Introduction

Ethereum has established itself as the most battle tested, decentralized, smart contract Layer 1 blockchain within the crypto industry. However, as crypto continues to onboard new users, the network has begun to reach some of its capacity limitations and transactions have become increasingly costly. Hundreds of teams are building within the Ethereum ecosystem to scale the network to match this planned increase in demand with the “main goal of increasing transaction speed (faster finality), and transaction throughput (high transactions per second), without sacrificing decentralization or security.”

As a community, Ethereum has made the strategic decision to scale via off-chain execution and computation environments, which are dubbed “rollups.” The rollup centric scaling roadmap “outsources” execution to off-chain execution environments, effectively moving the vast majority of user activity off mainnet and onto isolated rollups. As of today, rollups have effectively improved the user experience, through bundling transactions and socializing mainnet gas costs across many users, offering soft pre-confirmations for transactions, and on occasion mitigating the downsides of maximal extractable value. However, transitioning liquidity and activity off of Ethereum mainnet and onto a number of Layer 2 (L2) networks takes away two of the most enticing factors of the Ethereum ecosystem itself: deep unified liquidity & composability between hundreds of Web3 and DeFi applications that were built on Ethereum mainnet.

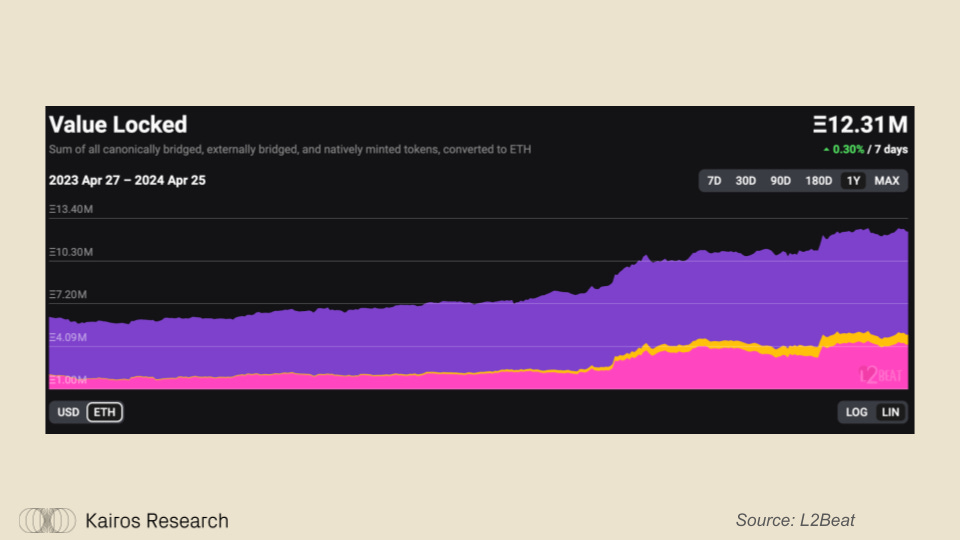

The below chart from L2Beat highlights this L2 adoption, measuring the sum of all tokens on L2 networks in ETH terms, helping quiet the effects of price volatility. While a sizable percentage of this “Total Value Locked” may be attributed to L2s launching their native tokens, it is difficult to dismiss the adoption of Ethereum scaling networks. For example, the purple section of the area chart represents only the “Canonically Bridged Assets” across L2s - currently sitting at ~$23.4B in market value. These canonically bridged assets are MOSTLY composed of bridged ETH and stablecoins, but may also count rollup’s native tokens that were launched on Ethereum L1 (STRK).

For the sake of clarity, the yellow section consists of assets bridged via non-canonical bridges & the pink section consists of natively launched tokens on L2s.

Kairos Research believes that the launch of Rollup-as-a-Service protocols and the customizability of application specific rollups in the modular world will lead to hundreds of successful rollups. Many of these rollups will likely utilize the Ethereum Virtual Machine (EVM) but we also expect to see experimentation with the Solana VM, the Move VM, and zero knowledge focused execution environments. This trend will continue to push the fragmentation of liquidity across execution environments in the coming months, necessitating a protocol that allows all rollups to interact with one another and function as a cohesive unit.

