Jito’s 24-Hour (Re)staking Cap Lift: A Catalyst for VRTs

A Deep Dive Into the Surge of Deposits to Jito's Vault Restaking Tokens

Executive Summary

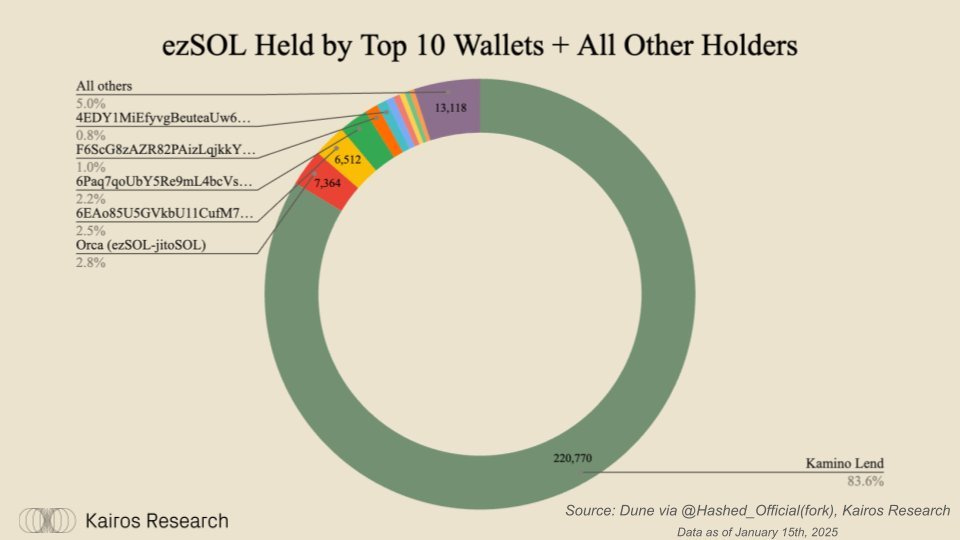

• Renzo’s Record-Breaking Growth: Renzo led with a 4.6x increase in ezSOL supply, surging from 57k to 263k. Strategic incentives with Kamino drove 83% of ezSOL to the protocol, amassing $77M in current TVL.

