LRT Liquidity and Utilization Updates July - October

Exogenous incentives have dwindled and now liquid restaking tokens have entered into their organic growth stage; driven by primarily by restaking rewards

Executive Summary

A lot has happened since our last LRT Liquidity & Utilization report went live in June. Notably, EigenLayer had its second stake-drop, along with the EIGEN token transferability going live. EIGEN programmatic incentives are now live, with the aim to bolster restaking rewards. 4% of the total EIGEN supply has been allocated to ETH stakers and operators for the first year, with 3% going towards ETH restakers, and 1% going towards EIGEN stakers and operators. At current prices, that is approximately $160m of additional staking revenue across the board on EigenLayer from this incentive program alone.

Notable News

Renzo:

EtherFi:

Deep Dive on DeFi Protocol Earnings Research by Kairos Research

weETH Listed as Collateral on Synthetix & on BitGet for Spot Trading

Gov Prop Passes for Incentives on Centralized Exchanges for weETH Collateral

Swell

Puffer

Kelp

Liquidity Updates

Liquidity across the board for the top 5 LRTs has decreased roughly 60% in dollar terms and 43% in ETH denominated terms since we released our last coverage back in June. However, Kelp DAO’s rsETH has seen a net increase since June of roughly 55% on ETH denominated terms.

In total, there is roughly $143m of total paired liquidity on DEXs across the top 5 LRTs.

Swell’s rswETH saw the largest MoM gain from September to October, with Puffer’s pufETH seeing the largest drawdown in ETH denominated liquidity, likely due to them enabling withdrawals along with their TGE of PUFFER.

DEX Trading Volume Updates

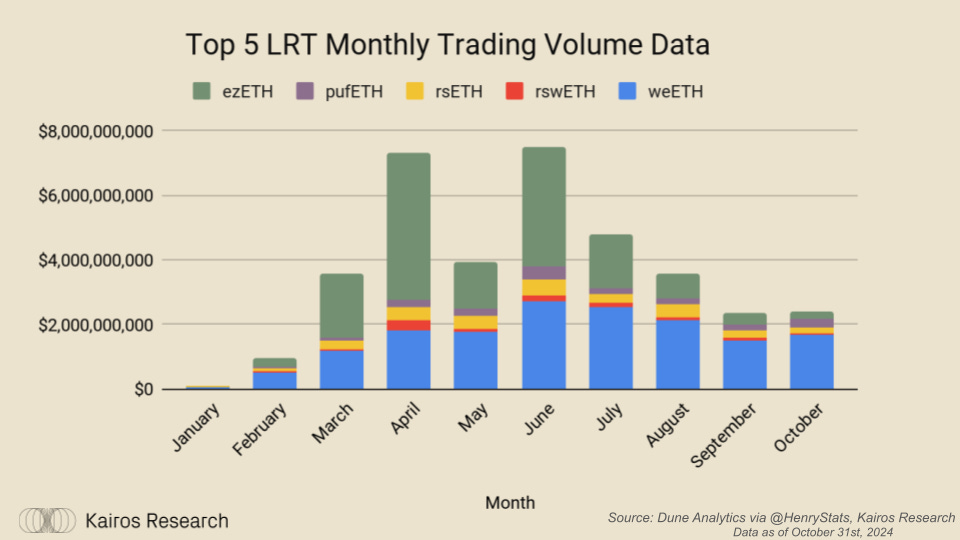

October saw the first monthly uptick in DEX trading volume across the largest LRTs, with 2.25% MoM growth, totaling over $2.4bn for the month. EtherFi’s weETH/eETH has maintained the most consistent monthly trading volume, likely a function of its raw size as the largest LRT in TVL terms.

Puffer’s pufETH saw the largest monthly jump for October, with volume increasing roughly 77.5%.

TVL Updates

EtherFi still remains the king, with roughly 2.25m ETH, but Renzo’s ezETH has notably flipped Puffer’s pufETH to regain the number two spot. This comes after Renzo enabled auto-compounding rewards for ezETH and Puffer enabled withdrawals, which led to a decline of roughly 200k ETH. Puffer was the last of the top 5 LRTs to enable withdrawals. Therefore, as AVS begin to dish out rewards to restakers, we are in the most organic market conditions we’ve seen yet for the LRT space. The final phase will be when slashing is enabled, when we may see an additional shift of TVL across protocols if the market recognizes any potential risk / reward discrepancies across the top liquid restaking token providers.