In comes the Omni Network, which looks to be an integrated rollup layer for the Ethereum ecosystem, mitigating the downsides of fragmented liquidity and reintegrating the network effects that made Ethereum what it is today. With the initial goal of abstracting away bridging, the Omni development team sees the end goal of their protocol as being the “Kubernetes for blockchains,” allowing developers to scale their applications on a singular layer and avoid managing distributed cross-rollup state.

Protocol Mechanics

In order to understand Omni’s protocol mechanics and design choices, we can dig into the team's vision of the product, as a “natively secured, externally verified interoperability network.”

Natively Secured: Omni leverages Eigenlayer for economic security through ETH restaking. Operators on the Eigenlayer network accept ETH deposits from restakers and natively stake it to Ethereum, but additionally opt in to run the software of Actively Validated Services (AVSs) like Omni, where they act as the network’s validator nodes. These operators act as pooled security providers for Omni and could eventually be slashed in the event that they sign invalid transaction data.

Leveraging Eigenlayer for crypto-economic security is lucrative, as the cost of security should be significantly lower than what is required when bootstrapping a native Proof of Stake system. Depositors into Eigenlayer are not expecting their yield to grow linearly with the number of protocols they secure, as time requirements and downside risk will not scale linearly thus neither will their payout. Therefore, using Eigenlayer will lower security costs for new protocols and allow them to bypass bootstrapping their own Proof of Stake system. By driving down the costs of economic security, we believe Eigenlayer further enables decentralized innovation.

Omni also operates using the idea that the Ethereum network is the common denominator of all rollups, maintaining the current state of each L2 and offering security in the form of censorship resistance and more. With this idea in mind, Omni believes the best way for an interoperability protocol to provide sufficient security, performance and compatibility with all of Ethereum’s L2 networks is to also utilize ETH’s crypto economic security through leveraging Eigenlayer.

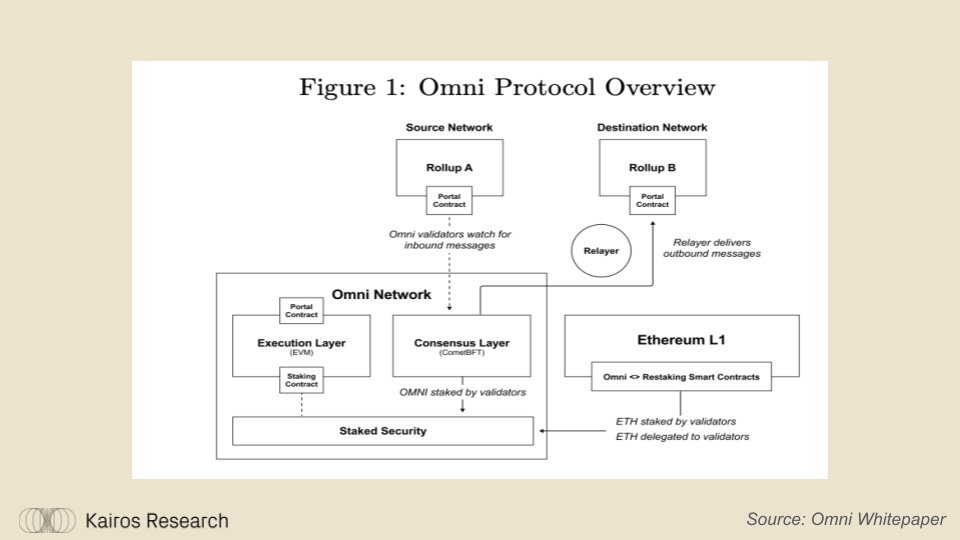

Externally Verified Interoperability Network: As seen in the graphic below, Omni is an independent network that utilizes a fast finality consensus engine (CometBFT) and leans on a set of third-party security providers (Eigenlayer Operators) to validate cross-rollup communication. According to the protocol’s whitepaper, Omni’s independent network structure allows it to easily integrate with rollups of all kinds, enabling sub-second cross-chain message verification. Many interoperability protocols in the past have used externally verified systems, but in a centralized manner - leveraging either anonymous team members or trusted, public third parties. In both scenarios, bad actors are economically incentivized to exploit the independent verifiers to drain cross-chain bridge assets. Omni will initially launch with 50 whitelisted Eigenlayer Operators but will look to expand to several hundred once slashing is enabled and the protocol can become increasingly trustless.

