Unlocking Akash's Potential: Aligning Incentives for the Supercloud

Strategies for Achieving Critical Mass and Democratizing Compute Resources

At Kairos Research, we view tokens as essential coordination mechanisms for the networks or protocols they pertain to. All parties in a network are incentivized in one way or another around the token, but these incentives don’t always overlap and connect uniformly to unlock the network’s full potential. For Akash, we believe wholeheartedly that their marketplace could, and should, become the global permissionless marketplace for computational resources, and fully manifest as the “supercloud”. However, as it currently stands, the incentives around AKT and its distribution methods are misaligned and hinder the network from reaching a critical mass flywheel adoption pattern.

In this paper we provide an overview of the Akash network, why we think it's important, and weigh its potential at large. More importantly, we present some findings with regards to current distribution methods, network costs, and pose some questions to the community with the intent to foster conversation and gather feedback. If our ideas pique the interest of the community, we aim to explore them further and look to materialize them through the governance process. If we’re met with backlash and thoughtful criticism against our points, we’re happy to accept that as well. All we are seeking is the optimal outcome for the network and community at large.

TL;DR

Akash is set to spend $97m on network security costs this year alone

AKT tokens should be directed towards marketplace incentives in lieu of stakers

Akash should explore using shared security services like Ethos, ICS (+Babylon)

Akash needs an LST (stAKT) whitelisted as a payment asset like USDC

Introduction

According to Amazon, ‘Compute’ is defined as “the concepts and objects related to software computation. It is a generic term used to reference processing power, memory, networking, storage, and other resources required for the computational success of any program.” At a high level, processing power & data storage are the backbone of artificial intelligence, machine learning and the rest of the digital world.

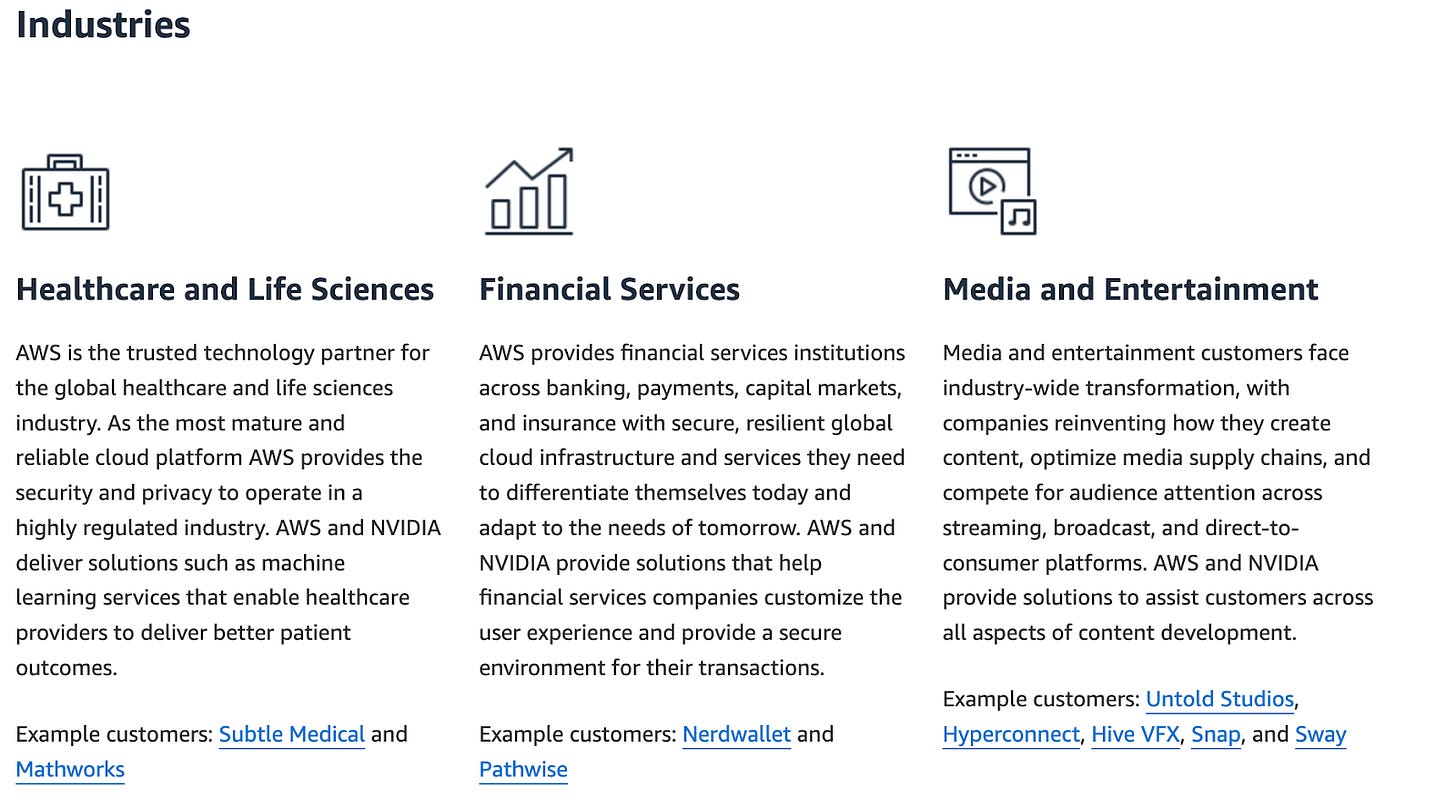

All the large tech giants (Google, Amazon, Microsoft) all provide “cloud computing services” - access to these compute resources over the internet. By outsourcing compute, smaller companies and individuals can offload a significant portion of their product’s technical lift, including sidestepping the need to build data centers and purchase hardware like processing chips.

