Liquidity Dynamics: Understanding Utilization in Liquid Restaking Tokens

Liquid Restaking Tokens have an average utilization ratio of 78% compared to Lido's stETH/wstETH utilization ratio of only 32%. So, where exactly are these toke

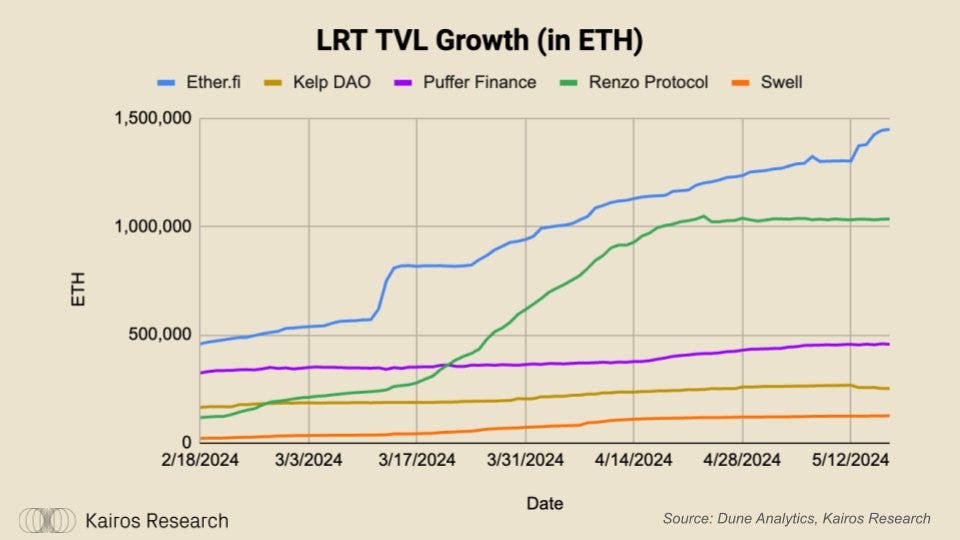

Since our last report on Liquid Restaking Token (LRT) Liquidity, on an ETH denominated basis, the entire sector has grown an additional 36.75%, while the overall EigenLayer total value locked (TVL) has increased roughly 14.86%. This increase in the LRT sector highlights the desire of depositors to limit their opportunity cost and gain exposure to other new protocols that are accepting LRTs deposits to bootstrap TVL growth via their points programs. During this same period of time we had the announcement of the EIGEN token which took place on April 29th, marking the current ATH for EigenLayer TVL in dollar terms. During this same period of April 29th to today, May 17th, ETH is down -4.45%. One could speculate that ETH was mildly overbought, or perhaps leveraged with borrows against BTC, to farm the EIGEN airdrop and then people began to de-risk following the token announcement, leading to a mild retrace.

