Particle Network: Redefining Crypto's User Experience

Maintaining decentralization while abstracting away the complexities of crypto has proven challenging. Particle Network is looking to revamp the abstraction stack to onboard the next cohort of users.

Introduction

As an industry, it is important to occasionally remind ourselves what crypto and decentralization ultimately unlocks and why we are here in the first place:

The option to self custody your assets

Access to cheap, fast, and final cross border payments

A way to hedge against / opt out of one’s respective monetary / fiat regime

A tool for speculation with low correlation to existing equity indexes, currencies & commodities

In 2018, Nic Carter explored the question of, might it be good that no single view dominates exactly what crypto should become?, in an important piece on the ever changing visions for Bitcoin. We, at Kairos Research, are strongly of the belief that through education and innovation, crypto will naturally become a tool for a multitude of different needs and that is undeniably a good thing. So, what are the key issues holding the industry back?

We are now approaching the back half of 2024, and we can confidently claim that the on-chain user experience (UX) has left much to be desired. Yes, users can self custody their assets, but now they must learn what a self custodial wallet is, and how they are at risk of losing their assets forever if they forget their seed phrase or interact with a malicious website. Yes, there are dozens of chains with different trust assumptions, capabilities & costs, but now users must learn how to bridge their assets to use a new application. Bad on-chain UX has pushed users to hold their crypto within brokerage accounts (ETFs) or centralized exchanges (CEXs), negating many of the benefits of the industry. Even crypto native users are drawn to centralization, as they naturally rely on CEXs for deeper liquidity & to bridge their assets from one network to another, not only costing them time and money, but also making the decentralized technology heavily dependent on off-chain entities.

