Liquidity & Utilization of Liquid Restaking Tokens (LRTs) - June

Important updates around the liquidity and utilization of LRTs for the month of June

As we approach the end of June, airdrop incentive programs are beginning to run dry. However, the real incentive behind restaking appears to be looming in the not so distant future: AVS rewards. In early June EigenLayer announced that the AVS + Operators were able to begin trialing rewards on testnet. While airdrop programs from LRTs and various protocols alike have garnered ample restaked capital to EigenLayer through their incentive programs, the real catalyst behind the long-term success of EigenLayer will be the additional rewards accrued via AVS. The introduction of these rewards unlocks the full potential of LRTs to uplift staking rewards rate above the native staking issuance, allowing them to challenge LSTs and their commanding presence across DeFi for becoming the top choice collateral for users. In this report we’ll be covering updates on the general restaking sector, and provide updated metric on liquid restaking token liquidity, utilization, and the key events that surround both. If you’re looking for more of an introduction to both of these topics individually, we recommend you check out our previous reports on LRT Liquidity and LRT Utilization, both of which will provide a better frame for best understanding the content in this report.

Notable News

Before we get into the updated data around LRT Liquidity and overall utilization, these are some important events that unfolded during the month of June:

June 5th - EigenLayer Blog Post on Testnet Launch for AVS / Operator Rewards

June 17th - Renzo Announces a $17m Fundraise

June 17th - EtherFi Launches Symbiotic Vault Product

June 18th - Renzo Enables Withdrawals & Increases Bug Bounty to $500k

June 19th - Eigen Foundation - $EIGEN Phase 2 Stakedrop

June 24th - ETHFI Buyback & Liquidity Pool Seeding Gov Prop Passed

June 26th - Pendle Products Reached Maturity For the Top 5 LRTs

June 27th - Renzo Launches pzETH - Symbiotic LRT in Collaboration with Mellow Protocol

June 30th - ETHFI Season 2 Points Program Ends

June 30th - ETHFI Season 3 Airdrop Token Allocation Gov Propo Passed

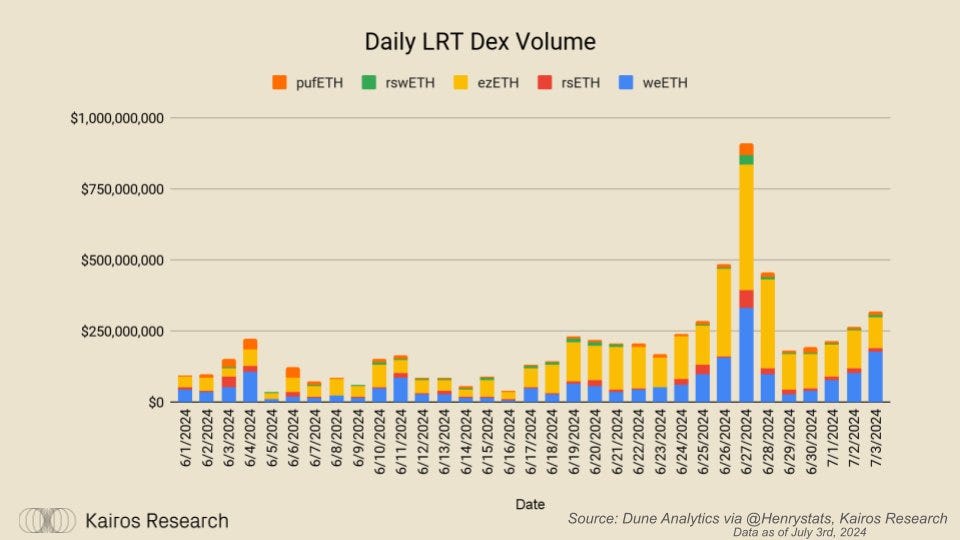

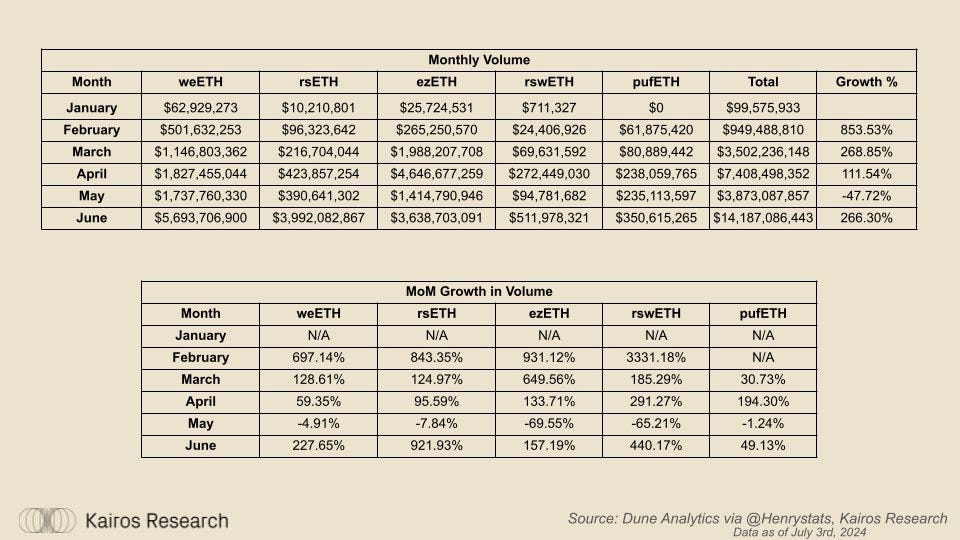

Dex Trading Volume

During the month of June, EigenLayer deposits remained flat at 5.1m ETH, despite a peak of about 5.42m ETH mid way through the month, with the overall LRT sector seeing a modest 1.5% boost in deposits during the same period of time. Across the top 5 LRTs, volume increased +266% on a month over month basis, totaling approximately $14bn of total dex volume.

See the tables below for specifics on the volume for the top 5 LRTs.