We believe that the phrase “natively secured” must be clarified, as Omni is not enshrined into Ethereum or secured by the Ethereum network itself. It is instead secured by a combination of restaked ETH and staked OMNI within its own proof of stake system. Leveraging restaked ETH allows Omni to scale its security directly with Ethereum’s security budget while staked OMNI allows the protocol to scale its security alongside demand for using the cross-rollup protocol. If Omni were to utilize only its native asset for security, the token would have to grow in market cap proportionately to the growth in protocol activity. Through Eigenlayer, Omni can effectively rent more (or less) ETH stake and ensure flexibility in times of both growth and contraction. Moreso, ETH brings relative stability to the protocol’s security budget given that its price is significantly less volatile than the rest of the crypto market.

By using this decentralized network of validators, Omni has taken a distinctly different approach than many other bridges such as Wormhole - which uses a trusted set of 19 “Guardians” that verify transaction and Layer Zero - which allows the applications that build on top of them to integrate their own Security Stack. While economic security is just one of the many security considerations for an interoperability protocol, we believe the below visual provides a fair representation of Omni compared to a native, enshrined interoperability protocol.

Now understanding what Omni is and how it is designed, who will be the end user of the Omni AVS? Omni is a backend, interoperability network capable of communicating arbitrary data across siloed blockchains. This means that users will not necessarily understand that they are using Omni, as developers will be able to integrate Omni’s software into their applications and remove the need for users to bridge in the first place. To understand how the protocol works, we can run through an Omni transaction’s lifecycle:

User on the Source Rollup submit a transaction (XMsg) to a bridging protocol or cross-chain DEX (xDapps) that utilizes the Omni Network, where it is picked up by the Omni validators that run full nodes on every integrated rollup

The XMsg is then submitted to a Portal contract that connects the Omni blockchain to the Source Rollup, where the message is included in an xBlock on the Omni Network

Validators staking ETH and OMNI must attest to the validity of the xBlocks to finalize the transaction

Permissionless relayers are able to collect data & signatures from finalized xBlocks and submit them to the Portal contract on the Destination Rollup, which makes a contract call that finalizes the user’s transaction on the the xDapp on chain

Below is a visualization from the Omni documentation that highlights the above cycle.

Transaction latency can be defined as the delay between transaction propagation and finality of the block that includes said transaction. Passing the finality threshold takes roughly 12-13 minutes within the Ethereum & rollup ecosystem and is hugely important for cross-chain transaction assurance, as a transaction on the source rollup MUST be finalized before processing a transaction on the destination rollup. Waiting 13 minutes adds significant friction to user experience, to the point that many bridges now utilize some form of rollup pre-confirmations that allow bridger’s quicker access to funds, offloading this equivocation risk to liquidity providers. In a similar vein, Omni is purposefully designed to allow users to pick their finality solution, where they can optimize for speed or security. For example, a bridge building on top of Omni could allow users to use alternative finality mechanisms such as an insurance pool or transaction pre-confirmations to speed up their transaction flow. Alternatively, for high value transactions, it may be optimal for the user to select the default finality mechanism and wait 13 minutes so they can enjoy the same security assurances as they would on L1.

Omni Token Economics

The OMNI token will be integrated within the network in several key ways, including: as a native gas & fee token, as a Proof of Stake, economic security asset and eventually as the governing token for protocol mechanics. There is clear demand for interoperability and bridging tokens within the crypto ecosystem, so we will start with a breakdown of a number of the most well known competitors and how they compare to Omni:

Since Wormhole’s inception, the protocol has facilitated $42.1B in total dollar transaction volume. 1.64% ($686M) of the protocol’s transaction volume has had popular Ethereum L2s (Arbitrum, Optimism & Base) as the destination network. Given the difference in protocol design and ecosystem focus, Wormhole is not a vanilla competitor to Omni, but could very well be in the future.

