Mitosis: Supercharging DeFi's Liquidity Marketplace

The State of On-Chain Liquidity

Liquidity is the lifeblood of financial markets and on-chain activity, without it most on-chain protocols are rendered useless. To understand the importance of liquidity, imagine the following scenarios:

Depositing $100k worth of ETH into Aave, but there is only $2,000 worth of USDC to borrow. Without sufficient liquidity, the user would have to borrow several different stablecoins, pay an unrealistic borrowing rate, or maybe have no access to leverage at all.

Trying to swap $100k of ETH to USDC on Uniswap & impacting the market 10%. Without sufficient liquidity, traders will lose a large portion of their trade to arbitrageurs and might as well just use a centralized exchange.

Depositing $100k worth of ETH to Lido in exchange for wstETH, but when they try to swap the LST into USDC they only get $75k worth of USDC. The user would’ve been better off waiting through Ethereum’s withdrawal queue instead of using “liquid staking.”

The need for liquidity is highly relevant to a majority of on-chain protocols, throughout DeFi (DEXs, Lenging, Liquid Staking, Derivatives, RWAs), Bridging, Payments, and more. Protocol developers are highly aware of this and are constantly ideating new liquidity incentives, through liquidity mining, points programs, fee accruals & airdrops. However, an understated cornerstone of this market happens behind closed doors through institutional liquidity agreements. Venture funds, hedge funds and high net worth individuals use their ability to bootstrap or seed liquidity to negotiate a portion of the token supply.