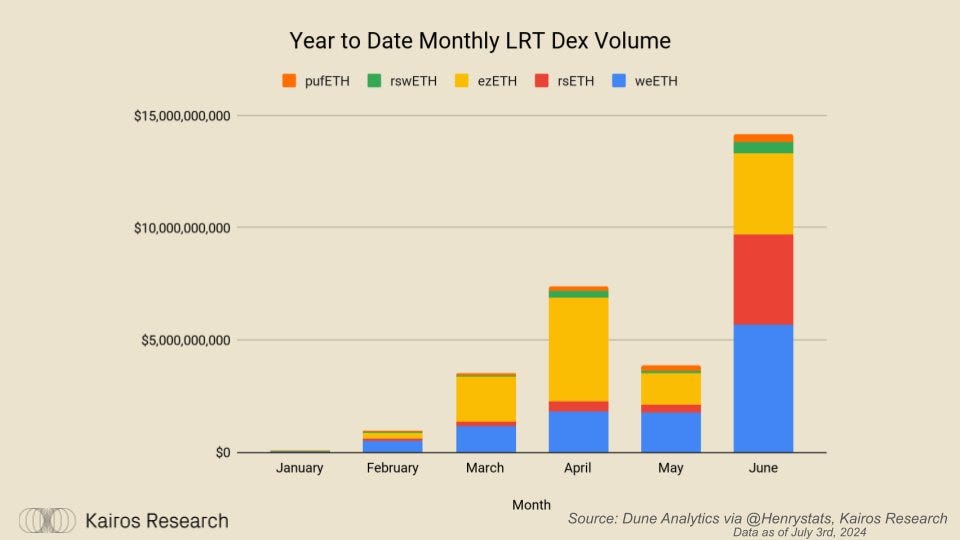

Year to Date Monthly LRT Volume

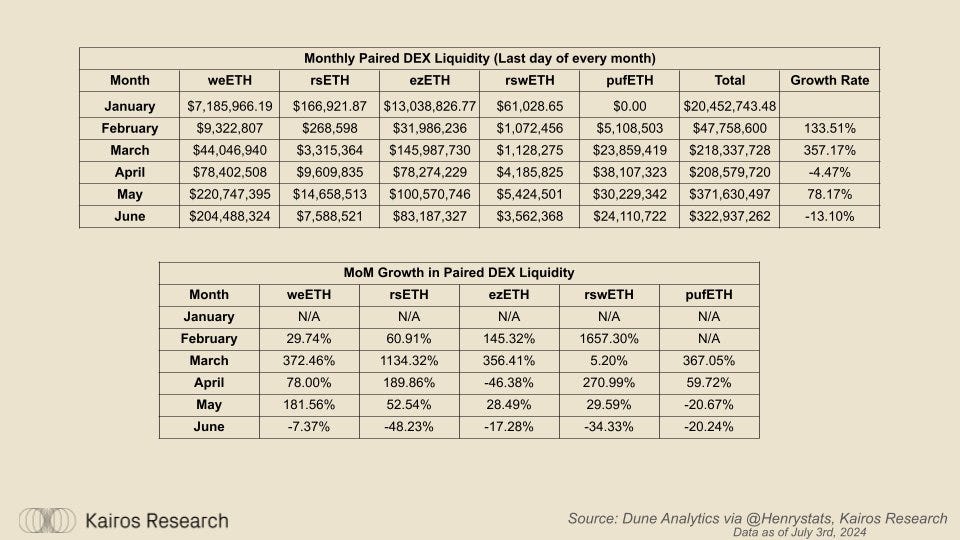

Liquidity Updates

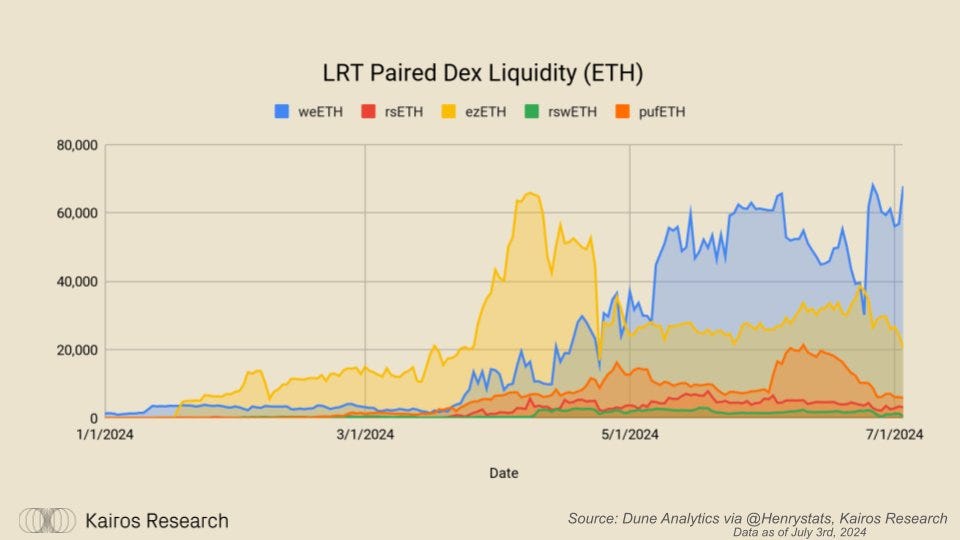

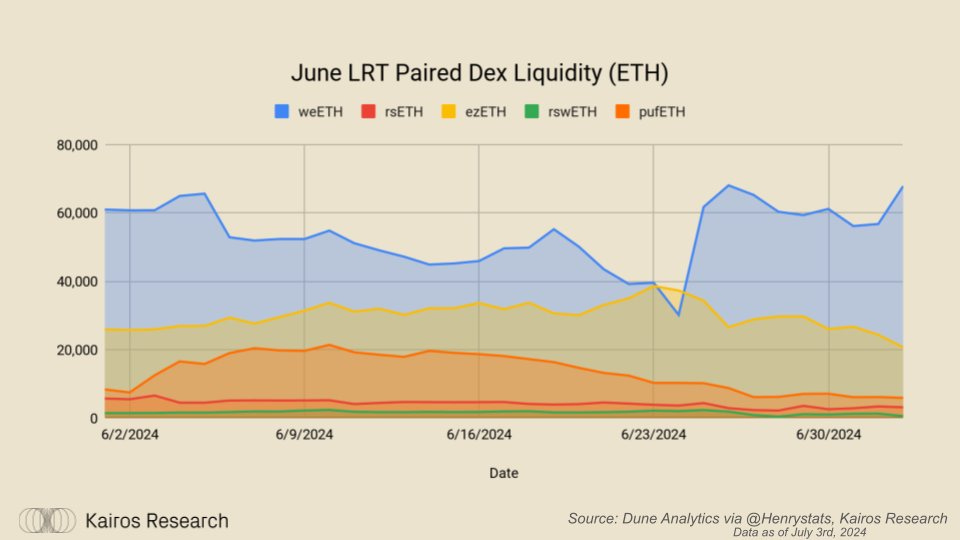

Related to DEX Volume, overall paired liquidity for the top 5 LRTs collectively fell 13% throughout June as volumes picked up heavily. KelpDAOs rsETH took the biggest hit with a -48% MoM decline in liquidity. EtherFi's weETH remains the most liquid LRT, with $183m in paired liquidity, with Renzo remaining as the second most liquid with around $63m.