LayerZero, however, appears to be further integrated throughout the L2 ecosystem, with roughly 30% of all cross-chain messages having Arbitrum, Optimism & Base as the destination networks. The LayerZero explorer does not provide the dollar value of transfers, but we can estimate a lower bound through Stargate Finance data, which has done $29.4B in transaction volume since the beginning of 2023. If we equate cross-chain messaging to bridging frequency, this would roughly estimate that LayerZero has facilitated over $8.8B in volume to these top L2s. It should be noted that a large portion of this volume is the result of airdrop farming, but it is difficult to estimate the true demand for volume.

Connext is also extremely integrated within the Ethereum ecosystem, facilitating $625M+ in bridging volume across Ethereum, L2s and BNB Chain. With a focus on ETH, stablecoins and liquid restaking tokens (ezETH), Connext uses liquidity providers to front assets for bridgers that are looking for fast cross-chain transactions. These liquidity providers take a fee from bridgers for their service, as they then must wait out the time it takes for the assets to pass through the respective canonical L2 bridge.

Finally, Axelar is a protocol that uses a similar design to Omni as they both are sovereign chains that use economically incentivized validators to facilitate interoperability between several ecosystems. Yet again, similar to many of the above protocols, Axelar’s focus is also beyond the L2 ecosystem, with the majority of their volume being derived from Sei, BNB Chain, Osmosis and Ethereum mainnet. The complexity and ever changing nature of the crypto landscape has created room for a number of differentiated messaging protocols, allowing for experimentation in design choice and ecosystem focus.

While the interoperability space is still nascent, it is obvious that there is large demand for permissionless bridging protocols. Kairos Research has the opinion that bridging demand will likely scale exponentially with on-chain adoption and cross-chain applications will push this trend even further. It is unclear where relative cross-chain transfer fees will settle, but even at 10 basis points that is over $10M in fees from just L2 destination transfers across these competitor protocols.

Demand Drivers

While Omni will source a portion of its security from restaked ETH, it has also issued the OMNI token. As noted above, OMNI will play a multifaceted role within the protocol, including:

Universal Gas Token: Users of Omni will pay for transaction fees in the native token (typically ETH) of the source network, then relayers will bid in OMNI for the right to execute a transition on the destination network via Omni’s “Gas Marketplace”. OMNI paid by relayers can either be burned or redistributed to the network’s security providers or users. This demand scales as Omni processes more cross-rollup transactions.

Omni EVM Gas Token: The Omni EVM will require developers and users to pay gas fees in OMNI to transact on top of the protocol’s execution environment.

Security: Omni uses a dual token staking model via their Delegated Proof of Stake architecture. Omni’s network validators are able to use OMNI or restaked ETH as staking collateral, driving demand for the native token and increasing the protocol’s economic security if OMNI grows in value.

Given its utility within the system, OMNI will likely be a large recipient of any value captured within the protocol, from cross-rollup transactions, gas fees, and economic activity that takes place on the Omni EVM. If these fees are indeed distributed towards network operators and Omni captures a large portion of the cross-rollup transaction market, economically incentivized actors will either run Operators on the Omni Network or delegate to the existing validator set. However, it should be noted that protocols like Omni, LayerZero, and Wormhole work with third party, user facing protocols (Stargate, Portal, Carrier) that will also be splitting value accrual - making any direct future fee estimates relatively difficult.

Token Distribution and Supply Data

The graphics provided by Omni below showcase the distribution and vesting schedule of its native token, OMNI. At launch 10.4% of the token supply is live, composed of the airdrop distributed to the Omni community, Eigenlayer restakers, Ethereum validators, restaking partner protocols, and a variety of NFT communities. A small portion (1.1% of supply) is also unlocked for ecosystem development and early advisors. In the immediate term, vesting will begin for ecosystem development and community growth, which include grants programs, third party developer incentives and the network’s security budget at the discretion of the foundation until transitioned to governance. On April 17 2025, investors, core contributors and advisors will reach their 1 year cliff and begin their stepwise unlocks over the following 2 years. Core contributors are subject to a 4 year vesting period (beginning at the date of joining the project) with a 1 year cliff for ¼ of their total tokens followed by stepwise unlocks every 6 months for the remaining ¾ of tokens.

