LRT Provider Renzo Makes a Push for Blue-Chip Lending Markets: Aave & Compound

A brief dive into the potential impact of LRTs being integrated into DeFi's largest lending markets and how similar past events have played out

It appears that @renzoprotocol is steadily narrowing the distance and may soon surpass @ether_fi as the leading LRT by total value locked.

We expect LRTs to play out similarly to LSTs with a winner-takes-most market structure. The race is really coming down to these two sector leaders of EtherFi and Renzo, but @RioRestaking could prove to be a dark horse contender if their launch strategy goes well.

Additionally, Renzo's ezETH is poised to potentially be the first LRT integrated into blue-chip lending protocols such as Aave & Compound.

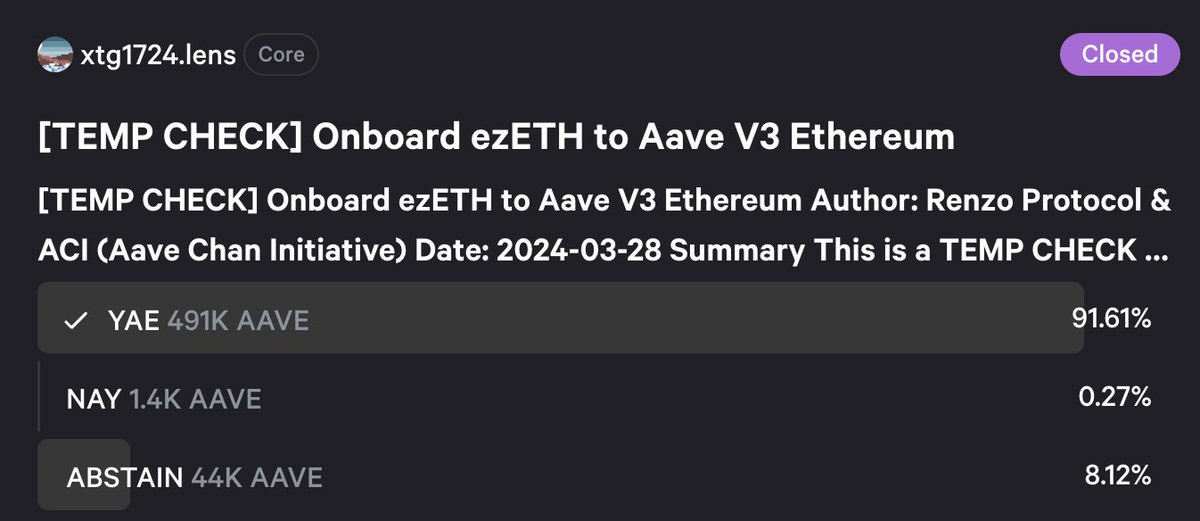

A temperature check vote on Aave has passed with overwhelming success on snapshot. The main pushback in the forum discussion from the likes of @wintermute_t harp on liquidity constraints, despite excitement for LRTs like ezETH to enter Aave's marketplace. They suggest a conservative cap if they are to vote yes, and also make the important point that native withdrawls are not yet live, despite competitors like @ether_fi having them enabled.

On the Compound front, ezETH appears to have community support in the compound forum, with @gauntlet_xyz providing some excellent insight on risk parameter recommendations on the forum post.

@KelpDAO's rsETH has also put forward a proposal on Compound's forum which seems to have decent community support thus far, but lacks expertise similar to that which is seen for ezETH's - however, given the structural similarities, some of the same parameters could potentially apply when adjusting for liquidity differences.

The liquidity profiles across these LRTs differ greatly. For example, rsETH only has $7.27m of exit liquidity onchain for $760m+ of TVL.

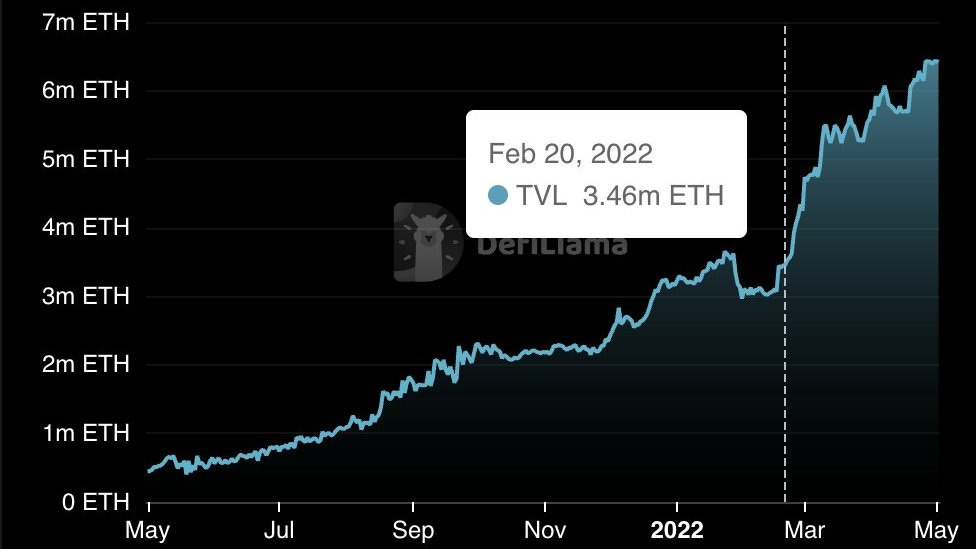

Nonetheless, the importance of these LRTs being listed on lending markets cannot be understated when looking at similar events such as stETH/wstETH's integration into Aave.

Following stETH's integration to Aave in late Feb of 22', the TVL nearly doubled in just a few short months - and with EigenLayer mainnet & AVS launches looming in the near future, there will surly be those who wish to "loop leverage" to gain additional exposure. We believe leverage is healthy, if the underlying protocols facilitating it are robust enough to withstand the volatility of those who fail to properly manage their risk. We saw Aave and Compound specifically withstand an incredibly volatile last year, when all their centralized counterparts still continue to work through bankruptcy proceedings.

We believe these potential integrations of ezETH into these large, robust, multi-billion dollar lending markets could potentially help push @renzoprotocol's ezETH into the number 1 spot.