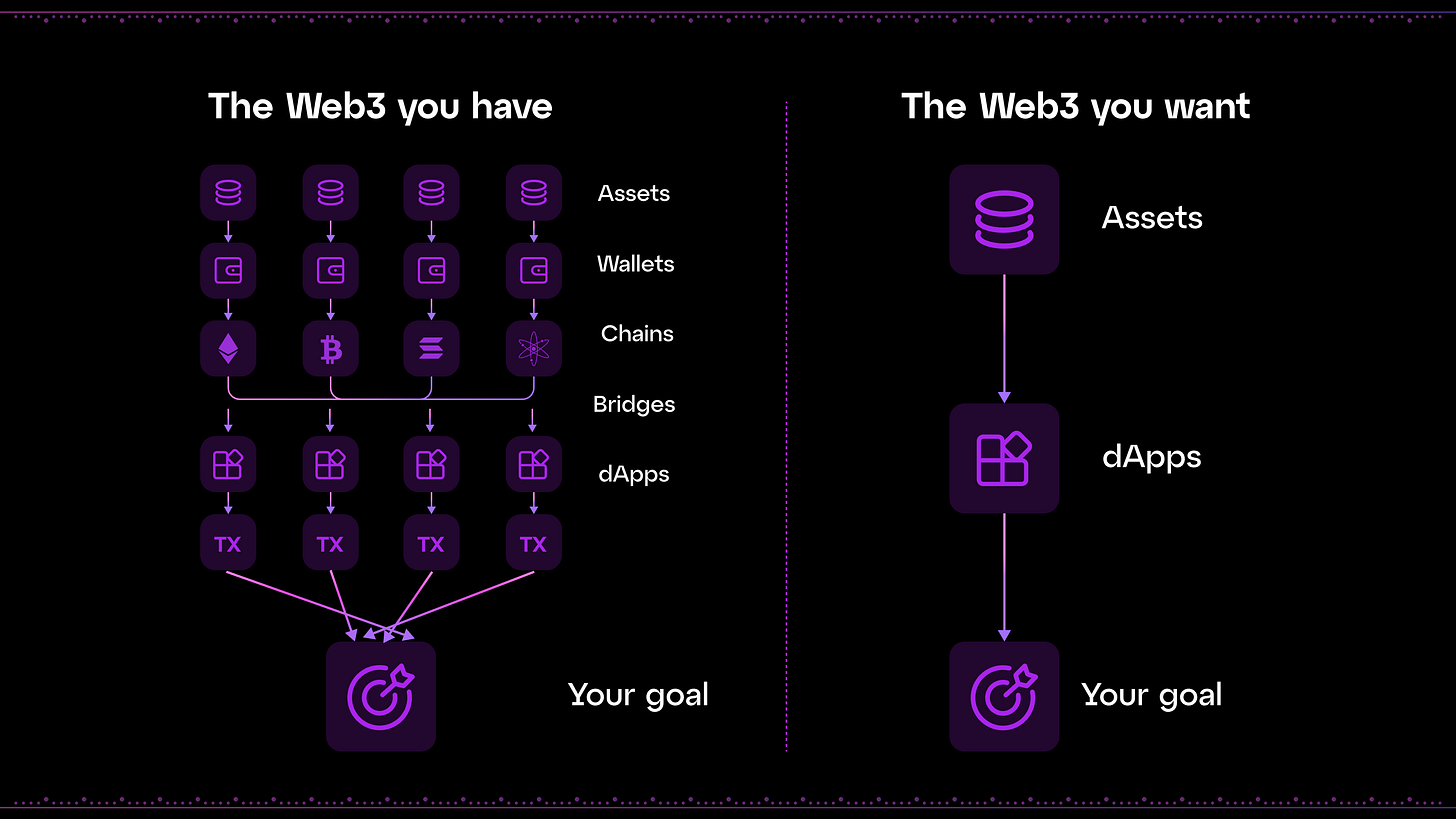

Particle Network is clearly aligned on many of the above issues and is at the forefront of building both chain and wallet abstraction tools that improve the world’s journey into crypto. The end goal of these two concepts are defined and visualized below:

Chain Abstraction: Coined by the Everclear team, this involves removing the need for end users to understand on which chain their desired applications & tokens live. Chain abstraction allows you to effortlessly make transactions on another chain, without having to bridge and acquire gas on the destination network. All of the necessary interoperability work will happen under the hood & users will not have to become technology experts to take advantage of decentralized blockchains.

Wallet / Account Abstraction: There are many strong resources that breakdown the true definition of Account Abstraction, which they define simply as the technology that enables developers to redefine the conditions needed to sign off on a valid transaction. Particle’s approach to leveraging account abstraction is multifaceted, consisting of:

Traditional wallet abstraction goals like embedding wallets directly into protocols, so that using crypto applications feels just like using the internet

Social log-ins for wallet creation & security such that users can create and recover their seed phrases through phone, email & social media password methods

Protocol Mechanics: Particle Chain & Modularity

Designed as a modular layer 1, Particle is built on top of the Cosmos SDK and acts as the backend technology enabling users to tap into multi-chain, smart contract wallets all from a single EOA - which the team dubbed, “Universal Accounts.” In contrast to other existing smart contract L1 networks, the Particle chain is not the user-facing product. Instead, the chain is simply the invisible infrastructure that enables Particle’s product suite. The user facing portion of the network can be broken down into three main features:

Universal Accounts: The core product of Particle Network, which can be thought of almost like a master account for users of Particle Network. Utilizing ERC-4337, Particle is able to have a single Externally Owned Address to deploy “smart accounts” across all of their integrated chains, such that their users can access all of their assets across the Ethereum ecosystem & its L2s, Solana & Bitcoin. These users now have one single address & seed phrase for all of their assets which controls the underlying accounts on each chain. Here is a video showcasing how an user would interact with a Dapp that leverages Universal Accounts.

Universal Liquidity: Building on top of the basics of smart accounts, Particle aims to unify an user's liquidity across each chain on which they hold assets. This is enabled through the user interface that shows combined network balances & an underlying ability to bridge these assets between chains seamlessly. Universal Liquidity is made possible through the Particle Chain’s intent based execution layer, explained further in the below sections.

Universal Gas: Particle Network removes the need to own gas tokens on each integrated chain, instead fronting the gas payment for their users and allowing them to repay in USDC, USDT or a number of other assets. Universal Gas is also made possible through the Particle Chain’s intent based execution layer.