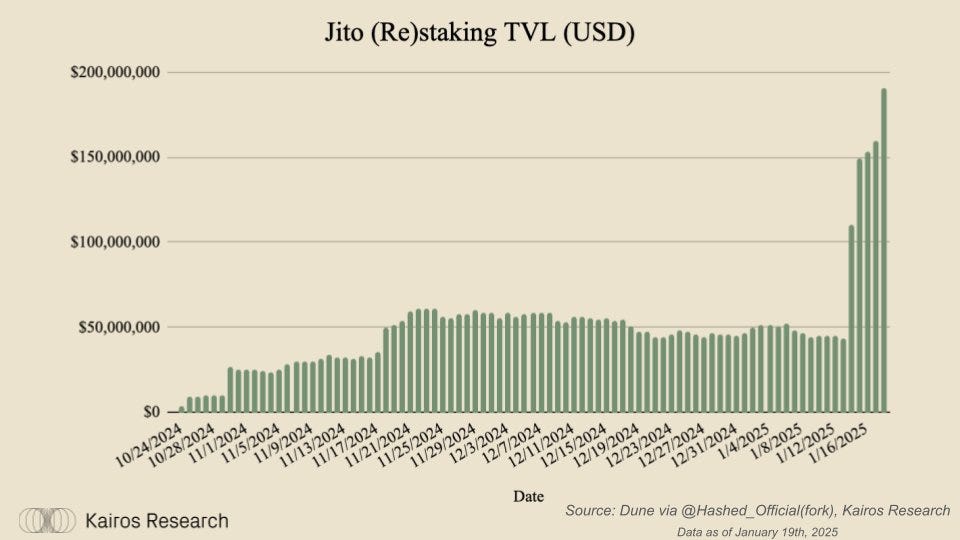

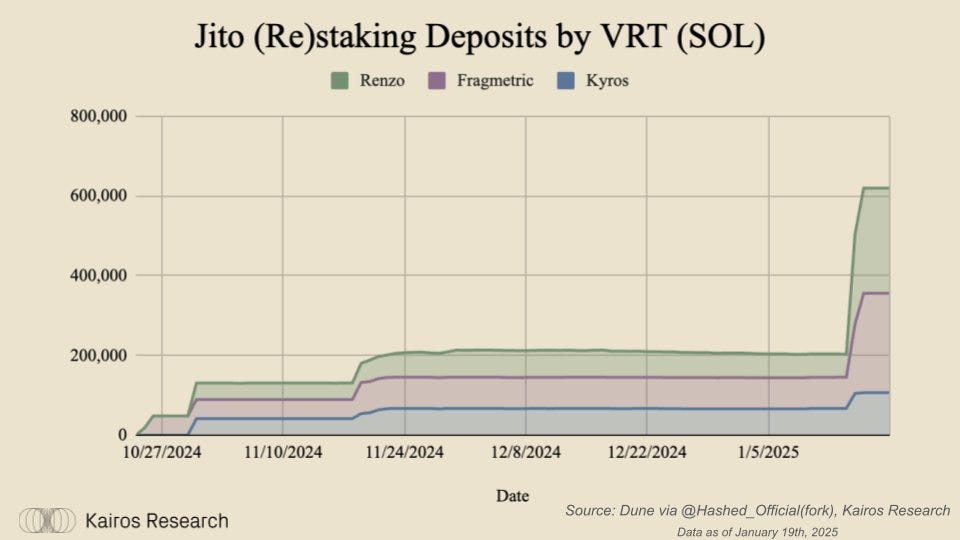

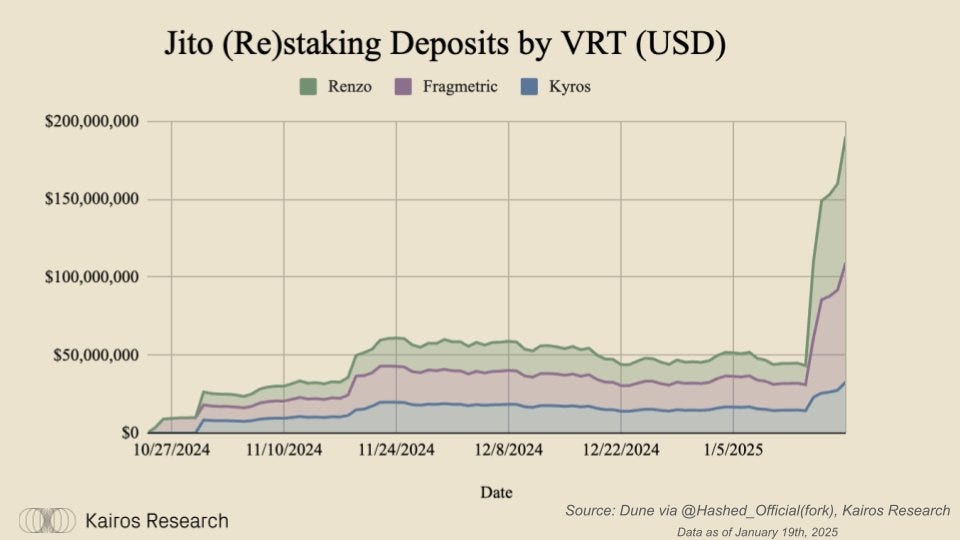

• Overall TVL Surge: Jito’s 24-hour cap lift boosted aggregate TVL across Fragmetric, Kyros, and Renzo by 339%, reaching $190M in TVL - a testament to the growing impact of VRTs on Solana’s DeFi ecosystem.

