SatLayer: BTC's Universal Yield Layer

How SatLayer and Babylon Are Transforming BTC into a Yield-Generating Powerhouse

Introduction

Bitcoin is a truly unique asset - it’s the only crypto asset which has crossed the chasm of adoption by nation-states, large corporations, ETF issuers, high net worth individuals, you name it. Bitcoin has nothing left to “prove” to people anymore, the asset reigns as the king of crypto. The tide has now turned, and while most crypto assets and their respective communities are trying to “prove” their token worthy of adoption, it is now builders trying to prove their products worthy of attracting BTC, and Babylon has done exactly that. Babylon is unlocking Bitcoin’s untapped potential as a yield bearing asset through staking, and so far it has attracted over 48k BTC (~$4bn). As Bitcoin continues to grow its presence as an essential global macro asset, the desire for yield on it will grow in tandem. We believe crypto’s transparency will allow for superior yield-bearing products to thrive, and SatLayer is set to be a categorical leader here. In this report we’ll dive into what exactly they are, how they function, and the demand drivers we think will accelerate their adoption. Restaking took the industry by storm during 2024. Even though it was (and still is) fairly misunderstood, the new crypto primitive was able to swallow $30B in TVL by December of last year, with nominal numbers now back down to roughly $16.2B – due to the recent retrace in risk assets across the board. Given the first wave of restaking platforms were built on Ethereum, the vast majority of deposits were made in ETH, as long term holders and yield farmers looked to make their assets productive.

A similar trend is now playing out across a variety of crypto assets as new restaking platforms launch and accept a broad range of collateral, including BTC, SOL, Stablecoins, and more. In the below report, we will focus on:

Defining Staking & Restaking

Break down how SatLayer unlocks liquidity and shared security for protocols and BTC holders

Explore what makes an asset fit to be used as cryptoeconomic security

Key themes unpacked will be: Liquidity, Stability, Decentralization and Yield Generation for BTC holders.

