Plasma: The Stablecoin Singularity

How a stablecoin-focused blockchain is redefining payment rails with zero fees, Bitcoin-grade security, and a vision for mainstream finance

Be sure to read til the end for additional analysis on Plasma’s recent deposit campaigns!

The Rise of Stablecoins and the Need for Specialized Infrastructure

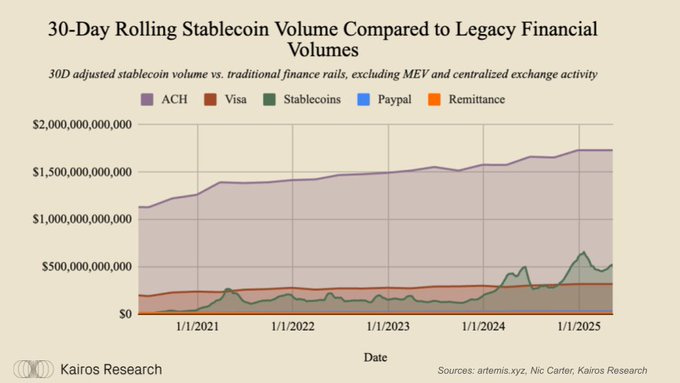

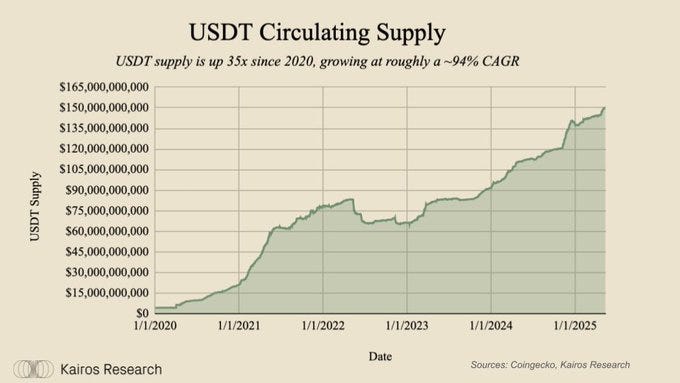

Stablecoins have exploded from a niche use cases into the most notable innovation within crypto markets, and a promising new medium for global payments. In 2024, dollar-pegged tokens like Tether’s USD₮ facilitated $15.6 trillion in transactions, 119% of Visa’s payment volume within the same period. Additionally, based on recent data, USD₮ has roughly 400 million users in emerging markets. This surge signals a “stablecoin singularity,” a reality where digital dollars circulate as freely as information, transforming how money moves.

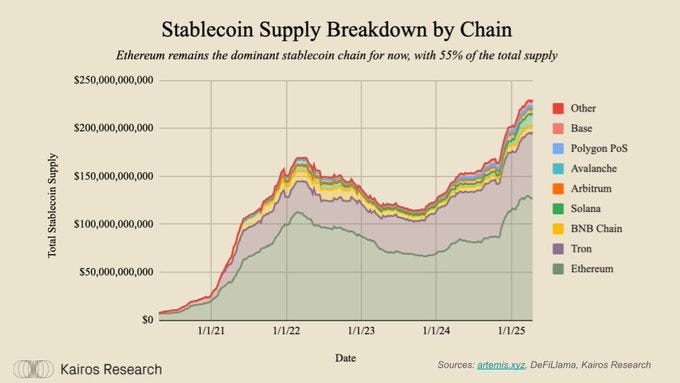

We believe that the integration of stablecoins throughout all facets of the global payment system (P2P, B2B and P2B) has the potential to significantly improve our daily lives. At their best, blockchains are able to reduce the time required for payments to settle and sidestep the need for highly extractive middlemen that take several percentage points of money transfers, while having the ability to take control of your money at any given time. However, today’s dominant blockchains are not built with stablecoins in mind, leading to high fees on networks like Ethereum and prompting users to flock to more centralized alternatives like Tron for minimally cheaper transfers.

Enter Plasma, a blockchain purpose-built for stablecoins. Plasma is designed to do one thing extremely well: moving stablecoins like USD₮ quickly and freely. Unlike general purpose L1 chains juggling a variety of applications and use cases, Plasma is laser-focused on stablecoin payments. This emphasis unlocks technical and economic advantages which could make Plasma the canonical payment layer for digital dollars worldwide. By limiting its scope to stablecoins, Plasma can maximize throughput, and minimize latency, while eliminating transaction fees for USD₮ users. The end goal is to achieve a seamless experience where transferring money, to peers or for purchases, is as effortless as sending a text, but we also believe there could be substantial second and third order effects.