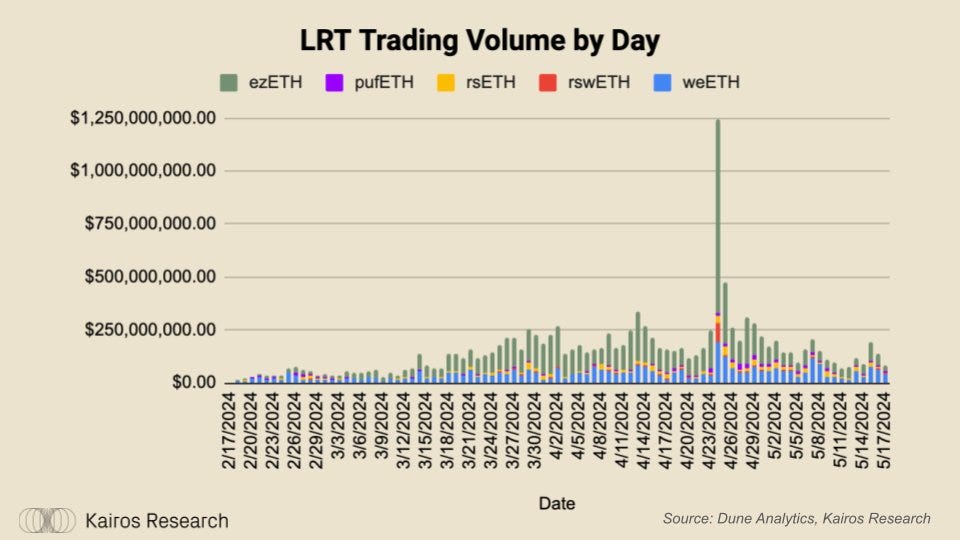

Additionally, since our last report, Renzo announced the launch of their governance token, REZ. It was a relatively quick process from their announcement to the claims and trading. REZ is currently trading at a market capitalization of $127m and a fully diluted valuation (FDV) of $1.12bn. For comparison, EtherFi’s ETHFI is trading at a $405m market cap, with an FDV of $3.52bn. Despite EtherFi having 40.21% more stake than Renzo, ETHFI is trading at a 214% premium to REZ, all while the circulating supply is nearly identical on a percentage basis. One major driver of this valuation mismatch between the two leaders in the LRT space could simply come down to Renzo’s ezETH liquidity profile. When the REZ token was announced on April 23rd, ezETH and the entire LRT space at large saw its largest ever trading day with nearly $1.25bn in onchain volume.

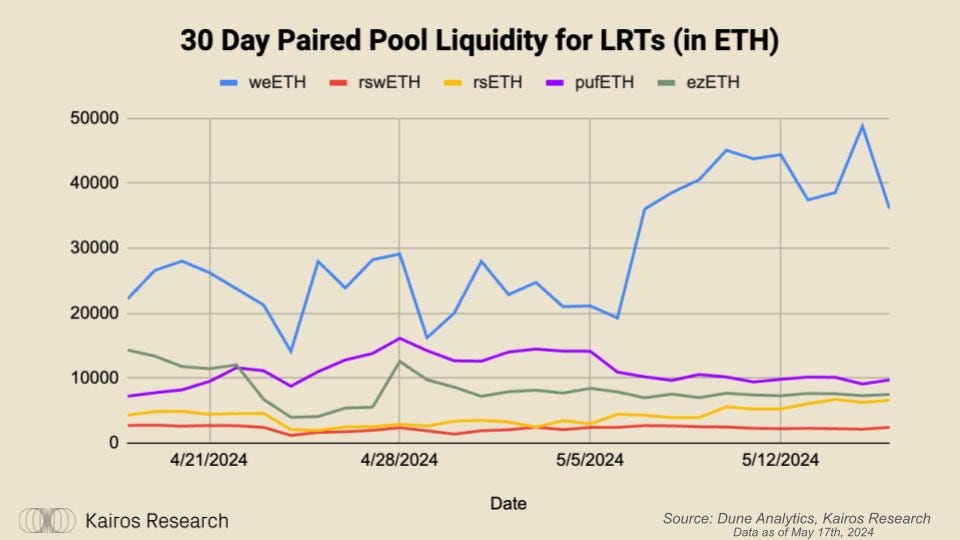

In our last report we highlighted that EtherFi’s weETH was impacted by a brief depeg following their token launch. While the direct reasoning is difficult to discern, we attribute it to capital flight from opportunistic farmers. However, given that EtherFi had native withdrawals enabled, this depeg was rather brief and not terribly impactful. However, this was not the same story for Renzo’s ezETH which at the time of writing is trading at a -2.64% discount to fair value. We attribute this depeg due to the following factors:

Dangerously High Leverage to Liquidity Ratio

No native withdrawals enabled for ezETH (going live soon)

Restaking farmers looking to de-risk EigenLayer & LRT exposure

That first bullet is important because outside of providing liquidity profile updates, it highlights the secondary topic of this research report; LRT Utilization. We believe that the line between staking and restaking is becoming continuously blurred and that the new additional staking rewards offered via AVS rewards on EigenLayer will continue to make Liquid Restaking Tokens (LRTs) the dominant form of collateral across the entire Ethereum DeFi ecosystem.

Updates on LRT Liquidity

When examining growth for the top five liquid restaking providers in ETH terms, we can see that EtherFi and Renzo continued to lead the pack on a relatively similar growth trajectory, right up until the 23rd of April when Renzo’s governance token was announced. Following that, Renzo’s TVL growth plateaued while EtherFi continued to fire on all cylinders, reaching over 1.44m in restaked ETH at the time of writing. EtherFi is currently championing roughly 42% market share, while Renzo maintains second place with 30.8% market share.