LRT Paired DEX Liquidity in ETH for the top 5 LRTs.

June LRT Paired Dex Liquidity

TVL Updates

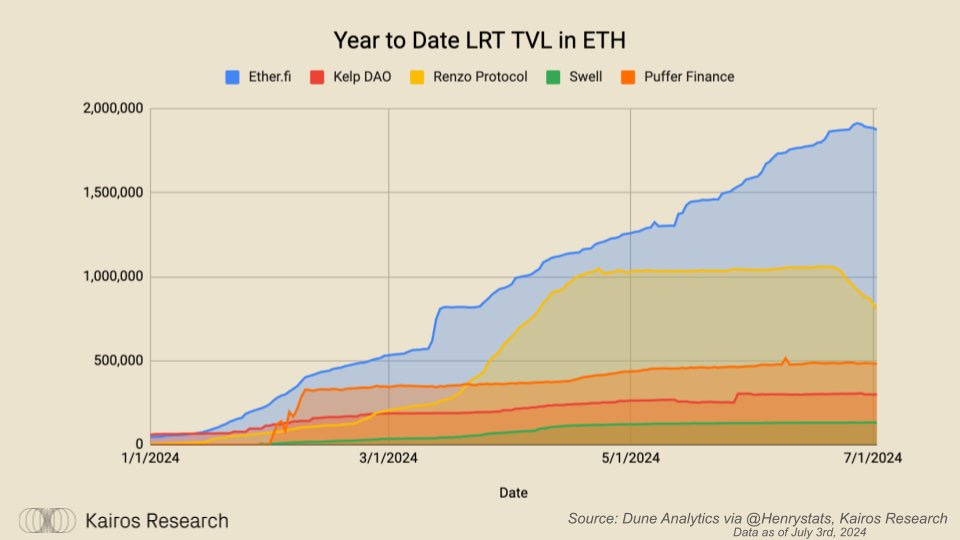

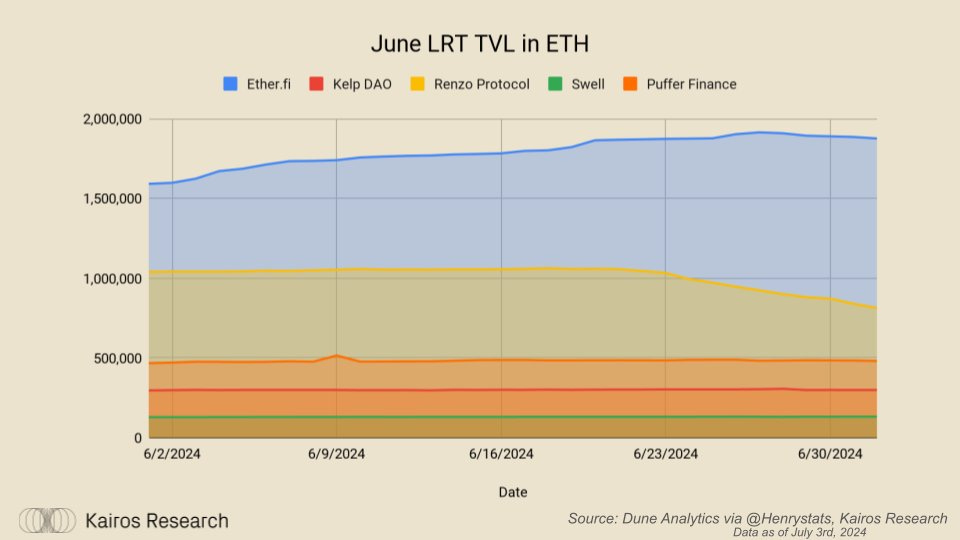

With regards to TVL, EtherFi has continued to climb higher, edging close to the 2m ETH mark. Following the withdrawals initiating for Renzo, there has been an outflow of around 200,000 ETH during the month of June, nonetheless they've held their place as the second largest LRT. Puffer and Swell are both yet to enable withdraws, but it is expected that they should be soon.