Zero-Fee USD₮ Transfers as a Liquidity Magnet

Despite being the largest platform by stablecoin issuance, Ethereum’s architecture has made stablecoin transactions relatively expensive, often costing several dollars in fees per transfer, driving many users to Tron’s lower-cost network. Tron successfully pushed its once low-cost transactions across emerging markets, which has seen continued staying power, as it processed an estimated $5.46 trillion in USD₮ volume across 750 million transfers in 2024 using data from Artemis. If low fees fueled Tron’s rise, Plasma’s no-fee model takes it a step further, allowing applications to forgo the concern of paying gas fees and potentially catalyzing an even larger wave of adoption.

For users, zero fees are not just about savings, they unlock new use cases. Microtransactions become viable when sending $5 doesn’t require a $1 fee. Remittances can reach families abroad in full, instead of losing a hefty cut to intermediaries. Merchants could accept stablecoin payments without surrendering 2-3% to invoicing & bill pay software + credit card networks. In short, Plasma’s free transfers remove the frictions that have kept stablecoins largely in the trading realm, and paves the way for everyday commerce. As Plasma is backed by Tether’s ecosystem, the incentives align to help continually spread USD₮ far and wide. Liquidity begets liquidity, and once users know they can move value freely on Plasma, it could attract a critical mass of stablecoin flow from across the crypto universe, reinforcing its utility as the primary rail for dollar value. Additionally, the onslaught of USD₮ deposits and native minting make Plasma a prime ecosystem and expansion target for existing DeFi protocols. We are already seeing some traction here with leading stablecoin focused protocols like Curve and Ethena announcing plans to deploy on Plasma’s EVM compatible environment. Aave, the largest lending protocol in all of crypto, also announced it will be expanding to Plasma. It’s also important to note that one of USD₮’s core network effects as the leading stablecoin has driven its adoption as the primary denominator for spot BTC pairs across leading exchanges. For example, the BTCUSD₮ pair on Binance alone has done $4.9 trillion dollars in volume since August 2017. As Bitcoin bridges improve as trust assumptions are minimized, we believe there is also a good chance that more nimble BTC finds its way on to the network, complimented well by its already familiar USD₮ pairing, which could be a catalyst for trading activity as more sophisticated users look to arbitrage away any price difference between BTC spot price on CEXs and BTC’s onchain price in any liquidity pools that may arise.

Outpacing Ethereum, Tron, and Traditional Payment Rails

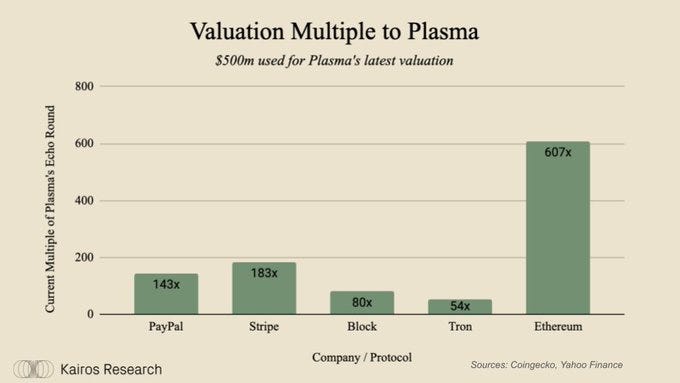

How does Plasma stack up against existing networks and Fintech incumbents? In many ways, it is designed to outperform both current crypto and traditional payment rails.

Ethereum: Ethereum hosts a diverse DeFi ecosystem, but that unfortunately comes at the cost of congested blockspace and high gas fees for simple USD₮/USDC transfers. Stablecoins thrived on Ethereum early on and today they account for a huge portion of Ethereum’s activity, with approximately 35-50% of all on-chain usage, but this is typically large trading related transactions that often price out smaller transactions. Layer-2 rollup solutions help with costs, but Plasma’s approach is more radical, a separate chain just for stablecoins, optimized from the ground up for cost-efficiency and speed. By not trying to “fit every use case under the sun,” Plasma can dedicate its full capacity to stablecoin transactions, sidestepping the congestion seen on general-purpose chains.