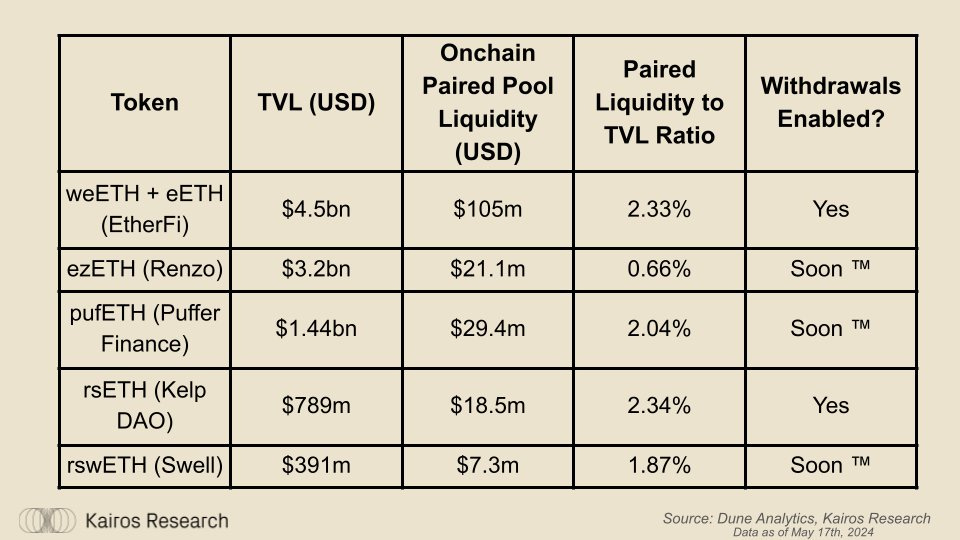

Following the announcement of the REZ token, ezETH has fallen from second to become the third most liquid LRT in dollar terms, with Puffer Finance’s pufETH continuing its steady growth pattern to reach a second place position. However, when taking the liquidity to TVL ratio into consideration, ezETH is the least liquid LRT amongst its peers. There is some nuance here as Dune does not have full data for Blast, Mode, and Linea, where there is additional ezETH liquidity. Additionally, the pufETH<>wstETH pool on Curve is now the second largest liquidity pool for any LRT with roughly $30m of reserve liquidity. However, the pool itself is still heavily imbalanced with pufETH making up 86% of the pool.

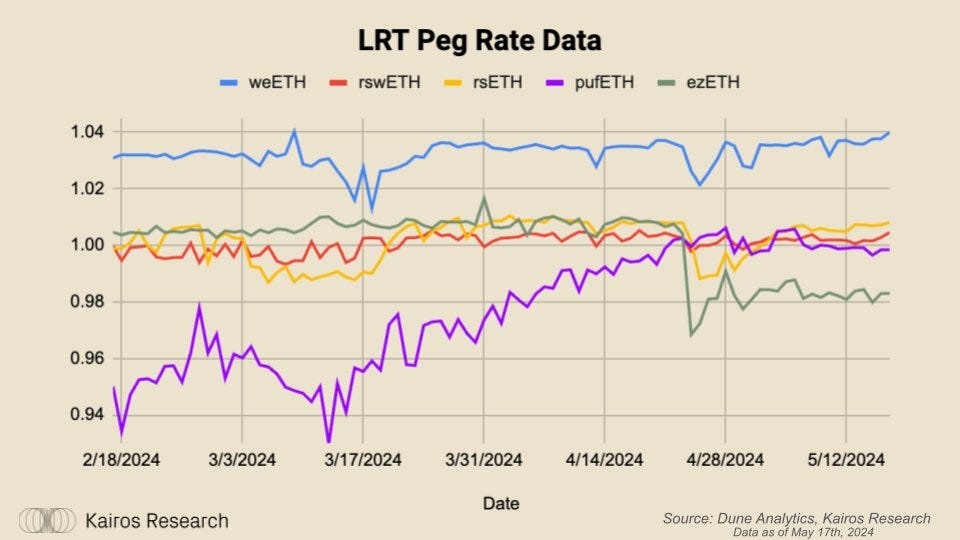

With regard to peg data, as you can see in the chart below, the clear outlier is ezETH which as previously mentioned has yet to reclaim parity with its fair value. However, note that all of these LRTs are trading at a slight discount to their fair value, but ezETH has the largest discount to NAV. To see the current discounts or premiums these LRTs are trading at you can reference this dashboard. The discount should make sense later in the report once we see how these LRTs are being used.

LRT Utilization in DeFi

For the LRT landscape today, EtherFi is maintaining a dominant position for the onchain landscape, but liquidity aside; where are Liquid Restaking Tokens being utilized?