June LRT TVL in ETH

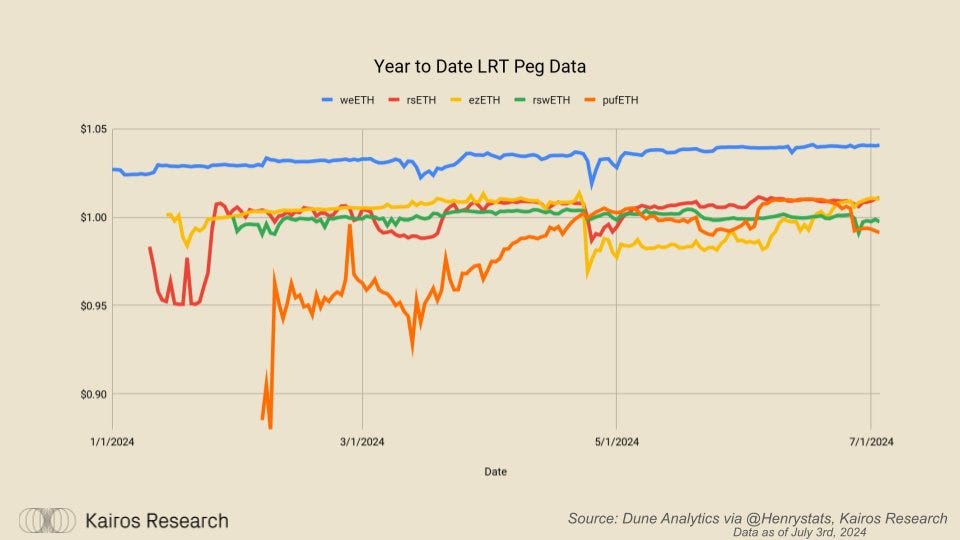

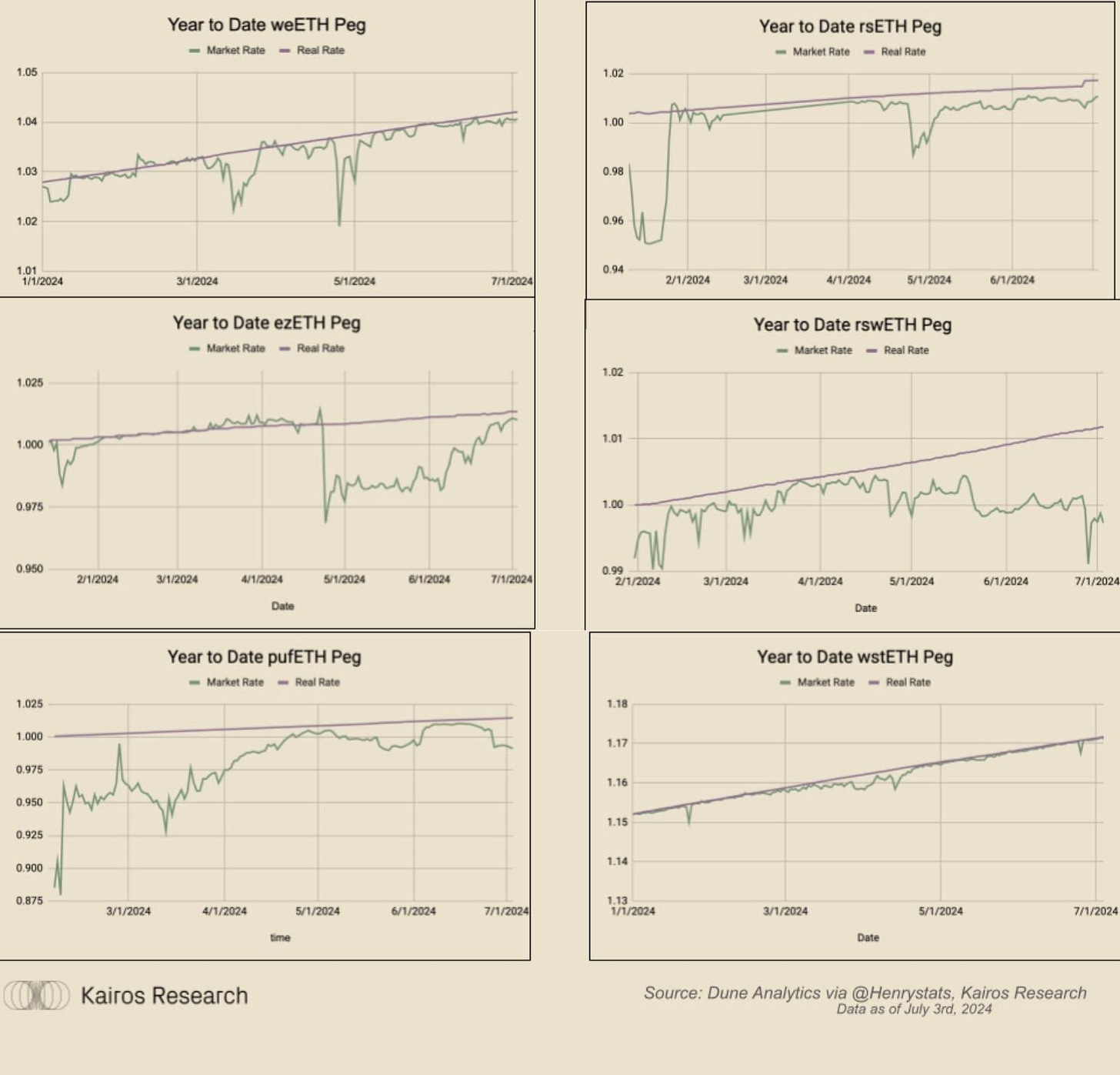

LRT Peg Updates

The importance of liquidity and the availability to withdraw Is important to the overall health of the LRTs peg. Depending on the lending market, some reference the market rate, while others reference the real rate (fair value). As incentive programs begin to wind down, it is likely that LRTs follow a similar pattern to LSTs and have the majority of their supply aggregate to lending markets. Therefore, it is important to keep an eye on which rate specific lending markets are referencing as this sub sector continues its accelerated maturation.

Following the introduction of Renzo enabling withdrawals, their peg notably Improved. Puffer saw a brief dip over June, but remains on a decent level. Swell's rswETH is now the main outlier which is around a 1.8% discount at the time of writing. However, it is very likely it follows a similar pattern to Renzo once withdrawals have been enabled.