Tron: Tron has become a stablecoin heavyweight, carrying a large portion of Tether’s daily volume thanks to low fees and faster confirmation times. Tron’s TRC-20 USD₮ transactions reached 22 billion since launch, dwarfing Ethereum’s ERC-20 USD₮ count of 2.6 billion. This highlights how a better user experience, most notably driven by low-costs and quick transfers, helped win stablecoin market share. Plasma’s edge is to push the UX envelope further. Where Tron still charges fees upwards of $2-3 or requires staking TRX for free, or discounted transactions, Plasma charges nothing at all for USD₮ transfers. Additionally, Tron’s DPoS architecture has been critiqued for centralization, as they have 27 pseudo-permissioned validators, and the network relies on its own native token for fees and “governance”. Plasma, by contrast, is anchored to Bitcoin for security and even allows fees, when needed, to be paid in the stablecoin itself, an arguably more user-friendly model. If Tron is currently the de facto “stablecoin chain,” Plasma is positioning to leapfrog it with both superior UX and economics.

PayPal and TradFi Rails: Traditional payment processors and fintech platforms are also eyeing stablecoins. PayPal launched PYUSD, its own USD-backed stablecoin, in 2024 and plans to integrate it across 20+ million merchants by 2025, showing the demand for better digital dollar rails. However, PayPal’s network, and similar systems like Visa or ACH, still charge fees, enforce transfer limits, experience delays, and have geographic restrictions. On PayPal, merchants can pay up to 5.4% + $0.30 per transaction in the current system, and cross-border payments incur FX spreads and waiting times. While PayPal’s stablecoin will reduce currency conversion friction, it remains to be seen if PayPal will significantly cut fees for merchants. Plasma approaches the problem from a crypto-native angle: open infrastructure, no middlemen, and no tolls for moving money. Anyone with a crypto wallet could access stablecoin payments on Plasma as easily as using email, without needing a bank or payment app in the middle. This openness and neutrality could attract fintech platforms and even traditional institutions to build on Plasma for settlement, much like how internet TCP/IP rails became the standard for data transmission.

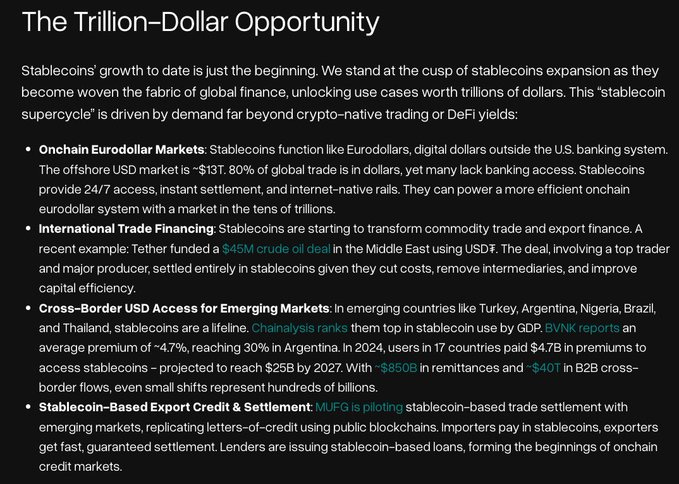

Massive Market Opportunity for Stablecoin Payments

The timing for Plasma’s launch looks ideal, as the total addressable market for stablecoin-based payments is not only immense, but rapidly expanding. Today, stablecoins have a combined supply of over $230 billion, making up approximately 1.27% of the U.S. M1, and 1.08% of U.S. M2. That may seem small, but stablecoins grew by 14% in a single month in January of this year, and have seen sustained a 38% annual growth rate since 2018, meaning they could rival the money supply of some G20 countries within a few years if trends hold. More tellingly, in 2024 stablecoin transfer volumes eclipsed those of major card networks, falling short only of the Fed ACH transfer system, pointing to a reality where a significant share of global value transfer, albeit highly speculative, happens on crypto infrastructure rather than traditional payment rails.

While the current dominant use case for stablecoins is trading and DeFi, the next frontier is traditional commerce and general payments. This spans everything from remittances (a ~$700B per year market) to e-commerce payments (several trillions per year globally) to B2B cross-border trade ($30+ trillion). We can already see signs of stablecoins moving into retail and business payments. For example, PayPal spent time highlighting stablecoin utility at their 2025 Investor Day. The company is aiming to enable businesses to pay overseas suppliers via PYUSD to eliminate the need for actual money transfers, instead relying on ledger-to-ledger updates. While saving merchants processing time and fees, PayPal is able to keep them in their own network. This is very important considering 80% of merchant payments leave the PayPal ecosystem into their own bank account as soon as they are received.

