LRT Liquidity & Utilization Updates: November (Time to Get Bullish on Restaking Again)

A deep dive into liquidity trends and utilization shifts across the top 5 LRTs.

Monthly Snapshot

Key Metrics at a Glance:

Total Liquidity: $173m (47k ETH)

Utilization Rate: 83% (Total LRT supply - those in EOAs)

Trading Volume: $2.54 billion

Top 5 LRT TVL: 3.38m ETH ($12.6bn)

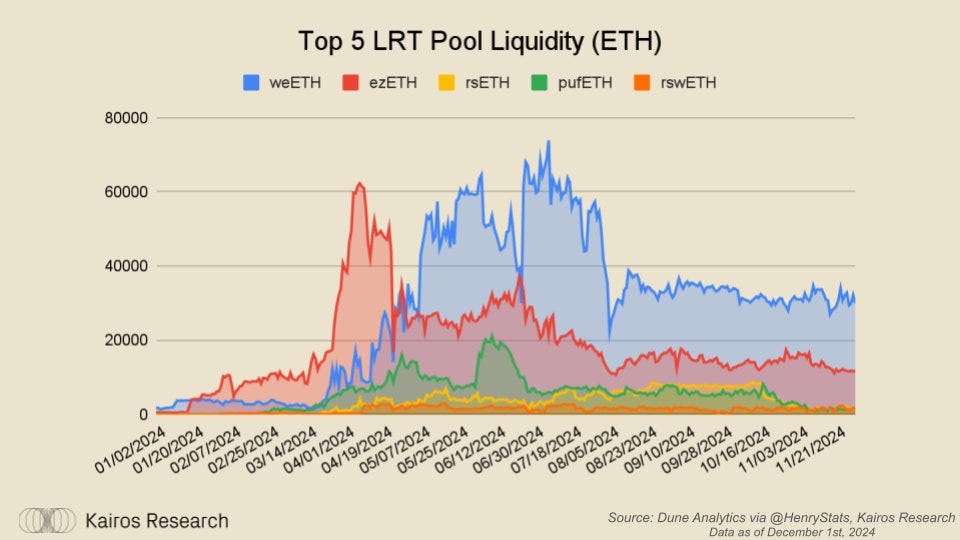

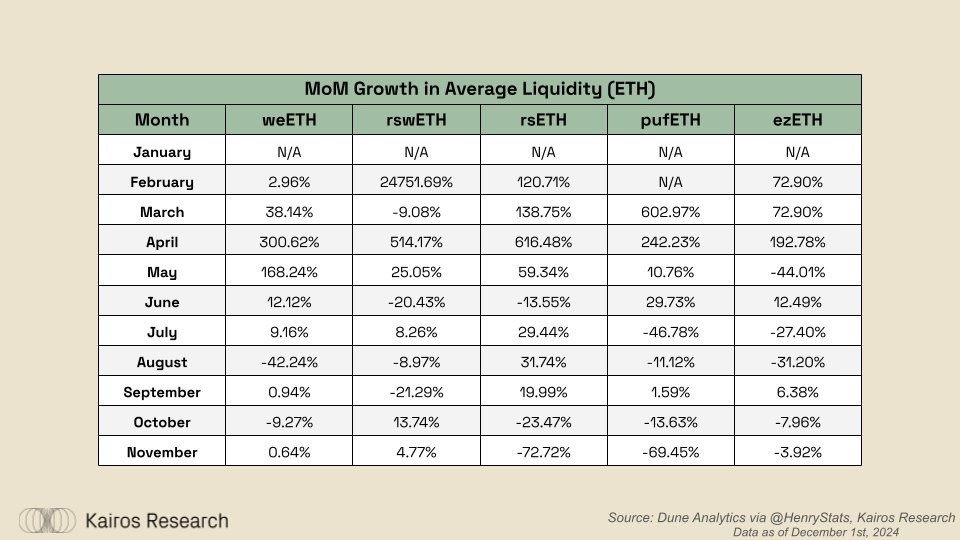