Before we dive into where LRTs are being used, let’s address our assumptions on what we believe is driving user behavior:

“Point Farming”

It’s hard to ignore the elephant in the room here. The average user who is willing to restake to EigenLayer via a liquid restaking token is expressing a high risk tolerance. The DeFi users of LRTs are heavily “risk on” and they’re attempting to get the highest utility out of their tokens by farming other protocols. On the other hand, protocols realize that there is a low barrier to entry to obtain new users by incentivizing deposits of LRTs, especially given there is currently no slashing risk coupled with no additional staking rewards through AVS.

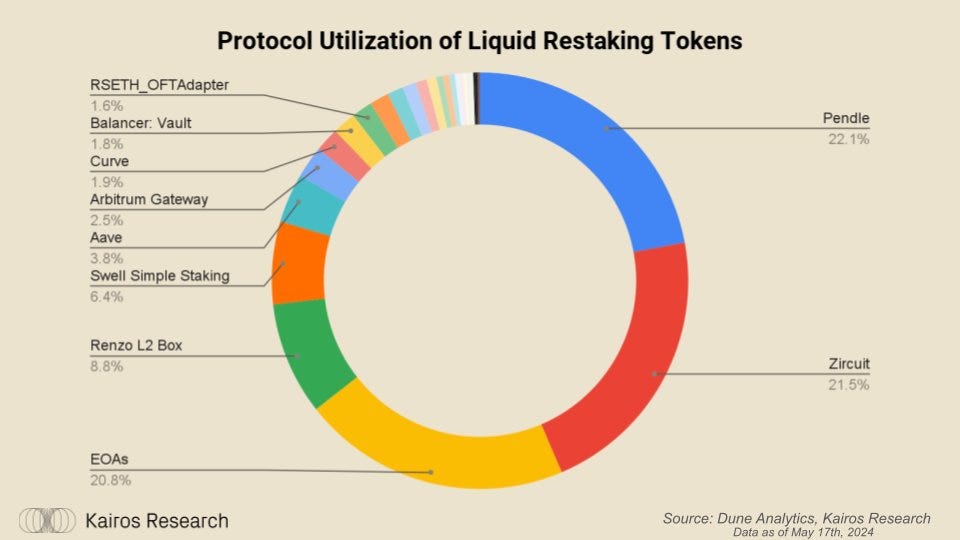

Because of these market dynamics, there has been a steady trend away from EOAs, and multi-sigs to “Farms” such as Zircuit, Swell L2, and Blackwing. While these are all protocols with bold future ambitions, they’re still all pre-token, pre-product projects that at current stages are just bootstrapping TVL via points systems or other such similar incentives, for their pre-rich users.

So, out of all of these LRTs, how are these tokens being used for farming, yield, and general DeFi use (DEX + Lending protocols)?

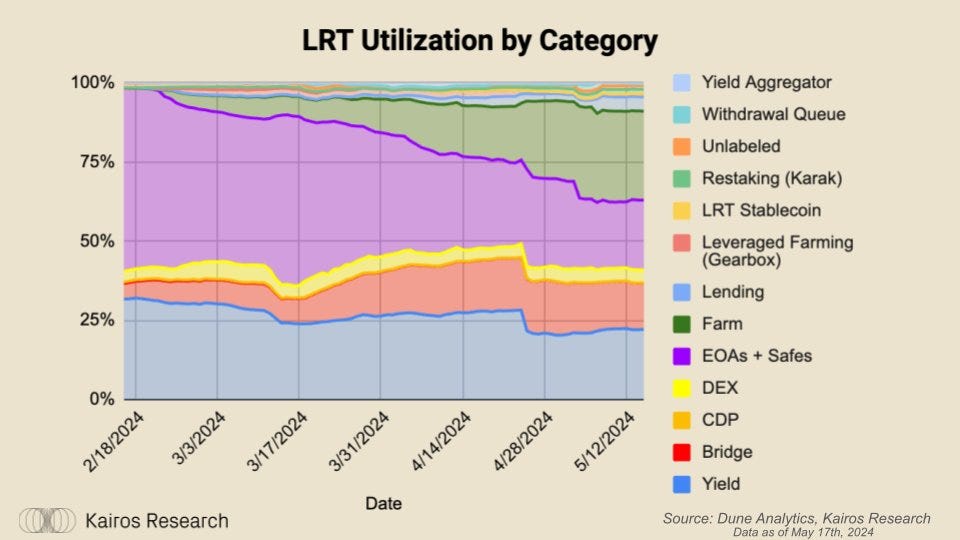

Across the last 90 days, we have seen a noticeable shift from LRTs sitting idle in EOAs + Multi-sigs, to productive use elsewhere. The largest categorical beneficiaries across the top 5 LRTs has been Yield Trading venues like Pendle, Bridges like Connext, “Farms”, Lending Protocols, and DEXs. Over the same period of time ETH chopped mostly sideways with a modest gain of 7.1% and a max drawdown of only 0.67%.