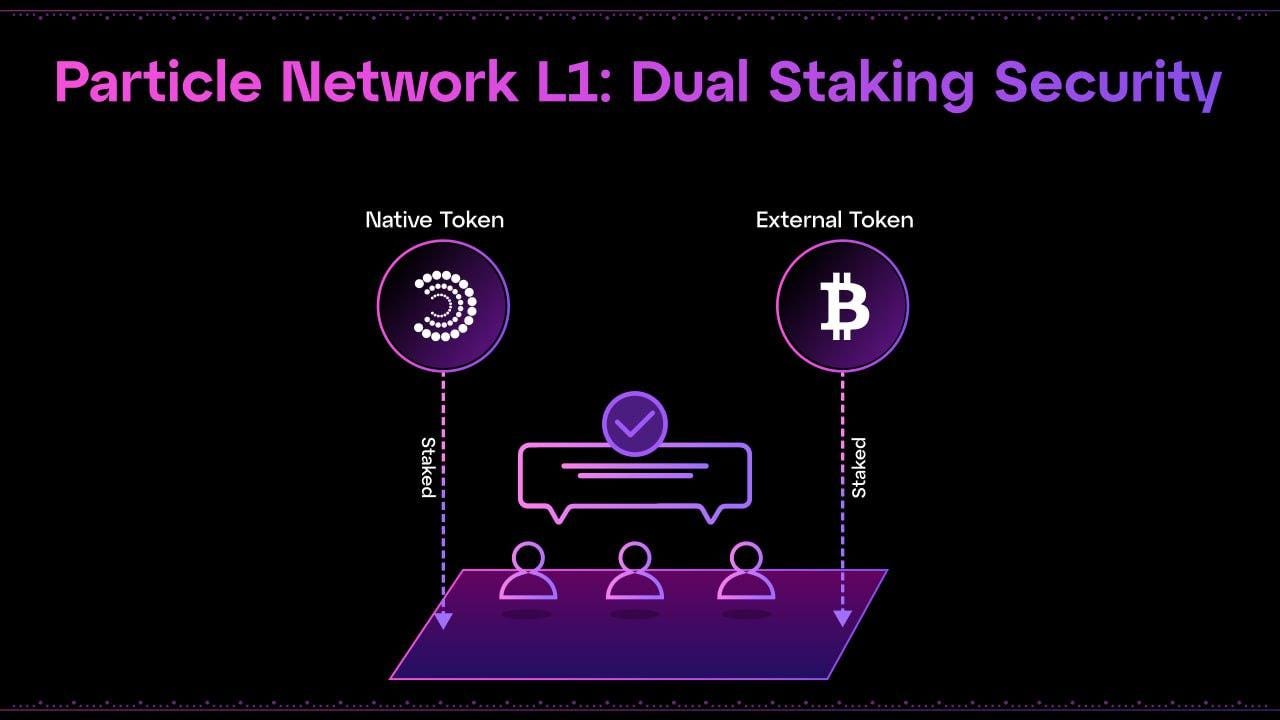

According to the development team, “relying on the Cosmos SDK to build this chain means the Particle Network L1 retains its sovereignty while being able to outsource key functions like validation and data availability.” Specifically, Particle Network leverages Babylon to bootstrap its Proof of Stake (PoS) validator set, allowing the network’s validators to use native BTC as collateral. Restaking is highly strategic for nascent chains, as they are able to remain sovereign, without recklessly diluting their token supply to incentivize validators to join the network.

Using Babylon over Eigenlayer, Symbiotic or Karak was allegedly a bet on both the Babylon R&D team as well as BTC, which has proven to be the least volatile, decentralized store of value within the crypto landscape. Kairos believes that there are additional benefits from being in an early cohort of Babylon based applications, including cheaper access to security due to supply and demand dynamics, given Babylon’s pre-airdrop status & the limited options for BTC holders to generate yield.

Particle Network will leverage Babylon in a unique manner, having a dual staking model in which users are able to delegate either BTC or Particle’s native asset, PARTI, to the network’s multiple validators sets. Kairos believes that dual staking modesl are practical, as this structure provides PARTI with important utility & gives token holders a say in the future of the protocol. Further, Particle Network receives additional flexibility on the weighting of which token they use for security, as they can adjust the stake weighting towards PARTI once the network matures, given that network fees could be substantial & the PARTI token will become less volatile, lowering the need for inflationary rewards to validators.