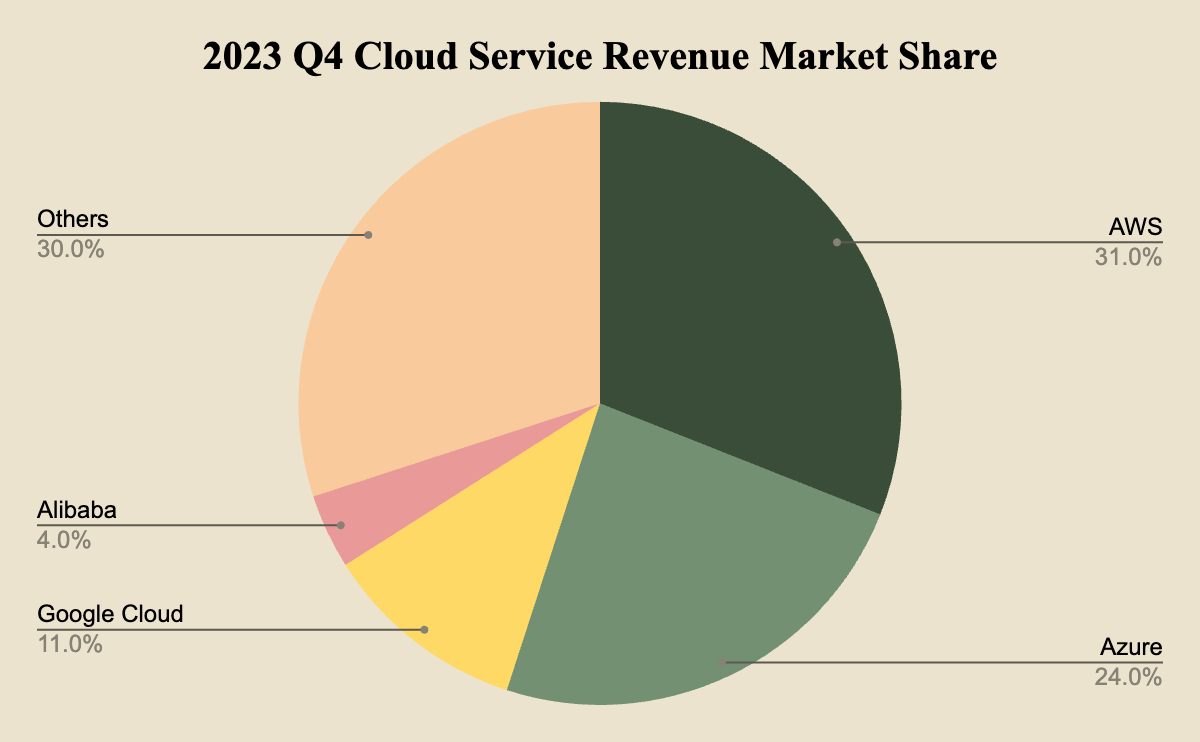

Amazon Web Services, Google Cloud and Microsoft Azure provide valuable services to a variety of industries, and frankly they’re doing a great job at it. However, the downside to a handful of corporations taking on this burden and providing cloud computing, is that it naturally centralizes compute resources. As seen in the graphic below, AWS, Azure & Google Cloud dominate the cloud computing industry with ~66% market share, a number that has only trended up over the last half a decade.

The centralizing forces of compute are concerning for a number of reasons, including:

Increased Pricing Power

Large Targeted Attack Vectors

Controlled Access to Compute

Governments and corporations will have full power of which entities and which use cases are able to rent computing power

Blockchain protocols like Akash could play a pivotal role in democratizing access to computing power, while at the same time aggregating the global marketplace, driving prices down for the end consumer.

What is Akash?

Put simply, Akash is a decentralized marketplace for cloud computing. A protocol that allows anybody in the world to buy and sell computing resources, free of a centralized intermediary. Decentralized compute has an uphill battle to fight in order to gain significant market share from the tech giants, however continuing to scale the supply side of the network will almost certainly attract both economically rational market participants and those that do not have access to traditional cloud computing services, due to cost, geo-blocking, or other hurdles. To understand how Akash removes the intermediary from computing services, there are 4 parties to consider:

Compute Providers: Act as the supply side of the computing marketplace and may be any individual / entity that has additional processing power and decides to lease it by running Akash’s open source software.

Compute Consumers (Tenants): Act as the demand side of the marketplace by leasing resources from the providers to run their applications, websites or products. Consumers may be companies that are looking to build decentralized AI products, crypto natives looking to run network nodes or any builders of computationally intense products.

Network Validators: As Akash is a Proof of Stake blockchain, validators provide economic security to the network by staking the network’s native token, AKT. These validators are responsible for storing the protocol’s historic ledger and producing blocks to facilitate transactions - effectively hosting the compute marketplace.

Nodes: Similar to validators, the network also has a subset of nodes that are responsible for downloading and maintaining the blockchain’s ledger - however they do not participate in the actual block production. Nodes, however, may facilitate a variety of other network services (RPC, data analytics, etc).