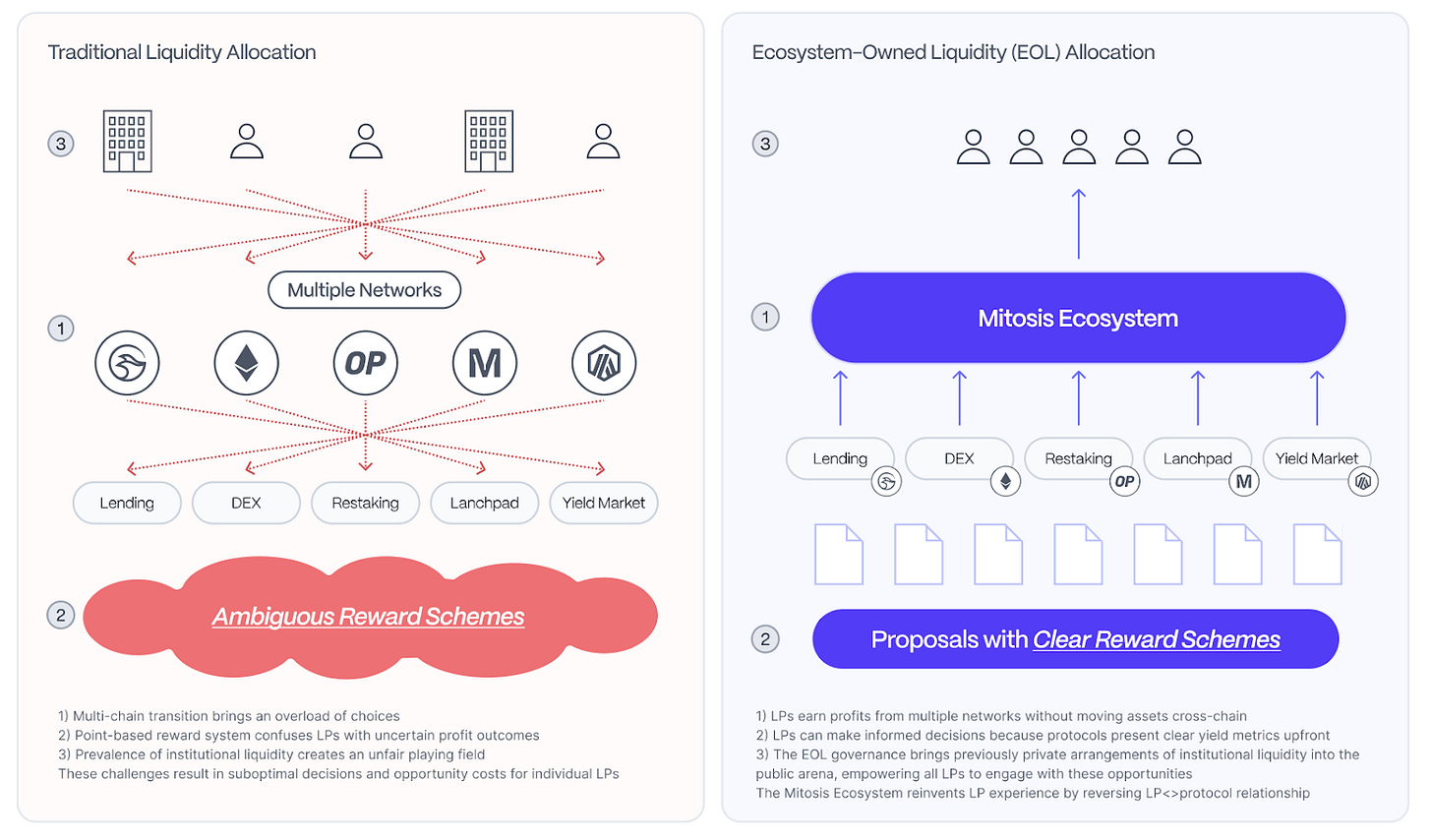

The current liquidity incentive approaches have significant downsides and are ripe for disruption:

Decentralized / Transparent: Liquidity mining, points programs & airdrops almost always attract mercenary capital, where the liquidity providers quickly pull any liquidity after a protocol’s TGE. Beyond this, protocols agree to distribute x% of their token supply through airdrop without conditions, meaning that the percentage of supply airdropped is constant whether $10 or $10M in liquidity is supplied.

Institutional / Backdoor: Private liquidity agreements leave protocols beholden to a small handful of LPs, centralizing not only the protocols functionality, but in turn their token distribution & governance as well.

Given that the crypto industry strives for transparency & level playing fields, moving away from back door deals seems like an important next step for the future of the DeFi space. The ability to express liquidity intentions within a trustless, on-chain orderbook is beginning to take shape.

What is Mitosis?

We expect Mitosis to be a central player in the disruption of the on-chain liquidity market through their Ecosystem Owned Liquidity (EOL) primitive. EOL allows any (retail or institutional) liquidity provider to pool their liquidity, creating a more powerful and transparent collective. Visualized below, Mitosis is creating an open market in which protocols can put forth proposals on how much liquidity they need and how they can incentivize Mitosis LPs to allocate their assets. In turn, Mitosis’ governance process is responsible for allocating their assets in a way to maximize the risk adjusted return.

Opening up the liquidity marketplace is beneficial for both protocols and the vast majority of liquidity providers. For protocols, it increases efficiency for the supply side of the market, driving down the cost needed to acquire $x of liquidity while also distributing any token rewards to a wider group of LPs. For LPs, it provides equal access to deal flow that was once only available to funds, whales and institutions. Rather than being second class citizens, all LPs will be able to share in the benefits of bootstrapping protocols. Furthermore, open liquidity marketplaces allow both sides (protocols & LPs) to diversify, which makes Mitosis interesting for institutions as well. Instead of having to provide millions of dollars in liquidity to a single protocol, institutions can be less concentrated and access the same deals split across dozens of protocols lowering smart contract risk, token price risk, etc.

While creating a trustless market for liquidity provision is appealing, how does it work in practice?