Because of LRTs, 56% of total EigenLayer TVL is actually being utilized in DeFi. Out of the top five LRTs, the average utilization rate is 78%, significantly higher than stETH/wstETH's current DeFi utilization rate of 32.5%.

Note before we bombard you with charts: "restaking" category = Karak "yield" category = Pendle "leveraged farming" = Gearbox "farm" = Swell L2, Zircuit, Blackwing We believe the remaining categories are self evident. So, without further ado, let's overstimulate you with colorful charts:

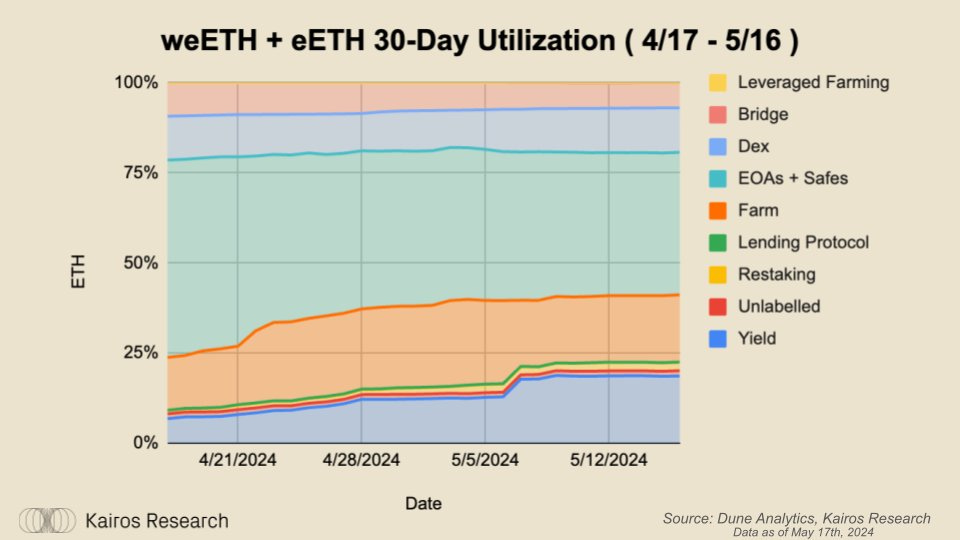

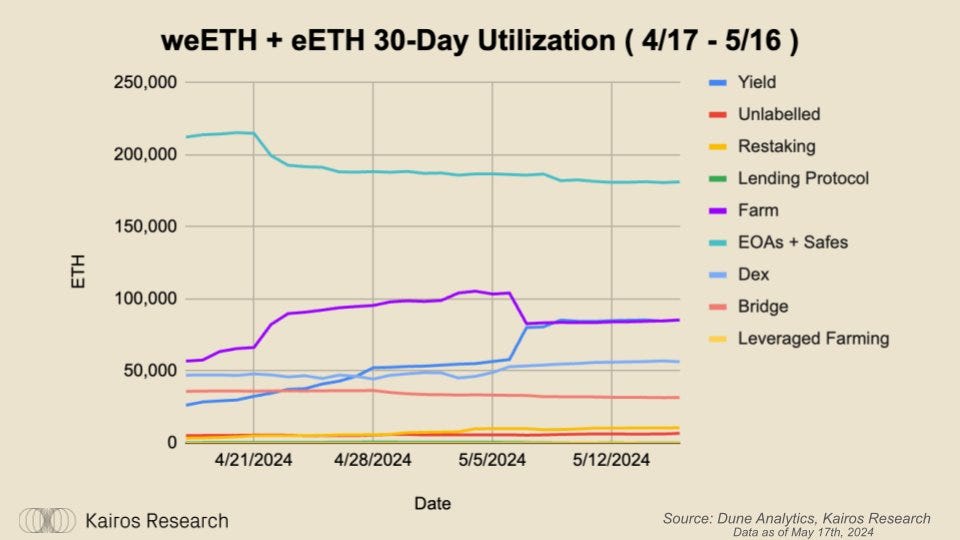

weETH +eETH DeFi Utilization

For the sector leader in TVL, EtherFi's LRTs saw an increased allocation towards pre-token protocol farming, along with an increased allocation toward fixed income yield trading venue, Pendle Finance. There was also a slight uptick in the amount allocated to DEXs, and a slight downtrend for the bridge category.