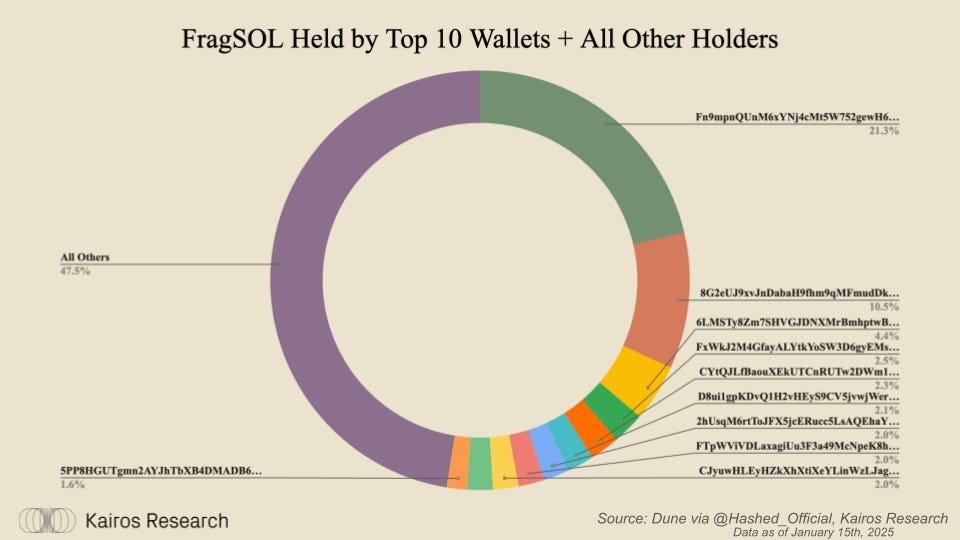

• Fragmetric’s Growth and Decentralization: Fragmetric tripled its TVL to ~$70M, with unique wallets holding FragSOL rising from 3k to 21k. Top 10 wallet concentration dropped from 75% to 52.5%, reflecting healthier decentralization.

• Kyros’ DeFi Adoption: Kyros saw 15% of its kySOL supply flow into Solana DeFi protocols, with Kamino Finance as the largest beneficiary, demonstrating seamless VRT integration into the DeFi ecosystem.

Earlier this week, Jito’s (Re)staking deposit caps were raised for a brief 24-hour period, igniting a surge of activity across key Vault Restaking Token (VRT) providers. Fragmetric, Kyros, and Renzo each experienced substantial growth, with record-breaking inflows marking new milestones in TVL, and shifting distribution patterns.

This fleeting window offered a glimpse into the evolving dynamics of the role VRTs will play in Solana's onchain economy and sets the stage for what’s to come as caps are eventually removed. At the time of writing, the aggregate TVL of the three Jito VRTs is $190m, up more than 339% where it was prior to the cap raise.

While this number is also due to SOL's recent price surge, SOL denominated inflows to VRTs also played a massive role. SOL denominated inflows saw a 3x increase across the board for these VRTs.

Here's how each individual VRT faired during the deposit window:

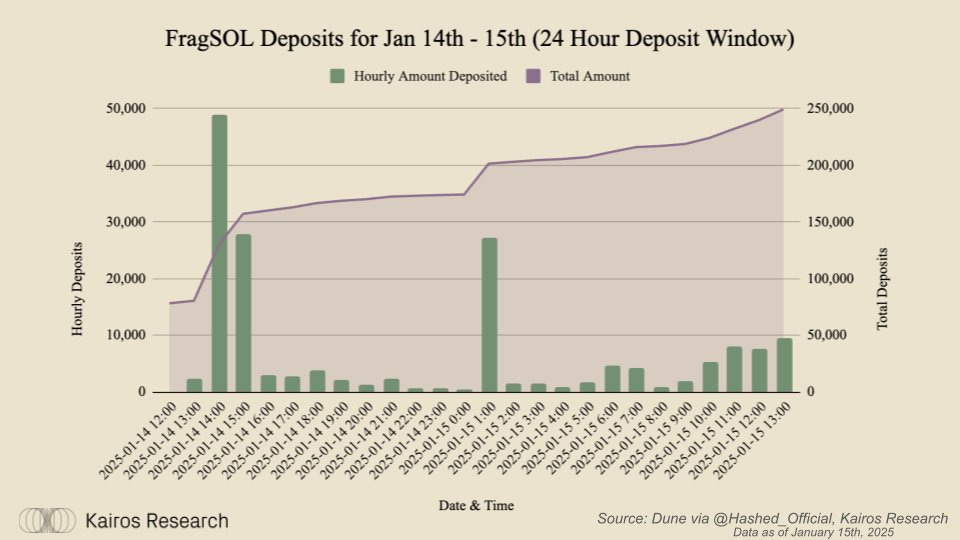

Fragmetric

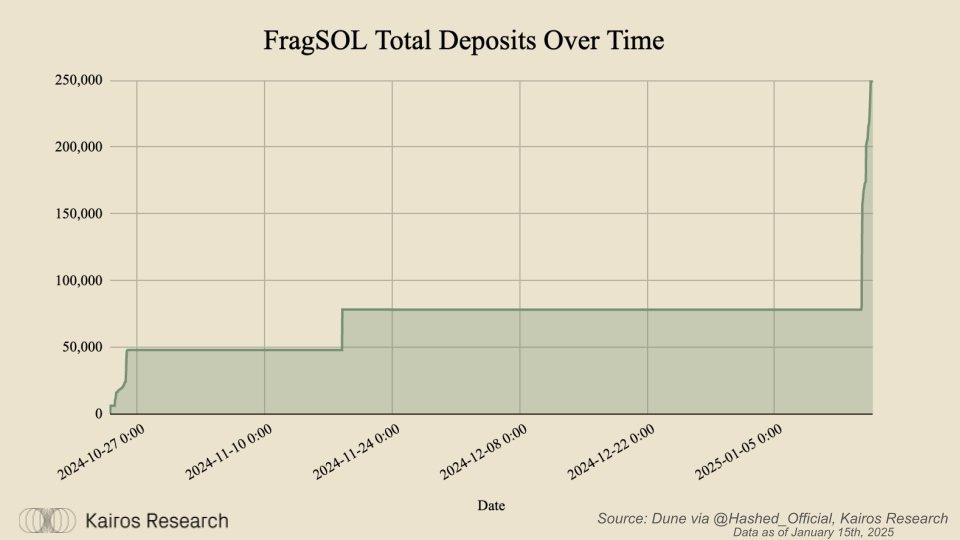

Fragmetric was able to more than 3x their TVL and surpass the $50m threshold (now at ~$70m).

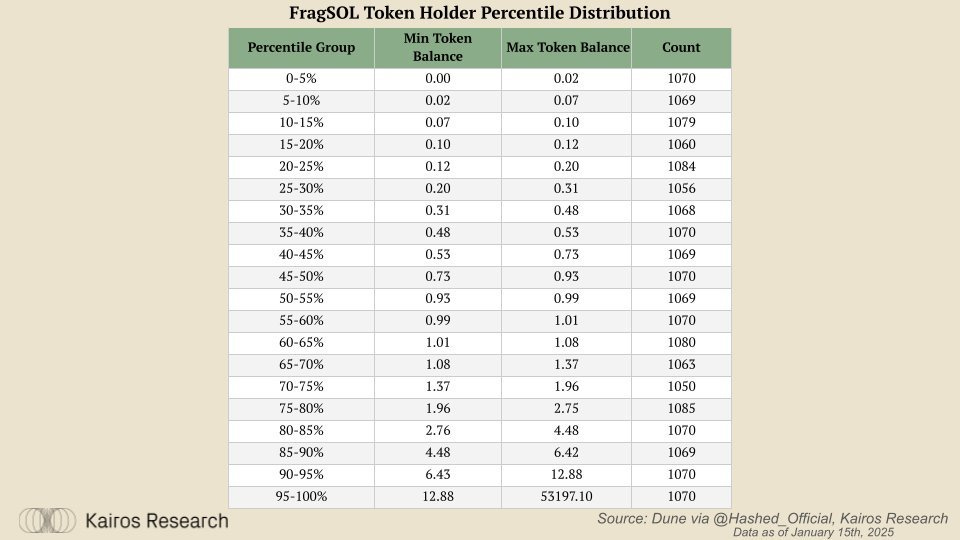

The count of unique wallets holding FragSOL also saw a spike from roughly 3k to 21k as deposits flowed in. When looking at the distribution of holders, more than 50% of wallets holding FragSOL have 1 unit or less.

To break into the top 5%, depositors need to have at least 12.88 FragSOL at the current levels.

The overall distribution is fairly sound with the top 10 wallets only accounting for 52.5% of the supply, showing continued signs of progress.

This is solid growth in whale distribution since the last time we covered Fragmetric back in October when the top 10 depositors accounted for roughly 75% of the supply.

Overall, we anticipate that the distribution for FragSOL and all other VRTs will continue to improve as caps are eventually eliminated. The total FragSOL supply now sits just shy of 250k - where do you think TVL will be by the end of the year?