Consider merchant payments. As mentioned, businesses often lose 2-3% per sale to fees. Stablecoins on a feeless network can virtually eliminate that hindrance on commerce. Assuming that a merchant is willing to accept US Dollars or could convert to their native currency via a crypto exchange, a business in Nigeria selling to a customer in Germany could settle in a USD stablecoin instantly on Plasma, rather than dealing with card fees or waiting for an international bank wire. In fact, Tether recently facilitated a $45M crude oil deal in the middle east, showcasing to the counterparties the effectiveness of stablecoin settlement.

Global trade is a $30T+ market and the dollar is fully integrated, being involved in 80-90% of all transactions. The pie is enormous, and if Plasma even captures a small slice, it could host value transfer on the order of billions of dollars per day, accruing network effects that make it increasingly indispensable.

Value Accrual Without Fees: Rethinking Crypto Economics

Given Plasma’s core offering of zero fee USD₮ transfers, one obvious question arises: how does value accrue to the network? This speaks to a novel economic model that prioritizes growth and utility first, and defers monetization to indirect channels, much like how Robinhood was able to attract an abundance of users and trading activity through their zero-commission trade offering.

On incumbent smart contract chains, value accrues via usage through gas fees (e.g. Ethereum’s billions in annual fees which drive ETH value via burn and staking rewards, or Tron’s $1.36 billion in fees over 6 months). Plasma flips this model by forgoing fees on USD₮ transfers to bootstrap adoption. In doing so, it banks on the idea that a network powering massive volumes of dollar denominated economic activity will find secondary and tertiary ways to capture value that won’t burden users per transaction. This is also analogous to Web2 platforms that scaled to billions of users with free services, then monetized via ancillary means. For example, Venmo charges no transfer fees, but makes money on credit transactions, instant withdrawals and now crypto purchases. And as a friendly reminder for crypto users too deep in the rabbit-hole, the marginal cost of using Web2’s most popular tools is often zero.

In Plasma’s case, multiple value accrual mechanisms are possible, but these are the two primary ones we foresee:

Issuance and Issuer Support: Stablecoin issuers will be incentivized to mint and redeem on the blockchain with the most activity, which could be an advantage for Plasma. The further stablecoins are integrated into trade and commerce, the more minting and redemption we may see. Millions of these transactions a day, even at just a penny in transaction fees will quickly add up and make the network sustainable. Additionally, with the recent advent of USD₮0, an omnichain solution that unifies USD₮ liquidity across chains via LayerZero, we may see Plasma become the canonical issuance layer for USD₮.

DeFi + MEV: If DeFi apps are attracted to the large inflow of BTC and stablecoins, the broader ecosystem could flourish on Plasma. Standard DEXs, lending platforms & futures trading all require high demand assets and quality collateral. As seen over the last several months with Solana’s REV (real economic value) data, token minting, trading, arbitrage and liquidations could produce enough activity to sustain the network’s free USD₮ transfers. The target network participants would also likely bring more validity to the crypto ecosystem and would likely be interested in a variety of other currency denominated stablecoins. We believe that the industry may be a year or so away from seeing an inflow of tokenized assets like commodities and securities (public and private) which makes Plasma an interesting network simply because of its institutional interest. Additionally, many investors believe MEV will be a primary value driver to networks over the long run, as it is a core piece of permissionless finance. In short, MEV can be thought of as the price people are willing to pay for priority access to state changes. With the top 5 largest non-stablecoin crypto assets (BTC, ETH, SOL, XRP, BNB) all having their largest volume pairs be denominated in USD₮, there is reason to believe that the chain which aggregates the majority of the primary denomination (USD₮), will attract non-native assets to its own chain. This is far from a reality today, but given the network effects surrounding money like USD₮, we don’t believe it’s too far-fetched, especially for BTC, as mentioned earlier in the report. Continuing on the BTC example, this could lead to more sustained network usage, driving more fees to stakers and validators on the network, in a manner that is far less cyclical than memecoin trading. For example, during Solana’s best ever month of total DEX trading (Jan 25’), volumes reached $379bn. During the same period of time the Binance spot BTCUSD₮ pair did $144bn. With DEX trading fees being determined by current network congestion, and pool specific fees, barriers are lowered, and swaps are often cheaper than on centralized venues where there are maker/taker fees at around 10 bips on average. Albeit these are through different mechanisms, the overall trend of DEX volume eating up CEX volume is unstoppable, and permissionless venues will ultimately capture the majority of trading in the future, where MEV will play a vital role.