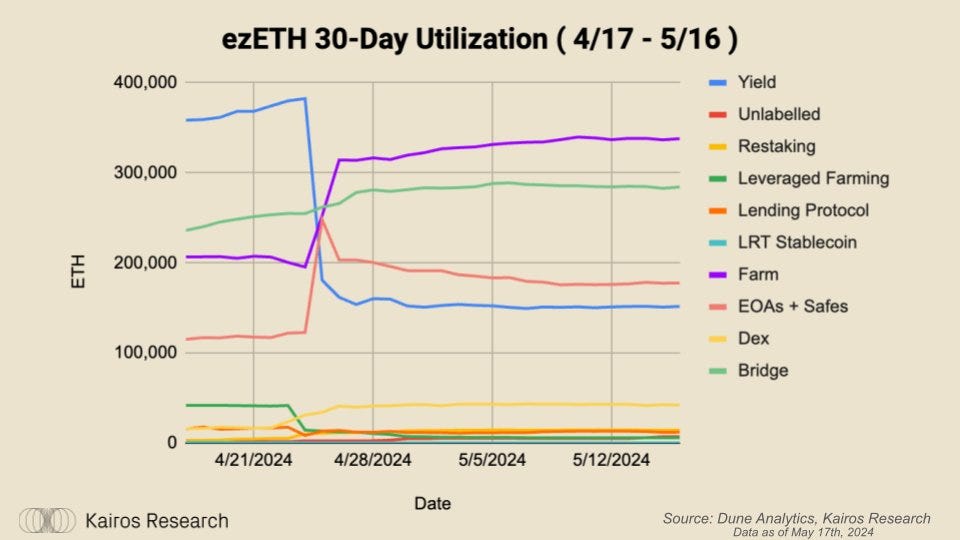

ezETH DeFi Utilization

For Renzo, there was some very interesting user behavior following the reaction to the depeg and airdrop announcement. Firstly, note that the drastic drop off for the "yield" category can be attributed to the April-25 Pendle market which has since matured. Following that, there was a noticeable shift towards protocol farming. A large chunk of their total supply remains in bridge contracts, highlighting their strategic focus on L2 adoption.

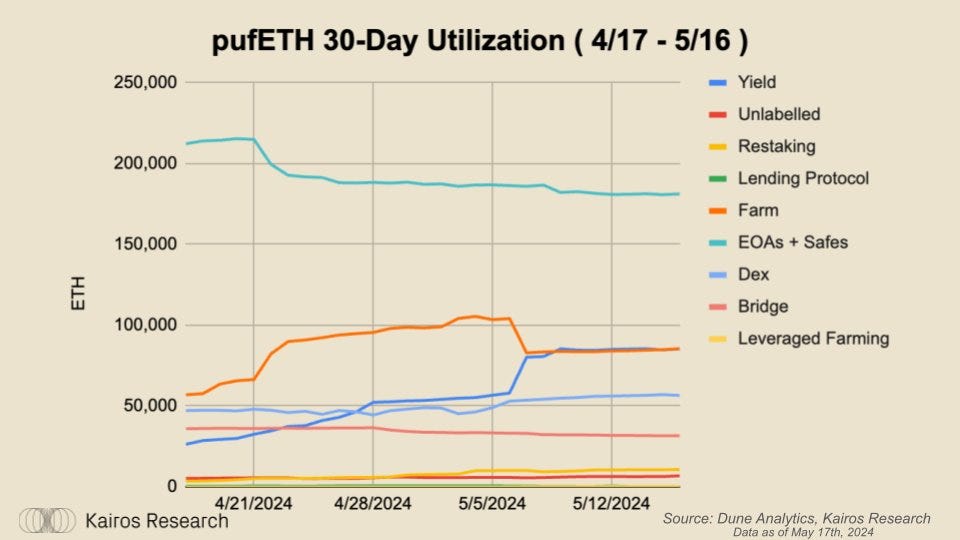

pufETH DeFi Utilization

Puffer Finance is the most boring of the LRTs with regard to utilization, however, boring can be a good thing. Notice in the peg chart provided earlier in the report shows the slow, steady, growth story of pufETH slowly returning to parity with its fair value. Additionally, pufETH has the largest amount of its TVL sitting in EOAs + Multi-sigs.