KyrosFi

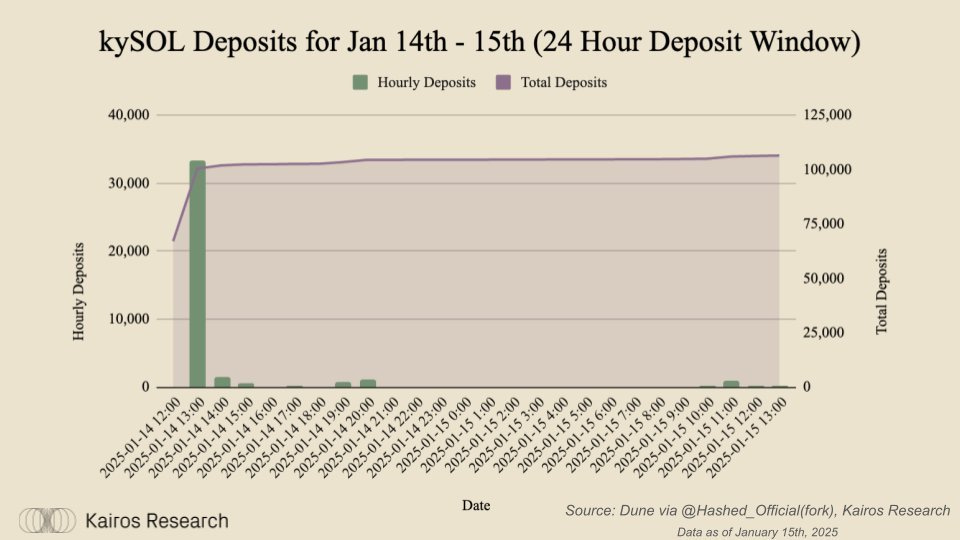

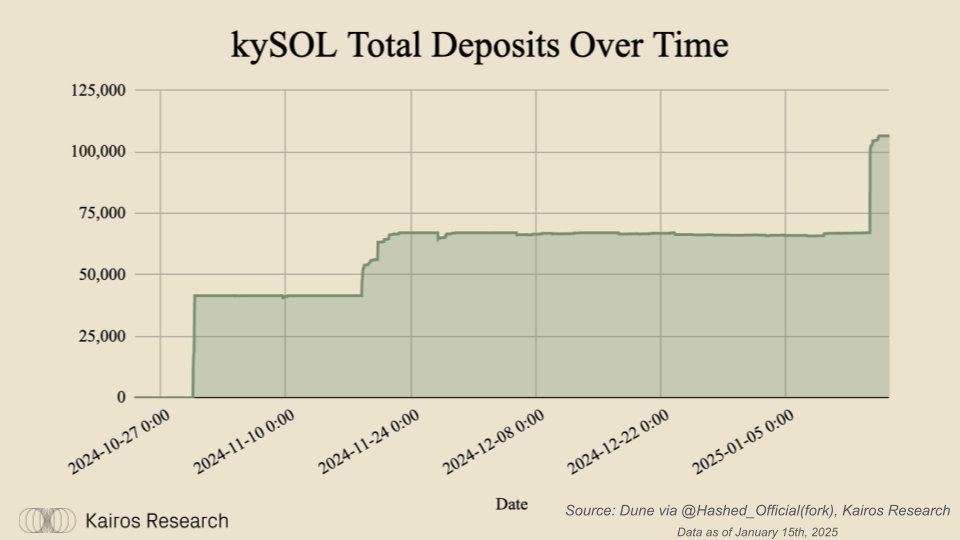

Kyros' TVL surged 58% - bringing their total deposits to approximately $27m, or 107k $kySOL. (now around ~$34m)

The largest inflows happened right at the start of their deposit window, with over 33k $kySOL minted almost immediately.