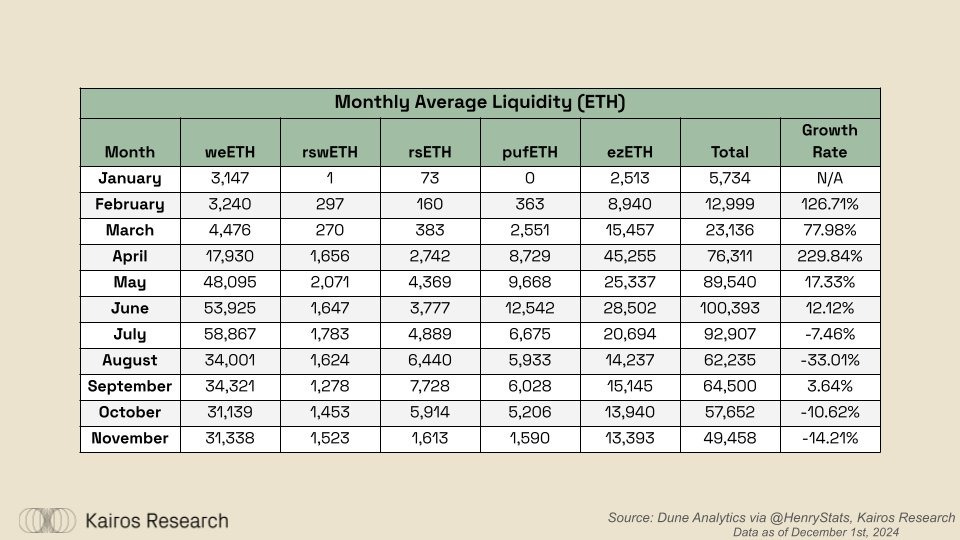

Liquidity Updates

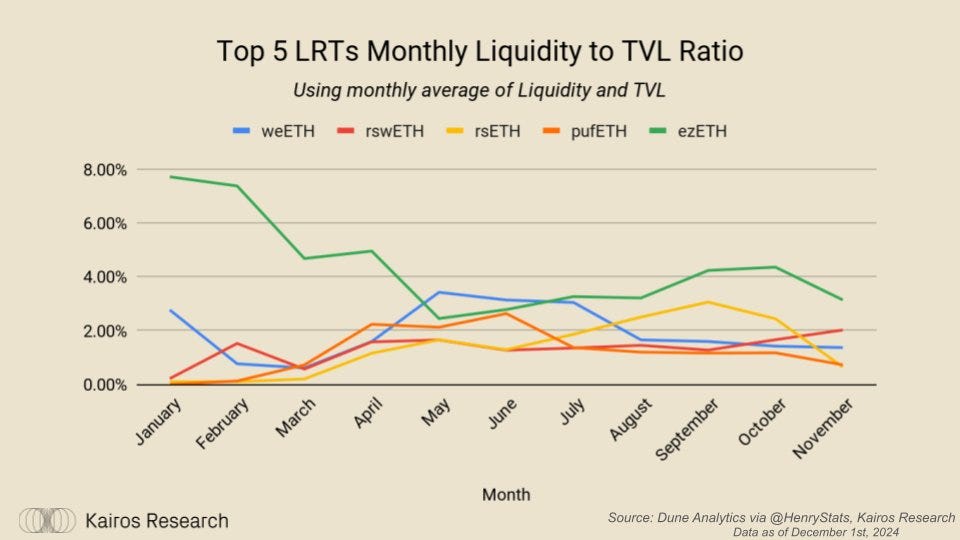

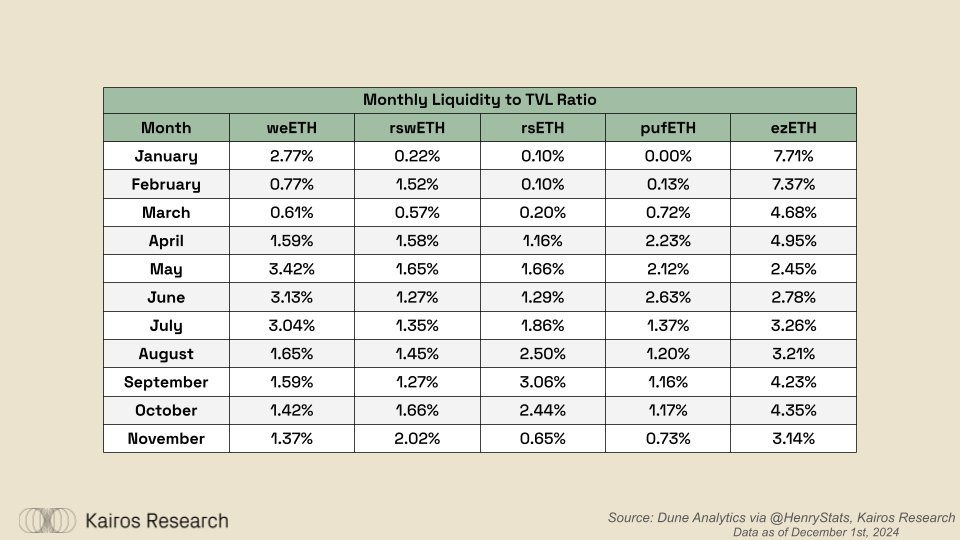

Liquidity across the board for the top 5 LRTs has increased roughly 5.6% in dollar terms, and decreased -14.21% in ETH denominated terms since we released our latest coverage last month. Swell's rswETH had the largest MoM increase of 4.77%, while Kelp's rsETH had the largest decline of -72.72%, all of which are on an ETH denominated basis.