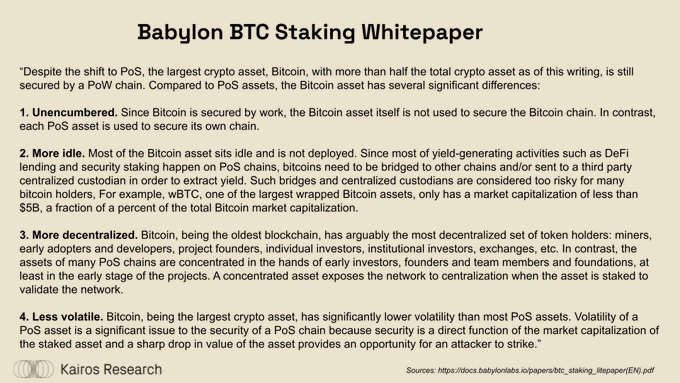

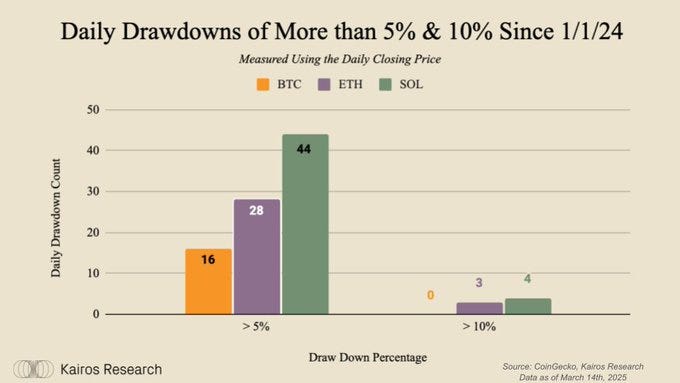

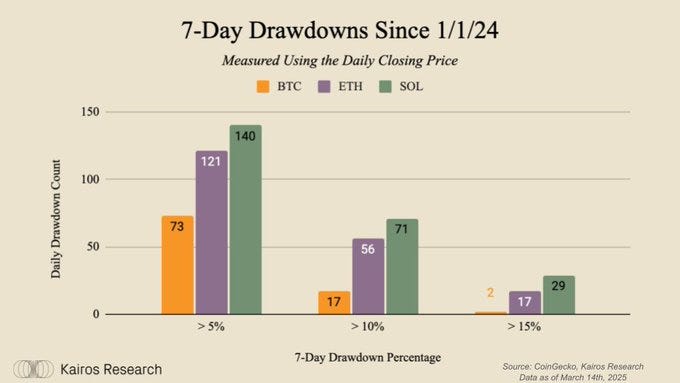

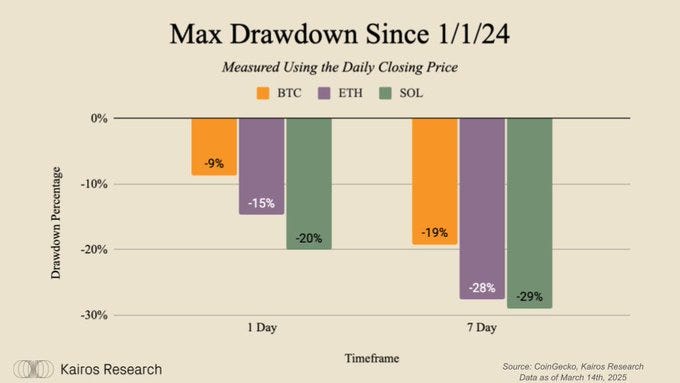

As seen in the visuals below, native BTC is one of the strongest matches for the above properties. BTC is the most liquid asset in crypto, fully censorship resistant, has a $1.7T market capitalization, has shown significant relative stability and has a user base that is very interested in making their asset productive. Unlocking its use as restaked collateral should provide not only strong cryptoeconomic security, but will also drive down security costs for any platform outsourcing their validator set, while boosting ecosystem liquidity.

The Universal Yield Layer - Securing Dapps with Bitcoin (Demand Side)

Using Eigenlayer’s words, Restaking fosters innovation by enabling early stage protocols to benefit from the security guarantees of more mature networks without the need to replicate the costly process of securing their own network - both in the sense of bootstrapping assets and building out a strong and nimble, yet decentralized validator set. Therefore, restaking can be thought of as a Proof of Stake as a Service platform, with the key difference being:

Staking: Utilizing a token(s) to secure your network’s validator set

Restaking: Utilizing an outside token to secure multiple networks through a security platform like Satlayer / EigenLayer’s operator set

With all of the experimentation taking place within staking and restaking, these lines have been blurred. For example, the name restaking came about as EigenLayer enabled ETH that was already securing Ethereum to then be extended as security to other blockchain networks hence the term “Re”staking. EigenLayer shortly after added other assets like stablecoins, which hadn't been staked in the first place, but were technically restaked as they were now capable of securing multiple networks. The reason we are broaching these technicalities is because Babylon will allow BTC to be staked to networks with preexisting validator sets that need additional, cheap security (Cosmos Hub). SatLayer, like EigenLayer, will extend these capabilities and allow Babylon depositors to opt into securing additional networks with the help of their own Operator Set. Given the current conversations around security budgets within the Solana, Ethereum and Cosmos ecosystems, we believe that both of these primitives will become increasingly important as chains optimize for long term sustainability.

At Kairos Research we believe that restaking will play three pivotal roles within the crypto ecosystem:

Commoditizing Crypto-economic Security: This will undoubtedly drive innovation in the space. Allowing someone to build a highly specialized product, without needing to fully build their own chain

Preventing Centralization Risk: Enabling existing protocols to decentralize pieces of their stack, that would've either remained under the control of their core team or required launching their own chain to solve.