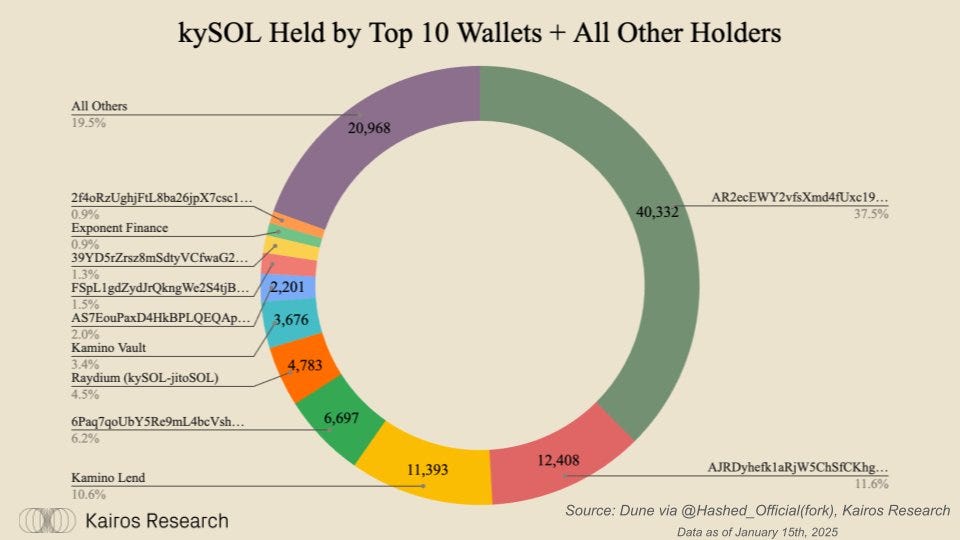

Unlike Fragmetric which we covered above, $kySOL is currently transferrable. While FragSOL will be transferrable soon, this feature allows us to begin seeing where Jito (Re)staking VRTs will naturally flow to within the onchain economy.

At the end of the deposit window, roughly 15% of the total $kySOL supply had made its way into various DeFi protocols on Solana, with KaminoFinance being the largest beneficiary. Between Kamino's Lend & Vault products, 15k $kySOL have flowed into the protocol thus far.

Additionally, ExponentFinance, a newly launched DeFi protocol which is analogous to Pendle on Ethereum has seen 1% of the $kySOL supply enter their product.

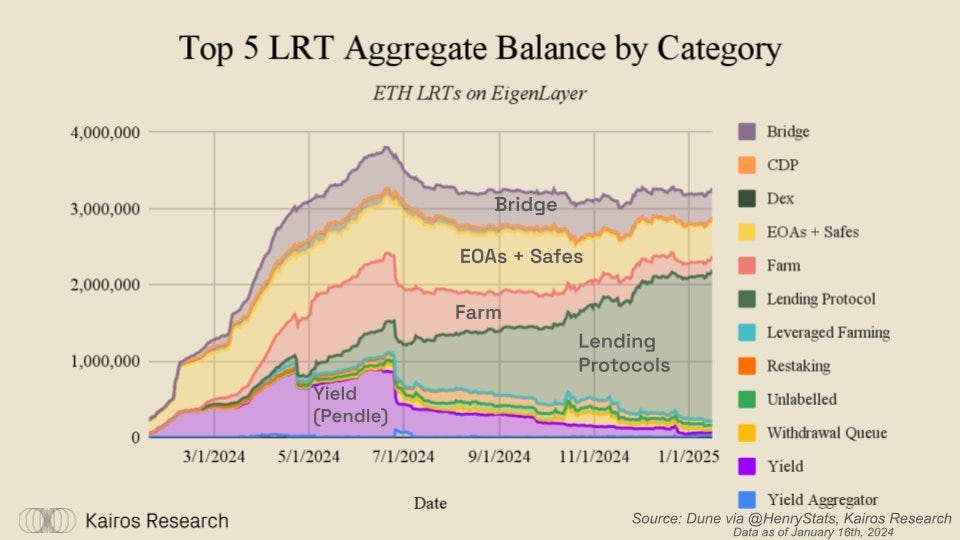

As seen in the chart below, Pendle was one of the largest beneficiaries of the LRT boom on Ethereum early last year. At it's peak, Pendle held around 50% of the total LRT supply.

While the flow of capital is likely to be similar for Jito VRTs as it was to EigenLayer LRTs, it's likely to not be identical given there are already lending market integrations for these assets.

The overall kySOL supply now sits around 107k.

Lastly, while we find their name incredibly tasteful, it's important to note that we are two different companies.

Where do you think the majority of $kySOL will aggregate in the short, medium, and long term?