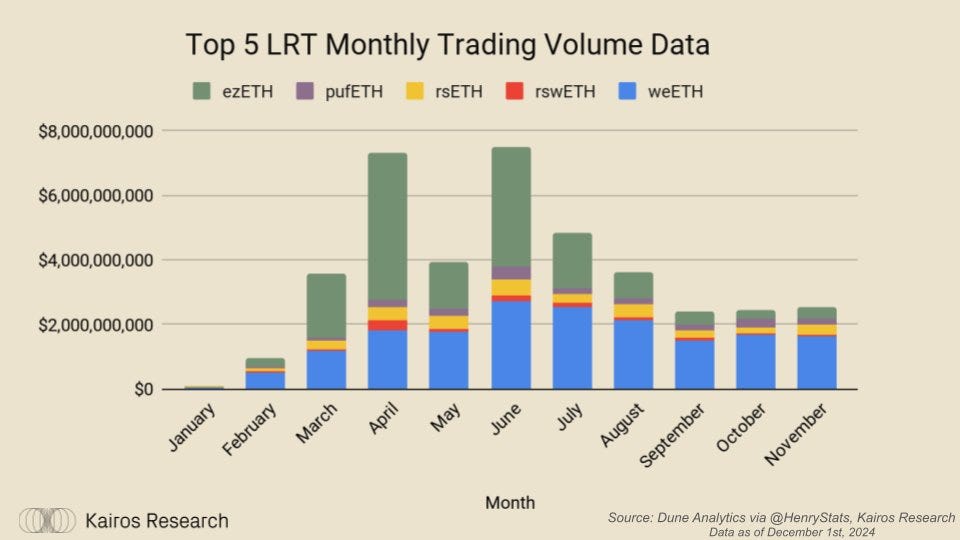

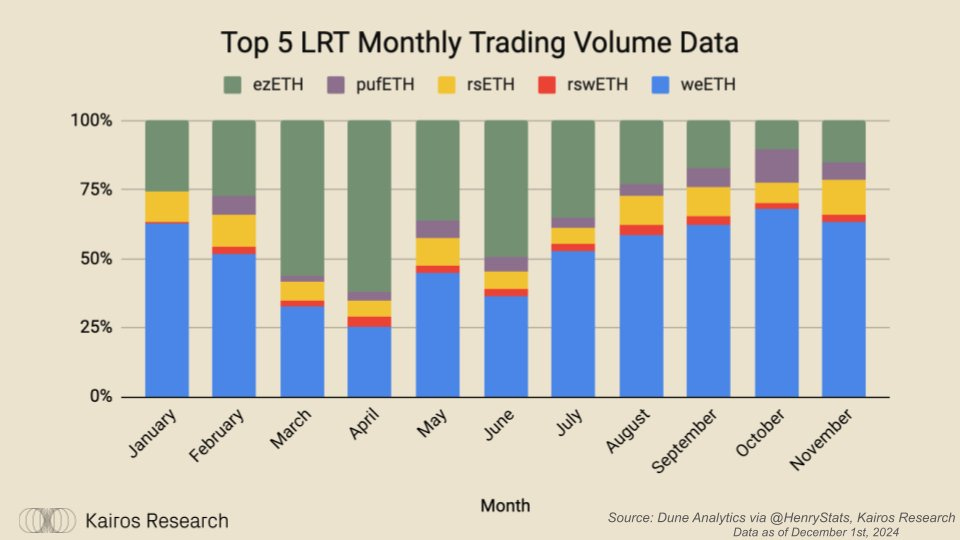

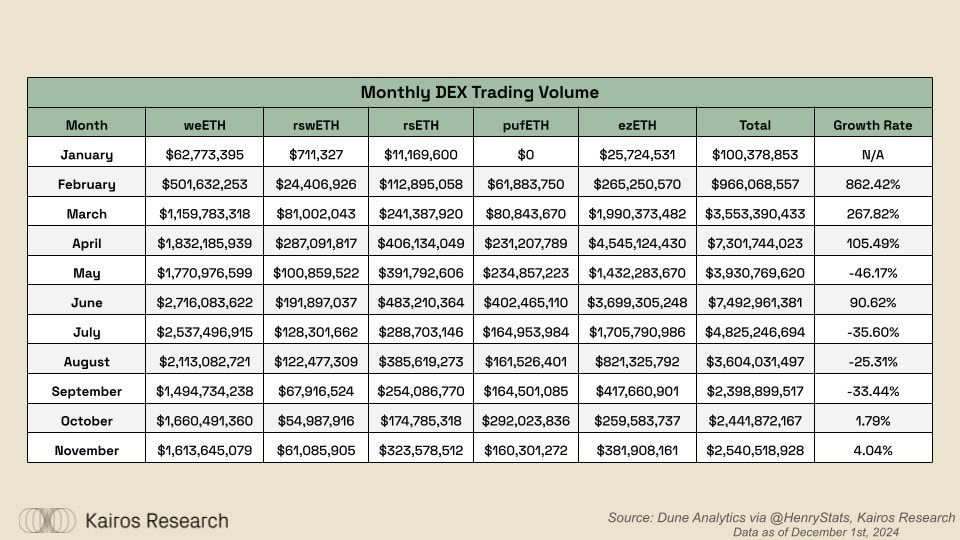

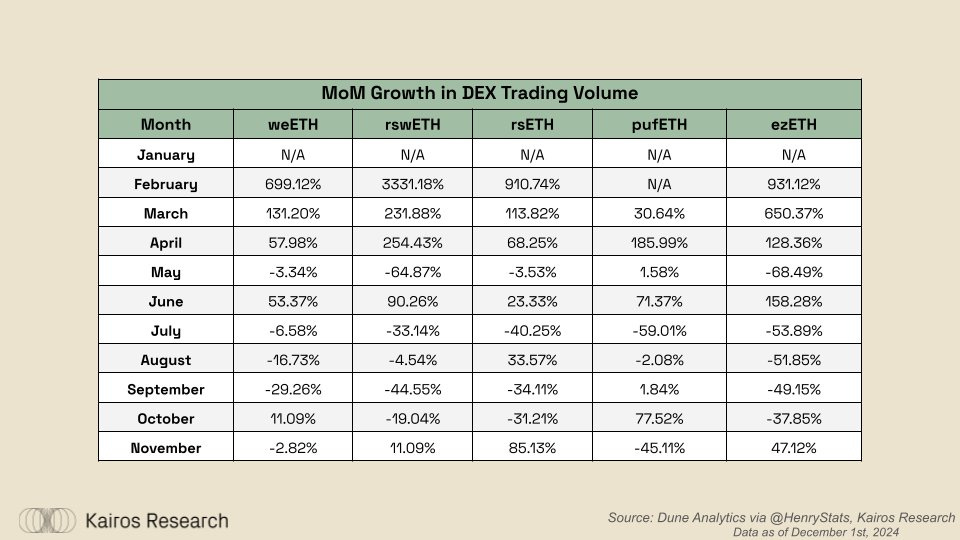

DEX Trading Volume Updates

Overall trading volume for the top 5 LRTs rose roughly 4% to $2.5bn in total. Kelp DAO's rsETH saw the largest jump, with volumes up 85% MoM, and Puffer's pufETH saw the largest decline with a -45% decrease.

EtherFi was able to claim its fifth straight month for market volume dominance, maintaining roughly 50% dominance across overall volumes since July.