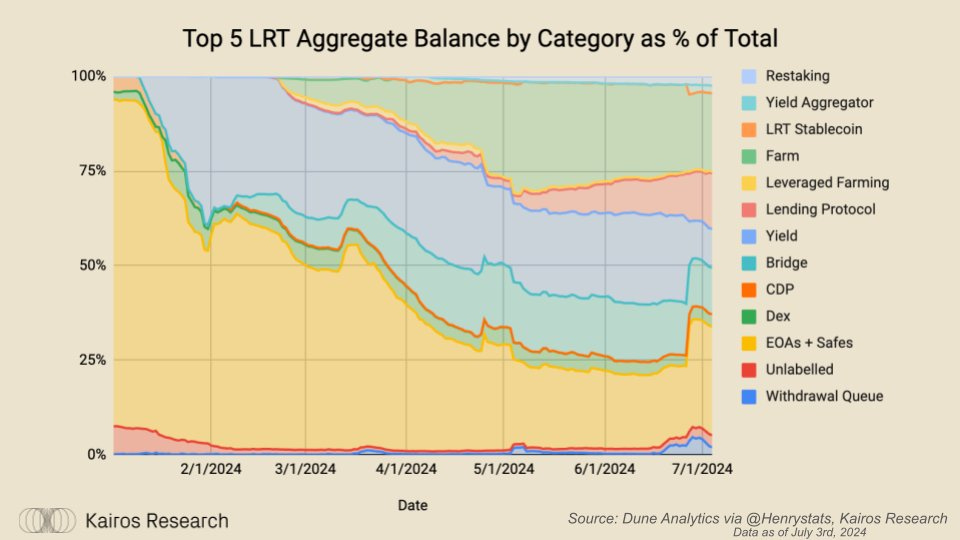

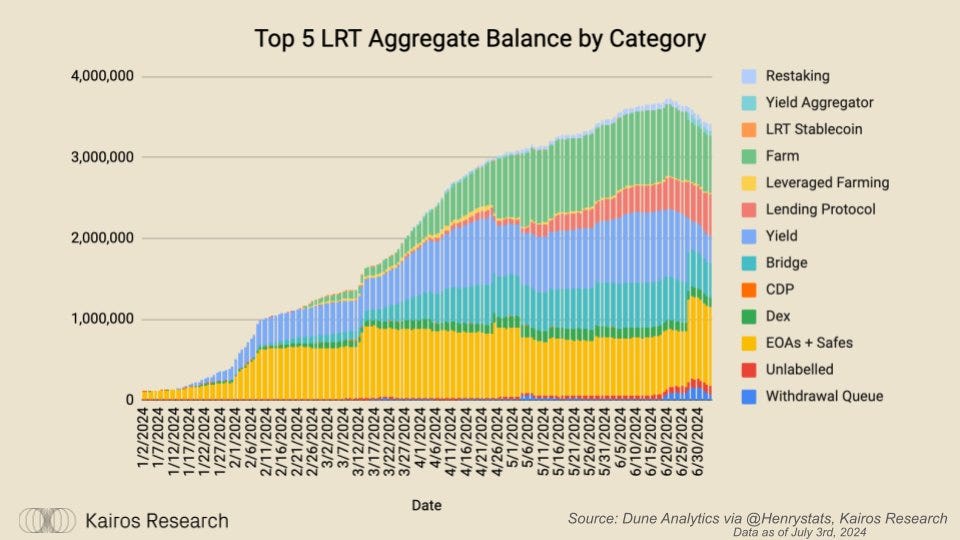

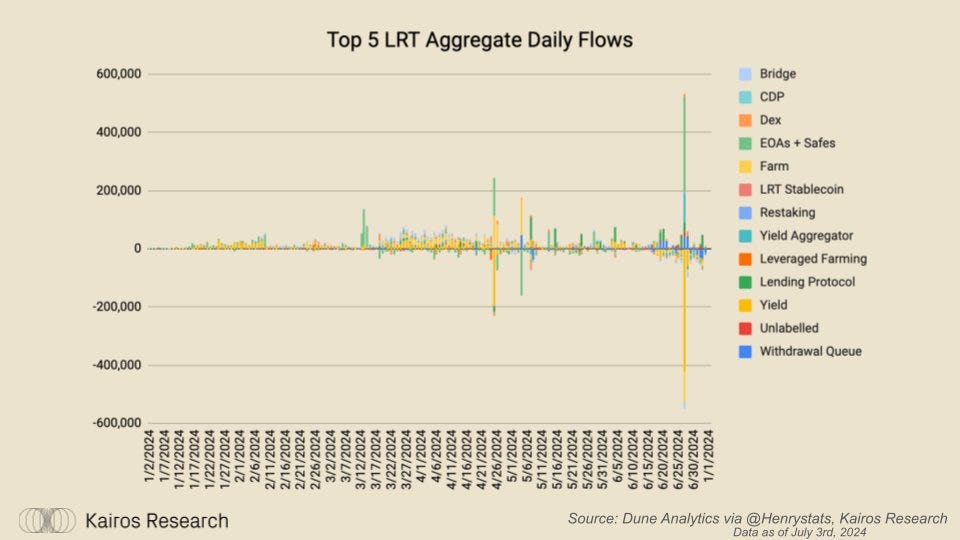

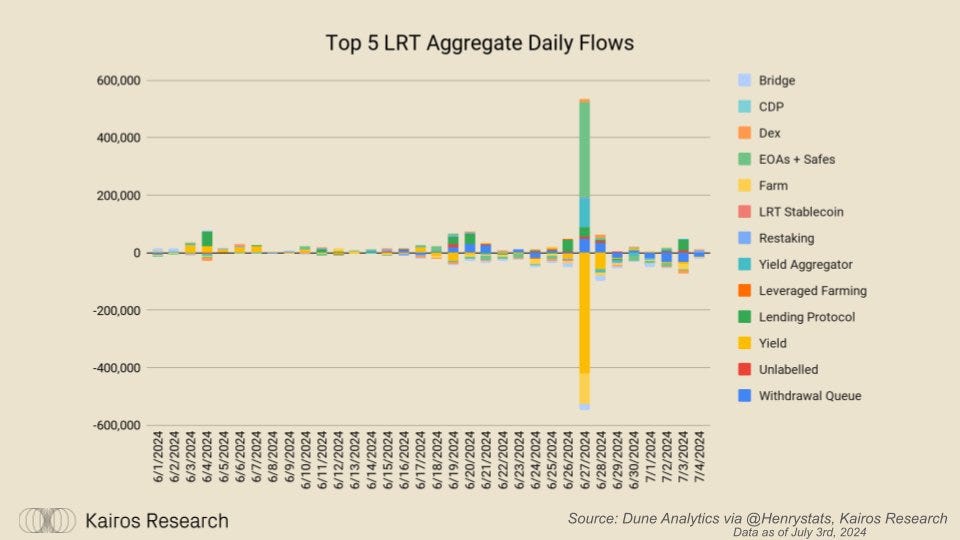

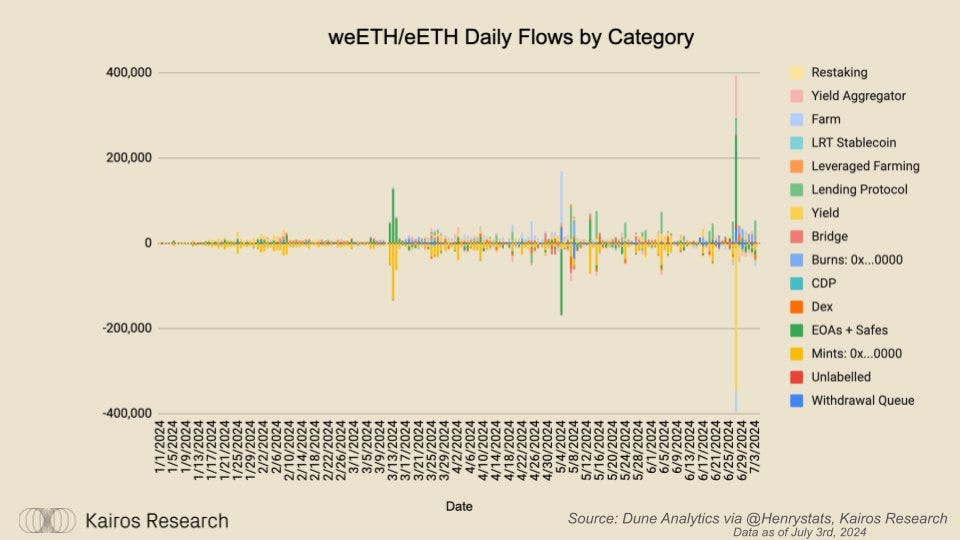

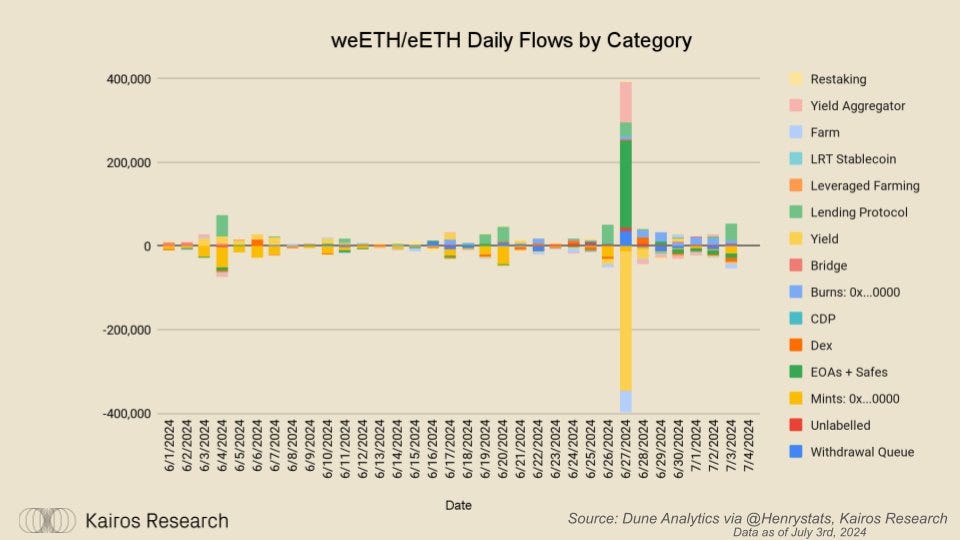

LRT Utilization and Categorical Flows

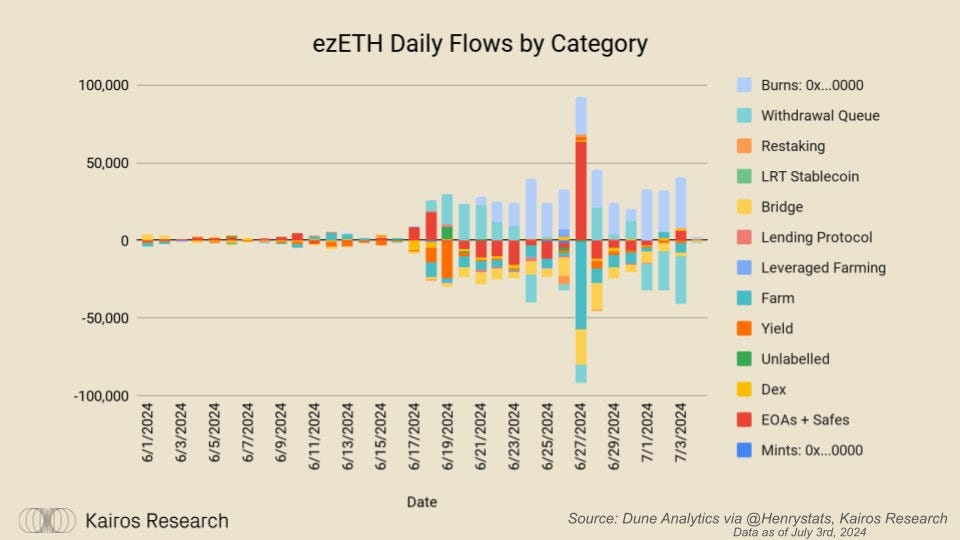

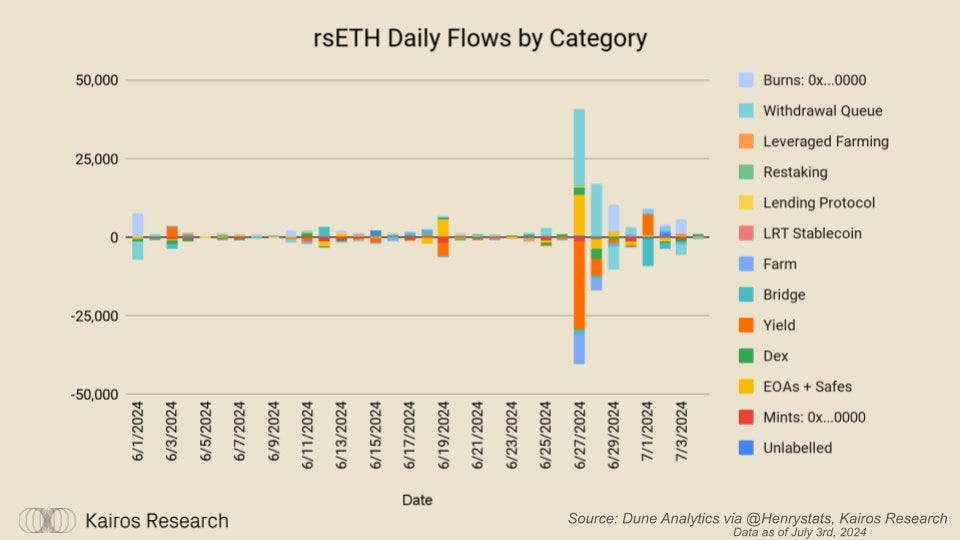

As mentioned above In the report, on June 26th Pendle markets for the top 5 LRTs reached maturity at the same time. With the majority of large airdrop incentive programs being close to finsihed, there was not a ton of users who rolled over to the next market, and thus we saw the largest single day outflow from Pendle. While Pendle certainly has PMF, its hard to deny that the TVL may have been temporarily overinflated due to points programs. However, it is undeniable that Pendle will have an important role in the future of onchain fixed income trading, especially when AVS and Operator rewards go live and the LRTs begin yielding additional staking rewards from the AVS they support.

With EOAs + Safes seeing their largest influx to date, and with AVS rewards looming in the near future, it is likely we will see additional protocols working around the LST/LRT DeFi space launch incentive programs to help bootstrap their networks.