Achieving Efficient Liquidity Through Shared Security: Unlike traditional staking that isolates capital in single-protocol silos, restaking enables the same collateral to simultaneously secure multiple protocols across the ecosystem. This creates a multiplier effect on capital efficiency without requiring additional liquidity injection.

a.) By forming interconnected security networks, restaking establishes ecosystem-wide resilience rather than isolated protocol-specific security islands.

b.) Allows the broader ecosystem to scale security in parallel with adoption while avoiding proportional increases in locked capital requirements

Who Will Provide the Security? (Supply Side)

There is a clear, insatiable demand for yield. The United States’ treasury market alone has a market size of close to $40T, yielding 4-5% across maturities, which is seen as a global “risk free” rate. This holds true in crypto as well. Funds and retail alike have an appetite for making their assets productive, whether that means participating in a network’s validator set to earn native staking yield, crypto’s adjacent to the “risk free rate,” or throwing their assets into a centralized black box of undercollateralized loans. These “black boxes” have proved popular, but also very risky. During 2021, we saw platforms like Celsius ($25B) & BlockFi ($10B) use this very concept offering 10%+ and securing a combined $35 BILLION dollars in deposits - a large amount of that being denominated in BTC.

The lessons learned from last cycle have hopefully stuck with everyone who was around, we believe users are showing a real demand for self custody, transparency and staying onchain. SatLayer and Babylon are bridging this gap for BTC holders, who have not historically had the access to DeFi and onchain yield as ETH and SOL holders.

Outside of your average BTC holder, there are several massive sources of idle capital that will want to earn yield on the BTC in the future.

Exchange Traded Funds and Products: There is enormous demand for BTC ETFs, seen through the $36.2B in inflows since launch. If other popular ETFs, like GLD, are any sign of what is to come over the next few years - there is a lot of additional room for growth. Additionally there is clear demand for staking. Along with Van Eck and others closely monitoring the market, there will likely be some form of combination between these two products in the coming year. While the majority of the conversation has been around staking ETFs for ETH & SOL, we believe that following market maturation, it is inevitable that we will see institutional-grade products focused around Bitcoin staking and restaking.

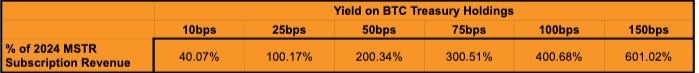

MicroStrategy, Miners, & Corporate Treasuries: The company has been financing BTC purchases through a variety of debt, convertible debt & preferred equity. At some point, MicroStrategy’s BTC holdings & obligations will become much larger than their actual operating business and it will serve them well to be able to make their BTC holdings (528,185 BTC) productive. If MicroStrategy was able to earn even 10bps of yield across their entire BTC treasury at a price of $81,000, that would be an additional $42.8M in yield per year – which is more than 40% of what the operating company generates in annual subscription revenue.

The Bitcoin Restaking Ecosystem

In order to fully understand the dynamics of Bitcoin Restaking, we will break down a few of the key players building out the Bitcoin Staking landscape:

Babylon: Babylon is a shared security platform that enables Remote BTC staking - meaning that BTC holders are able to lock their native BTC to secure Proof of Stake chains and other protocols in need of crypto-economic security. Without access to native smart contracts on Bitcoin, Babylon was able to leverage the network’s “native timelock combined with extractable one-time signature (EOTS) to convert slashable PoS attacks to spendable Bitcoin UTXOs for burning.”

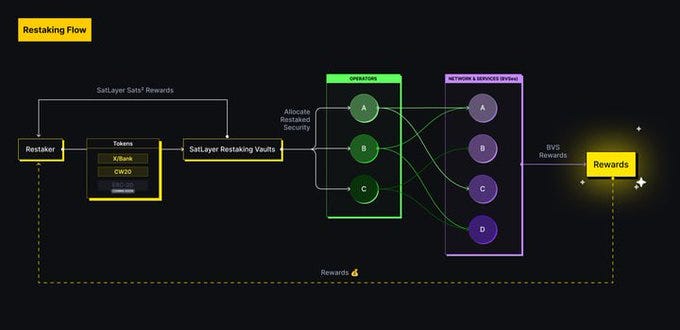

SatLayer: SatLayer was built on top of Babylon Protocol to expand BTC’s use as restaked crypto-economic security asset across other crypto protocols in need of economic security. Much like EigenLayer does for ETH, restakers will be able to secure networks of their choice through Babylon BUT then also be able to secure “Bitcoin Validated Services (BVSs).” These BVSs will be oracles, data availability providers & other crypto protocols / products in need of capital and an Operator Set.