As it relates to the security budget, 496,492 OMNI (~$10.3M) have been allocated towards early validator rewards and network bootstrapping. These tokens will remain idle until mainnet, once a validator issuance curve has been finalized. The structure of the Delegated Proof of Stake network allows Eigenlayer Operators to operate as validators within Omni’s set, putting forth restaked ETH & OMNI that is delegated to them. We believe one supply side consideration for protocols utilizing restaking is that ETH restakers will most likely want to be rewarded in ETH, creating a level of selling pressure through inflationary rewards that is not necessarily seen within other Proof of Stake networks. Kairos Research has the opinion that these mechanisms will likely create either positive or negative feedback loops. In the event that Omni Network sees strong adoption within the rollup ecosystem, OMNI the token would be likely to share in the protocol’s success - allowing the Omni Foundation / Governance to lower dilution for security as each OMNI will go a longer way in terms of securing the protocol or renting more ETH security. This concept is possible through a dynamic staking ratio that will allow OMNI to take an increasingly large role in economic security as the protocol matures and grows in value.

Omni EVM: Omni’s Vision & End Goal

At its core, the Omni Network is a cross-chain messaging and interoperability solution, but the team believes their blockchain could be much more than just a technology provider for bridging protocols. By building out an Ethereum Virtual Machine (EVM) equivalent execution environment that runs parallel to the Omni consensus network, the Omni team has attempted to design an abstraction layer for rollup developers to create multi-rollup applications that they dub “Natively Global Applications.” If Omni’s natively global applications are successful, they could present several benefits to both developers and users, including:

Developers

Easier application management of cross-rollup protocols

Easier deployment onto non-EVM execution environments

Access to liquidity and users across more than just a single rollup

Users

A single access point to applications across the ever growing rollup ecosystem

Deeper liquidity for ETH, stablecoins & multi-rollup tokens

Deeper liquidity creates a better user experience for all DeFi protocol across lending, perpetual futures, trading etc

In building the Omni blockchain, the team chose to combine CometBFT (Tendermint) for fast finality and the EVM for its strong tooling and developer network effects. Running the EVM with CometBFT has historically been a large problem for the industry, as existing frameworks like Ethermint have repeatedly failed to support EVM activity at scale. As a result, Omni created a novel framework for combining the EVM with CometBFT, dubbed Omni Octane. Octane is an open source software implementation that can be extended throughout the modular world. The only requirement for teams building with Octane is that they establish an IBC connection to Omni. Effectively, if projects building in the Cosmos ecosystem adopt this scalable framework, Omni can become the nexus of both Ethereum rollups and the Cosmos ecosystem.

The success of both Omni and its Natively Global Applications is dependent on application developers leaning into cross-rollup interoperability and opting in to build within the Omni ecosystem. We believe Omni should be positioned well given that this conversation will become increasingly more relevant within the Ethereum ecosystem in the coming months and years as the rollup landscape grows horizontally through both general purpose and application specific L2s. To quote Omni’s Co-Founder and CTO, Tyler Tarsi, “We will never return to an Ethereum ecosystem where state is globally unified, what we need to optimize for is relaying state updates across the isolated platforms with a low enough latency that end users don’t even notice data is being migrated behind the scenes.” This will be an exciting issue for the Omni team to tackle, as they look to grow their validator / operator set into the hundreds without taking on significant latency issues in the next few years.

We believe that the interoperability landscape will be one of, if not the most, exciting subsector to observe within the Eigenlayer ecosystem given that there is a large, existing demand for bridging and a number of already live interoperability protocols. Having competitors outside of the Eigenlayer ecosystem like Wormhole, Connext and Axelar will directly showcase the power of restaking as it enables the creation of sovereign chains at a lower cost than previously thought possible.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.