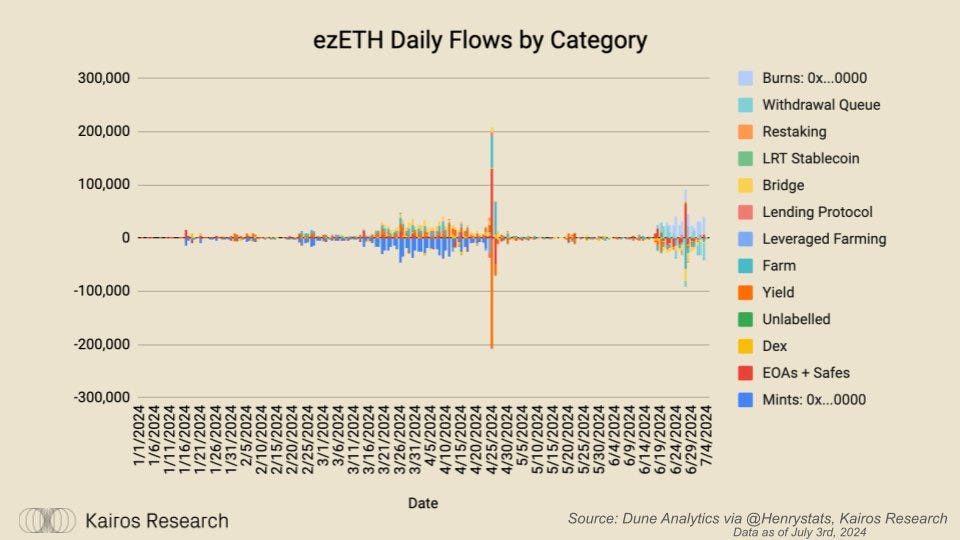

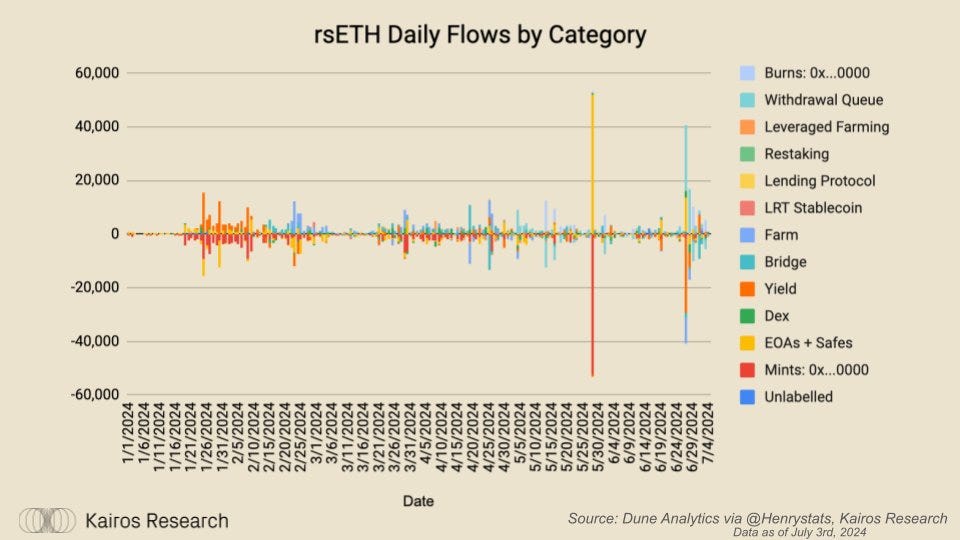

The image below does a great job of showing the raw rize of flows that Pendle experienced following the coinciding maturity of so many LRT markets on their platform.

For June specifically, there was not much action outside of the Pendle news.