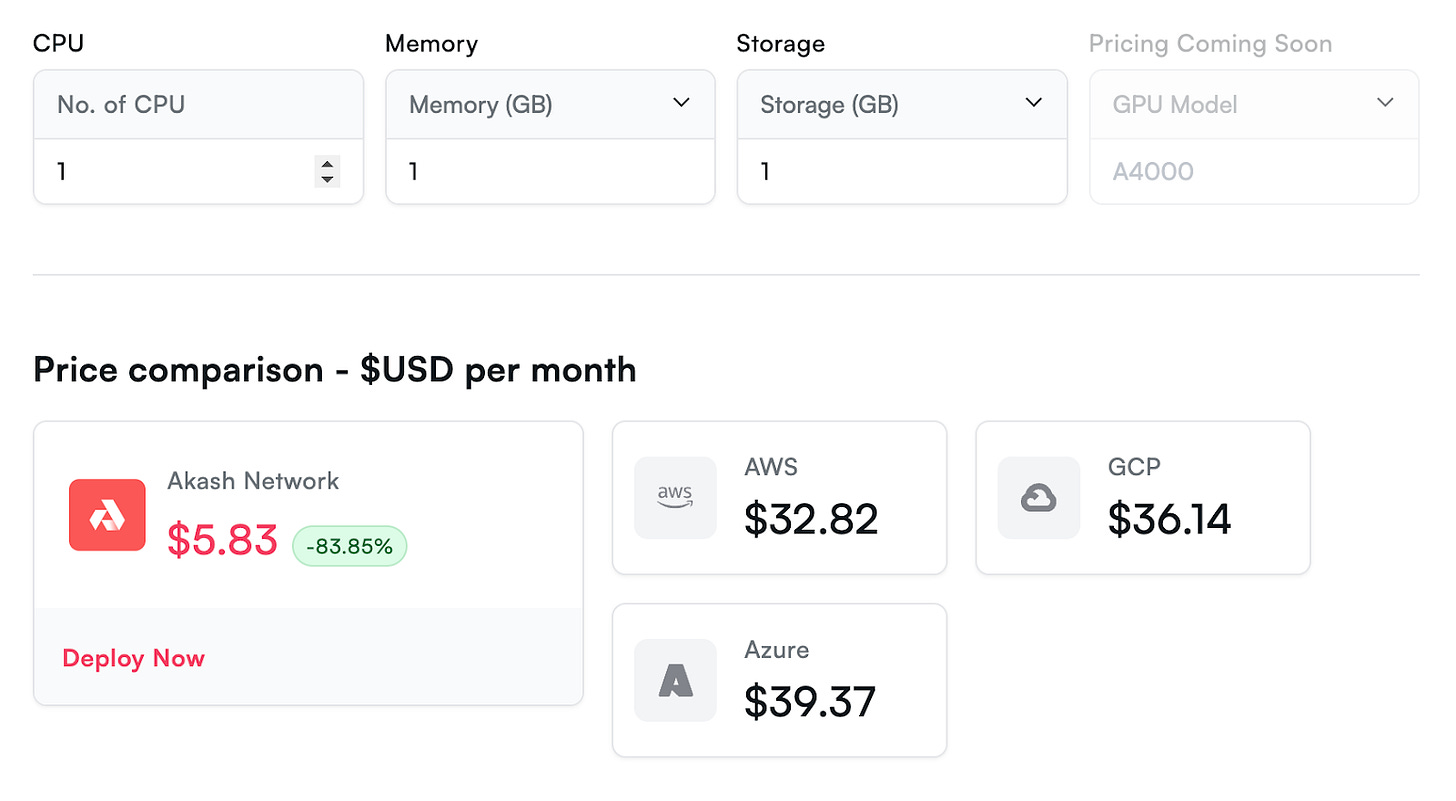

In our opinion, it is definitive that a platform like Akash has a significantly more free-market based pricing system than Amazon, Google, or any of the other current market leaders. With dozens to hundreds of compute suppliers working independently, there will always be competition to accept the optimal lease bid, keeping the market in equilibrium. Below is a screenshot showcasing the Akash marketplaces current pricing for CPU, memory & storage leases. As of today, providers on Akash are charging 1/5th what their centralized competitors are charging.

Market Size & Competitive Environment

It’s nearly impossible to overstate how large the market for compute will be in the next several decades. Not only are humans spending an increasing percentage of their lives online, but the next generation of machines powered by artificial intelligence will require a near infinite amount of processing power. So much so that Sam Altman, founder of OpenAI, is looking to raise a cool $5-7 trillion in an attempt to power the next iteration of the global semiconductor market. While “cloud services” as defined within earnings reports are not a perfect match to Akash’s services, here are a few interesting stats that showcase the true market potential for compute:

Amazon’s 2023 10-Q shows that Amazon Web Services has been the corporation’s fastest growing business segment in each of the last two years, totaling $90.76B in annual revenue or 15.79% of their gross revenue

Alphabet’s Google Cloud generated $33.08B in 2023 revenue (26% YoY increase) & Microsoft’s Azure is on pace to generate $102B (19.9% YoY increase) based on their trailing 6 months

ChatGPT has around 30M daily active users & GPT 4 alone costs $250M to run annually, based on data from Modular Capital

As ChatGPT & other services become more efficient at solving daily work tasks, the amount of compute they will require could easily 10-100x

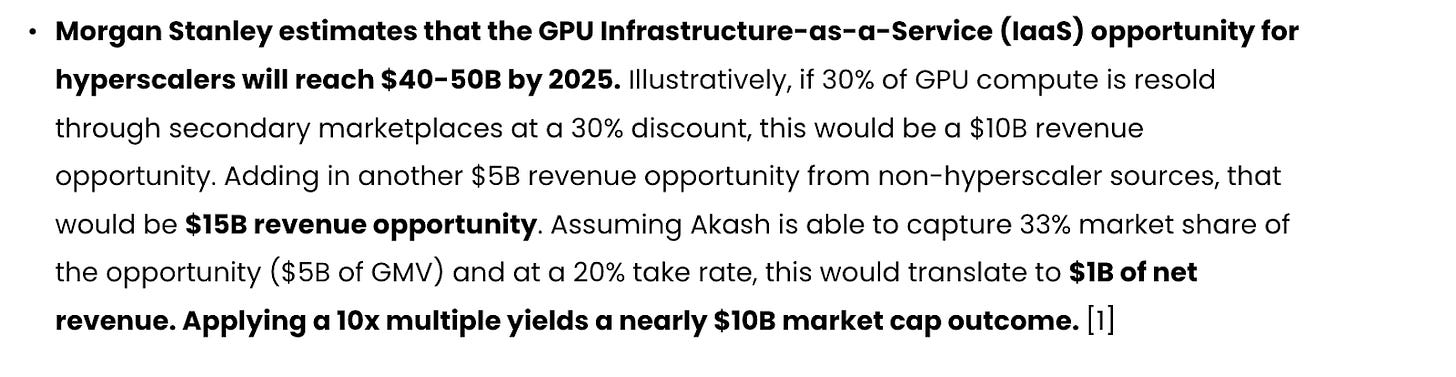

Within Modular Capital’s report on Akash, they present a J.P. Morgan estimate that GPU infrastructure & services will be a $40B-$50B revenue opportunity for AWS, Google Cloud and Microsoft Azure. While this is only a fraction of the total cloud computing revenue seen today - it is likely to grow in-line with AI innovation, which appears to be ever closer to a massive breakthrough. Below is a snippet from the Modular Capital write up, using the assumptions that the customers of AWS, Google Cloud and Azure will lock in 1-3 year GPU leases and be excited to sell any unused capacity through a secondary marketplace like Akash.

While Amazon, Google and Microsoft dominate the GPU as a service market, there is a multi-billion dollar opportunity outside of these tech giants. Any large corporation or nation state that has built an inventory of Nvidia hardware will also be a willing participant in selling excess capacity, another area that will undoubtedly continue to grow.