Crucially, by not charging end-users, Plasma amplifies its network effects. The history of successful networks tells us that usage often comes as a precursor to monetization. In crypto, the value of a blockchain’s native asset is often a proxy for the community and activity on that chain. If Plasma becomes the epicenter of stablecoin transactions, the value will likely be reflected in its ecosystem even if USD₮ transfers remain free. It’s a long-term play, capture the market first, then explore monetization. And because Plasma is effectively enhancing the utility of the U.S. digital dollar, it’s aligned with large, well-capitalized players who have a stake in the dollar’s global ubiquity.

Alignment with U.S. Policy and the GENIUS Act

As US crypto adoption matures, regulatory alignment is increasingly important and now is as good of a time as any to move with upcoming positive regulation. Notably, Plasma’s emergence dovetails with a push by U.S. lawmakers to bring stablecoins within the regulatory arena. This week, the U.S. Senate advanced the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), a bipartisan bill to create a comprehensive federal framework for stablecoins. This legislation, if enacted, would define how USD-backed stablecoins can be issued and managed under U.S. law, treating them as a legitimate part of the financial system rather than an unregulated gray area. While friendlier guidance from the regulatory agencies under the Trump administration has been net positive for the industry, positive crypto legislation provides innovators with much needed, longer term clarity. It’s a long-awaited point of clarity that major financial institutions have been waiting for before fully embracing stablecoins.

Plasma is naturally aligned with this regulatory trajectory. By focusing exclusively on fiat-backed stablecoins, as opposed to more controversial, and complex, algorithmic stablecoins, Plasma positions itself as a prime beneficiary of this specific piece of legislation, if it passes. Should the GENIUS Act, and parallel House proposals like the STABLE Act, become law, we can expect a surge in demand for incumbents like Tether’s USD₮ that meet the new standards.

It’s also worth noting that U.S. policymakers concerned with preserving dollar dominance might view networks like Plasma in a positive light. By making dollar stablecoins more useful and accessible, Plasma effectively extends USD’s reach globally in a transparent way. Contrast this with, say, foreign or domestic CBDCs, and Plasma’s approach of combining USD₮ liquidity with Bitcoin security could be seen as strengthening the position of U.S. currency in digital form. Already, over 98% of all stablecoin value is USD-backed, a trend likely to continue. The GENIUS Act would require stablecoin issuers to implement rigorous measures such as reserve requirements, audits, and redemption policies, to protect consumers.

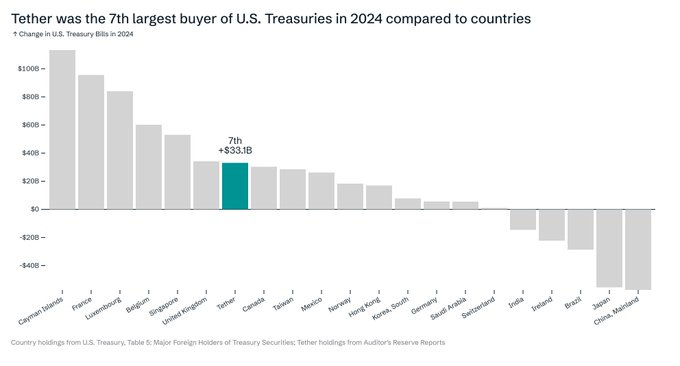

Further, continued stablecoin growth could provide an important source of demand for short term Treasury Bills in a period where other countries like China are using their holdings as a threat. While it’s tricky to measure stablecoin’s direct impact on market yield, Tether and Circle have amassed $120B+ in short term USTs (~3 months to maturity), which has now proven to be consistent buying on the short end of the yield curve.

Future Outlook: Plasma’s Role in Core Financial Infrastructure

Plasma’s vision to become core financial infrastructure for the digital age, in the same way that TCP/IP became core infrastructure for information, is ambitious, and rightfully so. It’s not about creating a new currency, but about upgrading the way USD₮, the existing dominant digital dollar, flows around the world, reinforcing dollar hegemony.