Protocol Mechanics

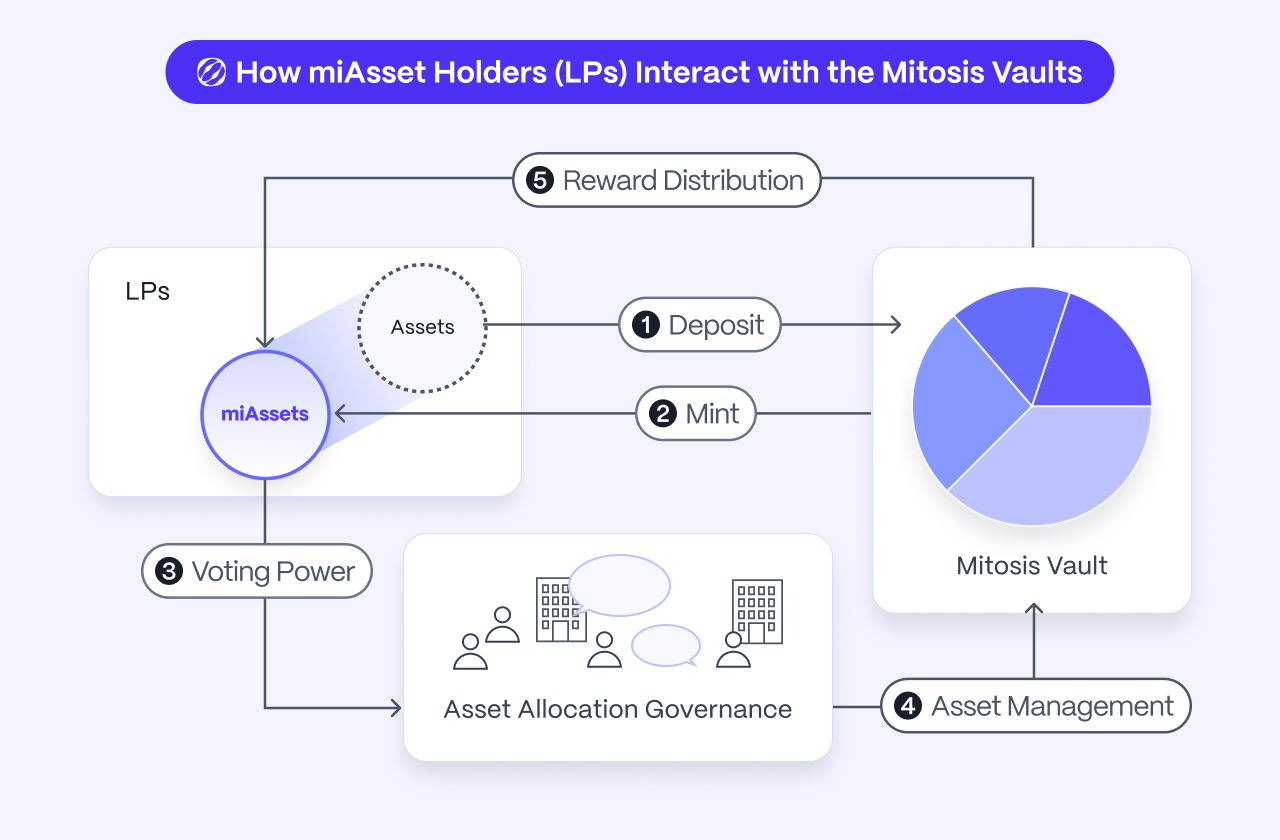

Above is a visualization of the process flow when utilizing the Mitosis protocol, which we will break down below:

Users are able to deposit their asset to a variety of Mitosis Vaults, which exist across a number of chains and are categorized by asset (Stables, ETH, LST, LRT)

Once Mitosis Chain is live, depositing into a vault is essentially the same as “bridging” to Mitosis Chain, but until then depositing is just gaining a share of the Ecosystem Owned Liquidity Vault

Mitosis pools the assets within each vault together, such that hundreds-thousands of users make up each pool

