Introducing Everclear: The Case for Crypto's First Clearing Layer

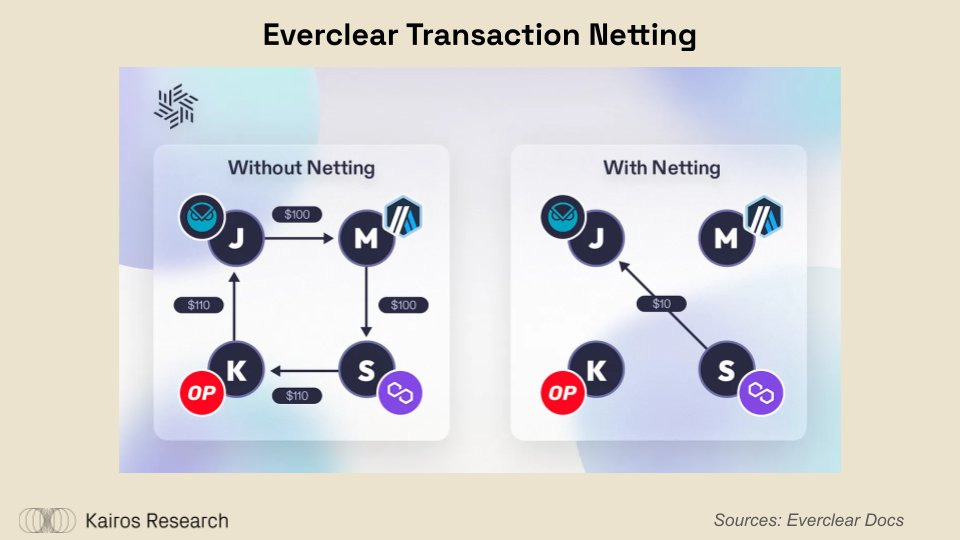

Did you know that 80% of transactions are “nettable” over a 24H period, meaning that there is less than $0.20 cents of true directional flows for every dollar bridged in a day? Everclear fixes that.

Scaling Ethereum Without Sacrifice

Ethereum’s rollup centric roadmap provided a unique solution for scaling blockchains, but created a new issue in fragmentation. We have talked about this very issue in previous articles, noting that while splitting the Ethereum ecosystem into hundreds of “siloed” execution environments is an effective way to lower transaction fees and offer faster (pre)confirmations, it is a major blow to the composability offered on Ethereum mainnet & other general purpose smart contract networks.

Connext’s recent rebrand to Everclear marks the launch of the first “Clearing Layer” and is part of a larger plan to solve rollup fragmentation at the application level, in what they refer to as chain abstraction. Chain abstraction is a concept in which the crypto end user is able to interact with ANY protocol on ANY chain, without needing to know which chain their assets are on or where they are going. In the background of these hopefully seamless transactions, Everclear would bridge, swap, and even acquire gas assets for the user, all in a “single transaction.” The ability to abstract away many of the complexities of the crypto landscape feels as if it is still in the very early stages, but Everclear could become a zero to one step for the crypto industry where Web3 becomes as simple as using the internet.

Connext self-admittedly stated that the current interchain ecosystem is falling short and that there are some clear drawbacks within intent-based bridging pools, including:

Bridging Pool capital moves over time towards the chains where it is *least* used.

Solvers (Liquidity Providers) typically do not want to accept funds on *every* possible chain. This means that liquidity becomes **path-dependent** (a solver must support both source *and* target).

Solvers must **rebalance** their liquidity between chains in order to ensure effective capital use. Rebalancing becomes the cost basis of filling, and presents further challenges:

Solvers either need large amounts of capital on each integrated chain or to be fully integrated into every possible cross-chain infrastructure rail (CEXs, other bridges, OTC markets)”

In the long run, these drawbacks cause centralization of solvers, as only the largest and most sophisticated solvers can provide efficient and cheap instant liquidity for bridgers. The result is then either giving pricing power to a small number of sophisticated solvers or forcing solvers to stick to a fee tier and then having low cross-chain liquidity, leading to a worse user experience. Connext V2 took a large step forward, partially patching this issue via an automated rebalancing feature for solvers, which abstracts away the need for solvers to manually rebalance. Yet, a real implementation of chain abstraction requires more robust interchain infrastructure that can encourage solvers to become non-path-dependent, and offer cheap access to bridging any asset to any chain.