Specific LRT Flows

weETH + eETH Year to Date

weETH + eETH for June

ezETH Year to Date Flows

ezETH June Flows

rsETH Year to Date Flows

rsETH June Flows

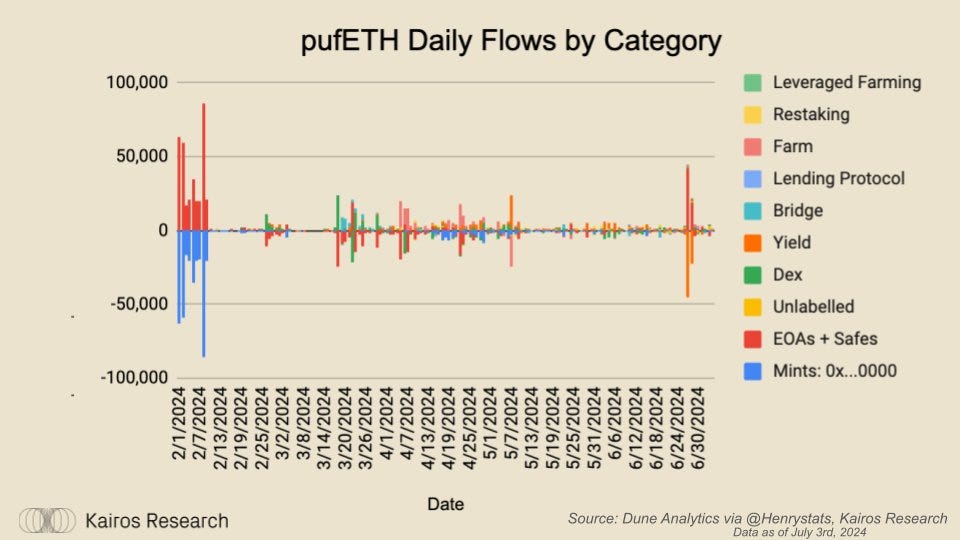

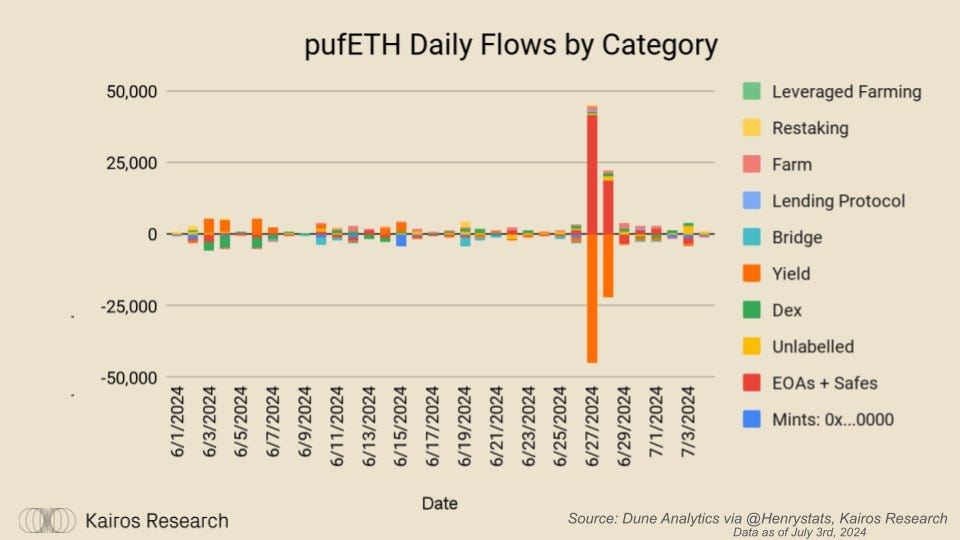

pufETH Year to Date Flows

pufETH June Flows

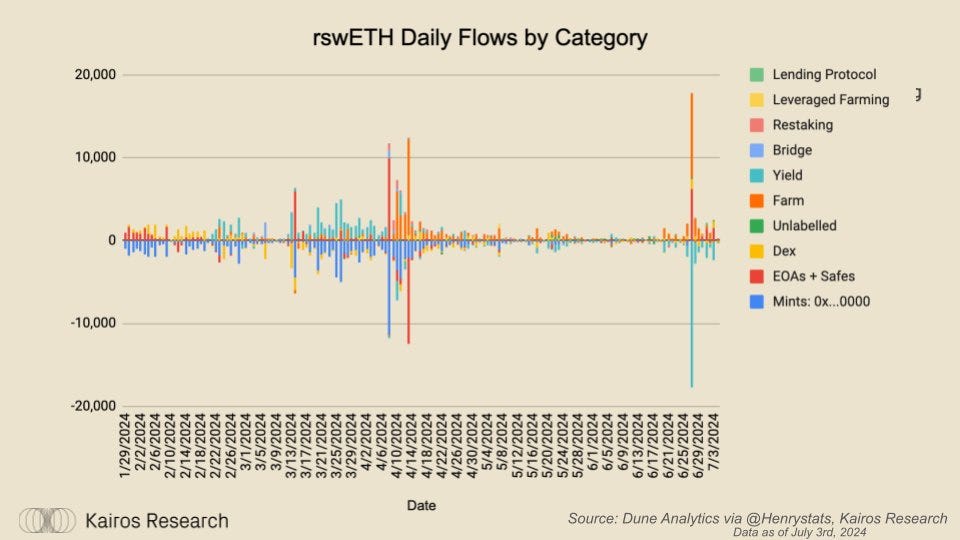

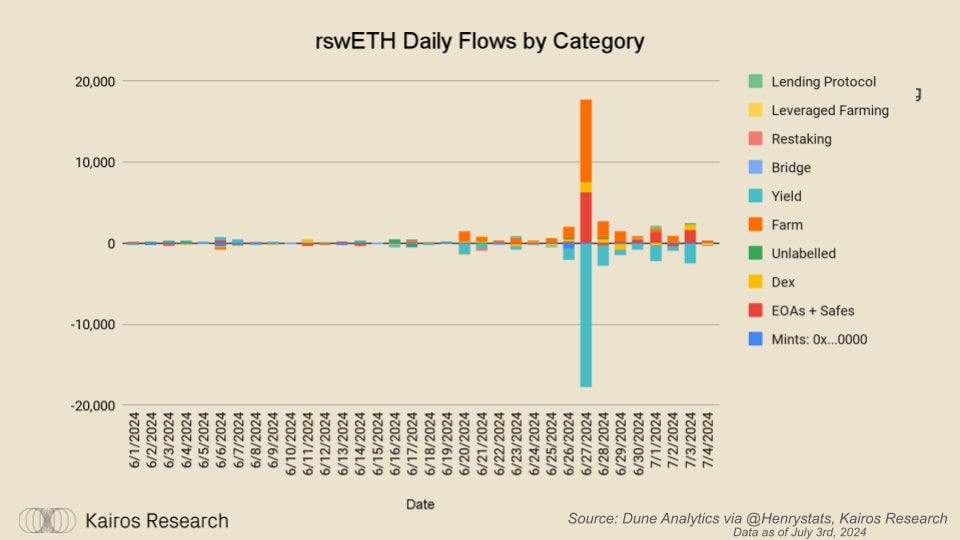

rswETH Year to Date Flows

rswETH June

Closing Thoughts

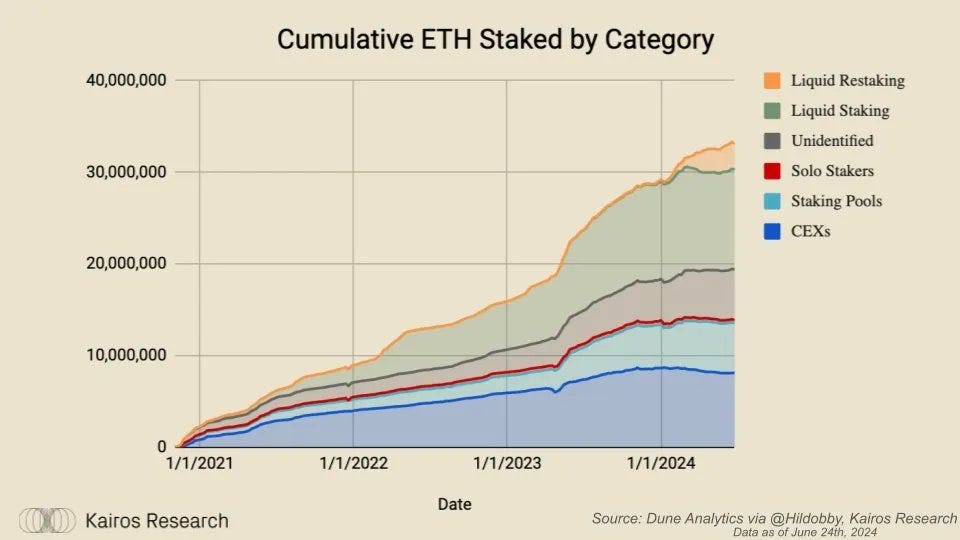

In summary, we are reaching a significant milestone in the expedited progress of this important DeFi sub-sector. With the majority of the significant airdrops coming to a close soon, we will begin to see the market reach its true equilibrium. In previous reports, we have noted ad nauseam that there is an abundance of exogenous nosie through incentive programs, which blurs the picture when trying to decipher how sticky the capital may be. Therefore, as these programs come to a close, we can surly expect to see some outflows as there were almost certainly participants who were solely there to extract as much value as possible. However, that is exactly what you should expect to happen in a truly permissonless DeFi system. Lastly, it is clear that restaking is not a temporary fad. It's the beginning of a multi-year trend that will shape Ethereum and crypto at large for years to come. We'll leave you with this chart from our recent piece on the ETH ETFs and how staking serves as a general supply sink.