State of AKT

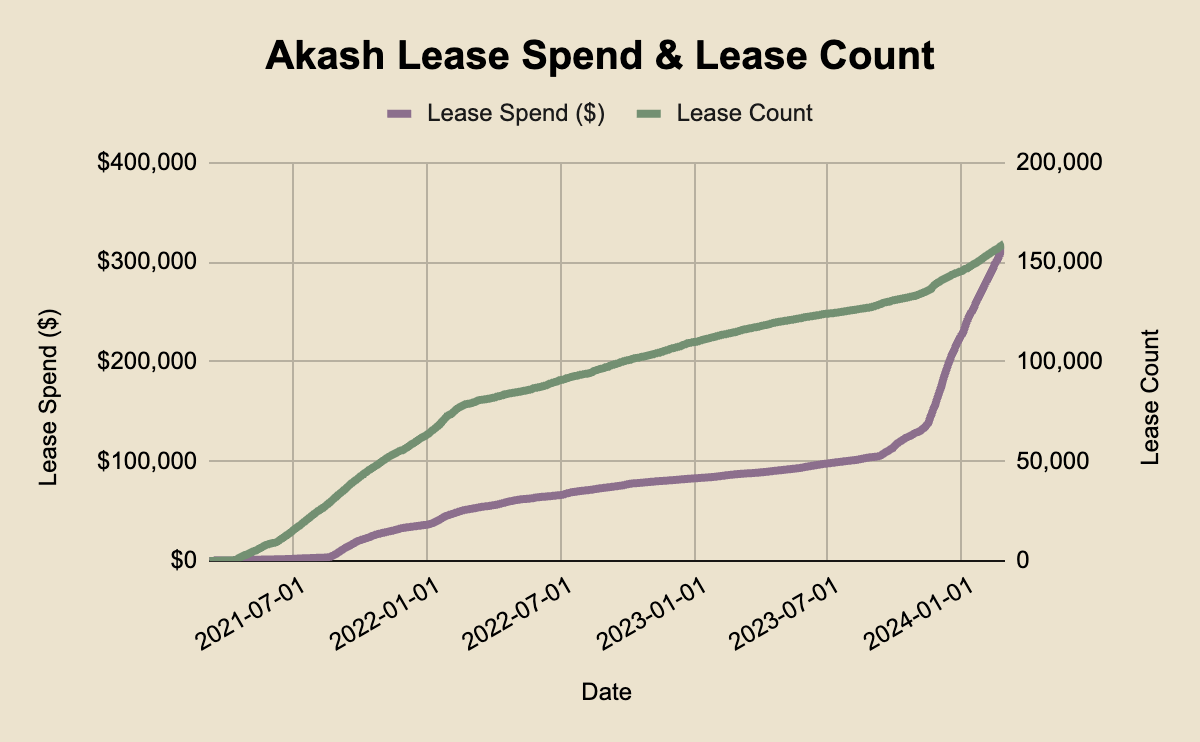

Since Akash’s inception in March 2021, the network has facilitated 159,000 total computing leases for a total of $312k. However, $208k (or ~66%) of the total lease revenue has been generated since September 1, 2023. Annualizing the last 6 months of revenue - Akash is on pace to facilitate $416k of computing leases on a 12 month basis, a number which we expect to increase exponentially in the coming months through both the network’s $8M incentive plan as well as an increasing in funding and launches of crypto native AI protocols.