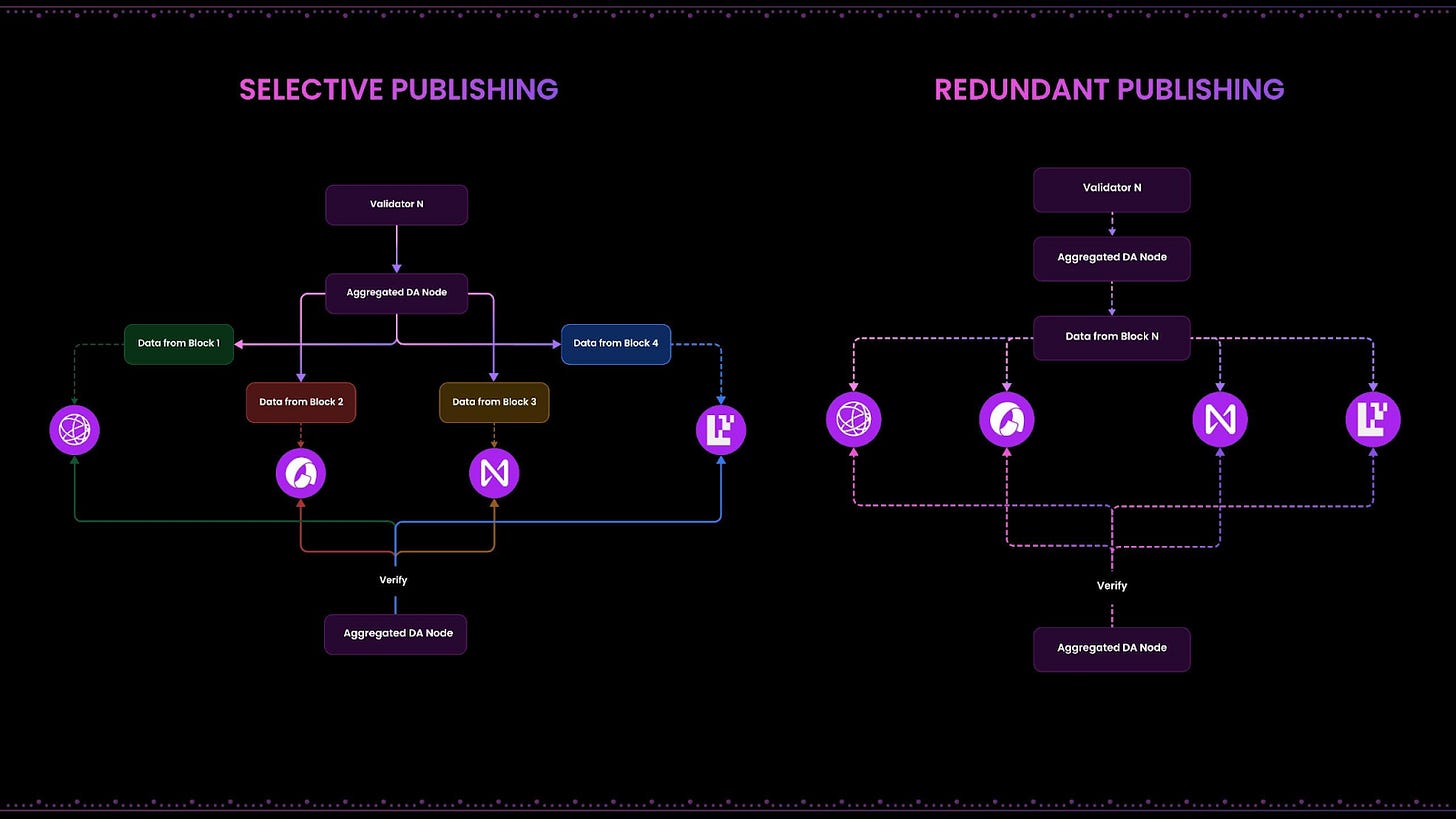

Particle Network also takes a modular approach to Data Availability (DA), likely integrating with Celestia, Avail, EigenDA & Near DA. While most modular chains outsource data availability, having several unique DA solutions allows Particle Network to avoid any single points of downtime or failure. Data availability is particularly important to Particle, as they are tasked with maintaining the state of all of their users' universal accounts. Below is a visualization of how the multi-DA solution actually works in practice, rotating between Selective Publishing & Random Deterministic Redundancy in order to “enhance availability, stability, redundancy, efficiency, and decentralization.”