So how can these issues be solved and why is Everclear the team to deliver the solution?

Why Everclear (Prev. Connext)?

As of today, airdrop farming is a clear driver of inorganic volume across DeFi protocols - confusing investors and developers on which protocol crypto users ACTUALLY want to use. One of the most extreme examples in recent history is Starknet, where the development team raised several hundred million at up to an $8 billion dollar valuation in the private markets. Mercenary farmers become acutely aware that the team would launch a highly valuable token for their Layer 2 (L2) and “sybilled” the network with dozens of wallets to get a chance to receive several allocations of the STRK airdrop. As seen on the chart below, the Starkware team announced the snapshot for this airdrop and users fled, withdrawing their ETH as there was no real product that they wanted to organically use on the network.

So what does this have to do with Connext?

The trend of mercenary farmers taking advantage of extreme private market valuations is overly prevalent within the bridging & interoperability space. Wormhole & LayerZero are two of the clearest examples, backed by some of the largest investors (Sequoia, Jump Trading, Andreessen Horowitz) and having raised hundreds of millions of dollars before launching their tokens. In anticipation of an airdrop, a few thousand farmers traded their time for money, making the data look as if there was a much higher demand for cross-chain bridging than in reality. Another chart below shows this trend playing out with LayerZero, as their protocol bridging activity has largely died off at the same time as overall crypto activity & prices have ramped up. None of this is to blame or insult the teams behind Wormhole, Starknet & LayerZero, which I’m sure have some of the best talent in the crypto industry and will likely see continued success: noting these trends is just important when filtering out noise and finding protocols with growing demand at this point in time.

