to ETH, with a slight premium, and going forward, they should all trade at a “premium” due to their nature. Given these are all non-rebasing tokens, as opposed to stETH, they instead auto-compound staking rewards and then that is reflected in the token price. This is the same reason that 1 wstETH currently trades at a price of around 1.16 ETH. Theoretically, as time goes on, the “fair value” should continue to increase as it is due to time * staking rewards, which is then reflected in the increased fair value of these tokens.

The peg of these LRTs is extremely important as they essentially represent the amount of trust market participants have in the project overall, which is dictated directly by skin-in-the-game, or the willingness of arbitrageurs to trade away these premiums and discounts to keep the token trading at “fair value”. Note that all of these tokens are non-rebasing, which means they auto-compound and instead trade based on a redemption curve.

You can see that for the two most liquid LRTs, ezETH and weETH, they have traded relatively stable over time, mostly on par with their fair value. The slight deviation away from fair value for EtherFi’s weETH can mainly be attributed to the launch of their governance token as opportunistic farmers swapped out of the token, and naturally other market participants stepped in to trade away the discount arbitrage. We can expect to potentially see a similar event unfold once Renzo launches their governance token.

KelpDAO’s rsETH traded at a relative discount to fair value around launch, but has slowly and steadily found its way back to parity.

As for rswETH, it has traded slightly below its fair value for most of its lifetime, however in recent times it appears to have reached parity with its fair value. Out of all these LRTs, pufETH is the main outlier, as they have only traded at a discount to fair value. This trend however seems to be coming to a close as it inches higher toward parity with its fair value for the underlying assets.

It is important to note again that none of these LRT providers have withdrawals enabled aside from EtherFi. We believe that ample liquidity plus the ability for users to withdraw their funds at their will will instill higher confidence for the market participants trading away these discounts or premiums.

LRTs in the Broader DeFi Ecosystem

Once LRTs become further integrated into the broader DeFi ecosystem, especially lending markets, the peg importance will increase dramatically. When looking at the current money markets for example, LSTs, specifically wstETH/stETH, is the largest collateral asset on Aave, and Spark, with roughly $4.8bn and $2.1bn supplied respectively. As LRTs become increasingly integrated into the broader DeFi ecosystem at large, we expect these to eventually flip LSTs in amount supplied, especially as risk and product structure is better understood by the broader market, and they become more Lindy over time. Additionally, there are governance props on both Compound and Aave to onboard Renzo’s ezETH. Read more about that process here.