Particle’s development team is still building out their data availability solution, which they dubbed AggDA. We will continue to follow their design choices as the network approaches mainnet launch, but until then it is worthwhile learning from similar solutions like the Crosschain Alliance’s panDA. panDA attempts to provide modular chains and L2 networks the ability to customize their approach to DA, giving them the flexibility to easily rotate into new DA solutions as they spawn or use multiple DA solutions for either the sake of added assurances or efficiency during times of network congestion.

All of the above explains the design mechanisms of the Particle Chain, but how does the network actually facilitate cross-chain transactions? Like Everclear, Across & other interoperability / bridging protocols, Particle Network will have an intents-based bridging architecture. We have previously defined blockchain intents as “a more flexible variation of the standard blockchain signature, capable of taking many different computational routes to fulfill a user's expressed end goals.” They have been popularized within the bridging landscape given their ability for fillers to use many different routes to achieve the same goal - instantly sending a bridger their desired token on their desired chain.

Liquidity providers, also known as fillers, are responsible for understanding a bridger's goal & fronting this capital on the destination chain. The liquidity providers are then repaid in the bridger’s assets (plus a spread) on the source chain. With respect to Particle Network, these liquidity providers combined with an abstracted UX, are the magic behind the interchain accounts where users can be selective about which asset they use to confirm a trade, purchase or payment on another chain - without even knowing that they needed to bridge.

The PARTI Token & Value Accrual

As noted, the PARTI token is deeply integrated into the network, playing an integral role within Particle’s chain abstraction ecosystem, as both a:

Native Proof of Stake Asset: The Babylon dual staking structure will allow PARTI holders to delegate their tokens to the network’s validator set, from which they would receive a portion of the network’s transaction fees and inflationary token emissions.

Gas Payment Token: Ideally, most users will not know that they are directly interacting with Particle Network, but their transactions will still be submitted to the chain. These transactions will take a portion of the user’s assets on the source chain and convert them to PARTI to pay gas fees on the network.

We believe that there is potential for a strong positive feedback loop with PARTI. As users and Dapps become increasingly interested in the Particle’s Universal Accounts and the network’s transaction count continues to increase, transaction fees (gas & bridging) should become a meaningful source of revenue for stakers. Increasing real revenue lowers the need for inflationary token rewards and makes PARTI a more attractive economic security asset, such that the chain will not need to rent as much BTC from Babylon. By looking into how we view Particle monetizing their product suite & how value could accrue to the PARTI token, there are a few large opportunities, listed by order of importance:

Gas Fees: A high demand for Universal Accounts combined with a lower need for token issuance can create a favorable supply and demand dynamic that makes the Particle economy sustainable.

Bridging Fees: Cross chain transactions will always require a fee paid to the bridge’s fillers, but there should be room for Particle to charge an additional flat fee back to the network.

In-Wallet Swap Fees: This is the main strategy for monetization for wallets like Metamask, they charge a large spread on swaps that take place through their interface and it is highly lucrative. However, users will be able to access Universal Accounts through their existing wallets and not necessarily need to use the Particle wallet interface.

Particle’s positioning within the competitive landscape is extremely compelling, given that it is not competing with other layer 1 networks, instead it is complimenting them. If Particle is able to make a 10x improvement to existing crypto UX, some of the largest winners are DeFi protocols and general purpose smart contract networks - who are in desperate need of a new cohort of users. We strongly believe that a zero to one improvement in UX could bring about a crypto renaissance through payments, tokenization (funds, loyalty points, commodities, etc) and prediction markets. On-chain payments become much more enticing once:

Wallets have two factor authentication, social log-ins & password recovery

Wallets have a “master address” that holds the keys to all of the integrated networks