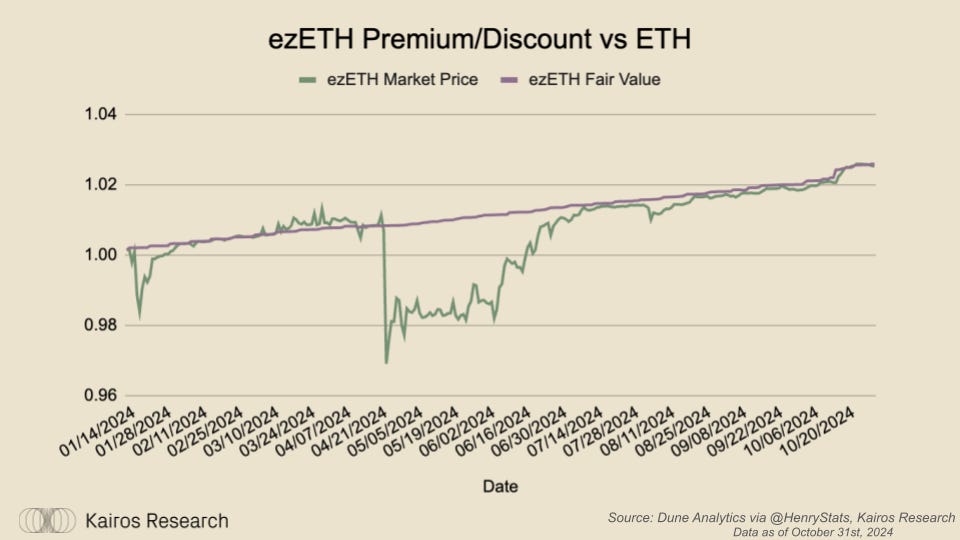

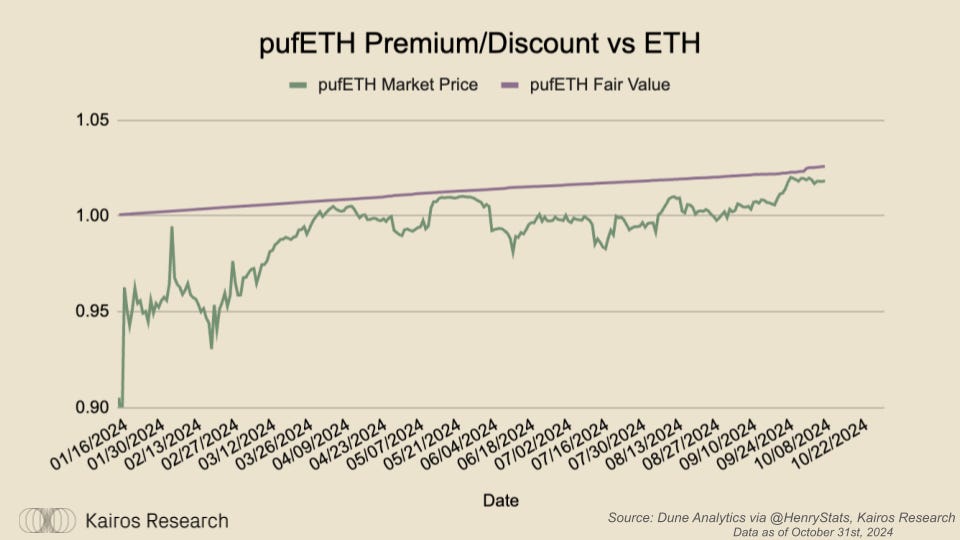

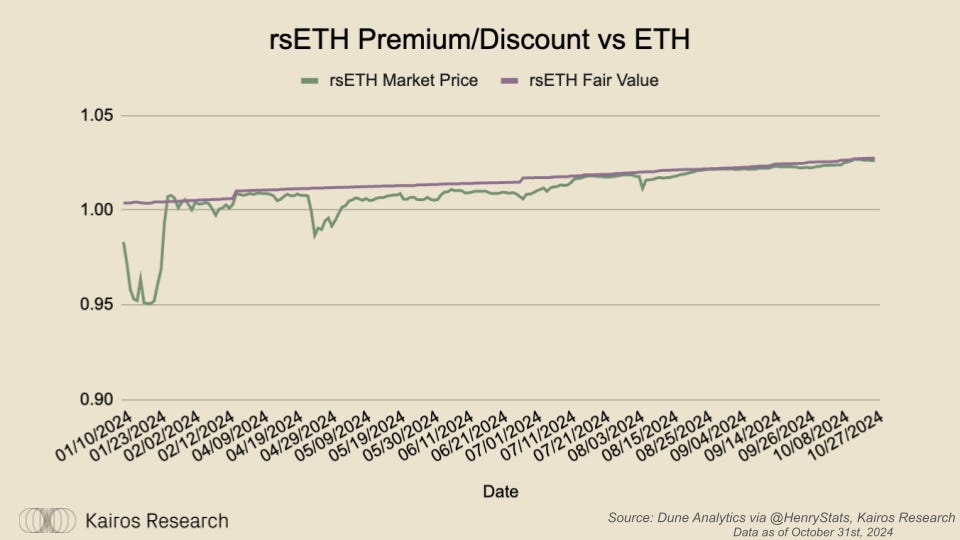

On a liquidity to TVL ratio basis, Renzo and KelpDAO are leading the pack. In simple terms, they have the most available paired pool liquidity as a percentage of their total TVL. This can be a helpful metric for risk management, esepcially as it relates to tail risk. However, its also important to note that the overall confidence of the market can also be reflected in the peg of the LRT to its underlying fair value. We’ll dig into that in our next section.

LRT Peg Updates

Categorical Flows Updates

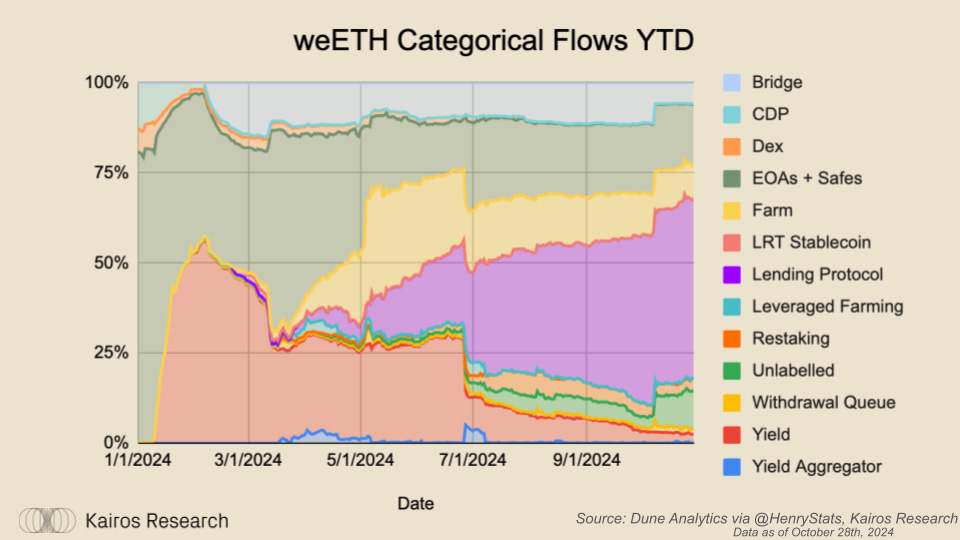