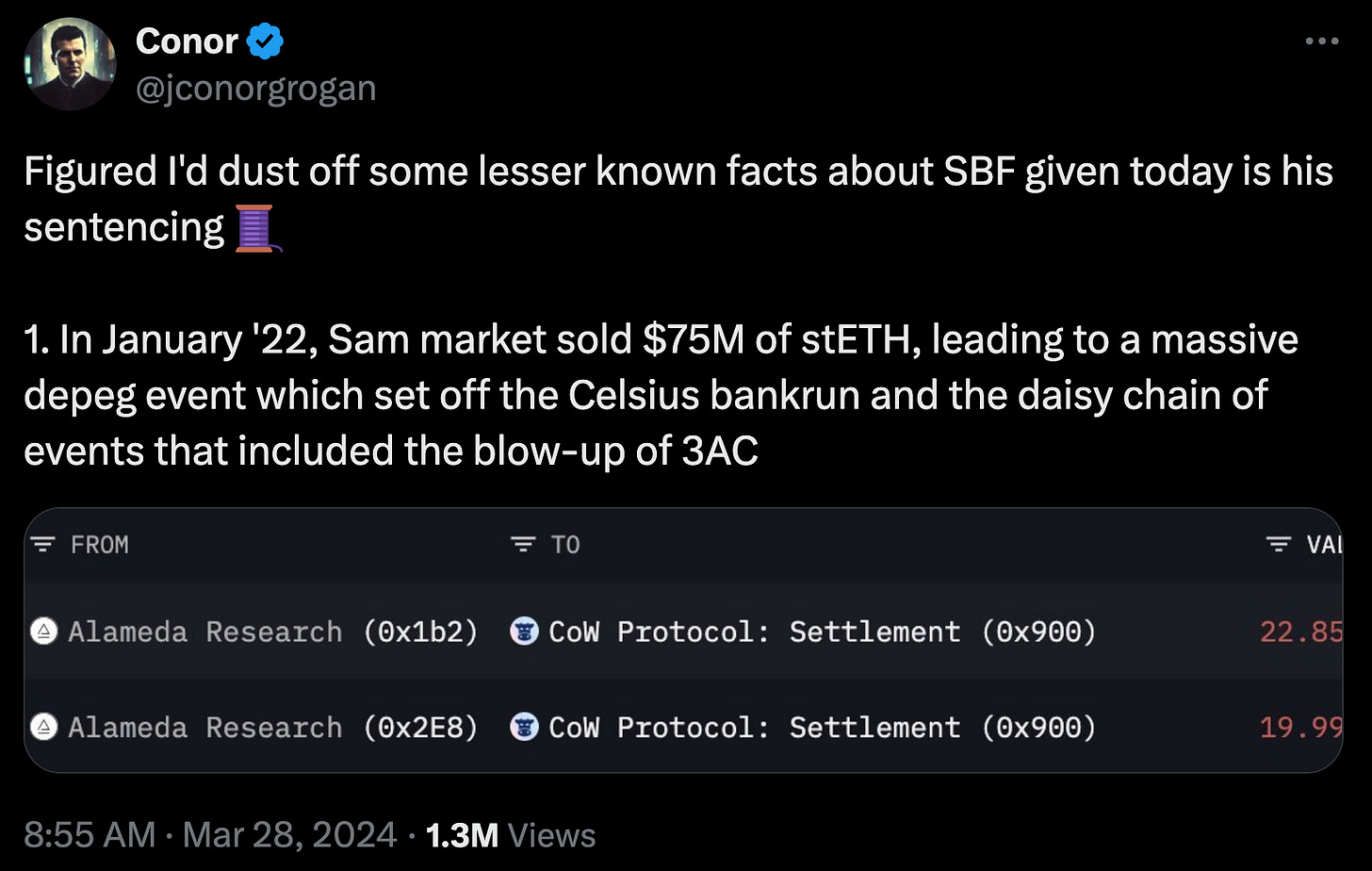

However, as previously mentioned, liquidity will continue to be the lifeblood of these products to ensure their breadth and depth of DeFi integrations and longevity at large. We’ve seen past examples of how LST depeg events can cause a daisy chain of chaos with this post below

Closing Thoughts

While stETH got an early headstart and dominated due to their first mover advantage, the suite of LRTs mentioned in this report all roughly launched around the same time and have market momentum on their side. We expect this to be a winner takes most market structure, given power laws apply to most liquid assets; simply put, liquidity begets liquidity. Hence why Binance has continued to dominate CEX market share despite all the fud and turmoil.

In conclusion, liquid resaking tokens are not incredibly liquid. The liquidity is decent, however there is greater nuance associated across each individual LRT and this nuance will only continue to grow as delegation strategies begin to differentiate from each other in the longer term. From a mental model perspective, it may be easier for first time users to think of LRTs as staking ETFs. Many will compete for the same market share, but allocation strategies and fee structure will likely be the deciding factor in the long run as to who is crowned the winners and losers. Additionally, as the products become more differentiated, liquidity will matter even more given how long the withdrawal period is. Seven days in crypto can sometimes feel like one month of regular time due to 24/7 global market operations. Lastly, as these LRTs begin their integration into lending markets, pool liquidity will matter even more as liquidators will only want to take on acceptable amounts of risk due to differing liquidity profiles of the underlying collateral in question. We think token incentives could potentially play an important role here, and we look forward to diving into the different token models following potential airdrop events from other LRT providers.