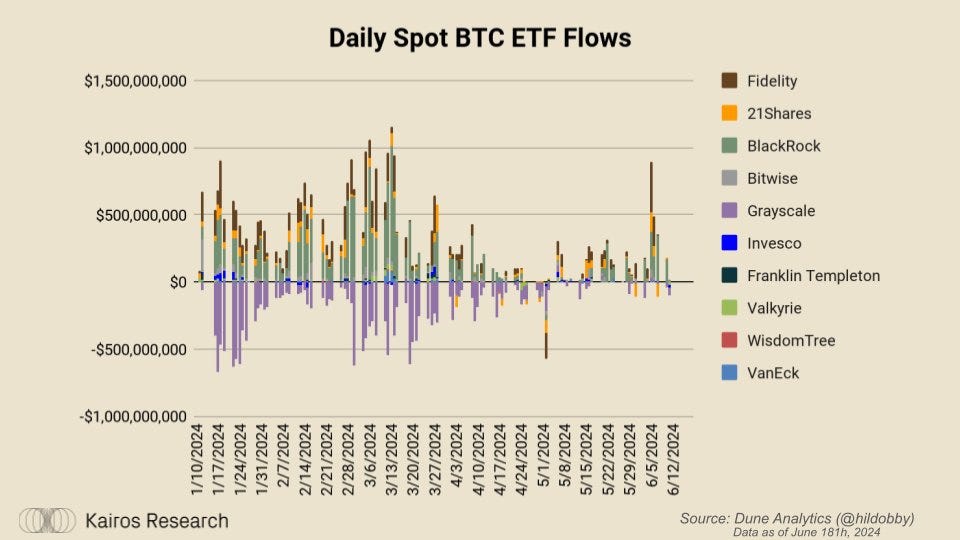

By most measurable data points, the BTC ETFs have been a massive success. To date, we’ve seen net-inflows of around $15bn, with around ~260k BTC. The volume on these ETFs has been astronomical as well, with about $300bn in cumulative volume across the 11 ETF products which began trading early this January. Now, the second largest crypto asset gets its time to shine. We won't be projecting flows, but here's how we think this will impact the entire ecosystem more broadly.

In this article we'll cover:

- Grayscale Overhang Worries

- Launch Conditions Differences to BTC

- Demand Proxies

- The Impact on DeFi

Grayscale Overhang Worries

This is a point that has been mentioned by others, and for good reason. We think there are several reasons to be a seller of ETHE at launch. When looking at the discount rate of ETHE to NAV leading up to its eventual approval and conversion, ETHE was trading as low as -56% to NAV. Additionally, if a similar pattern follows for ETHE to GBTC, we will likely see the management fee translate into an expense ratio that is still several multiples higher than the nearest competitors. Right now ETHE has a 2.5% management fee, meanwhile Van Eck & Franklin Tempelton have their fees set around 20 basis points. We expect other issuers to be around these levels. If the seller is motivated purely by achieving a lower management fee, then it would likely just net out with inflows to a different product. In summary, these are the two primary seller profiles we anticipate.

Selling due to high fees relative to other issuers

Selling to realize profits from buying the product at discount

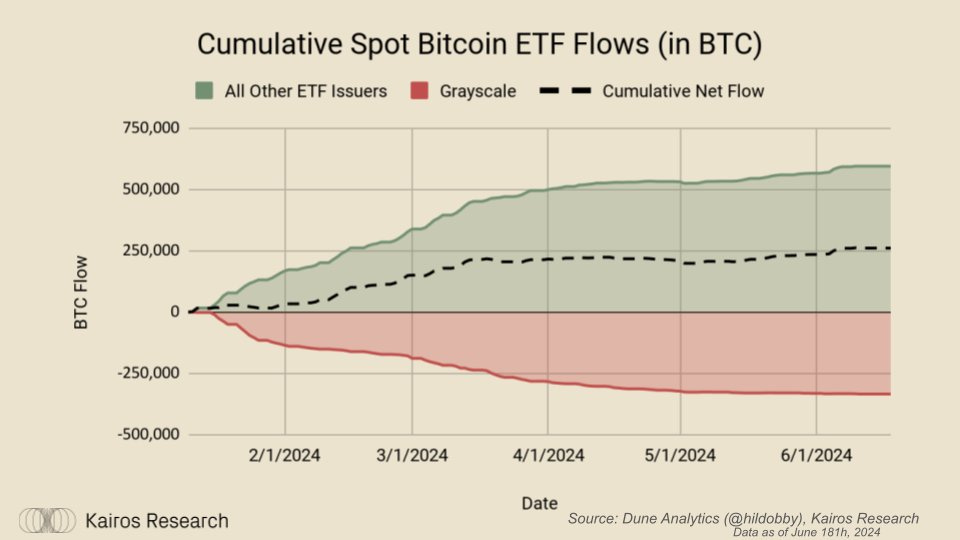

Despite all the Grayscale selling, we have still seen net inflow in both USD & BTC to the ETFs overall.