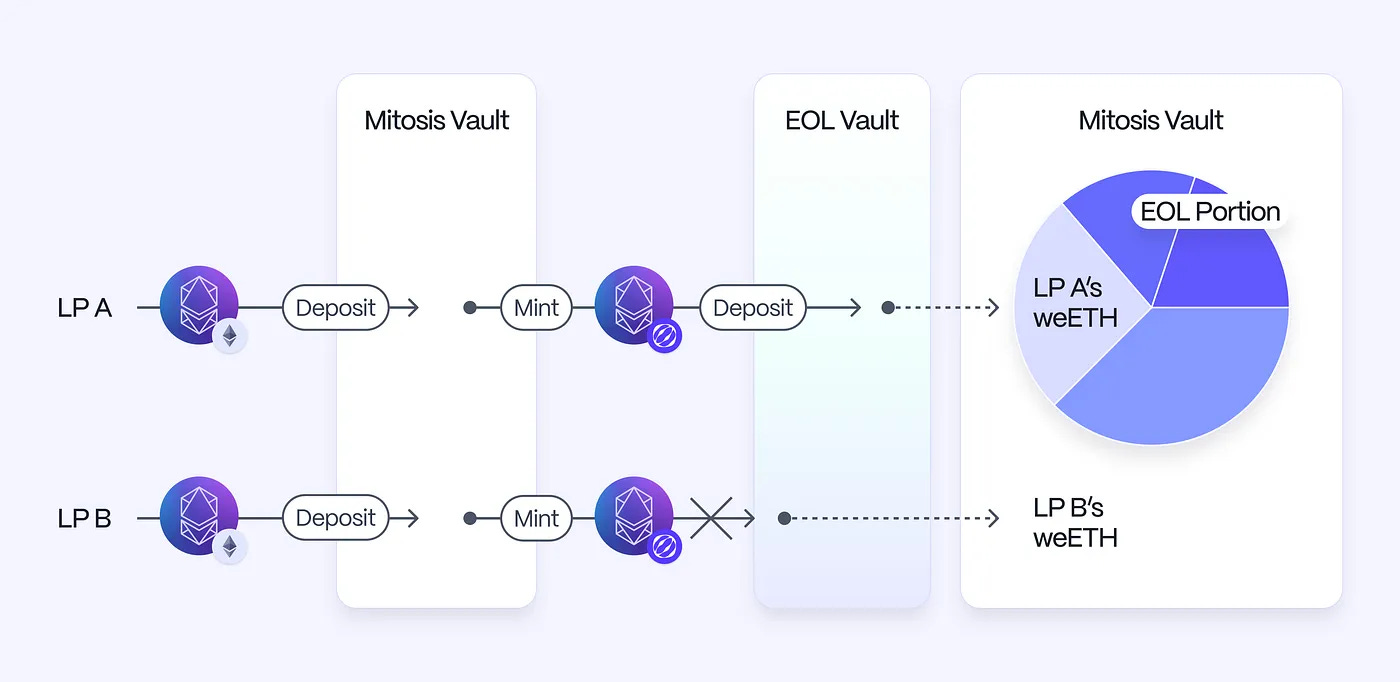

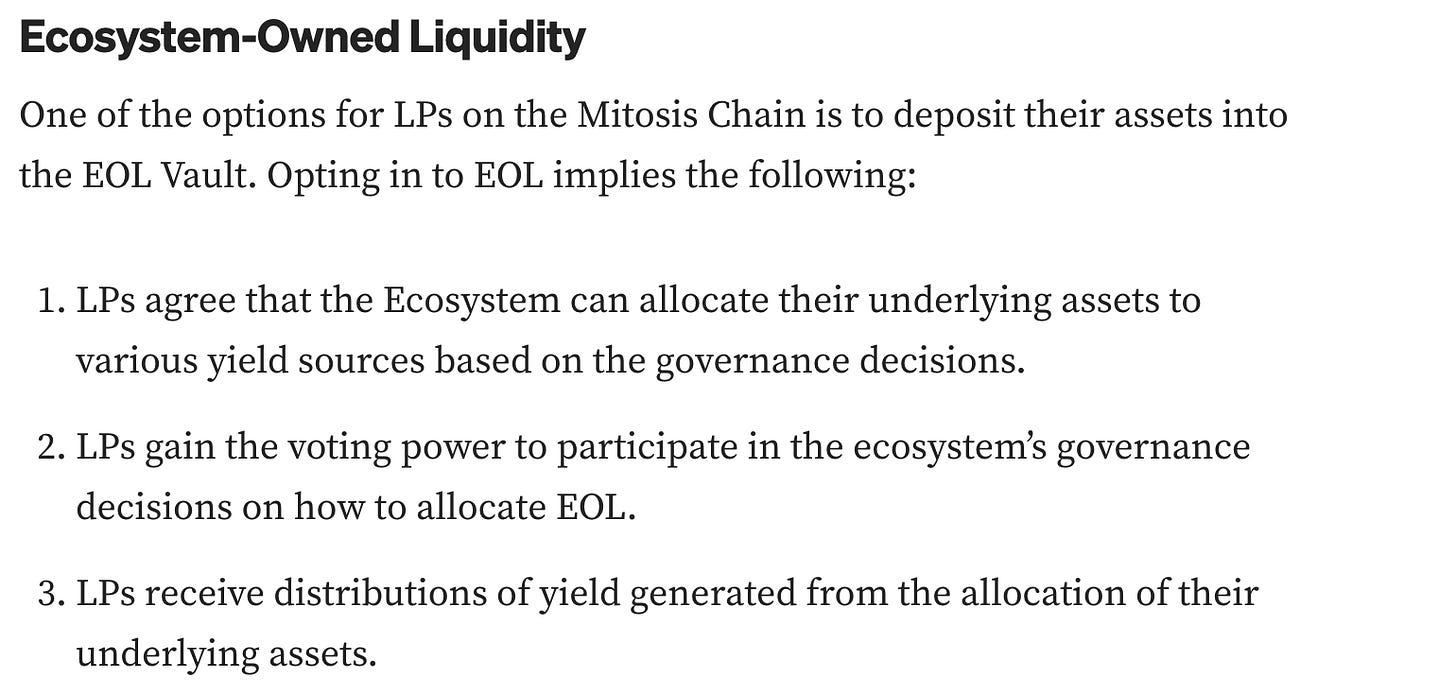

Mitosis will eventually offer two options depending on the depositors preference: 1.) Mint an miAsset receipt to the individual liquidity provider that represents their pro-rata share of the Ecosystem Owned Liquidity vault, or 2.) Simply bridge the deposited asset to the Mitosis Chain without opting into EOL

miAsset’s will live on-top of the Mitosis Chain and can be redeemed for their underlying asset + any accrued rewards

The miAsset can be loosely compared to a receipt or derivative token representing their underlying asset in the sense that they can also be used throughout the DeFi ecosystem on top of Mitosis Chain, letting users maximize their capital efficiency

By holding an miAsset on the Mitosis Chain, the user is also granted prorated voting power over how the liquidity is utilized, these votes are broken into two parts

Initiation: Protocol’s in need of liquidity are able to create a proposal to be whitelisted, such that the Mitosis Vaults are capable of supplying them liquidity

These votes are broken down individually by both protocol and asset

Gauge Voting: If a protocol is whitelisted, they are able to receive liquidity provision in Mitosis’ next allocation round

The exact allocation of the Mitosis Vault’s liquidity is decided by the voting % that each whitelisted protocol receives within that voting period

You can see the options presented to Mitosis depositors in the below visuals, where LP A opts into EOL & receives an miAsset on Mitosis Chain and LP B opts out of the EOL vault and simply receives their bridged weETH on Mitosis Chain.

Competitive Environment

As we have noted throughout the report, Mitosis is not reinventing the wheel. The more primitive concepts of on-chain liquidity marketplaces can be seen across a variety of protocols, whether it be Sushi’s liquidity mining, Arbitrum’s promised airdrop, Votium / Redacted’s bribe systems or Eigenlayer’s points programs. These are examples of both direct & indirect competition, some of which are built in house (Sushi, Eigenlayer) & some of which are products built to facilitate liquidity incentives (Votium, Redacted).