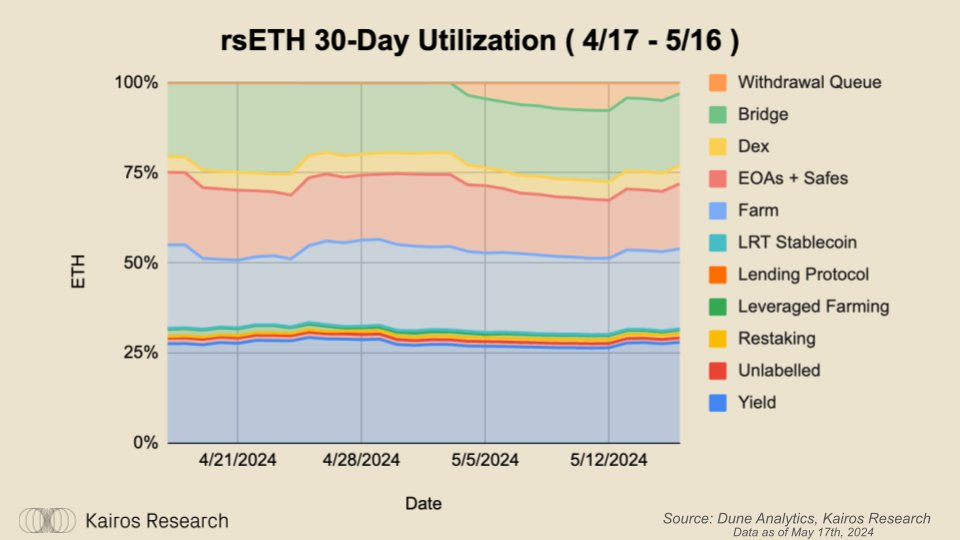

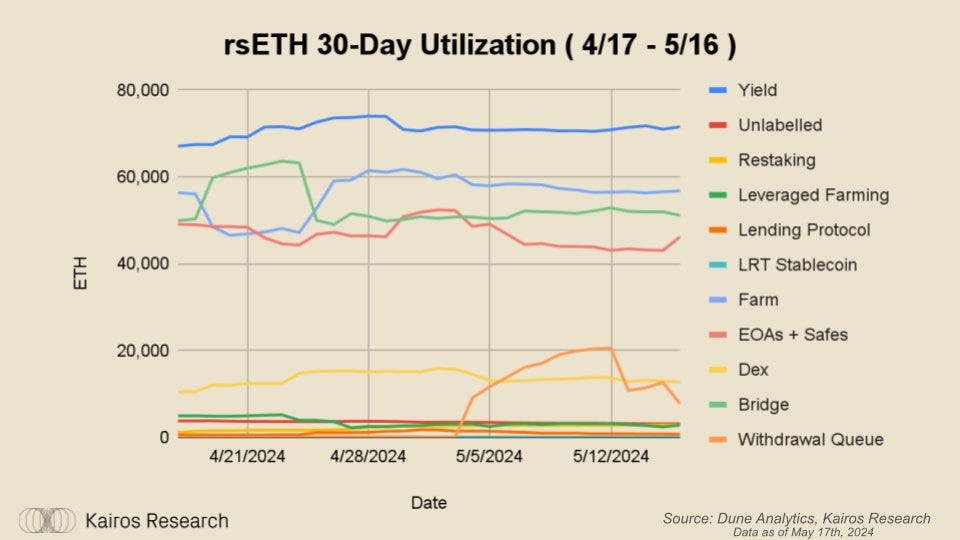

rsETH DeFi Utilization

rsETH has a relatively even distribution with regards to its utilization. Its also important to note that as of the time of writing, they are the only other LRT protocol aside from EtherFi with functional withdrawals.

