Stability Meets Innovation: ezUSDC’s Role in Solana’s Restaking Future

With USDC’s low volatility, deep liquidity, and huge growth potential, it's ideal for both restaking collateral & NCN payments alike - read on to find out more!

Introduction

In less than one year, restaking has found its footing, amassing nearly 17 billion in TVL across various platforms. Ethereum itself has taken 95% of that alone, across EigenLayer, Symbiotic, and Karak, respectively. Throughout the rise of restaking, there have been lessons learned with regards to design trade offs, as these various design choices emerged on Ethereum, it allowed builders in other ecosystems, like Solana to carefully study them and implement best practices when designing their own. While there are still many open questions about how the restaking ecosystem will work, Jito is aiming to answer these questions as fast as possible. Throughout this paper, we’ll explore Jito’s restaking platform, and how we believe USDC could play a key role in stabilizing their infrastructure both through providing crypto-economic security, and also by being the primary medium of exchange between Node Consensus Networks (NCNs), and their customers.

What Exactly is Restaking?

Restaking, in a nutshell, can be thought of as “staking” tokens to opt-in to additional slashing parameters. For Jito’s (Re)Staking platform, there are two primary components we can examine, the Restaking program, and the Vault Program.

The restaking program acts as a registry for NCNs, operators, and relationships between NCNs, operators, and vaults.

It allows users to do the following:

Registers NCN, operators, and their configurations.

Stores relationships between NCN, operators, and vaults.

The restaking program does not store any funds; it is purely used as a registry and relationship manager between entities in the system.

The vault program manages the vault receipt tokens (VRTs) and associated deposits. The program stores deposited funds and handles the minting and burning of tokenized stake. It also manages the vault’s stake in an NCN, including delegation and slashing.

So, Why the (Re)?

Restaking initially gained its (Re) prefix from EigenLayer’s platform, which in its early stages only allowed staked ETH or Liquid Staked ETH to be deposited to the platform. Depositors could then select an operator of which they would entrust to meet, and maintain the necessary infrastructure for Actively Validated Services (AVS), or miniature service-oriented networks which inherit the crypto-economic security guarantees of these restaked assets. Each NCN has unique requirements from operators, the failure to meet and maintain these requirements would then result in slashing. For Jito’s (Re)staking, the platform will allow for a variety of tokens to be restaked at launch, not just SOL, staked SOL, or Liquid Staked SOL. From Day 1, the platform will allow for SPL tokens to be “restaked”, in other words, the crypto economic security for the NCNs on Jito’s platform will potentially be derived by a variety of assets. While jitoSOL is the most widely used asset across DeFi on Solana today in terms of TVL, USDC has continued to grow in its importance, and this importance may grow with the introduction of Jito’s platform.

USDC’s Role in (Re)Staking

When looking at other restaking platforms, the primary asset utilized is ETH, SOL or LST variations of those assets. However, USDC could be an attractive asset for restaking purposes due to the following:

Stable price = Stable Security

NCN payments in USDC could allow for a more stable operator income

A VRT of restaked USDC could find (product market fit) PMF across various DeFi venues.

Stable Price = Stable Security

When it comes to crypto-economic security, there are a few things to keep in mind as an NCN:

How much security do you have?

How much security do you need?

What is the volatility of the assets constituting your security?

What is the onchain and offchain liquidity of the assets constituting your security?

What is the opportunity cost of restaking the crypto assets you allow in your quorum?

These first two questions go hand in hand, while there may not be one definitive answer on how much security an NCN needs, it also directly ties into the core economics and how much additional restaking yield is passed on to operators, and VRT holders. With other restaking platforms, many of the restaking delegation deals were done through unenforceable Letters of Intent (LOI), allowing protocols to gain exclusivity. However, the trouble of having security deals denominated in SOL is multi-fold:

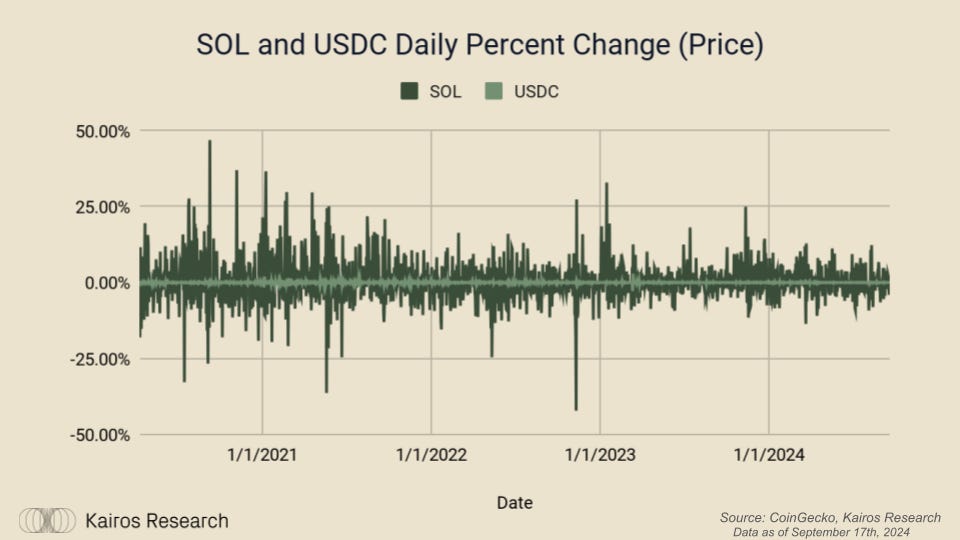

The price of SOL is volatile ( about 5x as volatile as the SPY)

The LOIs cannot account for large user withdrawals / deposits

These fluctuating variables make it difficult to forecast cost for the NCN, and difficult for the operator to forecast potential rewards they may accrue

The third point of “what is the volatility of the restaked assets” is also important for ensuring NCNs’ security remains stable, even throughout times of volatility. This plays a key role not only in ensuring stability and predictable security for the underlying NCN, but also when it comes to paying the operators, and vault curators, for the security they provide. For traditional proof of stake networks, operators outside of the top N validators typically find it difficult to become profitable. This is largely due to them having to engage in a decision of: - Staking their take rate (network revenue) to become more competitive, and increase their chance of producing more blocks

- Selling their take rate to cover the standard overhead costs: hardware costs, electricity, salary for DevOps, other miscellaneous costs.

Therefore, USDC with its low-volatility may potentially prove to be a superior asset with regards to restaking. Additionally, with regards to liquidity, USDC is a very liquid asset, both with regards to onchain (on DEXs) and offchain (exchanges). Additionally, USDC can be redeemed for the underlying assets (USD) through centralized exchanges such as Binance, Coinbase, Kraken, etc, or also through Circle directly, assuming that a user has the account credentials required in order to do so.

Therefore, for all the reasons mentioned above, USDC meets all the criteria for becoming a potentially reliable asset for restaking; given its stable, low-volatility price properties, coupled with deep liquidity. However, one key thing to keep in mind is the opportunity cost that restakers of USDC would take on. In other words, what potential rewards are missed out on by users restaking? Providing liquidity to DEX pairs for USDC, specifically on stable-stable pairs, yields are around ~2.5%-3% for LPs. For the sake of this case study, we’ll only examine yield that would be received back in a dollar denominated version. When examining the supply APY for USDC on Solana’s two largest lending markets, Kamino, and MarginFi, when looking at historical data going back to the beginning of the year, the average supply APY comes out to 11% which makes it very competitive with regards to opportunity cost.

How ezUSDC Lowers Opportunity Cost

While supply APY is very competitive from an opportunity cost perspective for users aiming to maximize their onchain yield, Renzo’s ezUSDC provides users a compelling offer. Having a liquid vault receipt token like ezUSDC inherently offers users optionality, but the core offering increases with more NCNs that utilize restaked USDC. Below is an example NCN that Is currently being developed that is aiming to do exactly that:

The Squads Insurance Protocol (SIN)

The Squads Insurance Node Consensus Network (SIN) explores a decentralized insurance model for smart contracts (programs), leveraging Jito’s restaking platform to provide protection for onchain assets. Operators and Restakers can earn yield by staking USDC, which is used to cover claims in the event of account compromise (e.g., a smart contract vulnerability). Unlike traditional insurance, this model incentivizes decentralized security through premium payments from SIN users, offering a unique way for stakers to earn yield while securing the broader DeFi ecosystem.