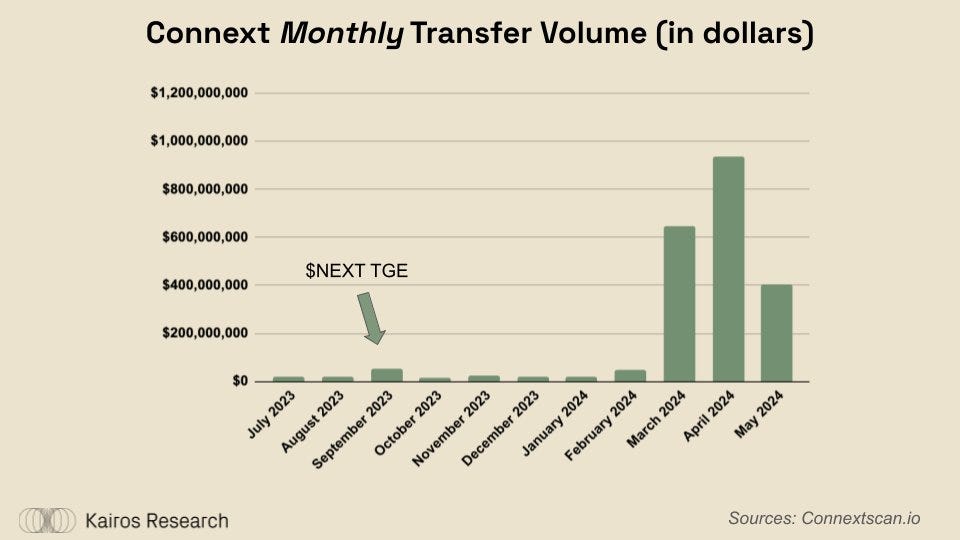

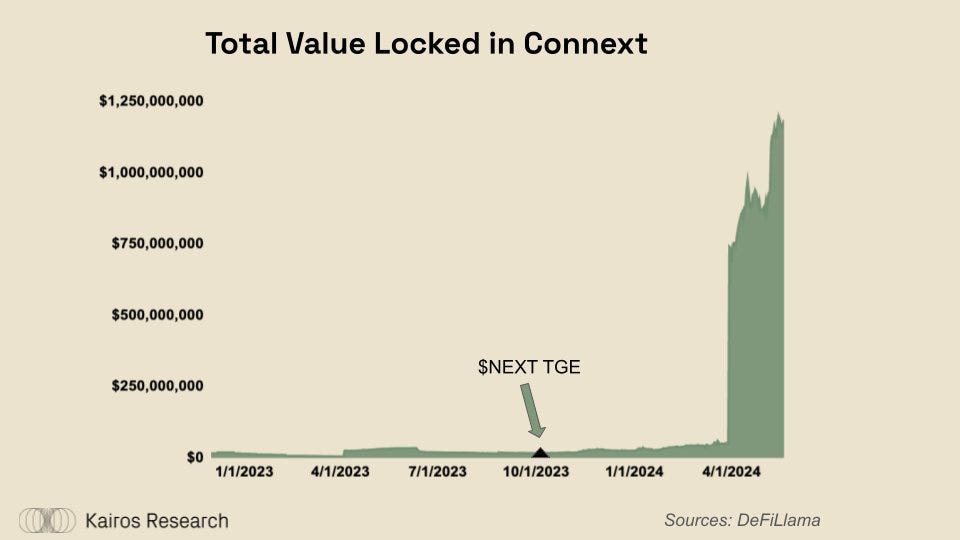

On the opposite end of the spectrum, Connext launched their token (NEXT) in September 2023, which forced the team to iterate and find product market fit rather than rely on volume from airdrop farmers. As seen in the chart below, the vast majority of Connext bridging activity has taken place within Q2 of 2024 post the launch of NEXT. Why is this? The Connext x Renzo ezETH Restake from Anywhere product has been hugely successful, allowing ETH holders on Arbitrum, Base, Mode, Linear & BNB Chain to restake ETH with Eigenlayer via L2, avoiding costly gas and bridging fees. In the charts below, you can see Connext’s recent influx of volume and Total Value Locked.

Why Now?

Definitions for the sake of this article**

Intents: A more flexible variation of the standard blockchain signature, capable of taking many different computational routes to fulfill a user's expressed end goals.

Settlement: Part of the bridging process in which solvers are refunded for fronting their capital, once it is confirmed that they released tokens to the bridger on the destination chain