However, the journey is just beginning. Plasma will need to prove its security and reliability at scale, attract a broad set of validators, and onboard not just existing crypto users but net-new participants, whether they be individuals, fintechs, or institutions. It will also face competition from incumbents like Tron, Solana, and Ethereum L2s, as well as any new purpose-built payment blockchains. However, the market opportunity is vast, and clearly more than one network can thrive given the global scale of payments. In an industry that often chases the next general-purpose L1 or the next memecoin craze, Plasma’s focus on stablecoins feels refreshingly pragmatic.

In conclusion, Plasma isn’t trying to reinvent the wheel. It’s taking USD₮, the largest and most liquid dollar stablecoin, and empowering its distribution and ubiquity throughout the world via zero-fee transfers. It’s not controversial to say that stablecoins have proven to be one of crypto’s core killer use cases. We believe that the aggregation and proliferation of USD₮ on Plasma will lead to not only improved distribution of USD₮, but important secondary and tertiary effects that will drive further innovation and economic activity to the chain. For all these reasons and more, we believe that Plasma is in a prime position to capitalize on this multi-trillion dollar opportunity.

Disclaimer:

Kairos Research is an investor in Plasma. The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.

Plasma Deposit Campaign Analysis (Bonus Content)

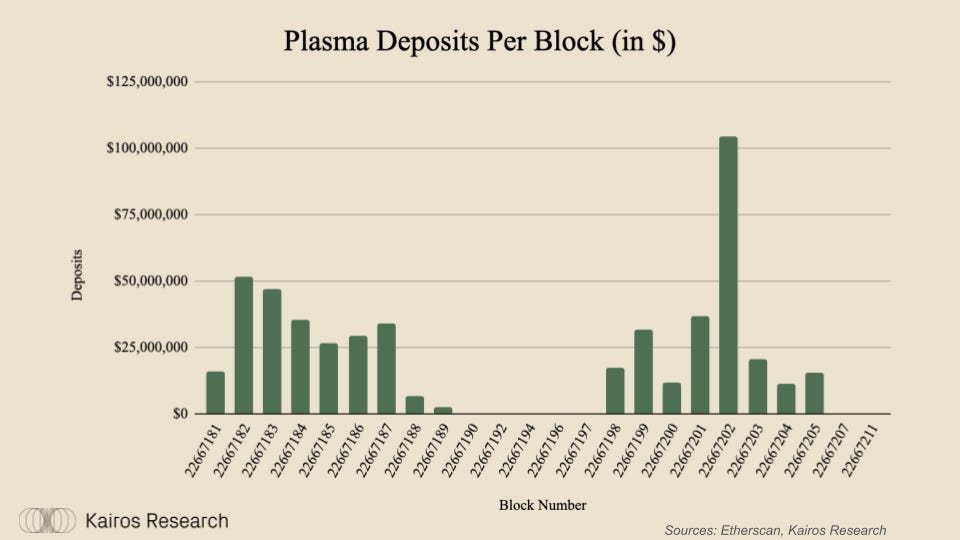

Over the past week Plasma began its deposit campaign. Across three cap raises, they were able to go from $0-$1bn, in an aggregate time of less than one hour. The initial cap was $250m, which was reached in approximately 10 blocks. The cap was then lifted an additional $250m to $500m max cap. This filled again very quickly, in roughly the same amount of time.

The deposits included a wide range of participants, and while the max cap on a per wallet basis was $50m, this was only hit once.