Launch Condition Differences to BTC

The Bitcoin ETF was probably the most anticipated launch of any ETF, perhaps ever. But despite all the loose messaging and chatter from the Bloomberg analysts, it really came down to Grayscale's key victory against the SEC which was announced on Aug 29th, following the announcement GBTC rose 30% and began its slow grind back towards its true NAV. Despite the Cointelegraph intern, the SEC twitter account being compromised, etc, the ETFs were eventually officially approved for trading on January 10th. All this to say: all potential stakeholders had ample time to prepare for this event. However, when we look at the setup for the Ethereum ETF, it's almost the complete opposite. There was essentially no chatter until March 20th when the Bloomberg analysts upped their odds from 25%-75%. The same day it was confirmed that the SEC asked exchanges to prepare themselves for an spot Ether etfs. Following this news ETHE surged, and then three days later the listings were officially approved. Since then ETHE has been back around NAV.

So what's important here? Well, clearly a lot of people were caught off guard here. From the ETF issuer side, that's not nearly the same amount of time that they had to educate their clients on Bitcoin. However, this likely varies on a case by case basis, but its clear that the Bitcoin ETF got an entire news cycle. Lastly, launching into a highly anticipated product at the begining of the year for a clear momentum trade was a no-brainer for some capital allocators as their YTD performance began. This could potentially mean inflows take place at a slower rate than Bitcoin as more time for education is needed, or perhaps the opposite; people just fomo in given the huge success of the Bitcoin ETF. Regardless of which one it may be, I think it is certain that investors will find Ethereum to be a more captivating digital asset.

Demand Proxies

There have been several people who claim that there is little to no interest for an ETH ETF. While there is little data to back up that claim, there is plenty of data that suggests, the West, and specifically Americans, have shown ample demand for ETH thus far.

For example, despite Binance being the largest CEX both by user base and volume, Coinbase has 1.4m more ETH ($4.75bn+). To further the point, Kraken, Robinhood, and Gemini (all American exchanges) have more ETH than OKX, UpBit, Bybit, BitThumb, and Crypto.com all combined - with 1.2m ETH to spare. To further the point, 34% of all Ethereum nodes are run in the United States, according to ethernodes.org. What we are really getting at here is that Americans like ETH, they have liked ETH for a while, and we expect the trend to continue, and intensify through the introduction of the spot ETH etfs.