The size of the bribe market is relatively easy to quantify and shows the demand for liquidity incentives. Each month, protocols use Votium and Hidden Hand to pay millions of dollars to veCRV, vlCVX & vlAURA holders for their votes. According to Llama Airforce, during the last biweekly voting period, nearly $740k was paid out to vlCVX voters and $350k to vlAURA votes. By bribing these voters, protocols are able to direct DEX token emissions to their preferred pairs and boost the yield paid out to LPs. While Votium and Hidden Hand are highly successful, they are somewhat limited to only facilitating liquidity for DEXs that have internal liquidity mining programs, while Mitosis takes steps to both provide the supply side liquidity and can be useful for bridges, lending platforms and a wider variety of DeFi apps.

There are also two newer liquidity primitives that we believe are conceptually relevant to Mitosis, including:

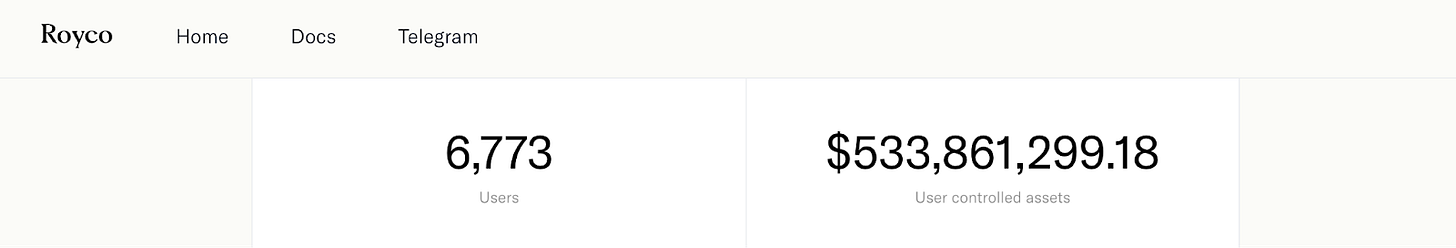

Royco: An orderbook that enables liquidity providers to connect with incentive providers, such that a ‘fair price’ for liquidity can be achieved. Within Royco, anyone is able to create a pool that defines which asset is accepted within the individual orderbook, what action will be taken if a bid and ask are matched and how long the assets will be utilized. Incentive providers are then able to place bids on the dollar amount of incentives they will pay for $x amount of liquidity for the specified time period. Royco also tokenizes these locked liquidity positions, such that LPs are able to sell their receipt token so that somebody else can wait it out until redemption.