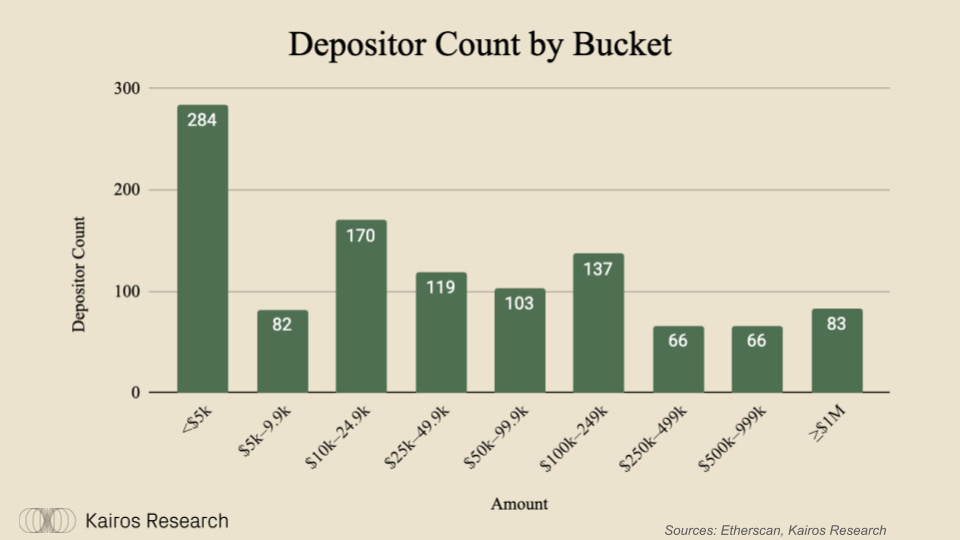

You can see the full stats for Phase 1 in the table below.

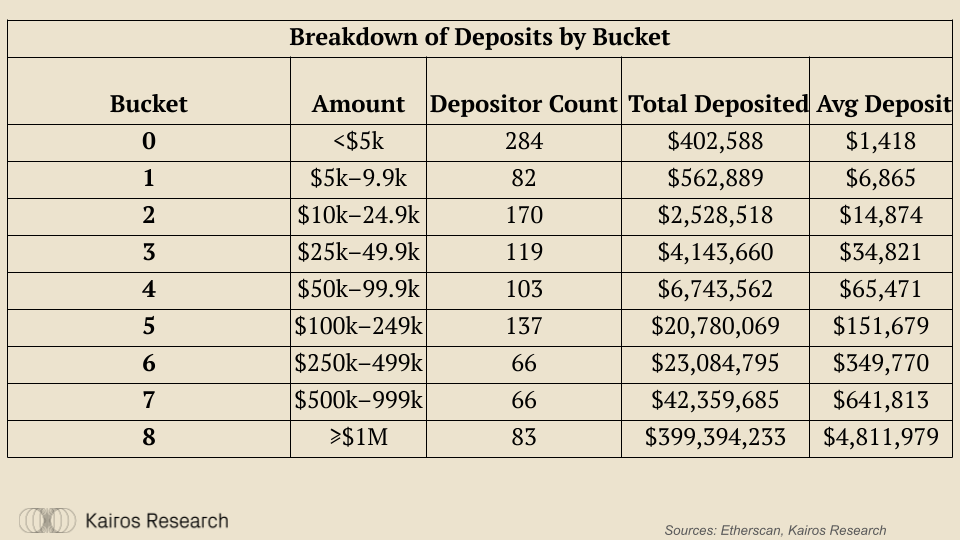

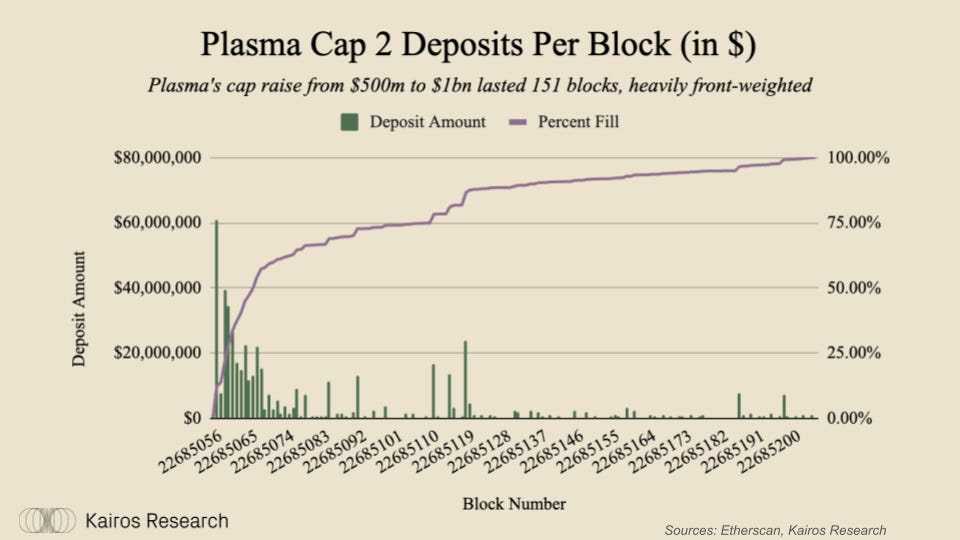

While Phase 1 occured on Monday, June 9th, Phase 2 then occured on Wednesday June 11th at 9:00pm EST. The key difference here, is that while Phase 1 was well telegraphed with several days notice, Phase 2 was announced on only a 1 hour notice from the official Plasma twitter account. Despite this, the $500m cap raise was filled within 151 blocks, heavily front loaded which revealed the pent-up demand for allocation to the vaults.