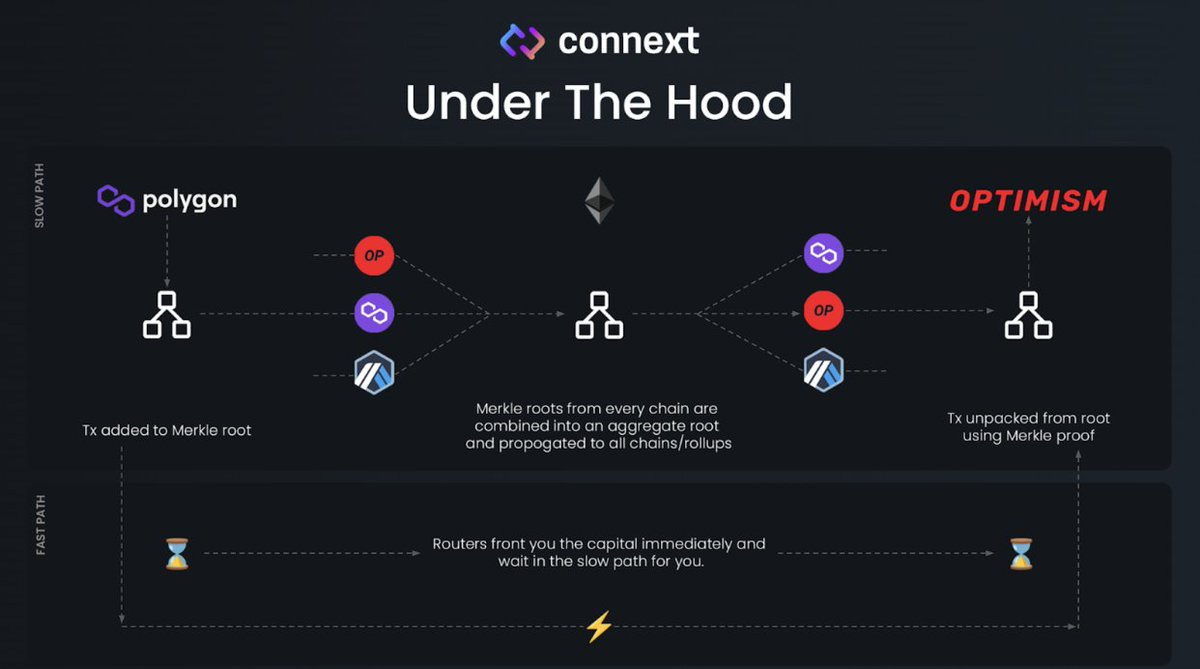

Last week Connext launched V3, the first step in their rebrand to Everclear, a modular settlement and clearing network for all interchain intents. To understand how Everclear builds on Connext’s capabilities, we must understand the current architecture of Connext V2 and the participants involved in facilitating interchain transactions:

Solvers (Routers): Liquidity providers that are willing to front liquidity for bridgers on their desired destination chain, in exchange for assets on the chain that the bridger is leaving. Solvers enable instant bridging for a small fee, rather than requiring bridgers to wait out the rollup settlement period.

Sequencer: The actor/s responsible for collecting batches of transactions and selecting Solvers that are able to fulfill the intents. The sequencer then propagates these batches to the Relayer network.

Relayers: “A decentralized network of infrastructure operators that can execute smart contract transactions on behalf of a user in exchange for a small fee. Because the last leg of an interchain transaction requires execution on the destination domain, relayers play an important role in completing the full flow.” Connext utilizes Gelato to act as their Relayer.

Watchers: Automated, off-chain actors that are able to halt / pause the protocol in the event that a fraud or hack is detected, minimizing the potential downside of the incident.

Everclear now introduces a customized Arbitrum Orbit rollup that will be able to:

Host auctions to determine which solvers can cost-effectively fill batches of interchain intents

Verify the execution of any filling transaction

Optimize for strategies that best settle funds for solvers and for future bridgers

The last point is extremely important, as efficiently rebalancing bridged assets will be integral in incentivizing solvers to provide bridging routes for every single asset on every existing chain. Bridging protocols working together makes more sense than you would think, considering across all bridges, at least 80% of transactions are “nettable” over a 24H period, meaning that there is less than $0.20 cents of true directional flows for every dollar bridged in a day. All of these bridging protocols (including Connext) could integrate Everclear to outsource solver rebalancing and lower their costs by up to roughly 90%, as there will be significantly less rebalancing once flows are net across many bridges.

As mentioned above, Everclear is the first modular clearing layer, which plugs into Hyperlane for Transport, Eigenlayer for Verification, “Connext” solvers for Execution, Gelato for Relaying and Everclear Arbitrum Orbit chain for Settlement. Kairos Research believes the modular design will not only allow Everclear to be highly specialized, but through working with Hyperlane the protocol will be easily integrated into every new blockchain ecosystem. Chain abstraction is only as strong as its weakest link & being able to integrate highly anticipated chain launches will be value additive not only to Connext, but to the wider crypto ecosystem. The image below showcases the necessary components for any bridging protocol, highlighting the design of Everclear and how it fits into the interchain stack.

In the Everclear introduction announcement, the clearing layer was very simply described as similar to the Visa payment network, wherein Visa immediately authorizes a transaction when you swipe your card so that you can quickly receive your coffee. However, on the backend, Visa aggregates all of the payments going through their network and nets them so that they do not have to make billions of individual settlement payments. Rather, they can see if multiple payments may be going towards the same vendor and coordinate with banks to net the settlement in a small handful of transactions. Using the above comparison, the intent-based bridges that plug into Everclear would act as Visa’s authorization system, Everclear would act as Visa’s in-house clearance and then the instant-liquidity and refunding of solvers on the underlying blockchain would be equivalent to bank settlement.