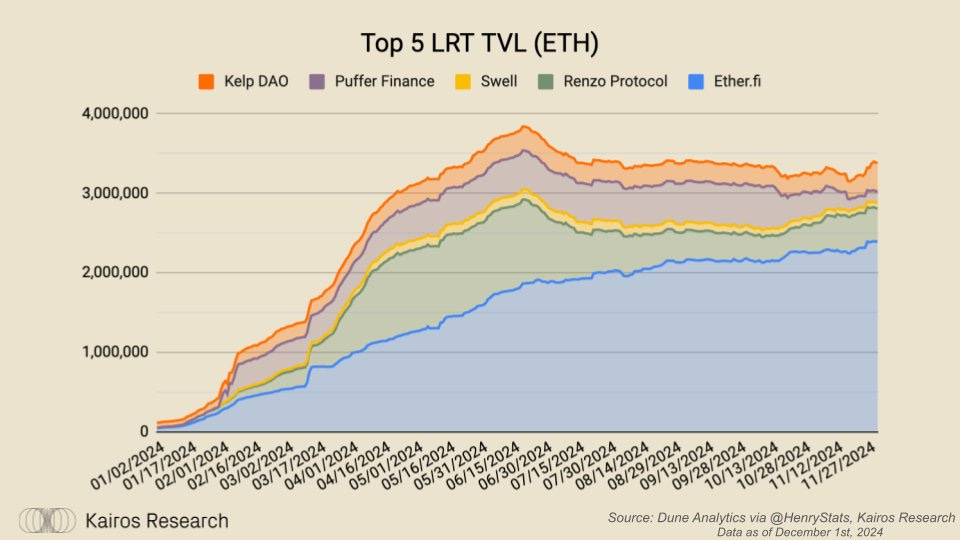

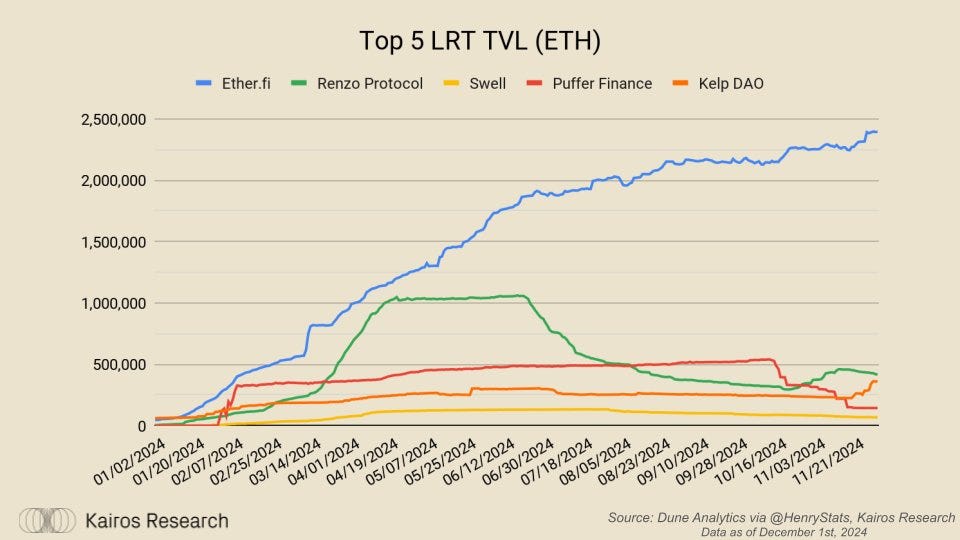

TVL Updates

Overall TVL for the top 5 LRTs currently sits at around 3.38m ETH, worth around $12.5bn. EtherFi remains king, and has actually seen a continued increase in deposits since our coverage last month. Renzo saw a slight decline after deposits began to rebound, and we anticipate we see further deposits flow in as the Aave caps are lifted accordingly. Kelp's rsETH saw a resurgence in deposits following their Aave integration, while Puffer seems it may have found its local equilibrium, while Swell's rswETH remains steady.

Swell's rswETH saw the largest liquidity to TVL ratio increase, while Kelp's rsETH saw the largest decline