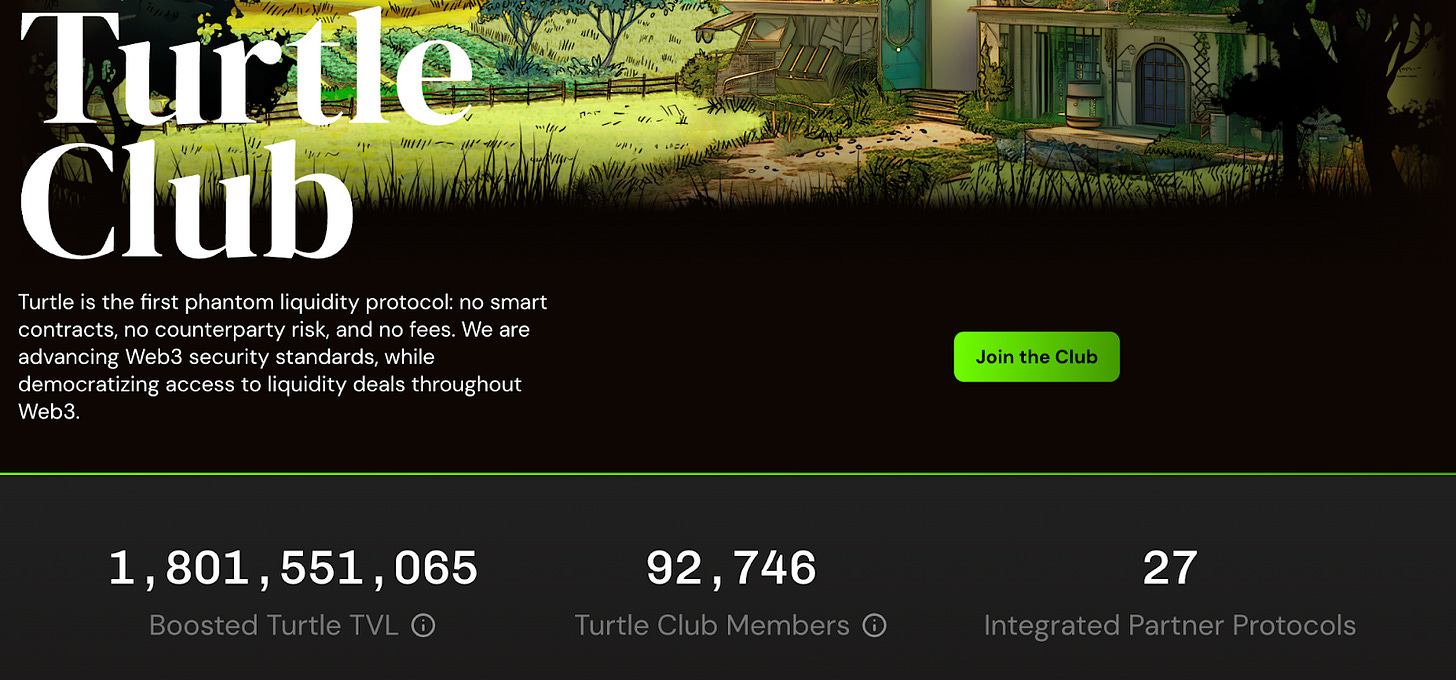

Turtle Club: A coalition of liquidity providers that self-custody their assets but use their collective status to negotiate larger liquidity incentives from partner protocols. Turtle Club is much simpler than Mitosis, but has a similar thesis: pooled liquidity is much more powerful than any single liquidity provider. The Turtle Club is responsible for auditing partner protocols & negotiating boosted rewards, but has no requirements for LP’s other than signing a transaction to join the club.

Mitosis, however, is significantly different from any of the protocol’s we mentioned above, due to its simplicity. The vision is that liquidity providers are able to come together, pooling both their assets and their market knowledge. By having a large collective dollar amount, Mitosis LPs have bargaining power with protocols and truly move the needle in bootstrapping liquidity and by having a diverse group of LPs, a wider range of “deal flow” can be researched & whitelisted for a gauge vote. The upside is that the opportunity cost of supplying liquidity is driven towards zero as you have exposure to all sorts of protocols across dozens of chains. miAssets are on the extreme end of capital efficiency, especially as Mitosis launches with a focus on the Liquid Restaking ecosystem, where depositing an LRT into a Mitosis vault means that the user is earning ETH staking yield, Eigenlayer AVS yield, Mitosis EOL DeFi yield & will still have their liquid miAsset on top of the Mitosis Chain where it can once again be deposited into DeFi protocols.

The extremes of capital efficiency and collective intelligence comes with a couple potential ramifications that we can think of, including:

DeFi protocols that take miAssets as collateral need to understand they layered risks of slashing (Ethereum & Eigenlayer) and liquidity provision via the EOL (smart contract risk, underlying collateral liquidity risk, etc).

Larger deposits in some sense equals assumed larger “intelligence,” within the Mitosis governance system as the depositor has a larger say in how everybody’s liquidity is utilized. We believe some of this risk is negated by the fact that the larger LPs bring additional negotiating power & must also risk their own assets.

Conclusion

Since inception, Kairos believes that the risk / reward ratio for airdrop farming has swung like a pendulum. In early 2020-2022, users were handsomely rewarded for being early users / liquidity providers throughout DeFi. There are dozens of examples, but DeFi protocols like Uniswap, Sushi, dYdX, and Yearn all paid out hundreds of millions of dollars in pseudo-liquidity incentives - an amount so large that it would be difficult to ever recoup in past or future fees. Behind closed doors, many protocol founders have decided that pre-negotiating fixed terms for liquidity provision was a much more effective way to bootstrap a protocol than relying on mercenary airdrop farming capital.