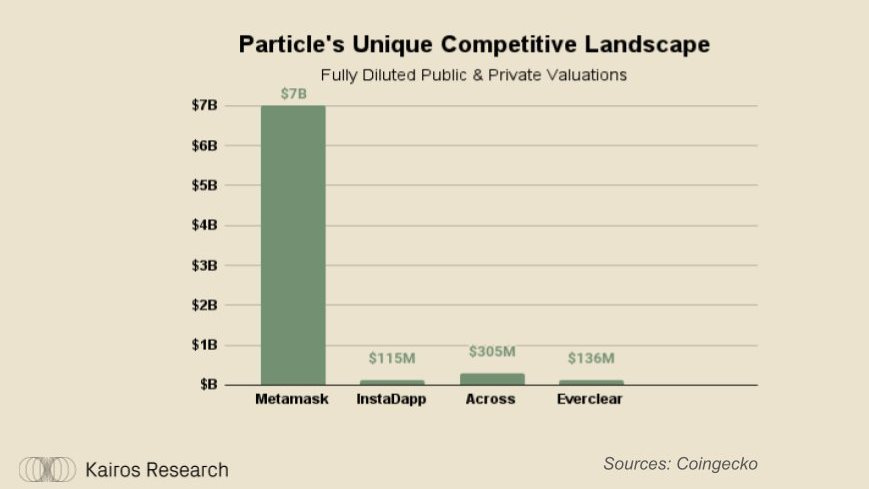

It is unclear if Particle has many clear cut competitors, but we can evaluate some of the closest sectors to see where Particle’s native token might fall:

Wallet / Payments: Metamask (~$7B private valuation)

Portfolio Tracker / Chain Abstraction: Instadapp ($200M private valuation)

Intent Bridges: Across ($354M fully diluted token valuation), Everclear ($151M FDV)

Particle Network has raised $25M + an additional follow on round from Binance Labs all at undisclosed valuations. Total capital raised & private valuations can give us estimates of where the PARTI token will likely fall in the short term. However, the long-term valuation of its token will be highly dependent on Particle’s ability to create a smooth product, onboard users and monetize its product suite. At Kairos Research, we believe that the network should be valued closest to a comparable bridging protocol (# of users) that is able to integrate itself directly into the Dapp landscape. Rather than competing for users to come directly to their bridging interface, users could be directed there as they sign in to the applications that people actually are looking to utilize.

Conclusion

Two easy criticisms of Particle’s approach to user abstraction could be that they may be trying to do TOO much and that the sector will be highly competitive. Why expand into chain abstraction, instead of focusing strictly on smart accounts and outsourcing bridging to a third party protocol? Certainly wallets like Metamask will try and continue pushing for a smoother multi-chain user experience by building bridging directly into their interface?

Particle’s answer to these questions is that by owning the full abstraction stack, they can ensure that they will never be beholden to another development team’s deployment timelines and priorities, especially on important features like chain, Dapp and asset integrations that will decide if the product is successful. Further, they are not directly competing with the Metamask’s of the world, instead they are offering them a potential integration that will hopefully revolutionize their user experience. Given that chain abstraction has heavy infrastructure requirements, there is a world in which integrating Universal Accounts is far more practical for wallet providers than building their own solutions.

Focusing on simply being integrated into the most popular Dapps and wallets is a materially different and more promising approach than the first wave of smart contract wallets took in attempting to get users to actually leave their existing wallets. If the Particle team releases an impressive product they will have the wind at their back and wallets and Dapps will be quick to integrate Universal Accounts. Fixing crypto UX should not be a zero sum game and we think there is a unique opportunity to truly grow the pie.

Taking the existing wallet & cross chain experience and flipping it on its head may be more effective than incrementally improving something that is broken. By owning both the wallet & bridging stack, there is a massive opportunity to change how users interact with crypto from start to finish. From creating & storing private keys, detecting malicious contracts and storing all assets under a master address all the way to changing the nature of how we sign transactions, where we embed smart contracts and more. If you are building applications within the space, you have to believe that on-chain activity will continue to trend upwards & that we are one step away from unlocking a larger cohort of crypto users. Between Paypal’s pyUSD, the largest asset managers wading into tokenization & Polymarket’s promising adoption, there are certainly a number of signs that ~ we are early ~ and the next wave of users are going to demand a much smoother onboarding experience.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.