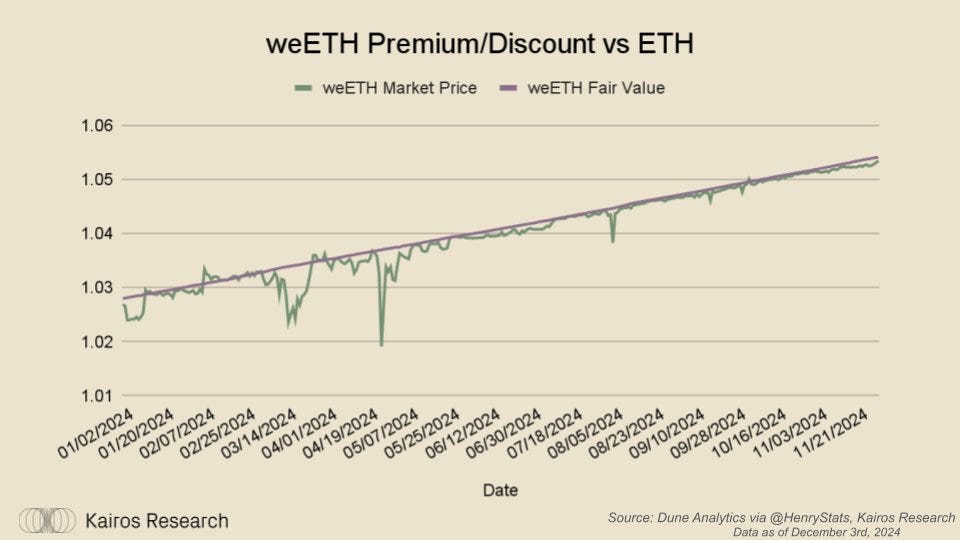

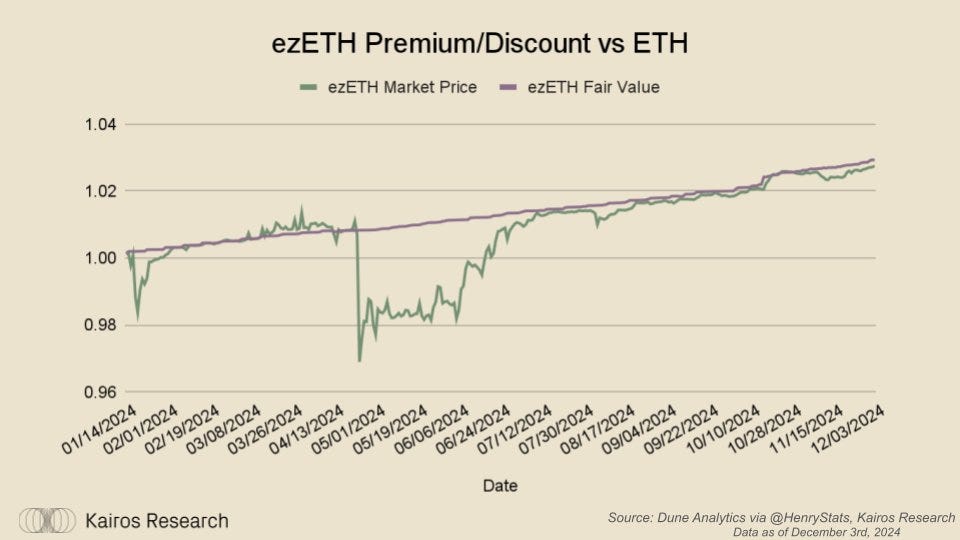

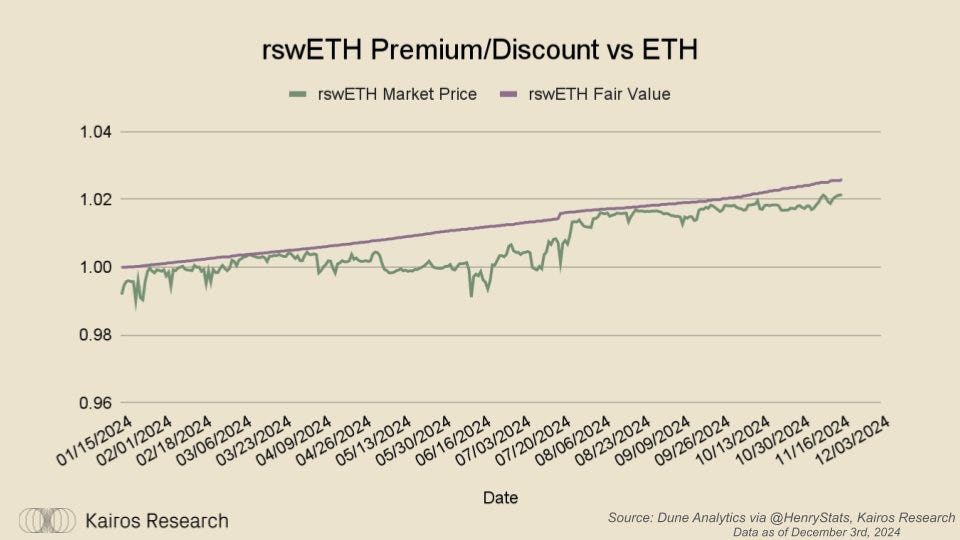