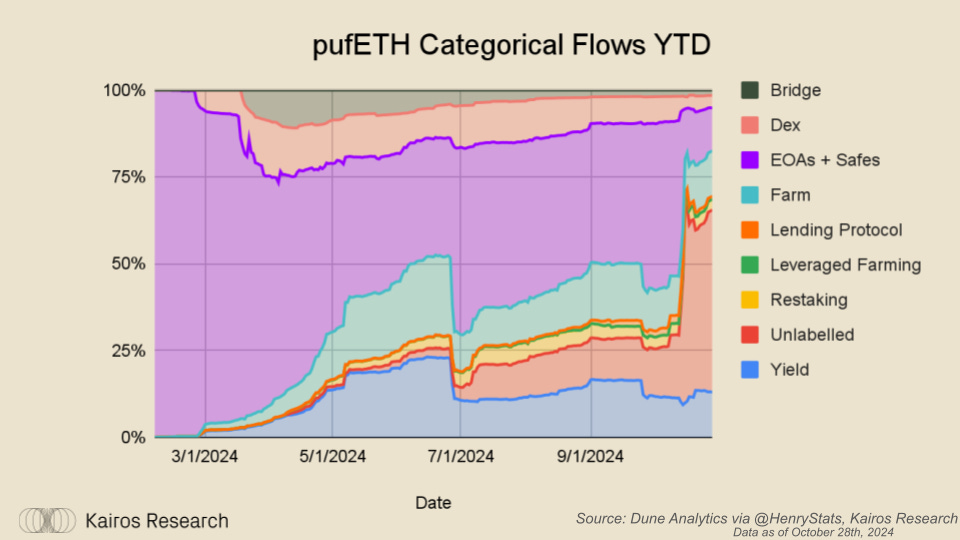

Following the second stakedrop from EigenLayer and transferability being enabled, the long-awaited farming events have mostly come to a close. This also coincides with all the LRTs except Swell having their TGE take place, and they’re expected to announce their TGE in the near future. (update: they announced claims will go live on Nov 7th) Following the end of what we have previously referred to as “exogenous incentives”, the vast majority of LRTs have flowed towards lending markets. This was expected, as mentioned in previous reports given LRTs can serve as superior collateral to LSTs and other non-yield bearing crypto assets.