Lombard / Solv / Lorenzo: These are some of the market leaders that are launching BTC Liquid Staking & Liquid Restaking Tokens. They enable users to deposit their native BTC into Babylon, receive a liquid representation on another chain (Ethereum, BNB Chain, Base, Swell, etc) and use that for collateral in restaking on SatLayer or throughout other DeFi protocols.

“A Bitcoin Restaker’s Journey”

Stolen from the Babylon Whitepaper, we thought that the process flow of staking and restaking native BTC was the clearest way for users to understand how their assets are being utilized, where the yield comes from & gain broader knowledge on the product itself.

Staking via Babylon

BTC holders are able to lock their BTC into a self-custodial wallet on Bitcoin, which will then enable the tokens to be used for securing a Proof of Stake network

The user is then validating the Proof of Stake network, receiving block rewards & transaction fees for the capital they provided

The user can request a withdrawal from the Proof of Stake chain, when their capital will exit the validator set and they will be able to claim their BTC again. If the user acted maliciously, a portion of that BTC will be immediately sent to the burn address

a.) If a portion of the BTC is to be burnt, the users private key gets immediately leaked to the public who is incentivized to claim the BTC (send it to the burn address)

Restaking via SatLayer

After a user has locked their BTC in a Babylon staking contract, they will have some form of deposit receipt (liquid or illiquid) on Babylon. If the user mints a Liquid Staking Token (LST) that represents their Babylon deposit, they are then able to deposit that as collateral within SatLayer

SatLayer delegates their stake across an Operator Set, which will then opt into securing any Dapps tapping into their economic security

The user will receive rewards for both their Babylon deposit, but also from any of the BVSs that they may secure through SatLayer, all of which can be seen in the visual below

Current State of SatLayer

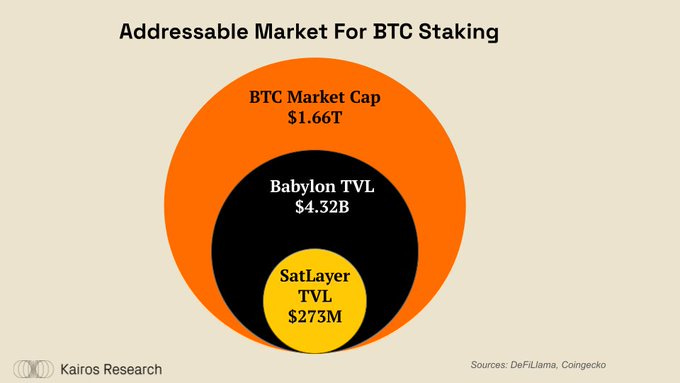

As of April 2025, Babylon is the 7th largest DeFi protocol and SatLayer falls around 90th on the list. Even though they are both top protocols, they only account for 0.3% and 0.016% of BTC’s market capitalization respectively. We believe that a significant portion of BTC’s supply will eventually be staked through Babylon. For reference, Celsius & BlockFi held approximately 58+ basis points of BTC’s circulating supply - according to data provided by Arkham Intelligence. If we see a second wave in demand for yield on BTC, Babylon could very well become a $40-50B TVL protocol, enabling SatLayer to grow in its wake. The below image is obviously not to size, but shows the nature of BTC staking, where Babylon is attempting to become a black hole for BTC and SatLayer is attempting to be a black hole for Babylon deposits.