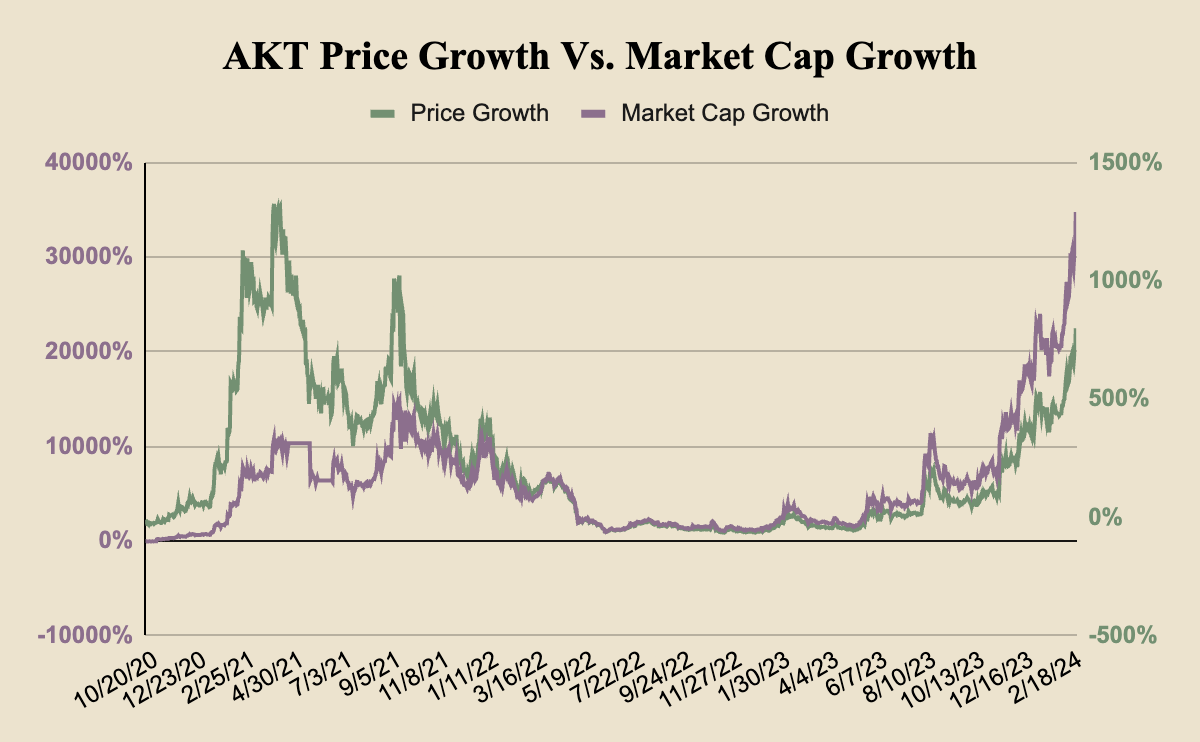

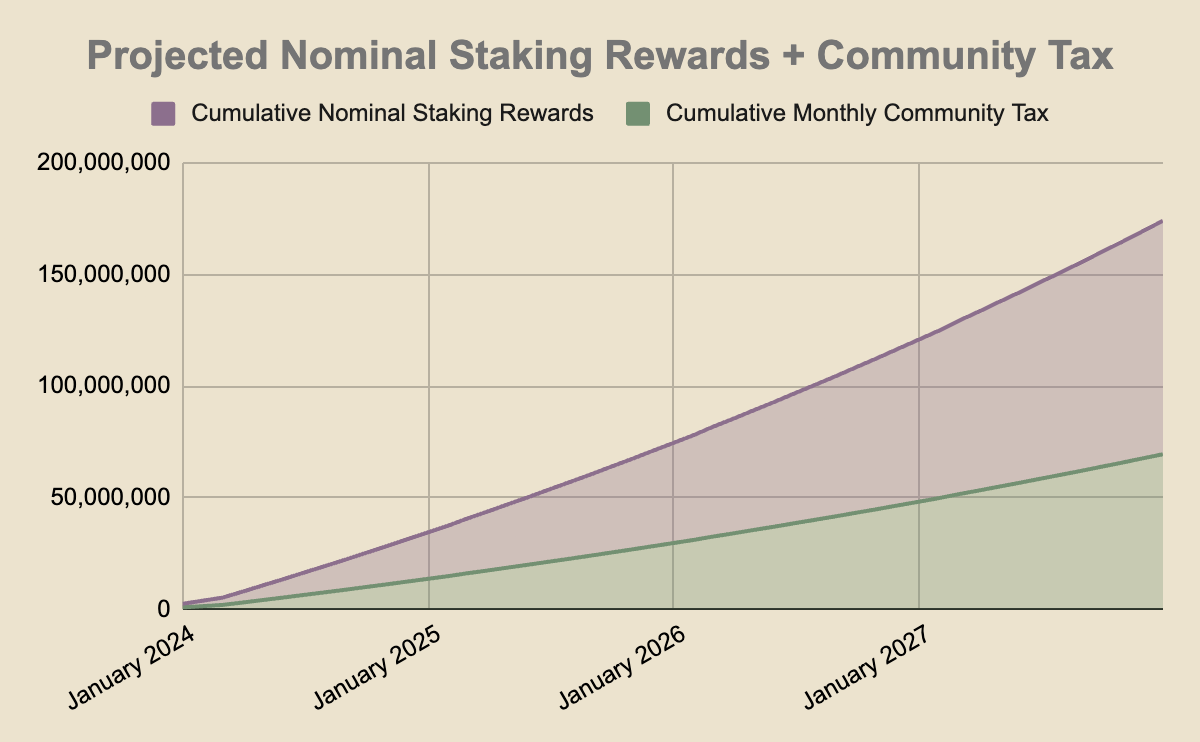

Now, knowing that nearly 0 of these leases have been paid in USDC, we can assume a 4% take rate for all active leases. The network is then on pace to generate an annualized $16,640 for AKT stakers. Not to say that this current run rate isn’t meaningful, but when you compare it to the 34.5M (~$155.3M) AKT tokens that are set to be emitted to the community pool & validators over a 12 month period, the network is still far from achieving long-term sustainability. Below is a graph comparing the growth in price of AKT to the growth in AKT’s total market capitalization - showcasing that a vast majority of market cap growth was due to inflation.

The AKT Token & Value Accrual Dynamics

Akash’s native token, AKT, is deeply integrated within the protocol as show below:

Demand Side

AKT must be used when making any network transactions via gas fees

AKT is required to be staked for operating or delegating to a validator, thereby enhancing network security.

AKT is the preferred marketplace token in which nearly all compute leases are denominated in

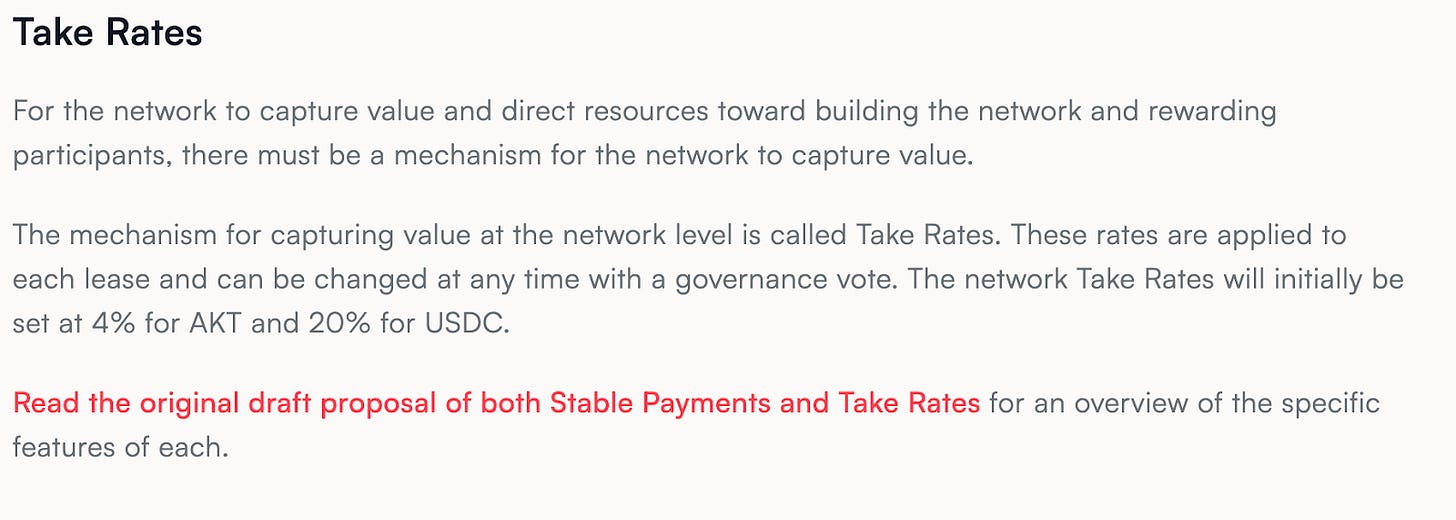

USDC is also whitelisted, but has a 20% take rate compared to AKT’s 4%

Supply Side

AKT is paid out to validators & delegators for securing the network (~14% APR)

AKT will be paid out in both provider & tenant incentives to bootstrap the marketplace

40% of both Akash’s block reward inflation & the network’s take rate within their marketplace are directed towards the community pool, which is used for protocol initiatives, such as incentivizing new providers and tenants. For example, a governance proposal passed in early February requested that 1.8M AKT (~$8M) from the community pool may be used for a provider incentive plan to vastly grow the supply of high-quality Nvidia and AMD GPUs within the marketplace.