We mentioned that Connext has been extremely successful in finding product market fit over the last half of a year, so below we will dive into the interchain experience that the protocol currently offers and show how that combined with Everclear, the chain abstraction thesis is coming to life.

The Current State of Connext

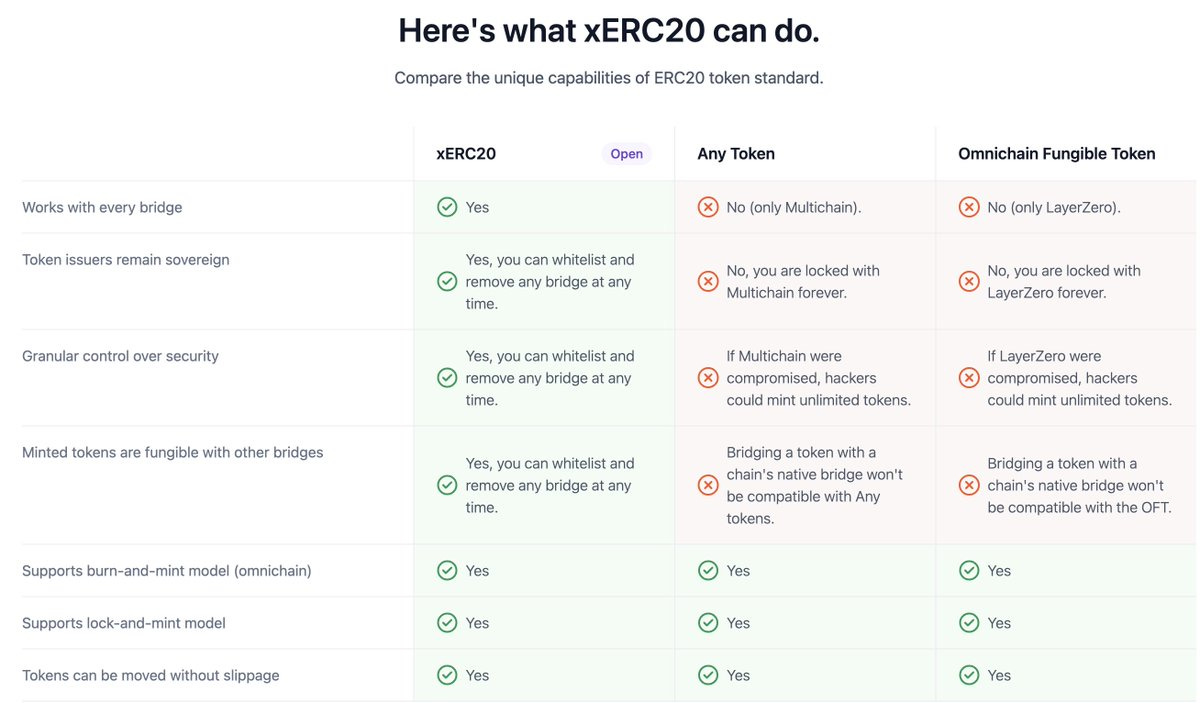

Introduced by Connext, xERC20 (ERC-7281) is an Ethereum interchain token standard, in which token issuers are able to have a token that is completely fungible across chains, no matter which bridge (canonical or third party) was utilized. xERC20 issuers have interchain authority over their token on all chains, such that they can effectively whitelist which bridges are able to mint the fungible version of their token. This provides a serious benefit in interchain UX: allowing multiple different instances of bridged assets to biome effectively equal throughout the L2 DeFi ecosystem, while also mitigating the large potential downside of this fungibility through rate-limiting. Issuers are able to use rate limiting to turn off minting from a risky / compromised bridge to mitigate the damage of bridge exploits.

When a token issuer creates an xERC20, they may also choose to use Connext as one of their whitelisted bridges, in which Connext solvers will enable fast / immediate bridging by holding the original “home token” and the cannonically bridged representation of the token in their interchain liquidity pools. Through this, token bridgers are able to access the canonical L1<>L2 versions of their token without waiting through the lengthy rollup challenge period. The image below showcases how Connext delegates “interchain message verification to canonical bridges, giving users the trust guarantees of the underlying chain.”