The times in which protocols significantly overpaid users for liquidity or early adoption therefore appear to be over. Of course this could change alongside market conditions & airdrop farming could once again be the best use of capital, but Mitosis’ creation of an efficient liquidity marketplace is a step in the right direction for both protocols and liquidity providers. Instead of protocols trying to trick users by over-promising on an airdrop or users trying to trick protocols by using dozens of wallets and pulling liquidity on the day of the snapshot, both parties are fully aware of their risk and return before any agreement is made.

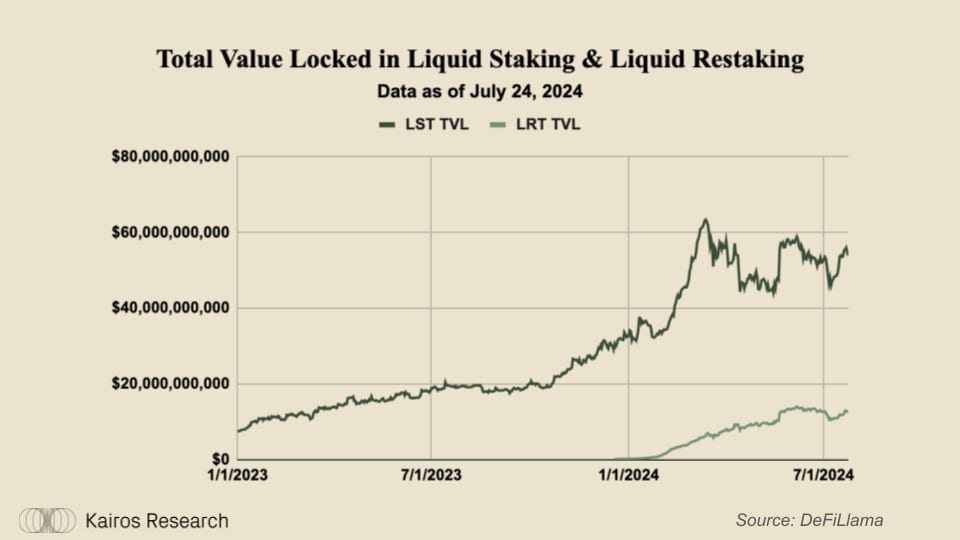

We believe that Mitosis’ Go-To-Market strategy is incredibly compelling given the nature of the liquid staking & restaking markets. LSTs catapulted to $45bn on Ethereum alone over the last few years. Now LRTs have gone from virtually zero to $14bn in only a few months, both of which have been some of the largest drivers of economic activity on Ethereum’s mainnet. Given LSTs meteoric rise in popularity was due to them becoming superior collateral vs native ETH, we see an improvement to this trend with LRTs, as they will benefit not only from the network staking rewards, but the additional restaking rewards on top of that for helping to secure Activity Validated Services (AVS) on EigenLayer. As LRTs continue to proliferate, potentially flipping LSTs in TVL, they will continue to be exported to other layer 2 ecosystems. Our thesis is that LRT holders will be extremely DeFi native within different ecosystems. Further, LRT holders will likely be experts in using “DeFi lego blocks,” such that they can maximize yield for their assets.

Mitosis’ plans to focus on LRTs allows users to do exactly that, by giving them miAssets which are described in depth above. These miAssets capture various reward opportunities across networks, accruing yield in the form of “cTokens,” such that miAsset holders will have a consistent reward stream. Therefore, there is maximized capital efficiency for liquidity providers on Mitosis chain, as they can take their LRTs one step further: earning native ETH staking yield, Eigenlayer AVS yield, multi-chain DeFi yield and then put their miAssets to use within DeFi yet again. We picture this having a snowball effect where more liquidity begets more liquidity, all driven by the underlying capital efficiency.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.