RenzoProtocol

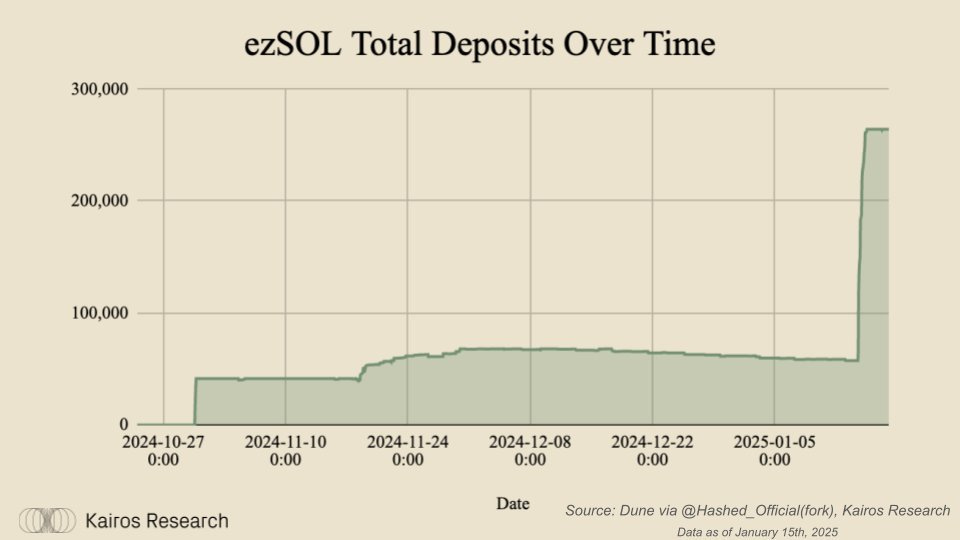

Last but certainly not least, we've got RenzoProtocol who saw the highest level of inflows out of all Jito VRTs.

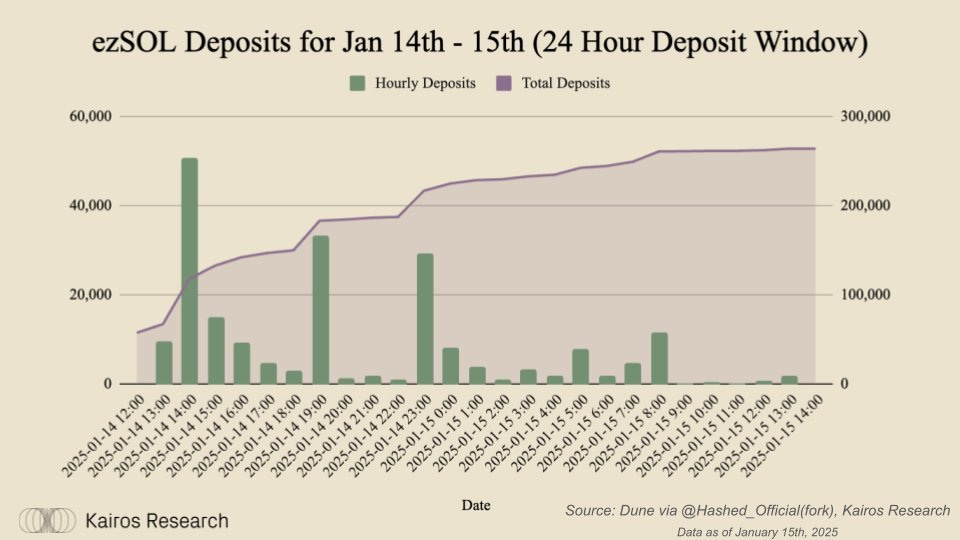

Renzo's ezSOL supply grew 4.6x from 57k to 263k, with an hourly average deposit of 7.6k.

Like kySOL, ezSOL is transferrable as well. Renzo has already seen first hand how the LRT market has played out on Ethereum, with lending markets like Aave becoming the top destination for these types of assets to be utilized.

Using this working knowledge, Renzo launched an incentives program with Kamino to incentivize deposits with their governance token, REZ, for 2m weekly supply side emissions. As a result, 83% of the ezSOL supply flowed to Kamino.

At the time of writing, the ezSOL on Kamino accounts for roughly $69m. Overall, it was a very successful 24 hours for all three of the VRT providers - giving us a glimpse of what is to come once deposits caps are fully lifted.

As VRTs continue to reshape Solana’s on-chain economy, follow & stay tuned for the next wave of growth and innovation—this is just the beginning.