The Impact on DeFi

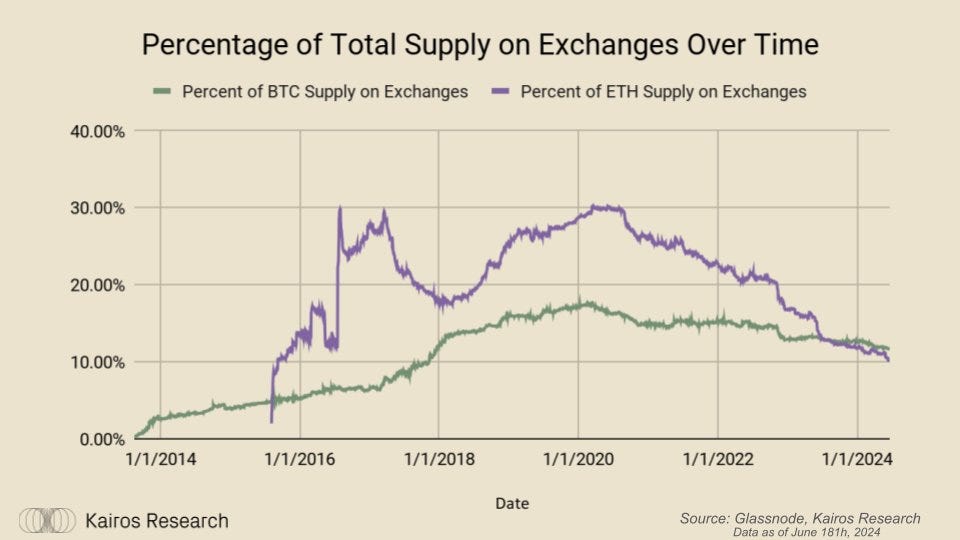

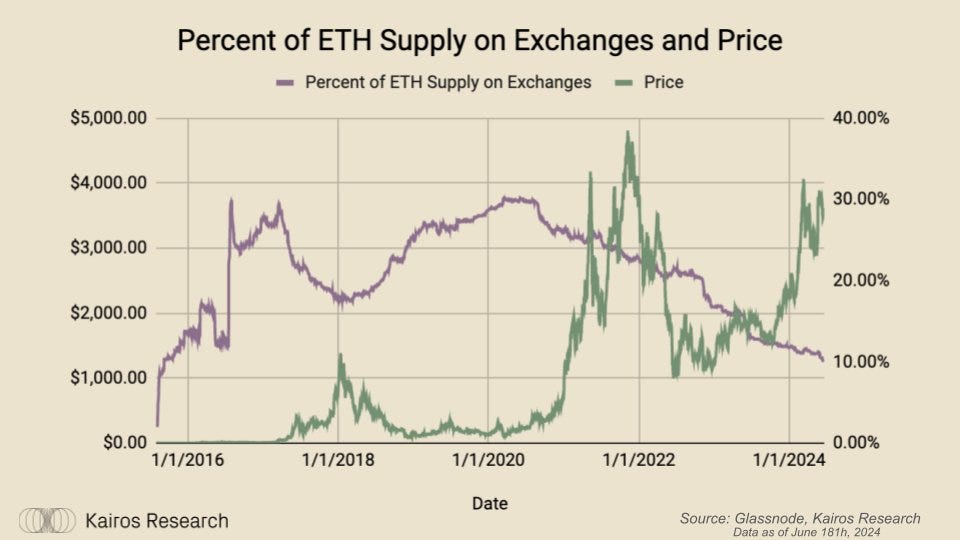

You can have your opinion on what you think flows will look like in the short term, but over the medium-long term we think flows will have a substantial impact on the overall Ethereum supply. In @rewkang's well reasoned piece, he made the point that Ethereum does not have "structural buyers" the way Bitcoin does (Saylor, Tether, Whales), however, Ethereum does have important structural supply differences. For example, when looking at the supply of ETH, it's showing a continuous decline for percentage of the total supply held on exchanges, even lower than Bitcoin. Even more interesting, the supply on exchanges decline trend lines up almost perfectly with the launch of Uniswap v2 in May 2020.

This trend seems to remain constant is in spite of Ethereum's price volatility

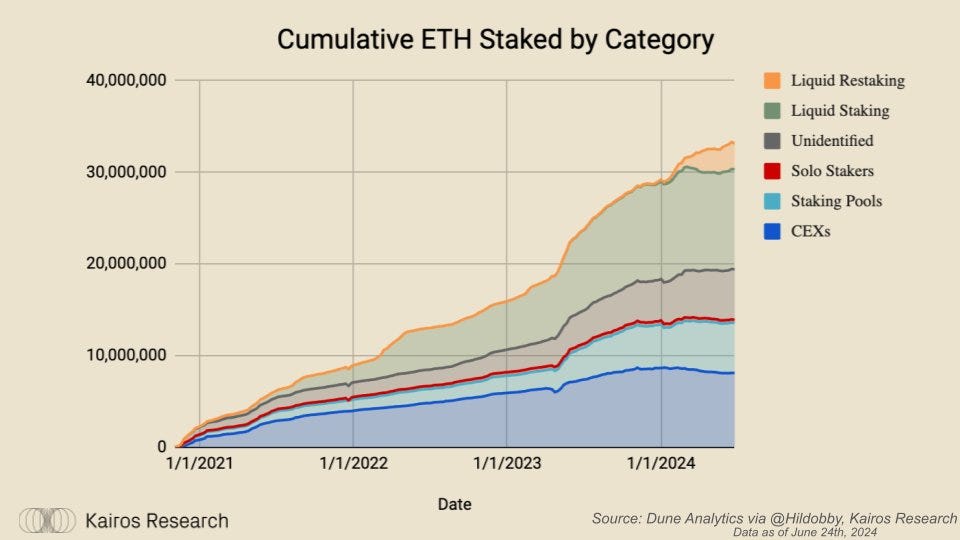

Additionally, staking alone constitutes 27.57% of the entire ETH supply, which as a percentage trumps any one single entity with regards to BTC. Add in all the ETH locked in canonical L2 bridges, the ETH in the wrapped ETH contract, and you’ve got more than 32.33% of the entire supply of ETH. This is all part of a larger trend. DeFi has only been around for 5 years, with a growing trend of liquid staking tokens, and liquid restaking tokens becoming choice tokens for DeFi users, that brings more ETH off of exchanges and locks more away in staking contracts, further fragmenting spot liquidity in ETH terms. Play this out over another decade or two, and ask yourself what ends up happening. Additionally, the more ETH that is liquid staked or liquid restaked, the more reflexive the onchain economy becomes.

Overall, we don't think we have an edge with regards to predicting $ amount of flows, but we think the reasons listed above we can get a general sense of the impact that the ETH spot ETF with regards to serving as a general supply sink for ETH the asset, but also for getting more investors interested in tokens, and the onchain economy in general. Lastly, let's be reminded that price drives usage, usage drives narrative, and then narrative steers price. We look forward to closely monitoring how these structured products impact ETH more broadly.