Use Case Example for USDC Restaking in the SIN

Imagine a user with $100,000 in a smart account on Solana who wants protection from potential DeFi smart contract vulnerabilities. They can choose a SIN Operator that insures their smart account. The Operator, backed by restaked USDC, will reimburse the user in case of a smart contract vulnerability, such as a reentrancy bug. This system leverages the liquidity and stability of USDC to offer insurance in a decentralized manner, ensuring that the insured party’s funds are secure, while providing yield to USDC restakers through insurance premiums.

This integration enhances the utility of USDC in the restaking platform by not only serving as a medium for crypto-economic security but also enabling decentralized insurance, which can attract more users and operators to the network.

How Big Can Restaking on Solana Get?

While restaking gets a lot of attention for the additional rewards, is it truly important because it creates a marketplace for trusted services to emerge through crypto-economic coordination. Allowing NCNs to create services enforced by custom slashing parameters expands the design parameters for developers and opens the door for more economic activity to take place onchain. More onchain activity is beneficial for most, if not all stakeholders in the network, especially validators, and JitoSOL holders as staking rewards are enhanced. As these network effects continue to play out, we believe it could lead to even further adoption for JitoSOL. Additionally, with staking rewards on Solana programmatically decreasing over the next few years, we believe the MEV captured by jito-sol validators will encourage more of the Solana network to adopt their LST. Furthermore, products like ezSOL can serve as a way to capture the rewards mentioned above, plus restaking rewards from Jito’s (Re)Staking platform.

Today, Solana LSTs constitute roughly 6.67% of network stake. Over the next few years, we assume this will be, at minimum, 33% of the network, which would give us a staked market cap of about $150bn. We believe this is a relatively conservative projection, and its accounting for a SOL price even more conservative than Van Eck’s “base case” scenario for SOL, using similar assumptions from their model. We anticipate that the JitoSOL market share will remain around 50%, which at 33% liquid staking market penetration for staked SOL, would come out to roughly $49.5bn, with JitoSOL making up around $24.75bn TVL, roughly 13x larger than what it is today. Assuming 25% of that TVL makes its way to Jito’s (Re)Staking platform, that would make up roughly $6.18bn of crypto economic security from JitoSOL alone. While the 25% is reached by looking at roughly how much stETH/wstETH is on EigenLayer and Symbiotic, the two largest restaking platforms on Ethereum, it is very possible that the overall percentage could go higher given different, perhaps superior, network effects.

Equally important, the adoption of USDC is continuing to grow as well. USDC, specifically on Solana, is growing incredibly fast, especially when considering the velocity of USDC on Solana. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. When calculating velocity as USDC transaction volume / USDC supply, the velocity of USDC on Solana is about 8.4x larger than on Ethereum. This is likely driven by the surge of SOL’s price over the last year, spurring activity on the network, coupled with fees that are several orders of magnitude cheaper than Ethereum. It is of course also important to note that transfer volumes for USDC have fallen off a cliff in recent weeks, however, the overall velocity remains much higher.

Additionally, the cumulative transfer volume of stablecoins on Solana is set to surpass Ethereum in the coming years if the current trend continues.

When aiming to get a sense of how large ezUSDC could grow, and how much additional security could be provided to NCNs via restaked USDC, we can do some forward looking projections for the growth of USDC on Solana. Our assumptions are simple, we’ve applied a daily growth rate of 0.01%, 0.15%, and .2% for our bear, base, and bull cases respectively. In the chart below, the three cases reach 3.2bn, 69bn, and 208bn, respectively.

Following this, we can take a percentage of the overall USDC supply, and apply that to our growth model for ezUSDC. We believe that this analysis, like our others, are conservative, thus we’ve put our bull case % of total supply at 5%, which is roughly in line with the percentage of total USDC on Solana which is supplied to lending markets.

Therefore, we see ezUSDC adding anywhere between $32m to $10bn in additional crypto economic security, with a base case of $1.7bn by September 2030.