The xERC20 token standard has seen significant adoption throughout the Ethereum ecosystem already, with Connext using the standard for their NEXT token and further integrations from protocols like Alchemix, Bunni, Kelp DAO and Renzo. While xERC20s significantly improve interchain UX, the primitive is not owned by Connext and adoption does not necessarily accrue value directly back to Connext the protocol. However, Connext is able to showcase the importance of xERC20s to Chain Abstraction through a partnership with Renzo on the “Restake from Anywhere” product. Restake from Anywhere allows an user with ETH on almost any L2 to restake to Eigenlayer and receive Renzo’s ezETH Liquid Restaking Token (LRT).

Inception to Date, roughly $768M in ETH has been staked through Renzo & Connext’s Restake from Anywhere, with a 19.9% of ezETH’s supply now living on Connext’s integrated L2s (does not include Blast). Kairos Research believes that the Restake from Anywhere product is a strong example of product market fit for Connext, as they have allowed L2 users to partake in one of the most interesting Ethereum mainnet applications, while avoiding unnecessary fees and bridging interfaces. The success seen from Restake from Anywhere, and xERC20s more generally, make Connext a compelling team to take chain abstraction head on through Everclear and more.

Competitive Analysis & Conclusion

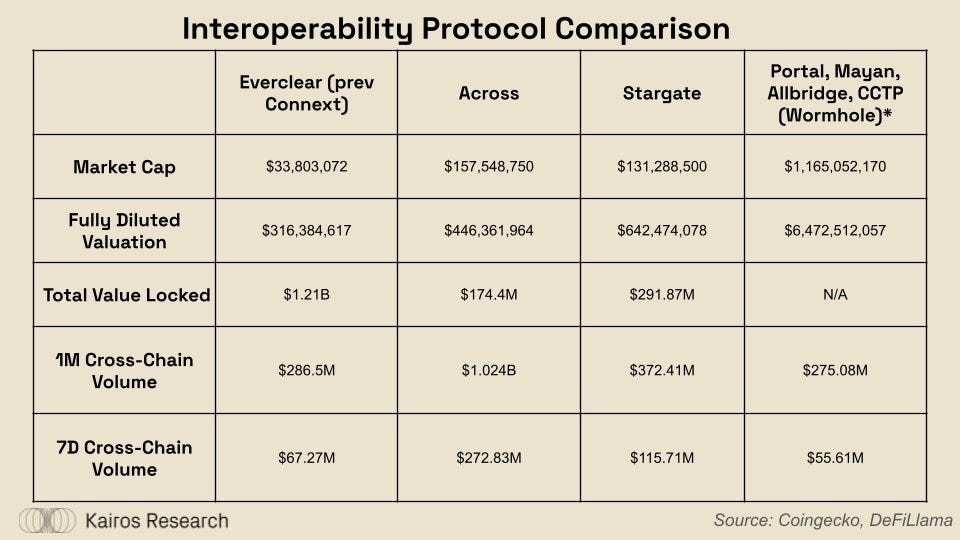

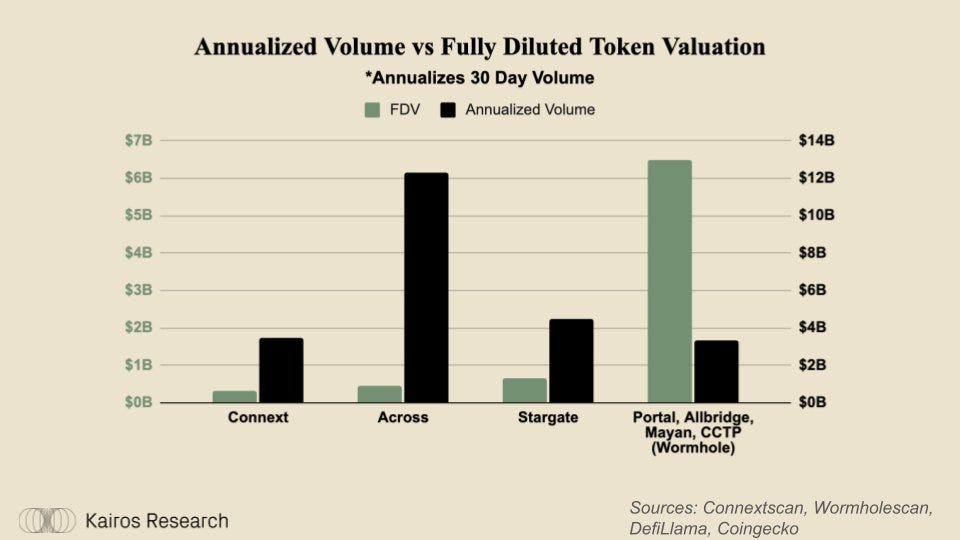

As seen in the slides below, on a relative basis to Stargate & Wormhole, Connext & Across’ native tokens are extremely undervalued. A portion of Wormhole’s valuation premium may be due to their use of the lock & mint model, which cuts out the need for liquidity providers (LPs) by adding trust assumptions to bridged assets - in theory cutting out LPs should increase the protocol’s margins as there is no need to share bridging fees to incentivize liquidity.

Connext is facilitating more cross-chan volume than Wormhole over a 1 month time period, but the NEXT token is trading at 1/25th the valuation of W. Neither protocol currently has any fee accrual, but in a world where both protocols turn on an identical fee switch, Connext would have to take just a 3-4% portion of ALL fee revenue (shared with solvers and liquidity providers) to collect 1/25th of the fees of Wormhole.

As shown above, Everclear will play a huge role in making the lives of solvers easier. While we will not speculate on exactly what portion of fees solvers should share with Connext / Everclear, the clearing layer should further increase solver margins and present a clear roadmap for where protocol fees might start. Further, there will be no shortage of value accrual opportunities within the clearing layer itself whether that takes place through transaction fees (sequencer) or through a flat rate charged on all settlements. Everclear grows the pie and is a value add for all intent-based bridging protocols, so even if the clearing layer charged 10 basis points on $150M in monthly settlement volume, it would generate $1.8M in annualized revenue.