The majority of weETH has slowly shifted towards lending protocols, notably Aave, now constituting the 3rd largest asset on the platform with over 1m weETH supplied. We expect this trend to continue given the economic superiority weETH offers over stETH and other liquid staking tokens. However, if the risk to reward balance shifts, we may see changes. We don’t anticipate this to happen in the short term given the close working relationships between AVS and LRTs.

Withdrawls for ezETH have essentially stopped, and we have seen an increase allocation to DEXs, and their bridge contract. Additionally, we’ve seen ezETH go live on Aave through the Lido instance, where we’ve seen the caps max out three times in a row thus far. We anticipate that during our next update the percent of ezETH allocated to lending markets will have grown significantly. Lastly, the allocation to “Farms” has dwindled, and the allocation to yield protocols like Pendle has remained roughly the same.

Swell’s rswETH has seen an uptick in allocation to EOAs and Safes, coinciding with a decrease from the “Farm” category which includes their Swell L2 deposit contract. The biggest depositor, Justin Sun (0x7a95f1554eA2E36ED297b70E70C8B45a33b53095) has not yet withdrawn, but given his actions following the PUFFER TGE, and other projects, it would be safe to assume he is likely to withdraw. However, this is just part of the process projects must face in the permissionless nature of DeFi. Despite all of this we believe Swell is well positioned to continue executing on their long-term vision of becoming the restaking yield layer.

While the “unlabeled” category saw the largest inflows of pufETH, this is actually because their withdrawal contract is lumped in there. We will update this before our next coverage piece is released. Aside from this, the rest of their allocations stayed relatively stable, along with a slight decrease in the DEX category. Puffer is unique among its peers as it was the last to enable withdrawals. We believe that this long-awaited event and anticipation, along with the launch of their token at the same time led to outsized outflows than they perhaps would’ve seen otherwise. However, they too have their own unique vision of becoming an integral part of the restaking ecosystem, with the launch of their own AVS, and based rollup as well.

Over the past few months, KelpDAOs rsETH has seen continued inflows to EOAs + Safes, and its Bridge contracts. We can attribute the increase in its bridge contract to it’s “Gain” product which helps users find DeFi opportunities across the ecosystem.

Closing Thoughts

Overall, the LRT ecossytem has entered into its next stage of growth. While previous stages were defined by points, airdrops, and shorter-term exogenous incentives, this stage will be defined by restaking rewards. Given AVS rewards in addition to EIGEN are set to begin flowing soon, we believe this next stage of growth will be defined by the amount and method of how restaking rewards are paid out to end users. It is fair to assume that given the shift of LRTs to lending protocols, users are going to become increasingly sensitive to their restaking rewards as they look to maximize capital efficiency. Therefore, we anticipate we will see most, if not all, LRTs move towards some sort of auto-compounding model, or at least give the users the option to opt-in to one.

Users who restake ETH are unlikely to truly care about longer-tail, lower-liquidity AVS tokens in contrast to ETH, unless an AVS achieves significant PMF with attractive cashflows. If you are going to risk a high-quality, highly-liquid asset like ETH via restaking, you are going to want to be paid out in ETH. Additionally, consider that more than half of EigenLayer’s TVL is through LRTs, this means LRTs also account for a significant distribution channel of restaking rewards. We believe, to ensure longer term sustainability, AVS should aim to pay out restaking rewards in either ETH or a USD stablecoin equivalent. Otherwise, the AVS tokens are likely to face an uphill battle as it is unlikely that net-buy pressure exceeds net-sell pressure associated with all the various restaking stakeholders including: operators, individuals, and LRTs. Additionally, AVS are likely to follow the "low-float” launch which many crypto projects do. Therefore, in addition to these organic market forces, the market will have to stomach significant unlocks as well.

To be clear, we do anticipate that as a collective, AVS will indeed be able to provide sustainable rewards over the medium to long term, but they may face multiple short-term headwinds. Despite this, even in the short-term, restaking rewards will remain higher than the native staking issuance rate, which we believe will continue to drive more users to adopt LRTs in place of LSTs. We look forward to AVS beginning to operate live so we can better assess their business models, associated cashflows, and the downstream impacts to LRTs and the overall restaking ecosystem.