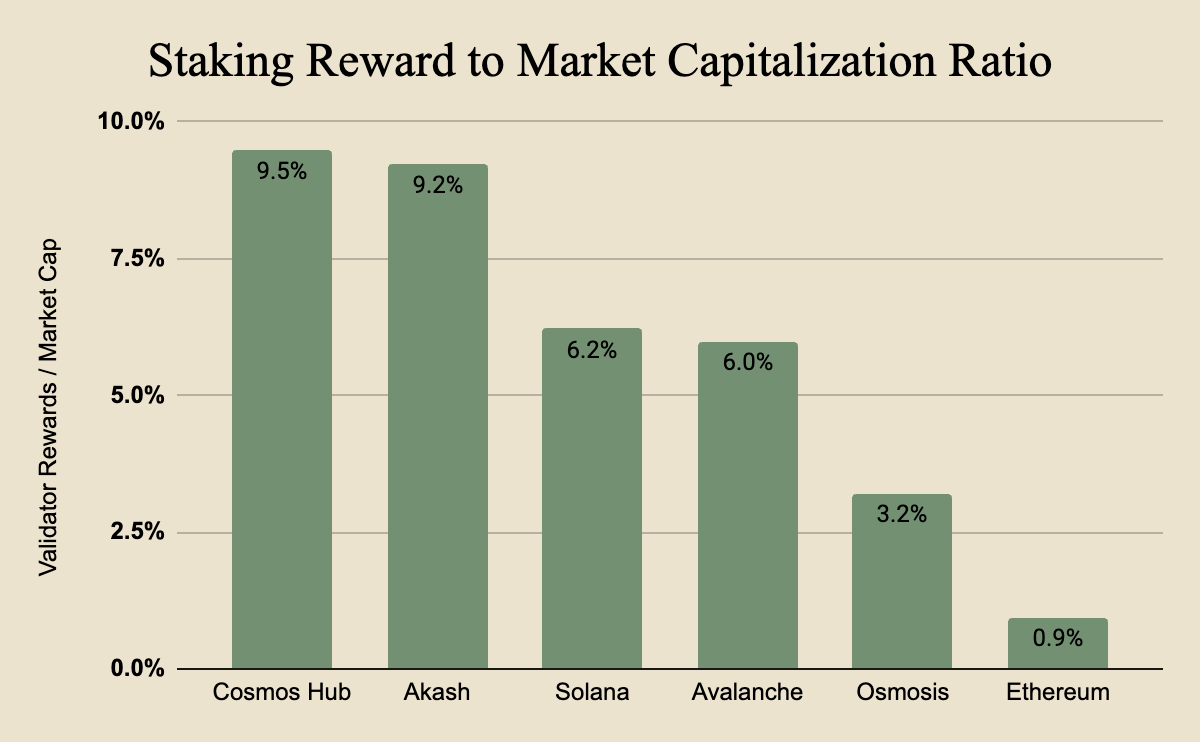

The remaining 60% of block reward inflation goes to network stakers. This inflation issue isn't unique to Akash; it affects nearly all blockchains, with Ethereum standing out as one of the few exceptions that has successfully identified solutions for long-term security funding. Inflation has been a hot topic within the Cosmos ecosystem and a potential barrier to entry for many projects to build their own application-specific chain. In December, members from Overclock Labs put forth a proposal (now passed) to increase the percentage of block rewards emitted to the community pool & additionally increase AKT’s annual inflation, to offset the impact of the community pool’s take on the validator set. We strongly believe that provider / tenant incentive spend is invaluable in bootstrapping Akash’s marketplace and that the community pool MUST be well funded at any given time. However, based on the imperfect metric below it appears that Akash is overpaying for network security - even relative to their peers.

It’s worthwhile to note that economic security requirements have a number of variables, including the total value of all assets on the given chain and the costs associated with running a validator - so we see several potential areas to refute our claim that both Cosmos and Akash are “over-paying” for security. However, under the assumption that we are generally correct, Kairos sees two potential routes to lower the negative externalities of high network inflation:

Exploring the potential benefits of a Shared Security service

Customizing & whitelisting a liquid staking token for AKT

Shared Security Structure & Reasoning

Let’s begin with a question: If consumers are driven to Akash because of economic efficiencies - using the same logic: Why should Akash not seek a shared security service to reduce network inflation (which is a cost to the network) ?

While blockchain security is being commoditized and costs are being driven towards zero through competition, we also realize this idea may be a hard pill to swallow for some of the key players in the network today; notably validators. That being said, preferences aside you are still facing $97m of network rewards paid out each year to stakers at the current price. Additionally, the cost of security scales with price, so if AKT doubles from where it's at right now, assuming the stake ratio stays roughly the same, the network is paying $194m.

This is great for validators & stakers as they rake in large sums, but it is actually counterintuitive to the fundamental economics of the network. Given Akash incentivizes payment in AKT via a lower take rate, that makes it the canonical “money” of the network. Increasing the supply of AKT while it outstrips demand is a losing game. Additionally, abnormally high inflation is ineffective when it’s aimed at parties that don’t contribute directly to marketplace growth or usage. If Akash is trying to encourage developers and providers alike, then the majority of AKT emissions should be directed towards these efforts, not over compensating validators. Prop 246 is a great first step in heavily directing inflationary AKT towards network growth.

Some Potential Solutions

In the next several months, Eigenlayer will be launching their mainnet and allowing app-chains, dubbed Actively Validated Services (AVSs), to tap into Ethereum’s existing crypto-economic security. Eigenlayer relies on a set of operators to run the protocol’s software, allowing them to natively stake or be delegated ETH, or ETH LSTs, while also providing validation services for an AVS. The process of securing Ethereum, while expanding their security to another application is called restaking. By using Eigenlayer, AVSs can avoid spinning up their own validator set and inflating their token or giving a vast majority of the supply to the early security budget.

At a high level, for the sake of this post, Ethos is a protocol that is looking to facilitate the launch of proof of stake and proof of authority AVSs via the Cosmos SDK. Akash could consider utilizing Ethos to tap into Ethereum’s crypto-economic security while keeping its sovereignty, customizability and interoperability - all of which the Cosmos has done so well. There are also potential distribution advantages for AKT here as well. Ethos is still in pre-launch mode, without much public information. However, it is estimated that AVSs will be able to limit inflation in their native token to low single digits. As Akash’s inflation rate is currently above 14%, exploring a collaboration with Ethos and Eigenlayer could be potentially lucrative for the network and token holders in the medium term.

On the other hand, when considering security offerings that are available today, we can turn to interchain security (ICS) sometimes referred to as replicated security, as another possibility. While still relatively nascent, ICS is somewhat battle tested, hosting two consumer chains as of today: Stride, Neutron, and a third on the way with Noble. With ICS, consumer chains are able to inherit the crypto-economic security guarantees of the hostchain, which in this case is the Cosmos Hub. The Cosmos Hub is currently offering roughly $2.9bn of security via staked ATOM. Note that ICS chains do share a predetermined fee back to the Cosmos Hub to pay for the security. However, one downside of ICS is the additional requirements placed upon ATOM validators to support multiple blockchains, which may continue to prove difficult for smaller operators within the validator set.

Another interesting development is the idea of the Cosmos Hub becoming a security aggregator, where they would be able to tap into other projects like Babylon, a Bitcoin staking protocol, which will offer consumer chains the ability to be able to tap into the the crypto-economic guarantees offered via Bitcoin, the largest and most robust blockchain to date. While still in development stages, it appears this will soon be a possibility where consumer chains will be able to choose multiple security providers, perhaps driving security costs even lower via competition. Lastly, it's important to note that Babylon does not require bridging and is trustless and self-custodial, read more about this initiative on the Cosmos Hub forum here.