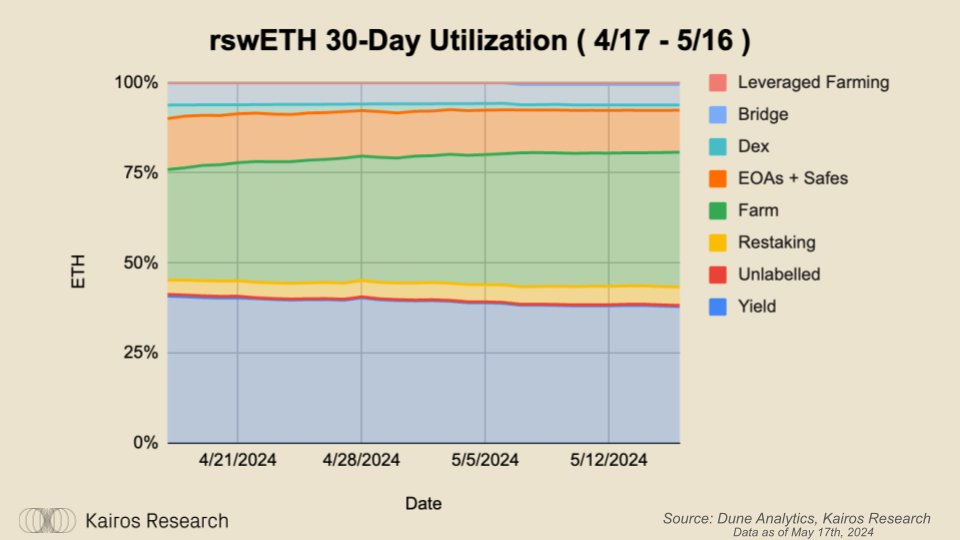

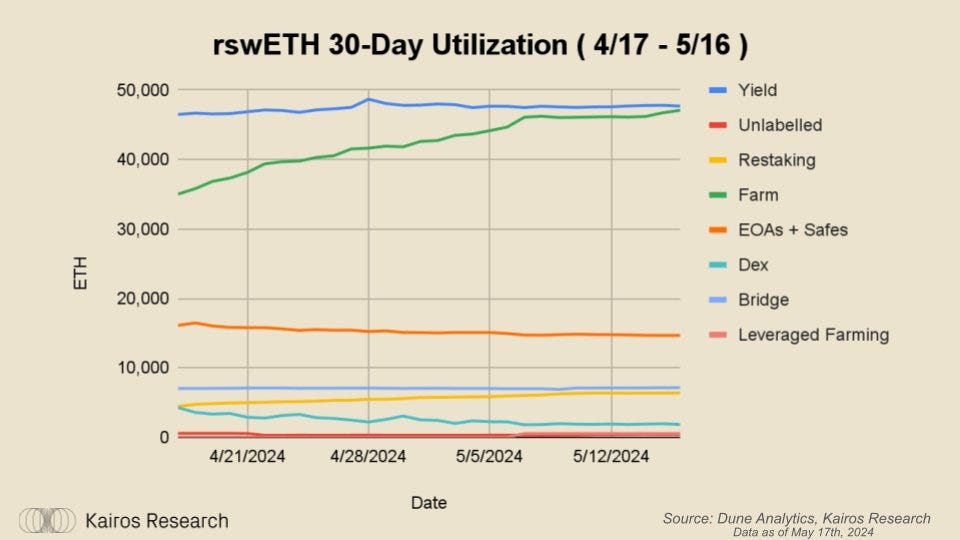

rswETH DeFi Utilization

Swell's rswETH has a very high allocation to the "farming" category, but this can be attributed to the fact that they're launching their own L2 where their LRT will serve as the canonical gas token. We expect the majority of their LRT to end up on their L2, and as their ecosystem continues to develop, we expect the vast majority of layer 2 LRT DeFi activity to take place on Swell L2. To read more about what Swell is doing with their L2, and further examination into their growth story at large, we absolutely recommend you check out our recent research report on them.

Closing Thoughts

Overall, its clear that the early capital that has chosen to restake through EigenLayer is highly motivated by yield opportunities. While AVS rewards are not yet live, the initial wave of restaked capital is objectively driven by points farming. While many others, including us, have spoken about the potential mismatch in restaked capital, to actual additional staking rewards which will be passed on by AVS, it is evident that we are not in an environment where we will see an organic equilibrium be established. With several "seasons" or "phases" yet to still play out for LRT protocols, EigenLayer itself, and other protocols being actively farmed via LRTs, such as Karak, Zircuit, and others, there is too much exogenous noise to understand how much capital has been restaked purely for AVS rewards. Albeit, we still do not foresee greater "set and forget" opportunities for less active ecosystem participants than EigenLayer. It's also important to understand that, to our knowledge, no centralized exchange or other large scale centralized venues have enabled restaking for retail consumers. We do anticipate this to change in the medium-term as the opportunity for CEXs is abundant and relatively untapped. However, the introduction of restaked capital derived from centralized venues introduces its own unique set of risks, but we will cross that bridge when we get to it. We look forward to continuing to see how the market and liquidity dynamics play out with regards to liquid restaking tokens, and their impact to the onchain economy at large.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.