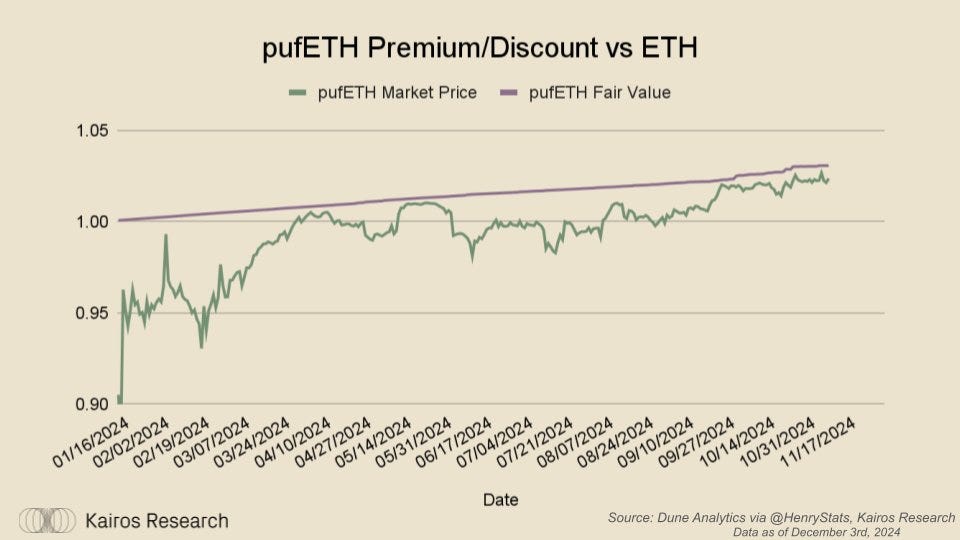

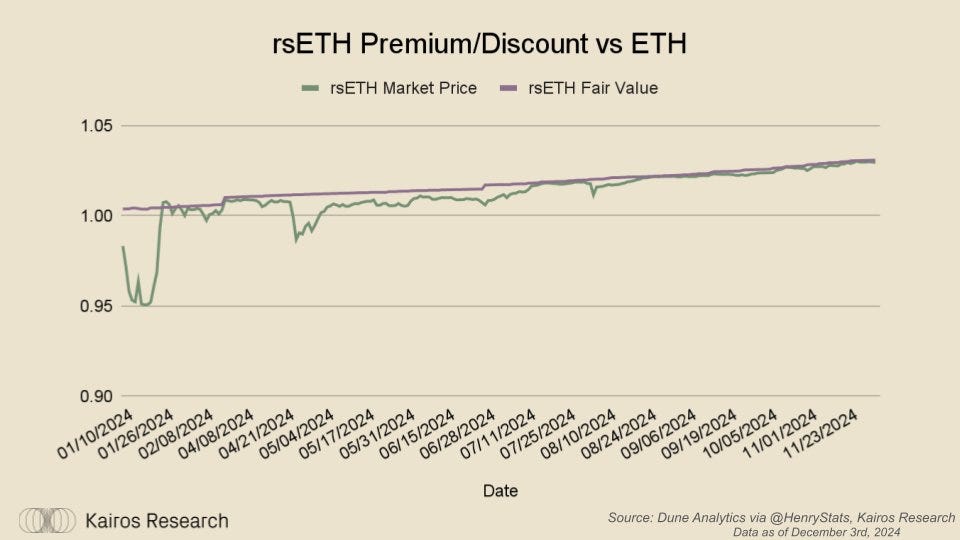

LRT Peg Updates

Pegs remained relatively stable across the top 5 LRTs.