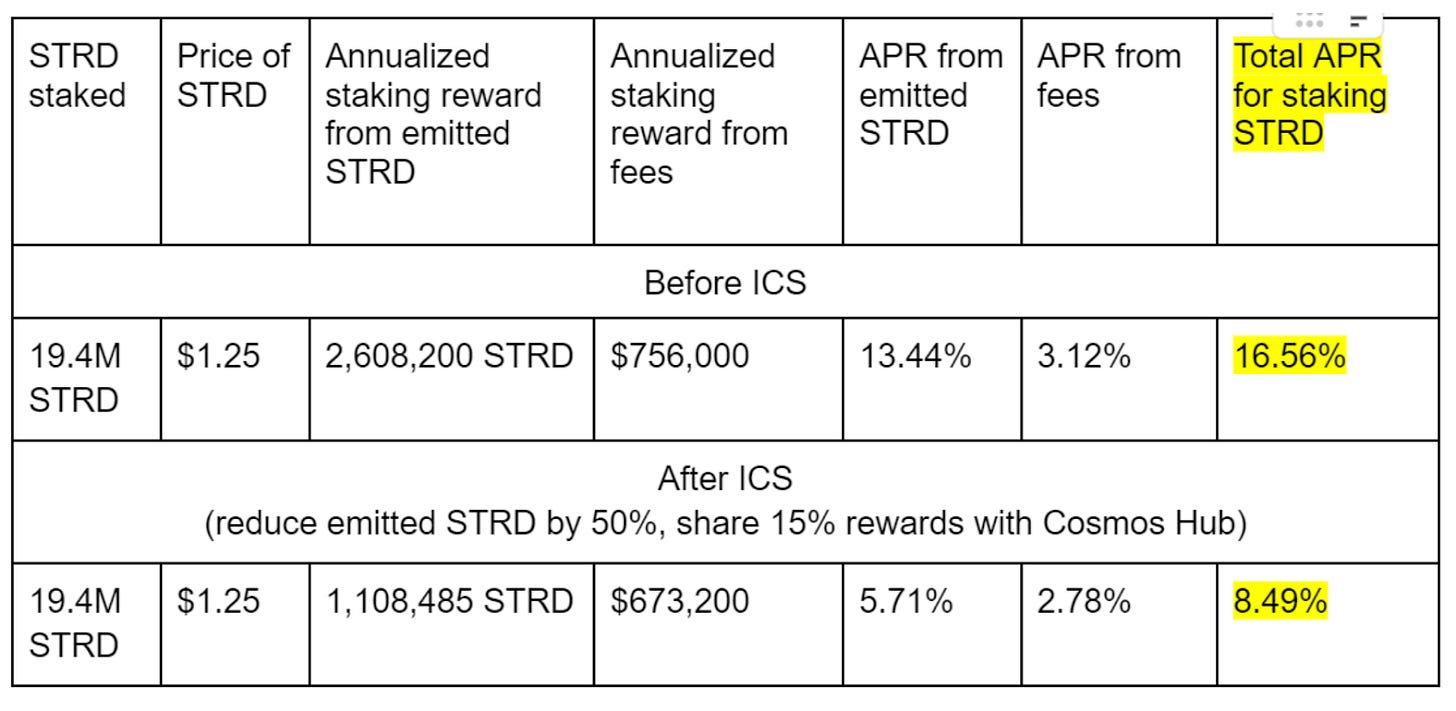

To date, only one chain with a pre-existing validator set has transitioned into adopting ICS via the Cosmos Hub, Stride. After this transition, the existing validators still serve an active role in the network as “Governors”, as they have a significant monetary stake in the network and continue to receive commissions on staking rewards. This significantly reduced the amount of token emissions the network had to issue to validators, and a breakdown can be found in the table below.

LST Structure & Reasoning

While Liquid Staking Tokens (LSTs) were largely popularized for lowering the opportunity cost of missing out on staking rewards, much of which comes from inflation, LSTs for appchains with zero or low inflation make good sense as well when there is proven product-market-fit (PMF). For Akash, there is a clear PMF given the demand for GPUs is only increasing as AI becomes more integrated into the world around us. Even if Akash were to adopt some form of shared security, there would still be value accrual back to AKT stakers via the network take rate which is explained above in the “AKT Tokenomics & Value Accrual” section.

We propose that Akash explores adopting an LST format similar to the structure of dYdX, with Stride as a preferred provider. While we encourage competition amongst various LST providers, Stride has continuously pioneered LST’s for Cosmos appchains. If you’re unfamiliar, the structure for stDYDX is as follows:

All staking rewards for DYDX are in USDC.

With stDYDX, every hour USDC staking rewards are IBC'd to Osmosis, swapped for DYDX, which is then IBC'd back to dYdX chain and staked.

So stDYDX has a built-in auto-compounder.

Therefore, given we anticipate an increase in USDC spend for compute in the coming months and years, we would love to see staking rewards which are derived from USDC follow this model and be swapped back into AKT and staked through Stride as stAKT. Akash could also consider whitelisting stAKT for payment for compute to ensure users of the network aren't missing out on staking rewards.

Aside from this, there are other benefits that stAKT provides such as auto-compounding (tax efficient), and access to liquidity. Additionally, to passively benefit from the proliferation of stAKT, we have seen past examples of various appchains liquid staking a small percentage of their community pool and then LP’ing it on Osmosis to receive trading fees. While the details of that are a bit outside the scope of this article, you can read more about an example here.

Fully integrating stAKT into Akash could prove to be a simple solution to combat the network’s current inflation / dilution for non-stakers, allowing all market participants an equal chance to earn staking rewards. Additionally, whitelisting stAKT to be an accepted currency for buying compute resources, alongside AKT and USDC, would also give users of the marketplace an easier way to provide network security, and reap the network staking rewards as well. Lastly, it's important to mention that as a technical prerequisite, Akash would need to have IBCv3 or a later version enabled, and they are currently supporting IBC v4.4.2 - so why not?

Two Sided Marketplace Incentives

Just as DeFi protocols need to attract liquidity via incentives, Akash needs to attract more computational resources and tenants via incentives.

Following a considerable reduction in security spend, Kairos recommends that the community explores focusing on incentivizing the core product for Akash; the two-sided marketplace for supply and demand of compute resources. Given AKT is the core coordination mechanism for the network at large, we recommend thoughtful distribution of incentives to bring more computational supply onto the network.