Kairos Research believes that the intent-based bridging space is still nascent and volume should be up only for a variety of reasons, including:

Interchain intents make Ethereum’s L2 ecosystem more user friendly, which could in turn take market share from the activity taking place on Ethereum mainnet, Solana and elsewhere

Chain abstraction is a leap forward in crypto UX, which should onboard a new set of users and make the technology a more intriguing place to build and interact

Pool-based intent protocols take away a number of the trust assumptions seen within lock & mint protocols like Portal (Wormhole), which better fits within the crypto ethos

We are potentially still in the early stages of crypto uptrend and current DeFi activity is still only a fraction of where it was in 2021

ETH is a $460B asset, of which only 1-2% has actually migrated to L2s. While there will always be a need for ETH on Ethereum mainnet, there should be a considerable migration as more and more users look for cheap and fast transactions. It would not be unrealistic for 40-50%+ of the ETH supply to someday migrate towards rollups if the Ethereum scaling thesis plays out. During this process, real cross-rollup activity could easily 10-100x, creating a new market for interchain arbitrage and driving tens or hundreds of billions of dollars in volume to protocols like Everclear. Additionally, Rollup as a Service providers will allow any application to easily deploy their own custom rollup, further fragmenting liquidity and integrating the need for chain abstraction and interchain bridging.

Being the first mover within clearing & settlement should present Everclear with a unique opportunity to gain sticky integrations that are beneficial for the whole ecosystem. Network effects will be of utmost importance, as settlement becomes increasingly efficient as you net the real flows across all bridges and amortize transaction fees across larger sums of money. Why would competitors build their settlement layer in house, if all other bridges are already using Everclear? We expect Everclear to play an integral role in not only a multi-billion dollar sub-industry of crypto, but also in the future of Ethereum scaling and blockchain UX.

Thank you for reading!

If you enjoyed this research article, be sure to subscribe to get our long-form research reports directly to your inbox & follow us on twitter to stay up to date with the latest news & analysis from Kairos Research. We’ll see you next time!