The Risks of Restaking USDC

While ezUSDC will likely be a very attractive novel restaking product, it isn’t without its risks. These can be boiled down to the following:

Liquidity Risk

Smart Contract Risk

Exogenous Shock Tail Risk

Liquidity Risk:

A Vault Receipt token, like liquid staking, and liquid restaking tokens, require a decent amount of onchain liquidity to best function and meet the needs of end users. While these types of tokens can of course be unwrapped for their underlying assets, the unwrapping process usually takes several days. Therefore, onchain liquidity is the most popular avenue to realize the benefits of such products. Additionally, the underlying liquidity is also important for maintaining a proper “peg” or price that is reflective of the underlying asset. If there is not sufficient liquidity, the asset may trade at a discount to fair value. However, given the underlying asset in this case is USDC, a largely stable asset, we anticipate that the asset will trade at fair value at all times given the lowered “exchange risk” for arbitrageurs

Smart Contract RIsk:

This is of course not exclusive to ezUSDC at all, but extends to all onchain crypto assets. For ezUSDC specifically, the smart contract risk is present in the token program itself, along with the Jito (Re)staking platform and its associated contracts. However, ezUSDC will be audited before released to the public, along with Jito’s (Re)Staking platform. Additionally, any other platform which ezUSDC is deposited to has its own associated risks. We of course advise users to do their own research before depositing to any other platforms.

Exogenous Shock Tail Risk:

Like any fiat backed stablecoin, there is downstream risk to the underlying banks and custodians of the canonical currency, along with any markets they may be participating in. While unlikely, if the banks fail to manage any of their associated risks, this may introduce a systemic shock to the overall system, resulting in the underlying stablecoin price fluctuations due to unforeseen liquidity constraints. This happened in March 2023, but it is important to note that no actual USD held by banks or custodians on behalf of USDC users were lost or impacted. However the price did trade as low as 88 cents, which caused a daisy chain of DeFi events.

Key Takeaways and Concluding Thoughts

Overall, the introduction of Jito’s (Re)Staking platform is beneficial for the entire Solana ecosystem. Allowing for NCNs to introduce new offchain services, coupled with Solana’s already blazing fast speed, is set to supercharge economic activity on the network, with USDC potentially at the heart of it all. Jito (Re)staking could strategically position itself by championing USDC as a preferred medium of exchange for NCNs and their customers, and subsequently passing on restaking rewards to stakers in USDC. We believe that due to its low volatility, high liquidity, and high velocity, USDC makes for an ideal restaking asset.

With the already rapidly growing importance of USDC on Solana, Renzo’s ezUSDC is well positioned to become the leading stablecoin LRT on Solana. Given our analysis above, we see a massive potential market opportunity for ezUSDC given its existing presence in DeFi, with our bull case scenario climbing to $12.5bn TVL by 2030. It’s also important to note that ezUSDC’s main barrier to adoption will likely be the opportunity cost of USDC elsewhere in DeFi, with lending markets likely being the primary venue. At this point in time, it’s also difficult to accurately estimate what restaking yield on Solana may look like, which would likely impact the rate of adoption for a product like ezUSDC.

Overall, if we had to capture this piece in one phrase, it would be: Ordo ex χάος (order from chaos). The introduction of Jito’s (Re)Staking platform will not only pave the way for a new era of experimentation at the architecture level for NCNs but also revolutionize restaking on the supply side. In the midst of the inherent chaos of restaking and the broader crypto ecosystem, USDC and ezUSDC serve as steadfast anchors of stability. We are confident in the continued adoption of ezUSDC and the significant role it will play as Jito’s (Re)Staking platform drives the next phase of growth and innovation in decentralized finance.

Disclaimer:

The information provided by Kairos Research, including but not limited to research, analysis, data, or other content, is offered solely for informational purposes and does not constitute investment advice, financial advice, trading advice, or any other type of advice. Kairos Research does not recommend the purchase, sale, or holding of any cryptocurrency or other investment.

Good take on the stable coin aspect! I was having these thoughts myself on the Ethereum side of things. Definitely would make it more accessible for institutions to engage, but might be more expensive for the projects to pay rewards in hard cash rather than their own tokens?