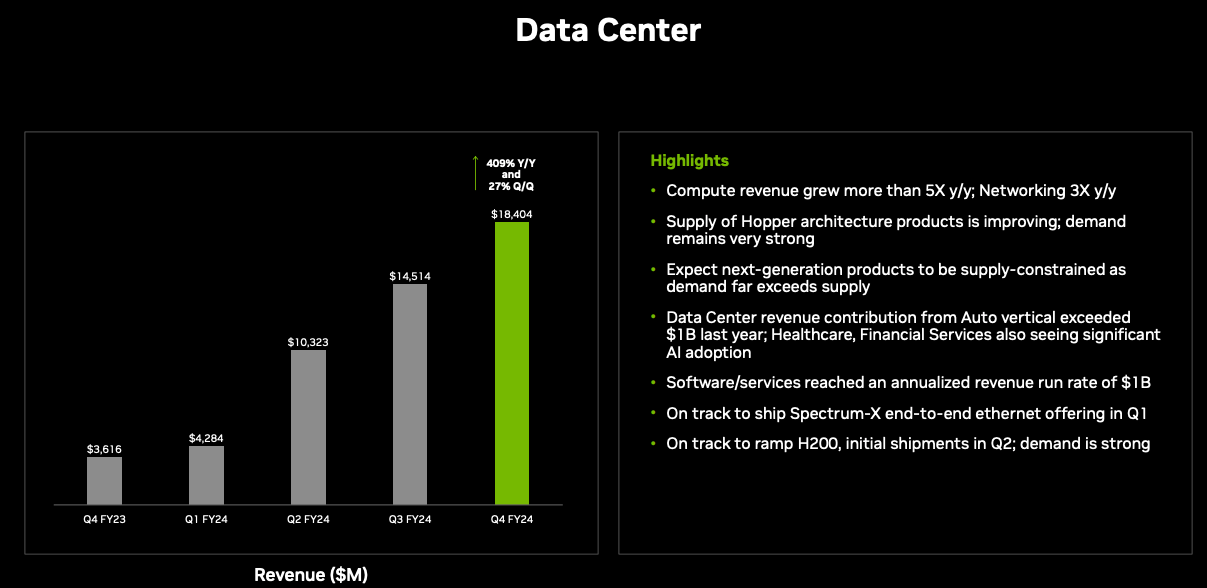

We know there is demand for GPU compute power, from Nvidia’s Q4 2023 earnings, they shared that compute revenue grew 5x year over year and they are forecasting next-gen products to be supply-constrained due to excessive demand. Computing power can almost be thought of as excess energy, which when is no longer needed, can be sold back to the grid on the open market. Akash has the chance to be the default marketplace for on-demand compute power in the midst of the largest supply side constrained environment we have ever seen, but they need incentives to get the flywheel going.

Let’s lay out our vision for the AKT adoption flywheel using the current economic & incentive framework:

Under the current regime, AKT is emitted via inflation to stakers through rewards and validators via a commission fee. AKT is periodically sold from validators on to the open market to cover operational costs and from stakers or other market speculators to lock in profit, or cut their losses. The hope is that developers obtain AKT from secondary markets and then IBC it over to the Akash network to use it to pay for compute resources. Just from reading this alone you can easily spot the points of friction and the unaligned incentive structure. Therefore, we suggest that following a material reduction in security costs, we see a continued incentives for network participation in line with examples such as prop 246, not only to bring more computational resources on to the network, but to keep them incentivized by lowering the dilution of AKT through less emissions.

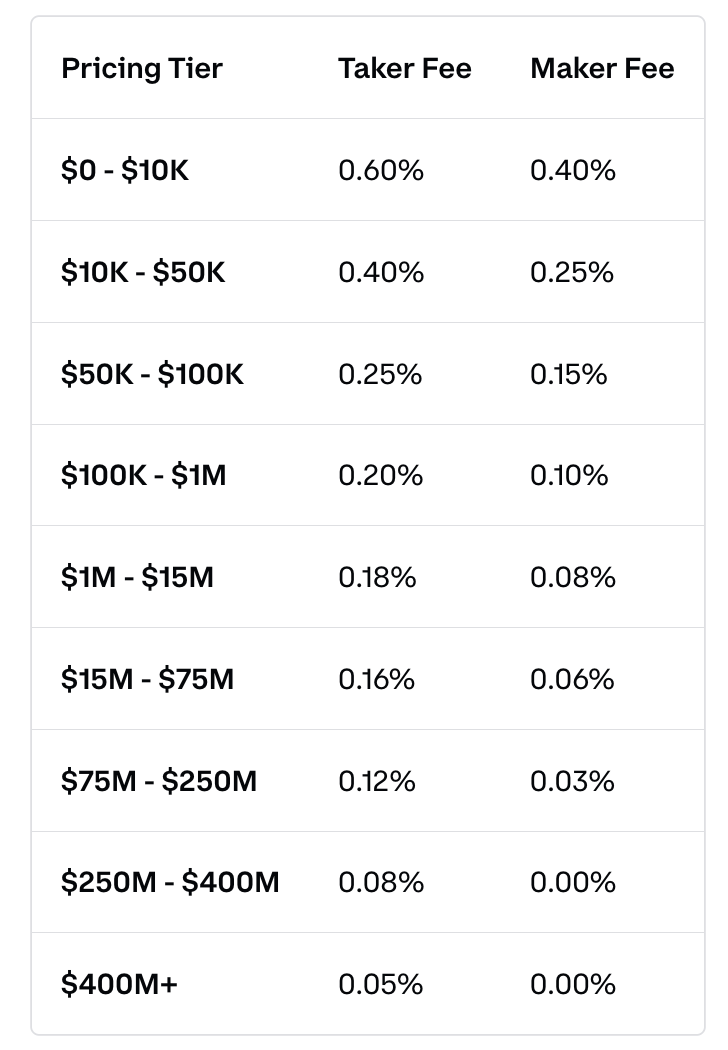

Lastly, we think it may also be worth exploring a reduced take rate for super-users of the marketplace. This idea already exists in the CEX landscape where those who trade higher amounts receive reduced maker-taker fees. This incentive structure can potentially provide: high volume usage, loyalty and retention, both of which could lead to prolific network effects.

While the reduced taker fees for power-users may not make sense to implement yet, we want to float the idea now to start the conversation around long-term user retention.

Conclusion

In summary, we believe that Akash has significant potential, but there are some necessary changes that should be made today to incentivize accelarated marketplace growth. We believe that once Akash crosses the chasm of:

Marketplace Fees accrued > Nominal Network Emissionsthere will simply be no return, the economics and flywheel effect will be too powerful. We think this goal is entirely attainable and net-beneficial to not only AKT holders, but end users of the marketplace at large. Kairos is in no way an expert on all matters Artificial Intelligence, however, we believe that having decentralized alternatives is in the best interest of humanity. Open source, decentralized models are beneficial as they force the developers behind them to be transparent with the public, while innovating faster and lessening the chance of a winner-take-all outcome in the most powerful tech in human history.

And lastly, as a reminder - our aim is to optimize the network through open discourse. We welcome criticism on any of our points regarding potential improvements, and we encourage others to join the conversation as well. Not too many other projects bare such an important burden, and we’re pleased to be here alongside the AKT community as they navigate the future.