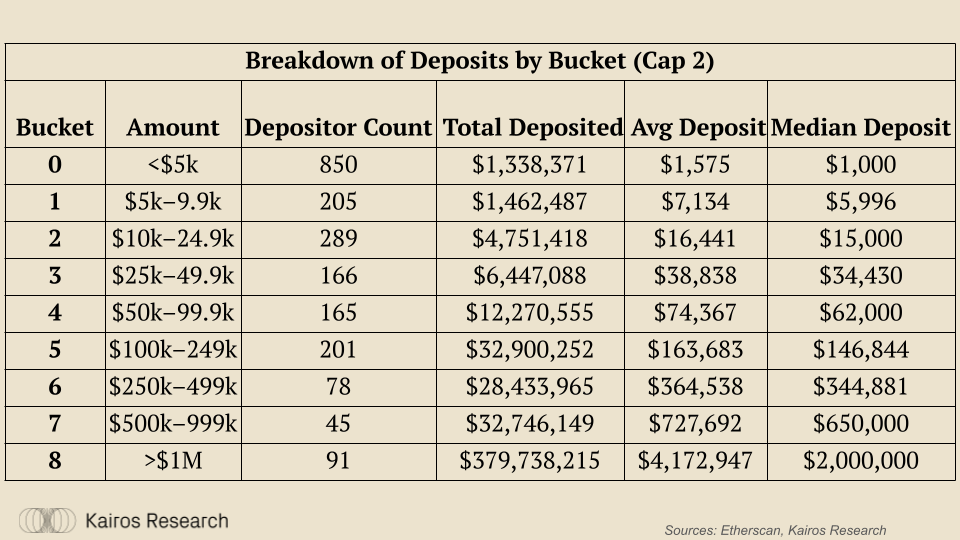

Phase two brought about many smaller deposits, which enhanced the distribution across more parties, which is ultimately a more egalitarian outcome. The full stats for Phase 2 can be seen below.

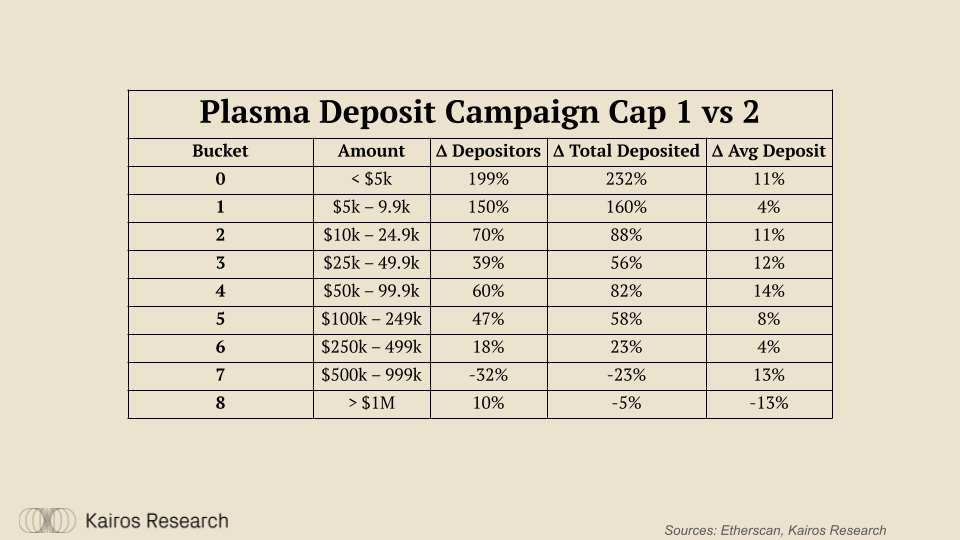

To easily compare the difference between the two phases, we’ve included a table which allows you to see the difference between each on a per bucket basis.

Overall, these two initial deposit phases showed just how much appetite there is for exposure to Plasma - which is a downstream of people seeking exposure to stablecoins as a sector. We strongly believe that Plasma’s focus on zero-fee USDT transfers will continue to attract more USDT to the chain itself, enhancing the second and third order outcomes which we anticipate in the article above.