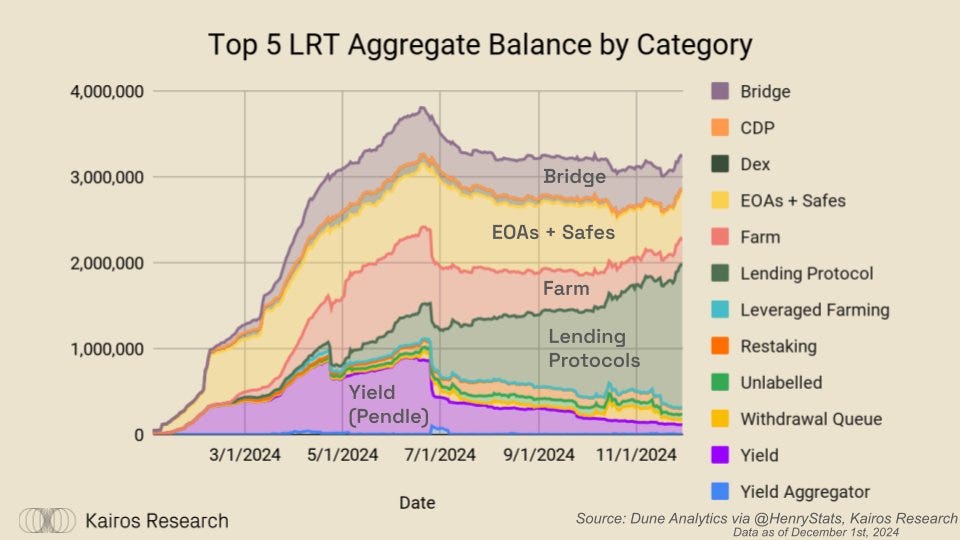

Categorical Flow Updates

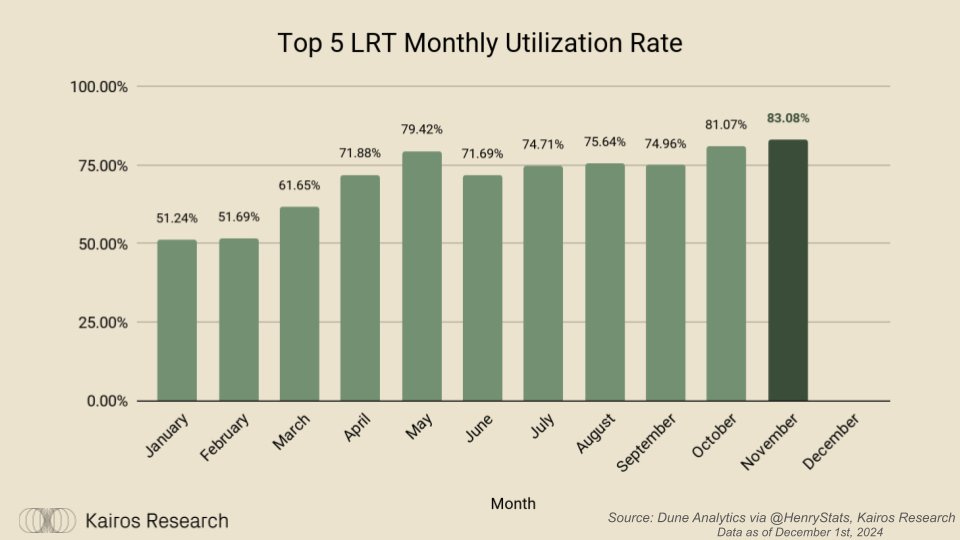

Overall utilization hit an all time high of 83% for the month of November. This was primarily led by increased flows to Aave from weETH, ezETH, and rsETH. The majority of the supply for the three largest LRTs now sits on Aave with 51%, 42%, and 52% supplied to Aave respectively. Across the top 5 LRTs, more than 50% is now supplied to Aave.

Closing Thoughts & Looking Forward

As we enter a world of net-positive ETH ETF flows, the onchain economy is about to become a lot more reflexive. That is why we have been harping on the importance of LRTs in lending markets. The current 51% supply of LRTs in lending markets will likely grow as high as caps allow, bolstered with restaking rewards aside from programatic EIGEN incentives that are set to begin flowing soon. Let's revist our take on the importance of ETH ETFs and their impact from "Our Thoughts on the ETH ETF”

We're still in the early innings for not only restaking, but crypto at large. In the future institutions will have a plethora of risk adjusted strategies to get the most out of staking their ETH. Of the top performing strategies, it is almost certain it will involve liquid restaking, and money markets like Aave. As we enter this next phase of restaking, we'll see slashing and rewards go live. This will likely coincide with many of the LRTs reassessing their risk profiles, if they haven't already.

Renzo already announced they will be un-delegating from most AVS. Again, this lines up with what we predicted would happen when we released our initial coverage on LRTs.

We anticipate the flows of restaking rewards, coupled with substantial and sustained flows to ETH ETFs could create the perfect storm for the onchain economy. This perfect storm would enhance the already capital efficient LRT marketplace, leading to more borrowing, and more onchain activity across mainnet and all ETH L2s. Swell has strategically positioned themselves to benefit from this exact type of scenario, and we covered their potential restaking flywheel in depth a few months back.

Lastly, @dabit3 recently noted that EigenLayer is tracking over 600 projects building AVS and Rollups on the platform. While restaking lost a bit of its luster as the broader community felt fatigued from infra projects, there are many powerful tailwinds for the entire EigenLayer ecosytem going into the end of Q4 and into Q1 and beyond. It's time to get bullish on restaking again.

The rewards must flow.