There is a clear opportunity for SatLayer’s BVSs to make an immediate impact within the broader DeFi landscape. Below is a high level breakdown of BVS use cases, as well as a highlight on a couple of existing partners:

Collateral Backstop / Insurance Fund

BTC restakers will be able to provide emergency backing to lending, stablecoin & other protocols relying on leverage (Perpetuals) in long-tail cases where the protocols become undercollateralized

The restakers would earn a percentage of the borrow yield on the protocol for providing additional backing

2. Oracles & Data Feeds: RedStone Oracle

Restaking allows an oracle protocol like RedStone to guarantee data feed accuracy through slashable economic security

Node operators face meaningful economic consequences for providing incorrect data

Oracles can also generate sustainable yield from data consumption

3. Secure, Decentralized Bridging Infrastructure: Fiamma

The trustless transfer of assets across chains requires creating an economically incentivized committee that is capable of approving mint & burn transactions - making them ideal candidates for BTC backed security.

Bull Case for SatLayer

For all of the reasons mentioned above, BTC is clearly a premier restaking asset. How can SatLayer ensure that it becomes the dominant asset within restaking?

We believe that over a long enough time horizon, supply and demand dynamics will take over and leveraging BTC will become a no-brainer for validated services. Meanwhile, protocols like Catalysis Network are building shared security abstraction, such that validated services can tap into restaked security across all assets & platforms without undergoing a full technical / developmental upheaval. Any economically rational actor will lean into the most abundant and stable form of security, which will almost certainly be BTC for the foreseeable future.

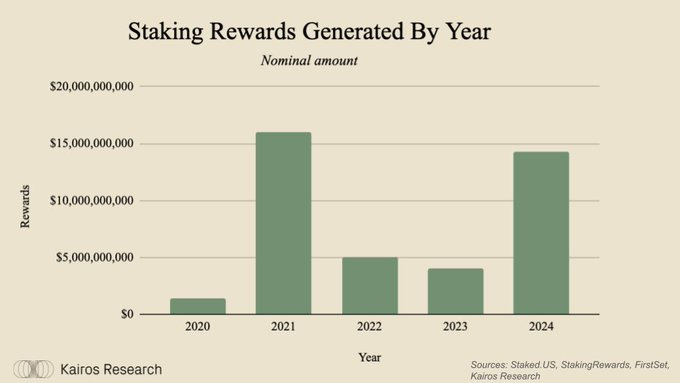

SatLayer has the wind at its back. The Bitcoin ecosystem seems very keen on building its own DeFi economy and it is due time for BTC to be further integrated within onchain activity. With the recent shift in the regulatory landscape, we are hopeful for a new wave of protocols, many of which may need to tap into economic security - a market that is not small we may note. As encompassed in the data provided by FirstSet below, chains paid close to $15B in staking rewards during the last calendar year. Very few of these chains are profitable, or even close, giving them plenty of reason to pivot to a shared security model that can make them more sustainable and save their token holders from unnecessary dilution. The combination of cheap security provided by the BTC Yield Layer and friendly regulation may spark innovation that returns yield back to restakers.

Conclusion

The market will ultimately show us the endgame in terms of demand for restaking: which protocols will seek to inherit external economic security, what is the going rate for the security, and how much yield can be earned on each dollar of restaked capital. As seen above, staking is a $15B dollar a year market that is ripe for disruption and bringing BTC into the mix could be what it takes for builders to rethink economic security.

BTC’s positioning as the clear winner in the Store of Value sector provides Bitcoin with a unique essence of neutrality. Combining this positioning with continued growth on the supply side for restaking, will quickly drive security costs down and make it difficult for early stage chains / protocols to not opt in to BTC restaking. We believe that the tremendous value of idle BTC could enable chains to significantly cut their security budget and position themselves for more sustainable growth. Babylon and SatLayer have the opportunity to facilitate this new wave of BTC yield generation via crypto economic security, which we will continue to monitor over the coming months.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.